InterRent REIT Acquisition: Details Of The Offer From Executive Chair And Sovereign Wealth Fund

Table of Contents

The Offer's Key Terms and Conditions

This section details the crucial elements of the proposed InterRent REIT acquisition, offering a comprehensive overview for informed decision-making.

Acquisition Price and Structure

The proposed acquisition of InterRent REIT involves a significant investment. The offer includes a price of [Insert Exact Offer Price Per Share] per share, totaling an acquisition value of [Insert Total Acquisition Value]. The payment structure is a combination of [Insert Percentage]% cash and [Insert Percentage]% in stock, offering shareholders flexibility in their investment outcome. This represents a premium of [Insert Premium Percentage]% over the previous closing price, a compelling incentive for shareholders. Contingency clauses, such as [Insert Example Contingency Clause, if any], are included within the offer.

- Exact offer price per share: [Insert Exact Offer Price Per Share]

- Total acquisition value: [Insert Total Acquisition Value]

- Payment structure breakdown (cash vs. stock): [Insert Percentage]% cash, [Insert Percentage]% stock

- Premium offered compared to the previous closing price: [Insert Premium Percentage]%

- Contingency clauses (if any): [Insert Example Contingency Clause, if any]

Governance and Approval Process

The success of this InterRent REIT acquisition hinges on several key approvals. Shareholder approval requires a [Insert Percentage]% affirmative vote. Regulatory bodies, including [Insert Regulatory Bodies Involved], must also approve the transaction. The timeline for completion is estimated at [Insert Timeline], subject to regulatory approvals and other conditions. The possibility of competing offers or counter-bids cannot be ruled out, adding another layer of complexity to the process.

- Shareholder vote requirements: [Insert Percentage]% affirmative vote

- Regulatory bodies involved in the approval process: [Insert Regulatory Bodies Involved]

- Timeline for completing the acquisition: [Insert Timeline]

- Potential for competing offers or counter-bids: Possible

- Key deadlines and milestones: [Insert Key Deadlines and Milestones]

Financing and Funding Sources

The acquisition is financed by a strategic partnership between the Executive Chair and the Sovereign Wealth Fund. [Insert Percentage]% of the funding comes from the Sovereign Wealth Fund, and [Insert Percentage]% from the Executive Chair, demonstrating a strong commitment to the acquisition. [Insert Details on Loan Financing, if applicable] further enhances the financial strength of the proposal.

- Percentage of funding from each party: [Insert Percentage]% Sovereign Wealth Fund, [Insert Percentage]% Executive Chair

- Details on loan financing (if applicable): [Insert Details on Loan Financing, if applicable]

- Equity contributions from both parties: [Insert Details on Equity Contributions]

- Indication of financial strength and stability of funding sources: Strong and Stable

Implications for InterRent Shareholders

This section analyzes the potential upsides and downsides of the proposed InterRent REIT acquisition for its shareholders.

Potential Benefits of the Acquisition

Shareholders stand to benefit from several potential advantages. The immediate cash payout offers immediate liquidity. The Sovereign Wealth Fund's involvement suggests improved financial stability and potentially accelerated growth in the future. Access to the fund's vast resources can unlock opportunities for new projects and enhance InterRent's long-term prospects.

- Immediate cash payout for shareholders: Yes

- Potential for future appreciation of assets under the new ownership: High

- Enhanced financial stability of the company post-acquisition: Expected

- Improved access to capital for future projects: Significant

Potential Risks and Drawbacks

Despite the potential benefits, shareholders should consider potential risks. The acquisition might limit potential future gains if InterRent's independent performance would have exceeded the offer price. Changes in management and company strategy are also possible. Integration challenges following the acquisition could also impact shareholder returns.

- Potential loss of upside if the company performs better independently: Possible

- Change in management and company strategy: Likely

- Potential integration challenges: Possible

- Impact on shareholder rights post-acquisition: Requires careful review

The Role of the Executive Chair and Sovereign Wealth Fund

The roles of the Executive Chair and the Sovereign Wealth Fund are critical to understanding this InterRent REIT acquisition.

Executive Chair's Motivation and Influence

The Executive Chair's involvement is multifaceted. Their personal stake in the company [Insert Details of Executive Chair's Stake] likely influences their decision. While potential conflicts of interest must be carefully considered and addressed, their deep understanding of InterRent’s operations and strategy are invaluable.

- Executive Chair’s personal stake in the company: [Insert Details of Executive Chair's Stake]

- Potential benefits or incentives for the Executive Chair from this transaction: [Insert Details of potential benefits]

- Possible conflict of interest concerns and how they are addressed: [Insert Details of conflict of interest mitigation]

Strategic Goals of the Sovereign Wealth Fund

The Sovereign Wealth Fund's participation is driven by strategic investment objectives aligned with InterRent’s portfolio. This acquisition likely serves the fund’s diversification strategy and provides exposure to a stable, income-generating real estate asset class.

- Sovereign Wealth Fund’s investment objectives: [Insert Details of Sovereign Wealth Fund's Investment Objectives]

- Alignment of InterRent’s assets with the fund’s strategic goals: Strong Alignment

- Diversification benefits for the fund: Significant

- Long-term outlook and planned strategies for InterRent: [Insert Details of Long-Term Strategy]

Conclusion

The InterRent REIT acquisition offer presents a complex situation requiring careful consideration by shareholders. This joint proposal from the Executive Chair and a Sovereign Wealth Fund presents both significant opportunities and potential risks. A thorough understanding of the offer's key terms, financial implications, and strategic motivations is crucial for making informed decisions. We strongly encourage you to conduct your own research and seek professional advice to fully evaluate this InterRent REIT acquisition and its potential impact on your investment. Stay informed and continue researching to make the best decision regarding this significant InterRent REIT acquisition offer.

Featured Posts

-

Hondas Competitive Edge Superior Bikes Superior Riders

May 29, 2025

Hondas Competitive Edge Superior Bikes Superior Riders

May 29, 2025 -

Strong 2024 Performance For Pcc Community Markets Profit Details

May 29, 2025

Strong 2024 Performance For Pcc Community Markets Profit Details

May 29, 2025 -

New Pokemon Tcg Pocket Expansion Overwhelmed By Gen 9 And Shiny Cards

May 29, 2025

New Pokemon Tcg Pocket Expansion Overwhelmed By Gen 9 And Shiny Cards

May 29, 2025 -

Arcane Season 2 Teases Whats Next For Caitlyn And Vi

May 29, 2025

Arcane Season 2 Teases Whats Next For Caitlyn And Vi

May 29, 2025 -

Rangers Future Uncertain A Change Of Plans In New York

May 29, 2025

Rangers Future Uncertain A Change Of Plans In New York

May 29, 2025

Latest Posts

-

Car Dealerships Push Back Against Mandatory Ev Sales

May 31, 2025

Car Dealerships Push Back Against Mandatory Ev Sales

May 31, 2025 -

V Mware Costs To Soar 1 050 At And T Details Broadcoms Extreme Price Hike

May 31, 2025

V Mware Costs To Soar 1 050 At And T Details Broadcoms Extreme Price Hike

May 31, 2025 -

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025 -

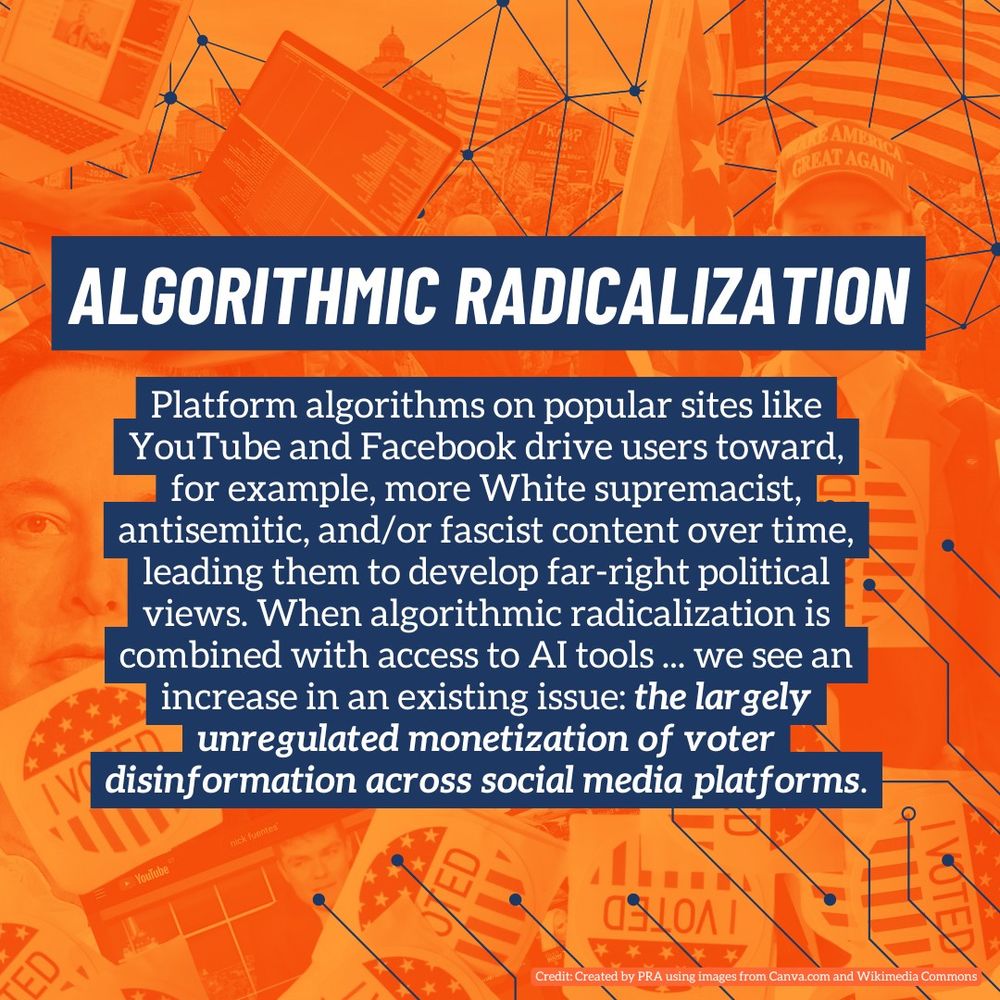

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025 -

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025