Investigating The Reasons Behind CoreWeave (CRWV)'s Thursday Stock Decline

Table of Contents

Thursday saw a significant drop in CoreWeave (CRWV) stock, leaving investors scrambling to understand the reasons behind this sudden market reaction. This article investigates the potential factors contributing to this sharp decline, examining recent news, market trends, and CoreWeave's financial performance to provide insights for investors navigating this volatile situation. We'll analyze various possibilities, offering a comprehensive overview to help you understand the complexities behind this unexpected downturn.

Impact of Overall Market Sentiment and Sector Performance

Keywords: Market volatility, tech stock downturn, cloud computing sector, broader market trends, investor sentiment

Thursday's decline in CRWV wasn't happening in a vacuum. Understanding the broader market context is crucial. Several factors contributed to the negative market sentiment:

-

Broader Market Conditions: The overall stock market experienced a period of volatility on Thursday. Many tech stocks, particularly those in the cloud computing sector, experienced significant drops. This indicates that the CRWV decline was partly influenced by a general negative market trend impacting the entire tech sector. External factors such as interest rate hikes or geopolitical events can contribute to such market-wide downturns.

-

Cloud Computing Sector Performance: It's important to analyze the performance of other cloud computing companies. Did they experience similar declines? If so, it suggests sector-specific pressures, such as increased competition, slowing demand, or concerns about future growth in the cloud computing industry. This context helps to determine if the CRWV drop was unique or part of a broader industry trend.

-

Investor Sentiment: Negative investor sentiment toward the tech sector as a whole can impact individual stock prices, including CRWV. Fear, uncertainty, and doubt (FUD) can trigger sell-offs, even in the absence of company-specific negative news. Understanding prevailing investor sentiment towards the overall technological landscape is critical for assessing the impact on individual tech stocks.

-

Macroeconomic Factors: Macroeconomic factors, such as inflation, interest rate changes, and recessionary fears, significantly influence investor behavior. These factors can cause a general risk-off sentiment, leading to sell-offs across various sectors, including cloud computing. A general economic slowdown can impact investor confidence and lead to a decline in technology sector investment.

Absence of Positive Catalysts and News

Keywords: Lack of news, earnings reports, announcements, company updates, investor expectations, positive catalysts

The absence of positive catalysts can contribute to a stock price decline. Let's examine this factor in relation to CoreWeave's situation:

-

News and Announcements: Did CoreWeave release any news or earnings reports on Thursday? The absence of positive news or announcements could leave investors feeling uncertain and potentially lead to profit-taking. If there were no significant positive developments to support the stock price, it could trigger a decline.

-

Unmet Expectations: Investor expectations play a crucial role. If the market anticipated positive news or announcements that didn't materialize, disappointment could lead to selling pressure. Investors' expectations are often based on previous performance, analyst predictions, and general industry trends. Falling short of these expectations can result in a stock price drop.

-

Lack of Positive Catalysts: Positive catalysts, such as new partnerships, product launches, or strong earnings growth, can boost investor confidence. The absence of such catalysts can contribute to a lack of buying interest and potentially lead to a decline in the stock price. Without any significant positive factors to drive investment, the stock price becomes vulnerable to selling pressure.

Specific Concerns Related to CoreWeave's Business Model or Financials

Keywords: Financial performance, revenue growth, profitability, competition, AI infrastructure, business model, debt, valuation

Analyzing CoreWeave's specific circumstances is vital:

-

Financial Performance: Scrutinize CoreWeave's recent financial reports. Were there any signs of slowing revenue growth, declining profitability, or increasing debt levels? Such indicators could raise concerns among investors and trigger a sell-off.

-

Competitive Landscape: The cloud computing market is highly competitive. Increased competition from established players or new entrants could impact CoreWeave's market share and profitability. Analyzing the competitive dynamics within the industry is crucial to understanding potential vulnerabilities.

-

Valuation Concerns: High valuations can make a company susceptible to corrections. Was CoreWeave’s stock price considered overvalued by some analysts before the decline? Overvaluation makes a company more vulnerable to negative news or changes in investor sentiment.

-

AI Infrastructure Dependency: CoreWeave's business model relies heavily on the AI infrastructure market. Any negative news or slowdown in the broader AI sector could disproportionately impact the company.

Potential Impact of Analyst Ratings or Price Target Adjustments

Keywords: Analyst ratings, price target, sell-off, downgrade, investment recommendations

Analyst actions can significantly influence stock prices:

-

Downgrades and Price Target Adjustments: Did any analysts downgrade their ratings or lower their price targets for CRWV around Thursday? Such actions often trigger sell-offs as investors react to negative expert opinions.

-

Institutional Investor Activity: Large institutional investors can significantly impact a stock's price through their trading activity. Their sell-offs can create a cascading effect and amplify the decline.

Conclusion

The Thursday decline in CoreWeave (CRWV) stock is likely a multifaceted issue, resulting from a confluence of factors. These include broader market volatility affecting the tech sector, the absence of positive news or catalysts, and potential concerns about CoreWeave's financial performance or business model, coupled with analyst actions. Understanding these interwoven elements is crucial for investors.

Call to Action: Staying informed about CoreWeave (CRWV) and the cloud computing sector demands continuous monitoring of market conditions, financial news, and analyst reports. Continue researching and analyzing the situation to make informed decisions regarding your CoreWeave investments. Understanding the reasons behind the CoreWeave stock decline is a vital step in managing your portfolio effectively. Thorough due diligence and a well-informed investment strategy are essential for navigating the volatility of the stock market, especially for stocks like CoreWeave (CRWV).

Featured Posts

-

Love Monster A Childrens Book Review

May 22, 2025

Love Monster A Childrens Book Review

May 22, 2025 -

Sanktsiyi Proti Rosiyi Grem Ogolosiv Pro Zhorstki Zakhodi

May 22, 2025

Sanktsiyi Proti Rosiyi Grem Ogolosiv Pro Zhorstki Zakhodi

May 22, 2025 -

Xay Dung Cau Ma Da Thuc Day Phat Trien Kinh Te Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Thuc Day Phat Trien Kinh Te Dong Nai

May 22, 2025 -

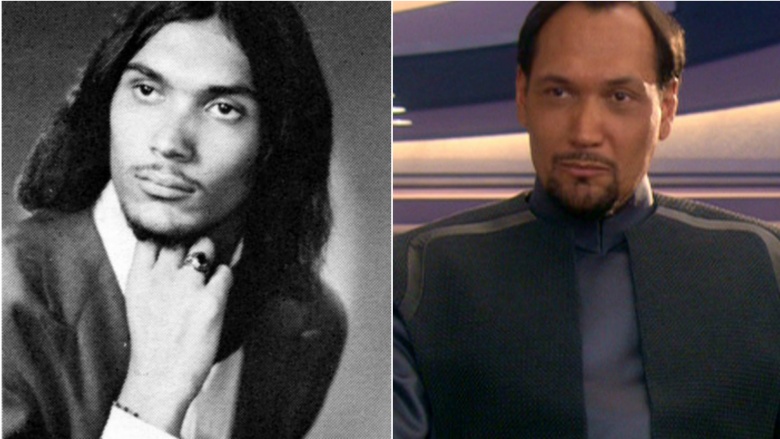

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025

John Lithgow Und Jimmy Smits Die Rueckkehr In Dexter Resurrection

May 22, 2025 -

Toledo Sees Week Over Week Drop In Gasoline Prices

May 22, 2025

Toledo Sees Week Over Week Drop In Gasoline Prices

May 22, 2025

Latest Posts

-

Big Rig Rock Report 3 12 Rock 106 1 Full Report

May 23, 2025

Big Rig Rock Report 3 12 Rock 106 1 Full Report

May 23, 2025 -

Big Rig Rock Report 3 12 Essential Updates From 98 5 The Fox

May 23, 2025

Big Rig Rock Report 3 12 Essential Updates From 98 5 The Fox

May 23, 2025 -

Big Rig Rock Report 3 12 Rock 106 1 Details

May 23, 2025

Big Rig Rock Report 3 12 Rock 106 1 Details

May 23, 2025 -

Analyzing The Big Rig Rock Report 3 12 96 1 The Rocket A Detailed Guide

May 23, 2025

Analyzing The Big Rig Rock Report 3 12 96 1 The Rocket A Detailed Guide

May 23, 2025 -

Big Rig Rock Report 3 12 96 1 The Rocket Key Findings And Interpretations

May 23, 2025

Big Rig Rock Report 3 12 96 1 The Rocket Key Findings And Interpretations

May 23, 2025