InterRent REIT: Executive Chair And Sovereign Wealth Fund Offer

Table of Contents

The Executive Chair's Role in the Offer

The InterRent REIT leadership plays a crucial role in navigating this significant offer. The executive chair's extensive experience and expertise in real estate are central to the deal's structuring and success. Their deep understanding of REIT management and corporate governance is invaluable in ensuring a smooth transaction and positive outcomes for all stakeholders.

- Years of experience in the real estate sector: The executive chair boasts decades of experience in various aspects of the real estate industry, including development, acquisition, and property management. This extensive background provides invaluable insight into the complexities of the deal.

- Specific achievements relevant to REIT management: Their track record includes successful REIT management, demonstrating a capacity for strategic decision-making and a proven ability to deliver strong financial results. Specific past successes, such as navigating previous market downturns or successfully completing complex acquisitions, bolster confidence in their leadership during this offer.

- Key contributions to the offer strategy: The executive chair has played a pivotal role in shaping the negotiation strategy, ensuring favorable terms for InterRent REIT and safeguarding the interests of shareholders. Their involvement in deal structuring has been instrumental in maximizing the potential benefits of this sovereign wealth fund investment.

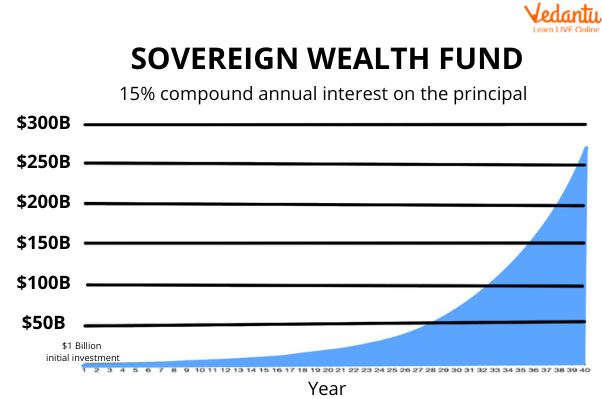

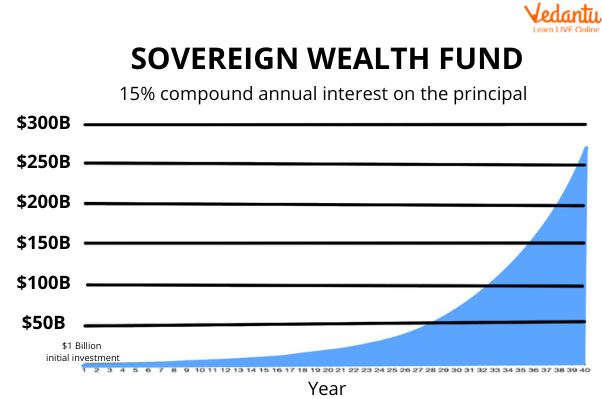

The Sovereign Wealth Fund's Investment Strategy

The involvement of a major sovereign wealth fund signifies a significant vote of confidence in InterRent REIT's future prospects. This long-term investment strategy demonstrates the fund's belief in the company's potential for growth and strong returns within the REIT portfolio diversification landscape.

- Sovereign wealth fund's previous investments in similar assets: The specific sovereign wealth fund involved has a history of successful investments in real estate assets, particularly in the REIT sector. This pattern suggests a clear understanding of the market and a strategic approach to long-term investment opportunities.

- The fund's typical investment timeline and expected returns: Sovereign wealth funds typically adopt a long-term perspective, seeking steady, sustainable growth rather than short-term gains. This aligns perfectly with the long-term value creation potential of InterRent REIT. Their expected returns are usually tied to long-term market growth.

- Potential synergies between the sovereign wealth fund and InterRent REIT: The combination of the sovereign wealth fund's financial resources and InterRent REIT's established portfolio and expertise can lead to significant synergies. This includes potential opportunities for expansion into new markets or the development of innovative real estate projects.

Potential Benefits and Risks of the Offer for InterRent REIT

This InterRent REIT acquisition, like any major investment, presents both significant opportunities and potential challenges. A thorough analysis is vital for investors to understand the full picture.

- InterRent REIT benefits: The injection of capital from the sovereign wealth fund can provide substantial resources for expansion, modernization, and improved financial stability. This strengthened market position can lead to enhanced competitiveness.

- InterRent REIT risks: Potential risks include the dilution of existing shareholder value, challenges in integrating the fund's investment strategy into the existing structure, and the ever-present risk of market volatility.

- Detailed financial projections illustrating potential benefits and risks: Independent financial analyses should be conducted to carefully weigh the potential benefits and risks before making investment decisions. This requires careful scrutiny of projected financial performance, both positive and negative scenarios, under various market conditions.

- Comparison with similar deals in the REIT sector: Benchmarking the offer against similar transactions within the REIT sector allows for a more informed assessment of its value and potential implications.

- Discussion of regulatory approvals and potential hurdles: Navigating regulatory approvals is a crucial aspect of any major transaction. Potential delays or unforeseen complications should be considered when evaluating the risk profile.

Impact on InterRent REIT Stock and Investor Sentiment

The offer's impact on InterRent REIT stock price and investor sentiment is a critical aspect of this investment analysis.

- Stock price performance before and after the announcement: Analyzing the stock price's behavior before and after the official announcement provides valuable insights into market reactions and investor perception.

- Analyst ratings and recommendations: The consensus opinion among financial analysts can offer guidance, although independent research remains crucial for informed decisions.

- Discussion of potential investment strategies for existing shareholders: Current shareholders need to carefully consider their investment strategy, perhaps diversifying their portfolios or holding onto their shares based on their individual risk tolerance and financial goals.

Conclusion: Evaluating the InterRent REIT Executive Chair and Sovereign Wealth Fund Offer

The InterRent REIT offer presents a complex scenario with significant potential benefits and risks. The executive chair's expertise and the sovereign wealth fund's strategic long-term investment approach both contribute to the potential for growth and market expansion. However, careful consideration of potential dilution, integration challenges, and market volatility remains essential. Ultimately, the success of this venture will hinge on effective management, successful integration, and favorable market conditions. Stay informed about the progress of the InterRent REIT offer and make informed investment decisions based on your own due diligence. Learn more about the long-term implications of the Sovereign Wealth Fund's investment in InterRent REIT to make the best choices for your portfolio.

Featured Posts

-

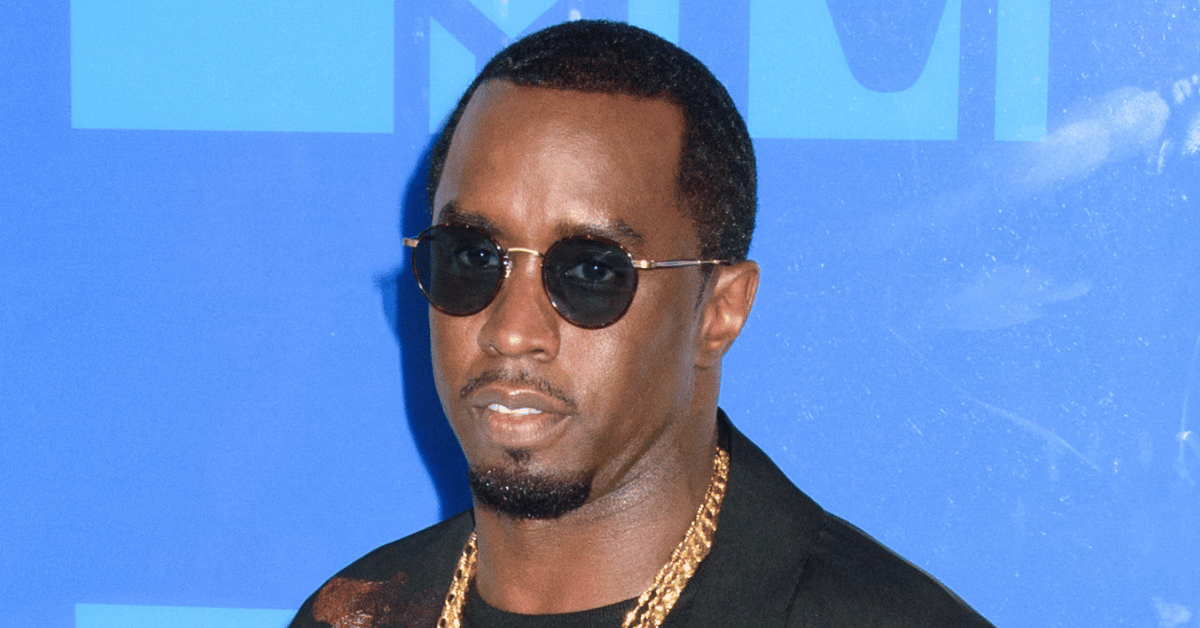

Kid Cudi Death Threat Allegation Key Testimony From Sean Combs Ex Employee

May 29, 2025

Kid Cudi Death Threat Allegation Key Testimony From Sean Combs Ex Employee

May 29, 2025 -

Will Tom Felton Return For The Harry Potter Tv Series

May 29, 2025

Will Tom Felton Return For The Harry Potter Tv Series

May 29, 2025 -

J K Rowlings Controversies And Their Potential Effect On The Harry Potter Reboot Hbos Stance

May 29, 2025

J K Rowlings Controversies And Their Potential Effect On The Harry Potter Reboot Hbos Stance

May 29, 2025 -

Rage Against The Machine O Morello Xtypaei Ton Tramp Stis Ipa

May 29, 2025

Rage Against The Machine O Morello Xtypaei Ton Tramp Stis Ipa

May 29, 2025 -

Russia Denounces Trumps Putin Criticism As Emotional Outburst

May 29, 2025

Russia Denounces Trumps Putin Criticism As Emotional Outburst

May 29, 2025

Latest Posts

-

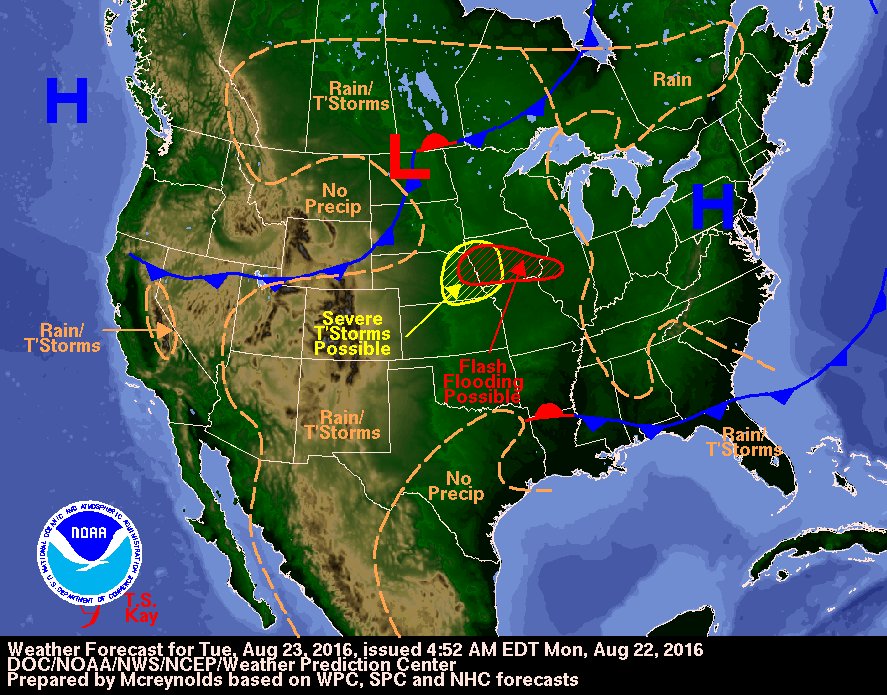

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025 -

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025 -

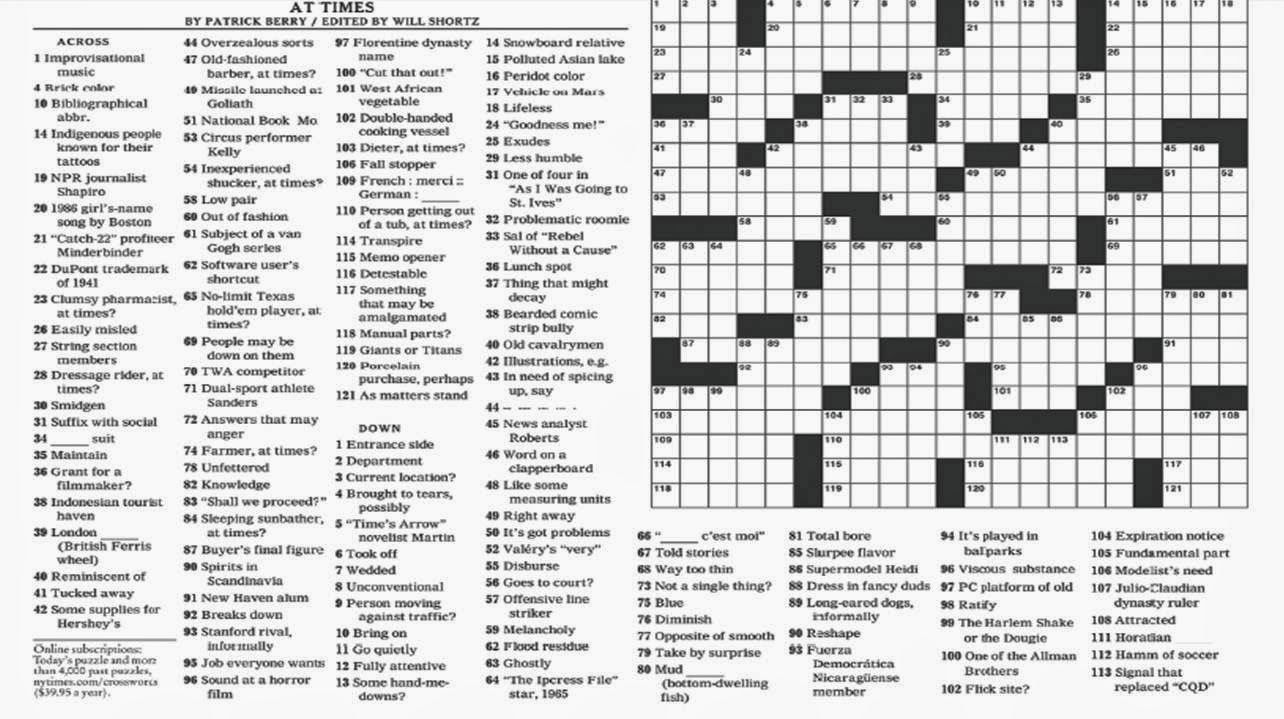

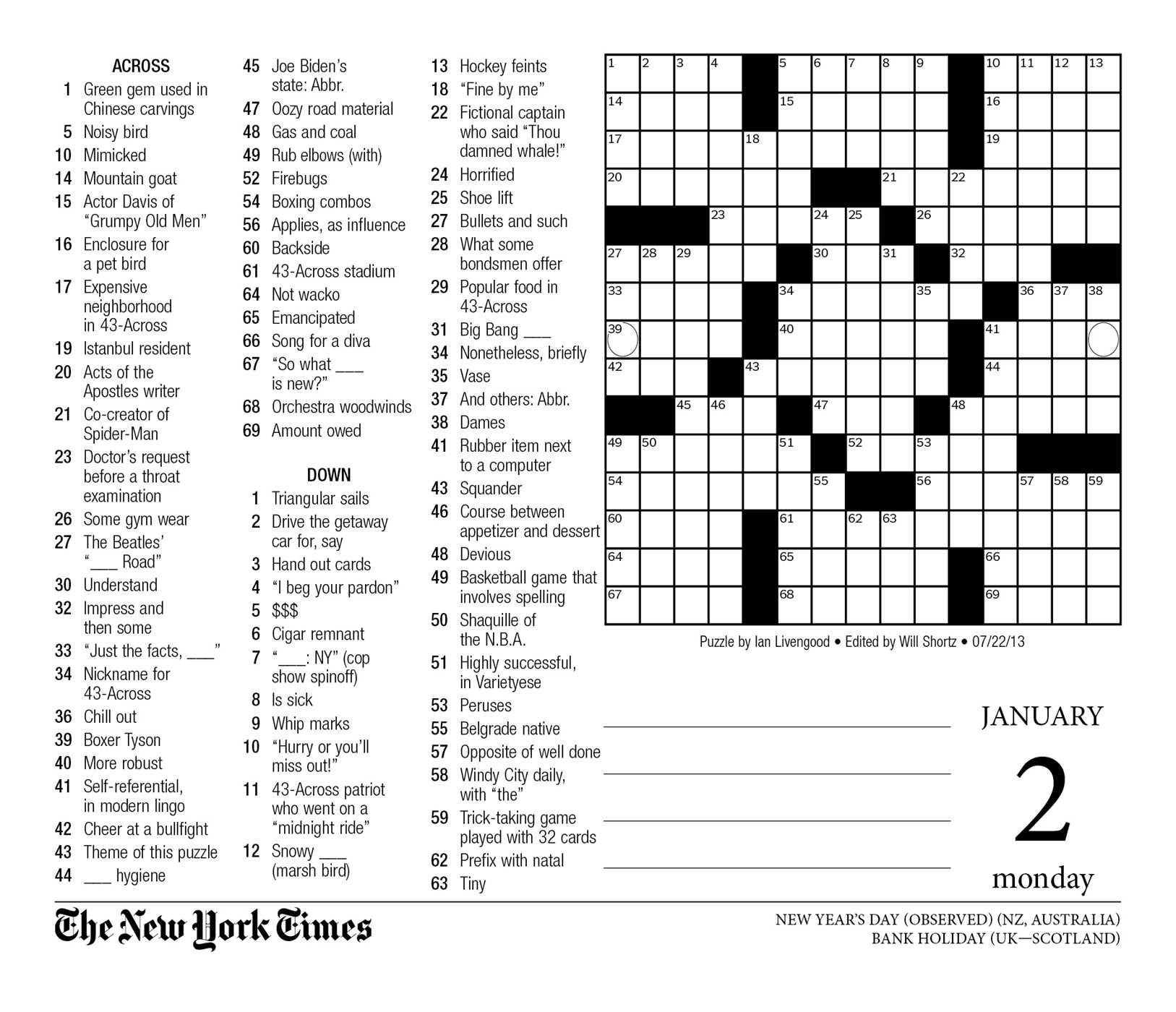

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025 -

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025