Investing In BigBear.ai (BBAI): A Penny Stock Deep Dive

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) is a technology company specializing in AI-powered data analytics solutions. Founded in 2018, the company has quickly established itself as a player in the government and commercial sectors, offering a range of services designed to help organizations make sense of complex data. Their BBAI business model centers around providing advanced analytics capabilities, leveraging AI and machine learning to solve intricate problems across multiple industries.

- AI and Data Analytics Services: BigBear.ai offers a suite of AI-powered solutions, including predictive modeling, anomaly detection, and risk assessment. These services are tailored to specific client needs and often involve custom development.

- Target Markets: BBAI's primary target markets include government agencies (defense, intelligence, etc.) and commercial enterprises seeking to improve their operational efficiency and decision-making processes through BigBear.ai AI solutions.

- Key Partnerships and Contracts: The company has secured several significant contracts with government agencies and major corporations, which are crucial to its revenue streams. These partnerships provide stability but also create a dependency that needs to be considered.

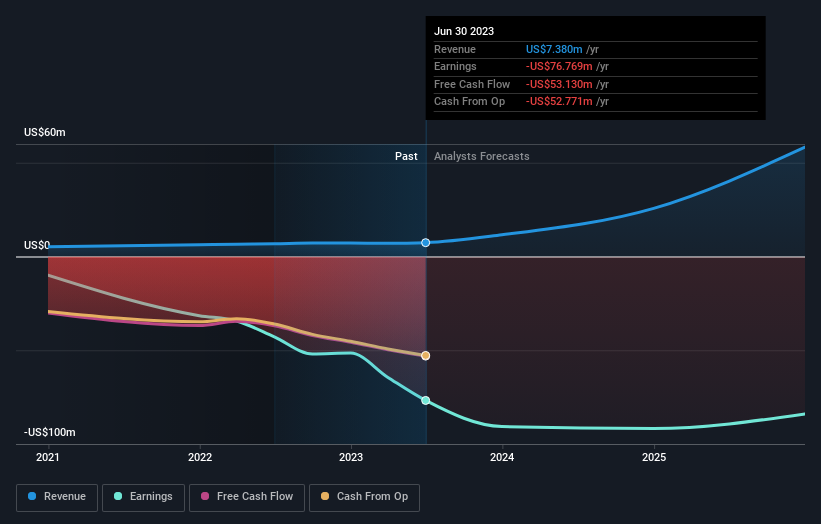

- Financial Highlights: While the company has shown growth in revenue, profitability remains a challenge, typical of many growth-stage companies, especially in the volatile penny stock landscape. Revenue streams are diverse, but heavily reliant on large government contracts.

- Strengths:

- Strong AI capabilities

- Established government contracts

- Growing commercial market presence

- Weaknesses:

- Reliance on government contracts

- Profitability challenges

- High competition in the AI/data analytics space

Analyzing BBAI's Stock Performance and Valuation

Analyzing BBAI's stock price requires careful consideration of its historical performance. The BBAI stock price has demonstrated significant volatility, a common characteristic of penny stocks. Investors need to carefully examine charts and historical data to understand the trends and fluctuations before making any investment decisions.

- Historical Stock Price Analysis: Charting the BBAI stock price reveals periods of rapid growth followed by sharp declines. Understanding these patterns and their underlying causes is vital.

- Market Capitalization and Price-to-Earnings Ratio: The market capitalization of BBAI is relatively small, reflecting its status as a penny stock. The price-to-earnings ratio (P/E ratio), if available, should be cautiously interpreted given the company's current stage of development.

- Competitor Comparison: BBAI faces competition from both large established companies and smaller, agile startups in the AI/data analytics sector. Comparing its valuation to competitors is essential for gauging its potential.

- Investor Sentiment and News: News events, regulatory changes, and announcements from the company significantly impact investor sentiment and, consequently, the BBAI stock price. Monitoring these factors is crucial.

- Risks and Rewards:

- Risks: High volatility, low liquidity, potential for significant losses.

- Rewards: Potential for substantial capital appreciation if the company achieves significant growth.

Assessing the Risks and Rewards of Investing in BBAI Penny Stock

Investing in BBAI carries significant risks, common to most penny stocks. These risks must be carefully evaluated before committing any capital.

- Inherent Penny Stock Risks: High volatility, low liquidity, potential for manipulation, and difficulty finding reliable information are inherent risks in penny stock investing.

- BBAI-Specific Risks: BBAI's financial stability, its reliance on government contracts, and the competitive landscape all pose specific risks to investors. The lack of consistent profitability represents a substantial concern.

- Potential Rewards: The potential for significant capital appreciation is the primary reward. If BBAI achieves significant growth and market share, the stock price could increase substantially.

- Risk Mitigation Strategies: Diversification is crucial. Don't put all your eggs in one basket, especially a volatile penny stock like BBAI. Thorough due diligence, a well-defined investment strategy, and a long-term perspective can also help mitigate risk.

- Key Risk Factors & Potential Returns:

- High Risk: Significant loss of capital is possible.

- Moderate to High Reward: Potential for substantial returns if the company performs well.

BigBear.ai (BBAI) Investment Strategies and Considerations

Investing in BBAI requires a carefully considered strategy.

- Investment Approaches: Long-term investors might view BBAI as a growth stock with potential for long-term gains. Short-term traders might aim to profit from short-term price fluctuations, but this approach carries a higher risk.

- Diversification: Diversifying your portfolio across different asset classes is essential to reduce overall risk. Don't over-allocate to BBAI or any single penny stock.

- Due Diligence: Thorough research is crucial before investing in any penny stock. Understand the business model, financial performance, competition, and risks involved.

- Fundamental and Technical Analysis: Utilizing both fundamental (financial statements) and technical (chart patterns) analysis can inform your investment decisions.

- Practical Investment Steps:

- Conduct thorough research.

- Assess your risk tolerance.

- Diversify your portfolio.

- Set clear investment goals.

Conclusion: Investing in BigBear.ai (BBAI): A Penny Stock Deep Dive – Final Thoughts and Call to Action

Investing in BigBear.ai (BBAI) presents both significant opportunities and substantial risks. The company operates in a dynamic sector with high growth potential, but its penny stock status necessitates a cautious approach. Remember, the information provided here is for informational purposes only and does not constitute financial advice. Thorough due diligence is paramount before making any investment decision.

Ready to delve deeper into the world of BigBear.ai (BBAI) penny stock investing? [Link to further resources]

Featured Posts

-

Astkshaf Imkanyat Aldhkae Alastnaey Fy Ieadt Ktabt Aemal Aghatha Krysty

May 20, 2025

Astkshaf Imkanyat Aldhkae Alastnaey Fy Ieadt Ktabt Aemal Aghatha Krysty

May 20, 2025 -

Chinas Fury Examining The New Us Missile Launcher Deployment

May 20, 2025

Chinas Fury Examining The New Us Missile Launcher Deployment

May 20, 2025 -

Understanding The Significant Drop In D Wave Quantum Qbts Stock Price In 2025

May 20, 2025

Understanding The Significant Drop In D Wave Quantum Qbts Stock Price In 2025

May 20, 2025 -

Analyzing Todays Rise In D Wave Quantum Inc Qbts Stock Value

May 20, 2025

Analyzing Todays Rise In D Wave Quantum Inc Qbts Stock Value

May 20, 2025 -

Eurovision Song Contest 2025 Meet The Artists

May 20, 2025

Eurovision Song Contest 2025 Meet The Artists

May 20, 2025