Investing In AI Quantum Computing: One Key Reason To Buy The Dip

Table of Contents

The Untapped Potential of AI Quantum Computing

AI quantum computing represents a paradigm shift in computational power. Unlike classical computers that rely on bits representing 0 or 1, quantum computers utilize qubits, leveraging superposition and entanglement to perform calculations at exponentially faster speeds. This revolutionary capability unlocks solutions to problems currently intractable for even the most powerful supercomputers. The potential impact spans various sectors:

- Faster drug discovery and development: Quantum computing can simulate molecular interactions with unprecedented accuracy, accelerating the development of new pharmaceuticals and treatments.

- Breakthroughs in materials science: Designing new materials with specific properties – from superconductors to high-strength alloys – becomes significantly faster and more efficient.

- Revolutionizing financial modeling and risk management: Quantum algorithms can optimize complex portfolios, predict market trends more accurately, and significantly improve risk assessment.

- Significant advancements in artificial intelligence algorithms: Quantum computing can power the next generation of AI, leading to more sophisticated machine learning models and breakthroughs in areas like natural language processing and computer vision.

These capabilities translate to enormous future market value. The companies at the forefront of AI quantum computing development are poised for significant growth as the technology matures and its applications become more widespread. Investing early in this burgeoning sector offers the potential for substantial long-term returns.

Current Market Dip Presents a Unique Buying Opportunity

The current market for AI quantum computing investments is experiencing a temporary dip, influenced by factors such as broader economic uncertainty and general investor apprehension regarding emerging technologies. However, this dip presents a strategic opportunity for long-term investors.

- Lower entry point for high-growth potential: The dip offers a chance to acquire shares at significantly reduced prices compared to recent highs.

- Opportunity to accumulate shares at discounted prices: Investors can strategically acquire more shares of promising companies while prices remain lower.

- Potential for significant returns once the market recovers: As the technology matures and adoption increases, the market is expected to rebound strongly, yielding significant returns for early investors.

This is a classic "buy the dip" scenario. While short-term volatility is expected, the long-term growth prospects of AI quantum computing remain exceptionally strong. This presents a compelling investment thesis for those with a long-term perspective.

Identifying Promising AI Quantum Computing Investments

Identifying promising companies in the AI quantum computing sector requires careful research and due diligence. Here's a structured approach:

- Focus on companies with strong technological foundations and experienced leadership teams: Look for companies with a proven track record in quantum computing research and development and a leadership team with deep expertise.

- Look at companies with strategic partnerships and collaborations: Partnerships with major technology companies, research institutions, and industry players often signal a company's potential for success.

- Analyze financial statements and growth projections: Carefully evaluate a company's financial health, growth trajectory, and potential for future profitability.

- Consider diversifying investments across multiple companies: Diversification mitigates risk and helps to balance potential gains and losses.

While specific company recommendations are beyond the scope of this article, researching publicly traded companies active in quantum computing hardware, software, and applications will provide several potential investment candidates. Remember to evaluate each investment opportunity based on its merits and your individual risk tolerance.

Mitigating Investment Risks in AI Quantum Computing

Investing in emerging technologies like AI quantum computing inherently involves risks, including market volatility and uncertainty around the technology's development and adoption. However, these risks can be mitigated:

- Invest only what you can afford to lose: Never invest more than you can afford to lose, especially in a high-growth, high-risk sector.

- Conduct thorough due diligence before making any investment: Thoroughly research any company before investing, evaluating its technology, financials, and competitive landscape.

- Diversify your portfolio to reduce risk: Don't put all your eggs in one basket. Diversify your investments across different companies and asset classes to reduce overall risk.

- Have a long-term investment strategy: AI quantum computing is a long-term investment. Patience and a long-term perspective are crucial for success.

Investing in AI Quantum Computing – A Call to Action

In summary, investing in AI quantum computing presents a compelling opportunity. The technology's immense potential, coupled with the current market dip, creates a strategic "buy the dip" scenario. However, careful research, due diligence, and a long-term investment strategy are essential to mitigate risks. Don't miss this opportunity to invest in AI quantum computing. Research the market, mitigate risks, and secure your position in this groundbreaking technology. Start exploring promising quantum computing stocks and build your portfolio for the future of computing.

Featured Posts

-

Switzerland Issues Strong Statement Against Chinese Military Actions

May 21, 2025

Switzerland Issues Strong Statement Against Chinese Military Actions

May 21, 2025 -

Love Monster Exploring The Power Of Friendship And Self Acceptance

May 21, 2025

Love Monster Exploring The Power Of Friendship And Self Acceptance

May 21, 2025 -

Mainz Extend Top Four Hold Following Win Against Gladbach

May 21, 2025

Mainz Extend Top Four Hold Following Win Against Gladbach

May 21, 2025 -

Voyage En Toscane Sans Quitter L Ouest L Architecture De Nom De La Ville

May 21, 2025

Voyage En Toscane Sans Quitter L Ouest L Architecture De Nom De La Ville

May 21, 2025 -

Can A British Ultrarunner Break The Australian Speed Record

May 21, 2025

Can A British Ultrarunner Break The Australian Speed Record

May 21, 2025

Latest Posts

-

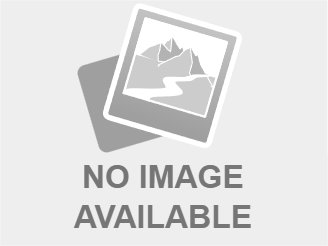

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025

Southport Migrant Rant Tory Politicians Wife To Stay In Jail

May 22, 2025 -

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025

Connollys Racial Hatred Conviction Upheld Appeal Rejected

May 22, 2025 -

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025

Tory Wifes Jail Sentence Confirmed After Anti Migrant Outburst In Southport

May 22, 2025 -

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025

Mother Imprisoned For Social Media Post After Southport Stabbing Incident

May 22, 2025 -

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025

Lucy Connolly Loses Appeal Over Racist Social Media Post

May 22, 2025