Investing In Palantir Stock: A Pre-May 5th Assessment

Table of Contents

Palantir's Recent Performance and Market Position

Understanding Palantir's recent performance is crucial before considering a Palantir investment. The Palantir share price has experienced significant fluctuations, reflecting the volatile nature of the technology stock market and the company's dependence on large government contracts and the growth of its commercial business.

-

Stock Price Fluctuations: Analyze recent stock price charts to identify trends and patterns leading up to May 5th. Look for significant upward or downward movements, and try to correlate these with news events or market sentiment surrounding Palantir stock.

-

Market Share: Palantir holds a significant share in the government contracting sector, particularly within intelligence and defense. Its commercial business is also growing rapidly, competing with other data analytics companies. Assessing its market share against competitors like Tableau, Qlik, and others is key to understanding its position.

-

Competitive Analysis: Palantir faces stiff competition in the data analytics market. Comparing Palantir's performance – revenue growth, profitability, and market penetration – with competitors reveals its strengths and weaknesses. Examine their technological advancements, customer acquisition strategies, and overall market impact to assess Palantir's competitive advantage.

-

Impact of Recent News: News related to new contracts, technological breakthroughs, or changes in government spending policies significantly impacts Palantir's stock performance. Keep abreast of relevant news to understand the potential influence on the May 5th Palantir earnings.

Upcoming Earnings Report (May 5th) and its Potential Impact

The May 5th Palantir earnings report is a significant event for PLTR stock. Analyst predictions and expectations will heavily influence the market's reaction.

-

Analyst Expectations: Carefully review analyst forecasts for revenue, earnings per share (EPS), and other key metrics. Understanding the range of predictions helps you gauge the potential impact of the actual results.

-

Impact of Results: Exceeding expectations typically leads to a positive stock market reaction, while missing targets can trigger a sell-off. Analyze historical patterns of Palantir's stock price movements after earnings announcements to understand the potential volatility.

-

Catalysts and Risks: Identify potential catalysts – like securing large new contracts or announcing strategic partnerships – that could positively affect the earnings and subsequently the Palantir share price. Conversely, be aware of potential risks, such as increased competition or delays in project implementation, which could negatively impact the report and the PLTR stock price.

-

Earnings Call Analysis: Actively listen to the Palantir earnings call. Pay close attention to management's commentary on key performance indicators, future guidance, and overall sentiment. This provides valuable insight beyond the numerical data in the report.

Long-Term Growth Potential and Investment Risks

Investing in Palantir involves considering both its long-term growth potential and the associated risks.

-

Long-Term Growth in Data Analytics: The data analytics market is expanding rapidly, presenting significant opportunities for Palantir. Assess its potential to capitalize on this growth by expanding its customer base, developing innovative technologies, and penetrating new markets.

-

Investment Risks: Investing in Palantir stock comes with risks. Market volatility, increased competition, and dependence on government contracts are significant factors to consider. Analyze the potential impact of these factors on the future performance of the PLTR stock.

-

Geopolitical Factors: Palantir's significant reliance on government contracts makes it susceptible to geopolitical changes. Consider the potential impact of shifts in government priorities or international relations on its revenue streams.

-

Technological Innovation: Palantir's success hinges on its ability to innovate and adapt to evolving technological landscapes. Analyze its R&D investments and its ability to stay ahead of the competition.

Diversification and Portfolio Strategy

Diversification is key to managing investment risk. Palantir, while offering significant growth potential, should be considered within a broader portfolio strategy.

- A well-diversified portfolio mitigates the impact of potential losses in any single investment. Consider your risk tolerance and allocate your assets accordingly. Palantir's high-growth potential may suit investors with higher risk tolerance. Always consult a financial advisor to help determine your appropriate asset allocation.

Conclusion

This pre-May 5th assessment of Palantir stock provides valuable insights into the company's performance, the upcoming earnings report, and its long-term growth potential. We’ve analyzed its market position, competitive landscape, and the inherent risks associated with a Palantir investment. Before making any investment decisions regarding Palantir stock, it's crucial to conduct your own thorough research and consult with a financial advisor. The information provided here is for educational purposes only and does not constitute financial advice. Consider all factors carefully before investing in Palantir shares or any other technology stock. Remember to regularly review your PLTR investment to ensure alignment with your overall investment strategy.

Featured Posts

-

Divine Mercy Extended Religious Life And Gods Compassion In 1889

May 09, 2025

Divine Mercy Extended Religious Life And Gods Compassion In 1889

May 09, 2025 -

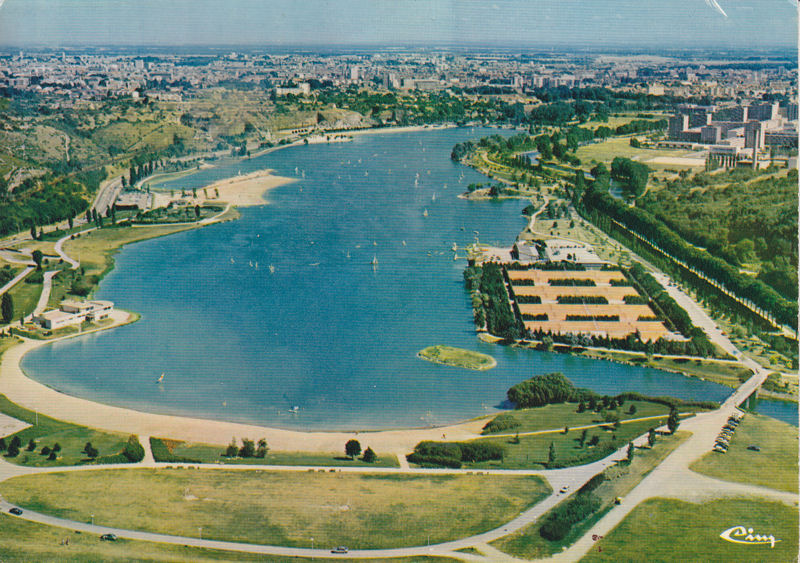

Dijon Agression Sauvage Au Lac Kir Trois Hommes Victimes

May 09, 2025

Dijon Agression Sauvage Au Lac Kir Trois Hommes Victimes

May 09, 2025 -

Palantirs Nato Deal How Ai Is Transforming Public Sector Operations

May 09, 2025

Palantirs Nato Deal How Ai Is Transforming Public Sector Operations

May 09, 2025 -

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025

Ashhr Laeby Krt Alqdm Aldhyn Kanwa Mdkhnyn

May 09, 2025 -

Incredibly Dangerous Months Of Warnings Before Newark Atc System Failure

May 09, 2025

Incredibly Dangerous Months Of Warnings Before Newark Atc System Failure

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025