Investigating BigBear.ai (BBAI) Stock Losses: Contact Gross Law Firm

Table of Contents

Understanding the BigBear.ai (BBAI) Stock Decline

Analyzing Recent Market Performance

BigBear.ai's stock price has experienced dramatic fluctuations recently. For example, [insert specific date] saw a [percentage]% drop, followed by another [percentage]% decline on [insert specific date]. These significant drops followed [mention specific news, e.g., the release of disappointing quarterly earnings, a negative analyst report downgrading the stock, or announcements of regulatory investigations]. These events likely contributed to the overall negative market sentiment surrounding BBAI.

- Specific examples of negative news impacting BBAI's stock price:

- Missed earnings expectations for Q[Quarter] [Year].

- Negative analyst reports citing concerns about [mention specific concerns, e.g., the company's growth prospects or its competitive landscape].

- Reports of regulatory scrutiny related to [mention specific regulatory concerns].

- Charts and graphs showing BBAI's stock performance: [Insert links to relevant charts from reputable financial sources like Yahoo Finance or Google Finance].

Potential Causes of BBAI Stock Losses

The significant drop in BBAI's stock price raises concerns about potential securities violations. Several factors could contribute to these investor losses, including:

- Bullet points: Explain different types of securities fraud:

- Misrepresentation of financial information: The company may have knowingly or unknowingly presented inaccurate or misleading financial data to investors.

- Insider trading: Insiders may have traded on non-public information, leading to unfair gains while other investors suffered losses.

- Omission of material information: Failure to disclose crucial information to investors that could have influenced their investment decisions.

- Bullet points: Mention potential breaches of fiduciary duty:

- Company executives may have violated their fiduciary duty by prioritizing their personal interests over the interests of shareholders.

Investigating Your Potential Legal Recourse

Securities Laws and Investor Protection

Several securities laws exist to protect investors from fraudulent activities. These laws aim to ensure fair and transparent markets. Key concepts include:

- Bullet points: Key legislation relevant to investor protection:

- The Securities Act of 1933

- The Securities Exchange Act of 1934

- The Sarbanes-Oxley Act of 2002

- Bullet points: Explanation of class action lawsuits and their benefits:

- Class action lawsuits allow multiple investors who have suffered similar losses to join together in a single legal action. This can lead to more efficient and cost-effective legal proceedings.

The Role of Gross Law Firm

Gross Law Firm specializes in securities litigation and has a proven track record of representing investors who have suffered losses due to corporate misconduct. They have extensive experience investigating potential securities fraud and helping investors recover their losses.

- Bullet points: Details on Gross Law Firm's successful track record in similar cases: [Insert details about successful cases and awards won by the firm].

- Bullet points: Outline the firm's investigative process: Gross Law Firm will conduct a thorough investigation, analyze financial statements, interview witnesses, and gather evidence to build a strong case on behalf of its clients.

How to Proceed if You've Experienced BBAI Stock Losses

Gathering Necessary Information

To effectively pursue legal recourse, gather the following crucial information:

- Bullet points: A checklist of important documents:

- Brokerage statements showing your BBAI stock transactions.

- Investment agreements or account statements.

- Any communication you have had with BigBear.ai or its representatives.

Contacting Gross Law Firm

If you've experienced losses due to the BigBear.ai (BBAI) stock decline, contact Gross Law Firm immediately for a free consultation.

- Bullet points: Reiterate the benefits of contacting the firm: Gross Law Firm offers experienced legal counsel and will guide you through the process of exploring your legal options.

- Bullet points: A clear call to action, encouraging readers to reach out for a consultation: Contact Gross Law Firm today at [phone number], [email address], or visit their website at [website link].

Conclusion

The significant decline in BigBear.ai (BBAI) stock price has resulted in substantial investor losses. Potential causes include misrepresentation of financial information, misleading statements, and other potential securities violations. Investors who have suffered losses may have legal recourse through securities laws and class action lawsuits. Gross Law Firm is dedicated to helping investors investigate these losses and pursue legal action to recover their investments. If you've experienced BigBear.ai (BBAI) stock losses, contact Gross Law Firm today for a free consultation to discuss your legal options and explore potential avenues for recovering your investment. Don't delay; protect your rights and explore your options regarding your BigBear.ai (BBAI) stock losses and potential securities fraud. Contact Gross Law Firm now.

Featured Posts

-

Itineraires Velo Loire Vignoble Nantais Et Estuaire 5 Suggestions

May 21, 2025

Itineraires Velo Loire Vignoble Nantais Et Estuaire 5 Suggestions

May 21, 2025 -

Fa Cup Rashfords Brace Leads Aston Villa To Easy Win Against Preston

May 21, 2025

Fa Cup Rashfords Brace Leads Aston Villa To Easy Win Against Preston

May 21, 2025 -

Australian Trans Influencer Shatters Record Addressing The Doubts And Debate

May 21, 2025

Australian Trans Influencer Shatters Record Addressing The Doubts And Debate

May 21, 2025 -

Giakoymakis Sti Los Antzeles

May 21, 2025

Giakoymakis Sti Los Antzeles

May 21, 2025 -

Provence Self Guided Hiking Tour From Mountains To The Sea

May 21, 2025

Provence Self Guided Hiking Tour From Mountains To The Sea

May 21, 2025

Latest Posts

-

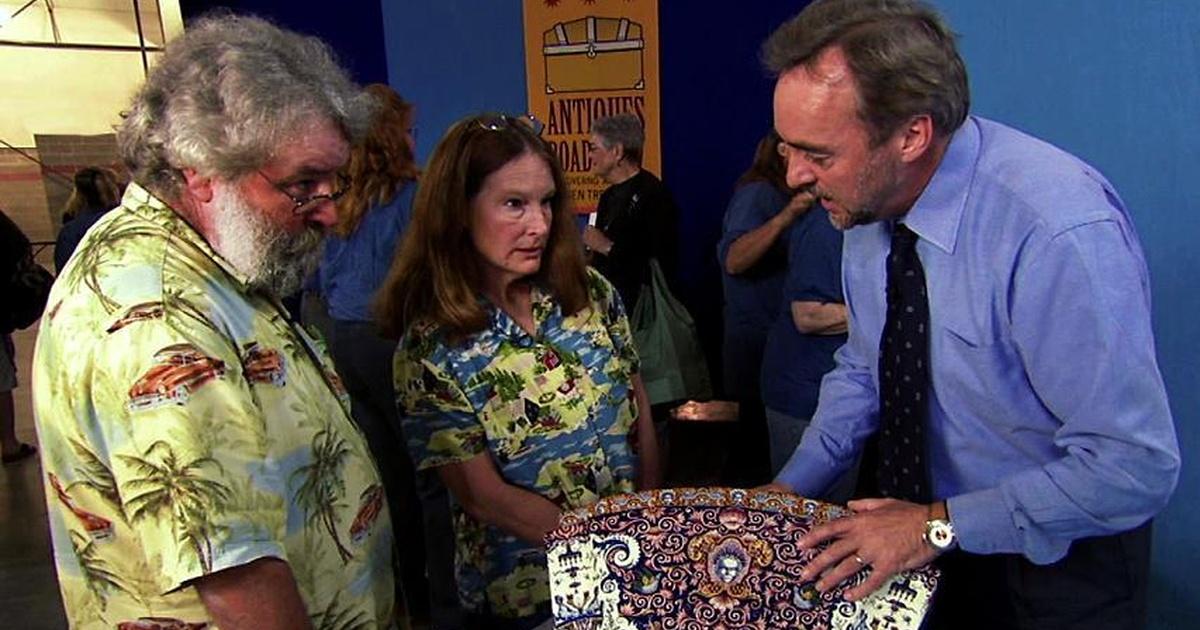

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025 -

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025