Invest Smart: A Guide To The Country's Rising Business Hot Spots

Table of Contents

Identifying Key Indicators of a Rising Business Hotspot

Before diving into specific regions, it's crucial to understand the key indicators that signal a burgeoning business hotspot. Identifying these factors allows for a more strategic and less risky investment approach.

Economic Growth and Stability

A strong and stable economy is the bedrock of any successful investment. Key metrics to consider include GDP growth, inflation rates, and government policies supporting business development.

- Stable political climate: Political stability ensures consistent policy and reduces uncertainty for investors.

- Favorable tax policies: Tax incentives and breaks can significantly reduce the cost of doing business and boost profitability.

- Access to funding: Easy access to loans, venture capital, and other funding sources is crucial for business growth.

- Infrastructure development: Efficient transportation, communication, and energy infrastructure are essential for smooth operations.

For example, regions showing consistent GDP growth above the national average, coupled with low inflation and proactive government support for entrepreneurship, are strong candidates for smart investment. Look for regions with positive economic forecasts and a history of sustained growth.

Talent Pool and Workforce

A skilled and readily available workforce is paramount for business success. Examine the availability of skilled labor and the strength of educational institutions.

- Presence of universities and technical schools: A robust education system ensures a pipeline of skilled workers.

- Skilled migrant programs: Attracting skilled workers from other regions can address labor shortages and boost innovation.

- Workforce demographics: Understanding the age distribution and skill sets of the workforce provides insights into future labor availability.

Areas with a growing, educated, and adaptable workforce, capable of meeting the demands of various industries, represent attractive investment opportunities. Regions with strong vocational training programs and a focus on STEM education are particularly promising.

Technological Infrastructure and Innovation

Access to advanced technology and a thriving innovation ecosystem are critical for businesses in today's digital age.

- Fiber optic networks and robust digital infrastructure: High-speed internet access is essential for efficient communication and data transfer.

- Technology incubators and accelerators: These support networks nurture startups and foster innovation.

- Significant investment in research and development: Regions prioritizing R&D attract innovative businesses and drive technological advancements.

Look for areas with state-of-the-art digital infrastructure, a strong culture of innovation, and active support for technological startups. Regions that attract significant investment in research and development are likely to experience robust and sustainable growth.

Top Rising Business Hot Spots in the Country

Several regions within the country are experiencing significant growth and present compelling investment opportunities.

Region A: Silicon Valley North (Hypothetical Example)

This region is rapidly emerging as a tech hub, attracting significant investment and boasting a highly skilled workforce.

- Key industries: Software development, artificial intelligence, biotechnology.

- Investment opportunities: Early-stage startups, established tech companies expanding operations.

- Infrastructure projects: New tech parks, improved transportation links.

- Projected growth rate: Above-average growth compared to national average.

Several successful tech companies have already established themselves in Silicon Valley North, and the local government offers substantial incentives for new businesses, making it a highly attractive investment destination.

Region B: Coastal Tourism Hub (Hypothetical Example)

This coastal region is experiencing a boom in tourism, driving significant investment in infrastructure and hospitality.

- Key industries: Hospitality, tourism, renewable energy.

- Investment opportunities: Hotel development, eco-tourism ventures, renewable energy projects.

- Infrastructure projects: Improved transportation, upgraded port facilities.

- Projected growth rate: Strong growth driven by tourism and renewable energy investments.

The region’s stunning natural beauty and growing popularity are attracting significant investment in tourism infrastructure and eco-friendly projects, offering diverse investment avenues.

Region C: Agricultural Innovation Center (Hypothetical Example)

This region leverages technological advancements to drive innovation in agriculture.

- Key industries: Precision agriculture, agritech, food processing.

- Investment opportunities: Agritech startups, sustainable farming practices, food processing facilities.

- Infrastructure projects: Improved irrigation systems, high-speed internet access in rural areas.

- Projected growth rate: Steady growth driven by technological advancements in agriculture.

Government support for sustainable agriculture and a focus on agritech are making this region a compelling investment destination for those interested in the burgeoning agritech sector.

Mitigating Risks and Due Diligence

While these regions offer promising investment opportunities, thorough due diligence is crucial to mitigate potential risks.

Conducting Thorough Market Research

Understanding local market conditions and competitive landscapes is paramount.

- Competitive analysis: Identify your competitors and understand their strengths and weaknesses.

- Market size and potential: Assess the current and future market demand for your chosen industry.

- Regulatory environment: Familiarize yourself with the legal and regulatory frameworks governing your chosen sector.

Conducting thorough market research, using reliable data sources and consulting with local experts, is essential for making informed investment decisions.

Assessing Legal and Regulatory Frameworks

Understanding local laws and regulations is crucial for navigating legal complexities and minimizing potential liabilities.

- Tax implications: Understand the tax implications of your investment, including corporate tax rates, VAT, and other relevant taxes.

- Licensing requirements: Determine the necessary licenses and permits required for your business operations.

- Labor laws: Familiarize yourself with employment laws, including minimum wage, working conditions, and employee benefits.

- Environmental regulations: Understand environmental protection laws and their implications for your business activities.

Consulting with legal professionals specializing in the specific region is highly recommended to ensure compliance with all applicable laws and regulations.

Diversifying Investments

Spreading your investments across different sectors and regions helps mitigate risk and improve overall portfolio performance.

- Real estate: Real estate investments offer stability and potential for long-term growth.

- Technology: The technology sector offers high growth potential but carries higher risk.

- Manufacturing: Manufacturing provides relatively stable returns, especially in established industries.

- Renewable energy: The renewable energy sector is experiencing significant growth driven by increasing environmental awareness.

Diversifying your investment portfolio reduces your dependence on any single sector and mitigates the impact of unforeseen events.

Conclusion

Investing smart requires careful research and understanding of emerging markets. This guide has highlighted key indicators to identify rising business hot spots and explored some of the country's most promising locations. By conducting thorough due diligence and diversifying your investment portfolio, you can significantly increase your chances of success. Don't miss out on the opportunity to invest smart in the country's burgeoning business hot spots. Begin your research today and discover the potential for growth and profit. Learn more about smart investment strategies and explore the opportunities available in these dynamic regions.

Featured Posts

-

Overcoming Adversity The Journey From Wolves To Europes Elite

May 10, 2025

Overcoming Adversity The Journey From Wolves To Europes Elite

May 10, 2025 -

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025

Mstwa Fyraty Me Alerby Alqtry Bed Rhylh En Alahly Almsry

May 10, 2025 -

Transgender Rights And The Trump Administration A Personal Account

May 10, 2025

Transgender Rights And The Trump Administration A Personal Account

May 10, 2025 -

Snls Harry Styles Impression The Singers Reaction

May 10, 2025

Snls Harry Styles Impression The Singers Reaction

May 10, 2025 -

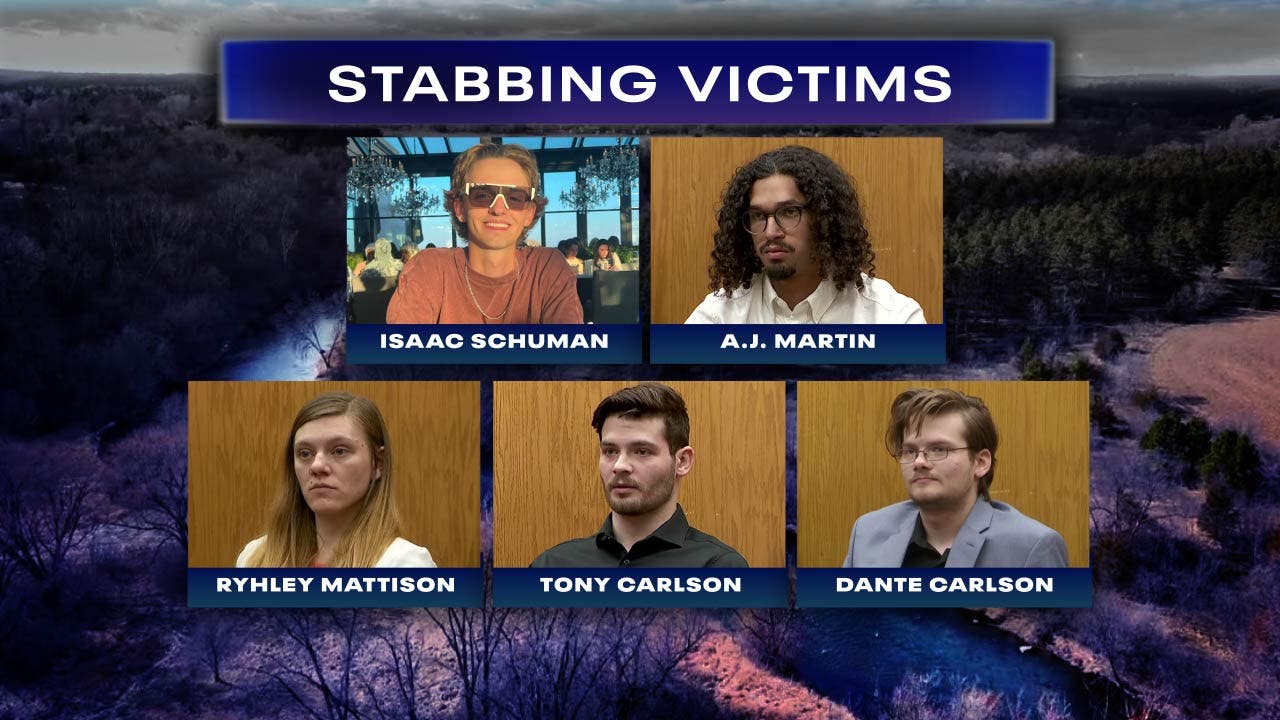

Nottingham Nhs Data Breach Families Outraged Over Access To A And E Records Of Stabbing Victims

May 10, 2025

Nottingham Nhs Data Breach Families Outraged Over Access To A And E Records Of Stabbing Victims

May 10, 2025