Investing In Palantir Technologies: Is It The Right Time To Buy?

Table of Contents

Palantir's Business Model and Growth Potential

Palantir Technologies operates primarily through two platforms: Gotham, focused on government clients, and Foundry, catering to commercial enterprises. Both platforms leverage sophisticated data analytics to help organizations make better decisions, improve efficiency, and uncover critical insights. Palantir's target markets represent significant growth opportunities. The government sector, with its increasing reliance on data-driven intelligence, provides a robust and recurring revenue stream. Simultaneously, the expansion into the commercial sector offers vast potential for scaling and diversification.

Key growth drivers for Palantir include:

- Strong government contracts: Palantir maintains significant contracts with various government agencies globally, ensuring a consistent revenue base.

- Growing commercial adoption: The adoption of Foundry by commercial companies across various industries is accelerating, hinting at substantial future growth.

- Potential for expansion into new markets: Palantir continues to explore and penetrate new markets, further broadening its revenue streams and reducing reliance on any single sector.

- Innovation in data analytics technology: Palantir's continuous investment in R&D ensures its technology remains at the cutting edge, maintaining a competitive advantage.

Analyzing Palantir's Financial Performance

Analyzing Palantir's financial performance requires a careful review of several key metrics. While revenue growth has been impressive, investors should scrutinize profitability and valuation. A detailed examination of the following provides a clearer picture:

- Revenue growth rate analysis: Consistent and sustainable revenue growth is crucial for long-term success. Examining year-over-year and quarter-over-quarter growth reveals trends and potential future performance.

- Profitability margins and trends: Monitoring gross profit margins, operating margins, and net profit margins reveals the efficiency of Palantir's operations and the potential for increased profitability.

- Debt-to-equity ratio: Assessing Palantir's debt levels and its relationship to equity provides insight into the company's financial health and risk profile.

- Cash flow from operations: A strong cash flow from operations indicates the company's ability to generate cash from its core business, which is vital for reinvestment and future growth.

- Comparison to industry peers: Comparing Palantir's financial performance to competitors like Snowflake or Databricks helps to contextualize its results and assess its relative strength and potential.

Assessing the Risks of Investing in Palantir

Despite the potential for significant growth, investing in Palantir carries inherent risks:

- High valuation compared to earnings: Palantir's valuation has historically been high relative to its earnings, making it susceptible to market corrections.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, exposing it to potential changes in government spending or policy.

- Competition from established tech giants: Palantir faces intense competition from established tech giants like Microsoft, Amazon, and Google, which possess significant resources and market share.

- Regulatory risks and compliance: Operating in data-sensitive sectors exposes Palantir to potential regulatory hurdles and compliance costs.

- Potential for economic downturns affecting growth: Economic downturns can significantly impact spending on data analytics, potentially hindering Palantir's growth trajectory.

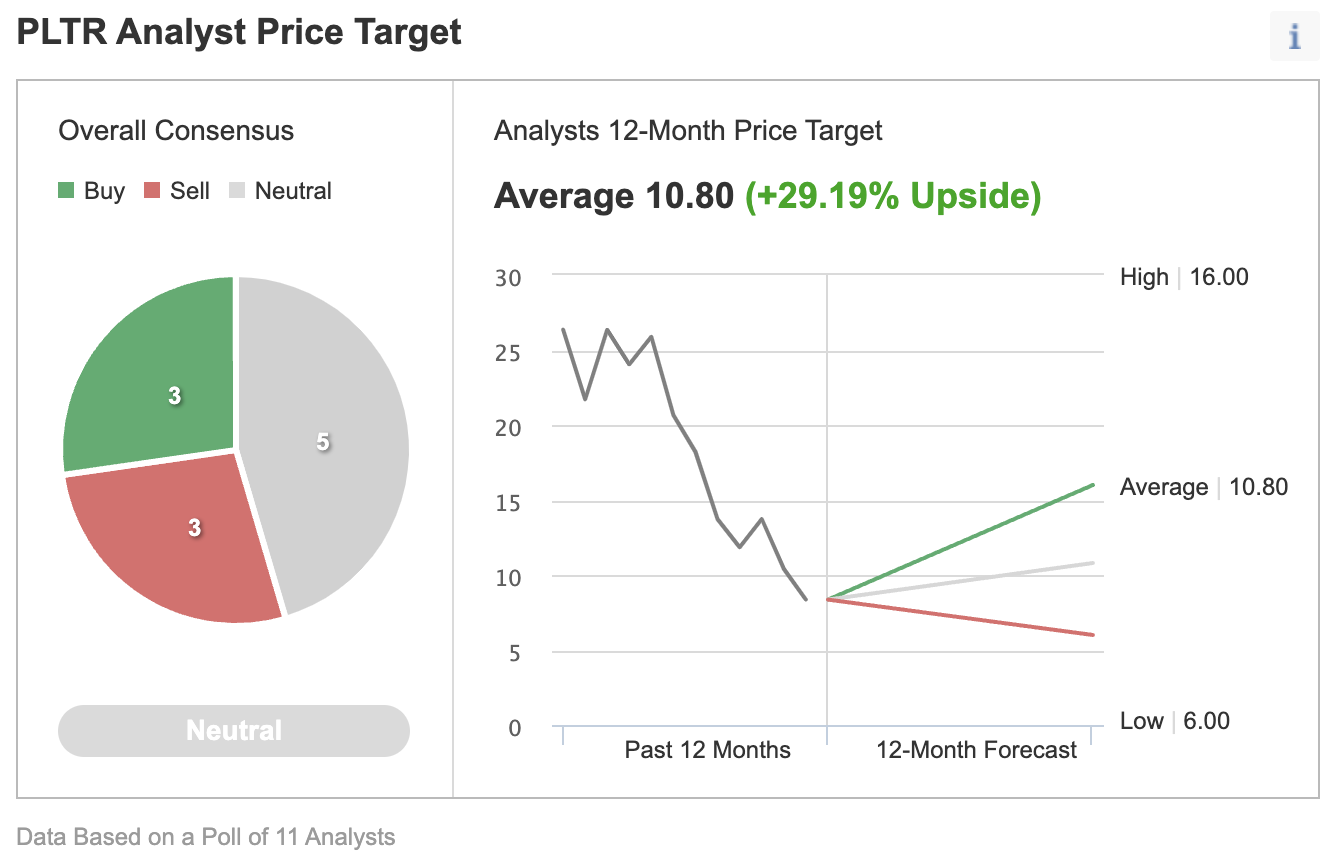

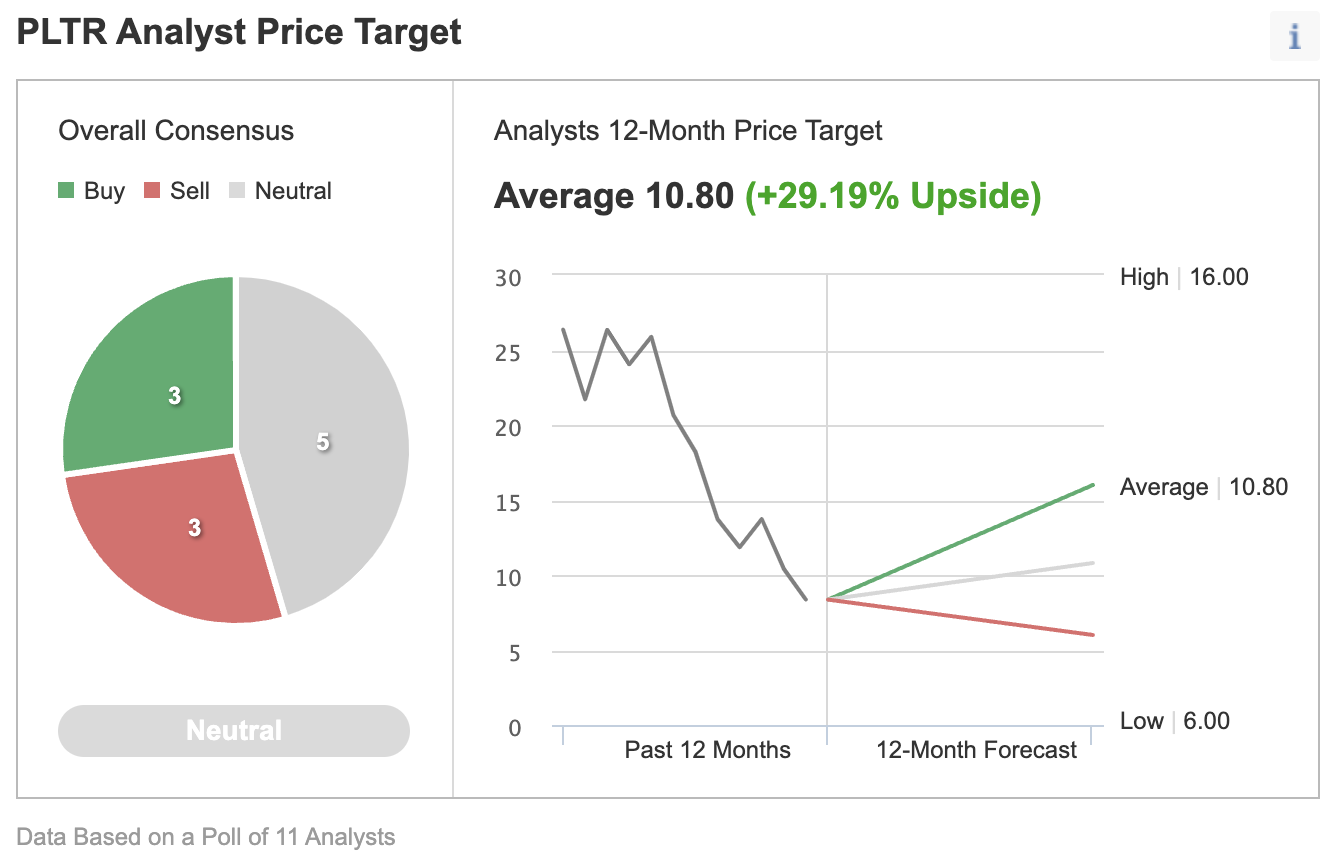

Market Sentiment and Analyst Opinions on Palantir Stock

Understanding the market sentiment towards Palantir is crucial for informed decision-making. Analyzing recent news, analyst ratings, and investor behavior provides valuable insight:

- Recent news affecting Palantir's stock price: Major news events, contract wins, or product launches can significantly impact PLTR stock price. Staying updated is crucial.

- Summary of analyst ratings and price targets: Following analyst ratings and price targets provides a consensus view on the future potential of Palantir stock.

- Investor sentiment (bullish or bearish): Monitoring investor sentiment through social media, news articles, and financial forums helps to gauge the overall market perception of PLTR.

- Impact of broader market trends on PLTR: Broader market trends, such as interest rate hikes or economic slowdowns, can influence Palantir's stock price regardless of company-specific news.

Strategies for Investing in Palantir (Risk Management)

Investing in Palantir requires a well-defined strategy, emphasizing risk management:

- Long-term investment strategy: Due to the volatility of PLTR stock, a long-term investment approach is generally recommended to ride out short-term fluctuations.

- Diversification across asset classes: Diversifying your investment portfolio reduces overall risk. Don't put all your eggs in one basket.

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of price, mitigates the risk of buying high and selling low.

- Risk tolerance assessment: Before investing, carefully assess your own risk tolerance. Palantir is a higher-risk investment.

- Setting realistic investment goals: Define your investment goals and timeline before investing in any stock, including PLTR.

Conclusion: Is Now the Right Time to Buy Palantir Technologies Stock?

Our analysis reveals that Palantir Technologies presents a compelling investment opportunity, driven by strong growth potential in both government and commercial sectors. However, the high valuation and inherent risks, including competition and economic sensitivity, demand careful consideration. There's no definitive yes or no answer to whether now is the right time to buy Palantir stock. The decision depends heavily on your individual risk tolerance, investment horizon, and overall portfolio strategy. Therefore, conduct thorough due diligence and consider consulting a financial advisor before investing in Palantir Technologies (PLTR) or any other stock. Consider your own risk tolerance and financial goals before investing in Palantir Technologies (PLTR).

Featured Posts

-

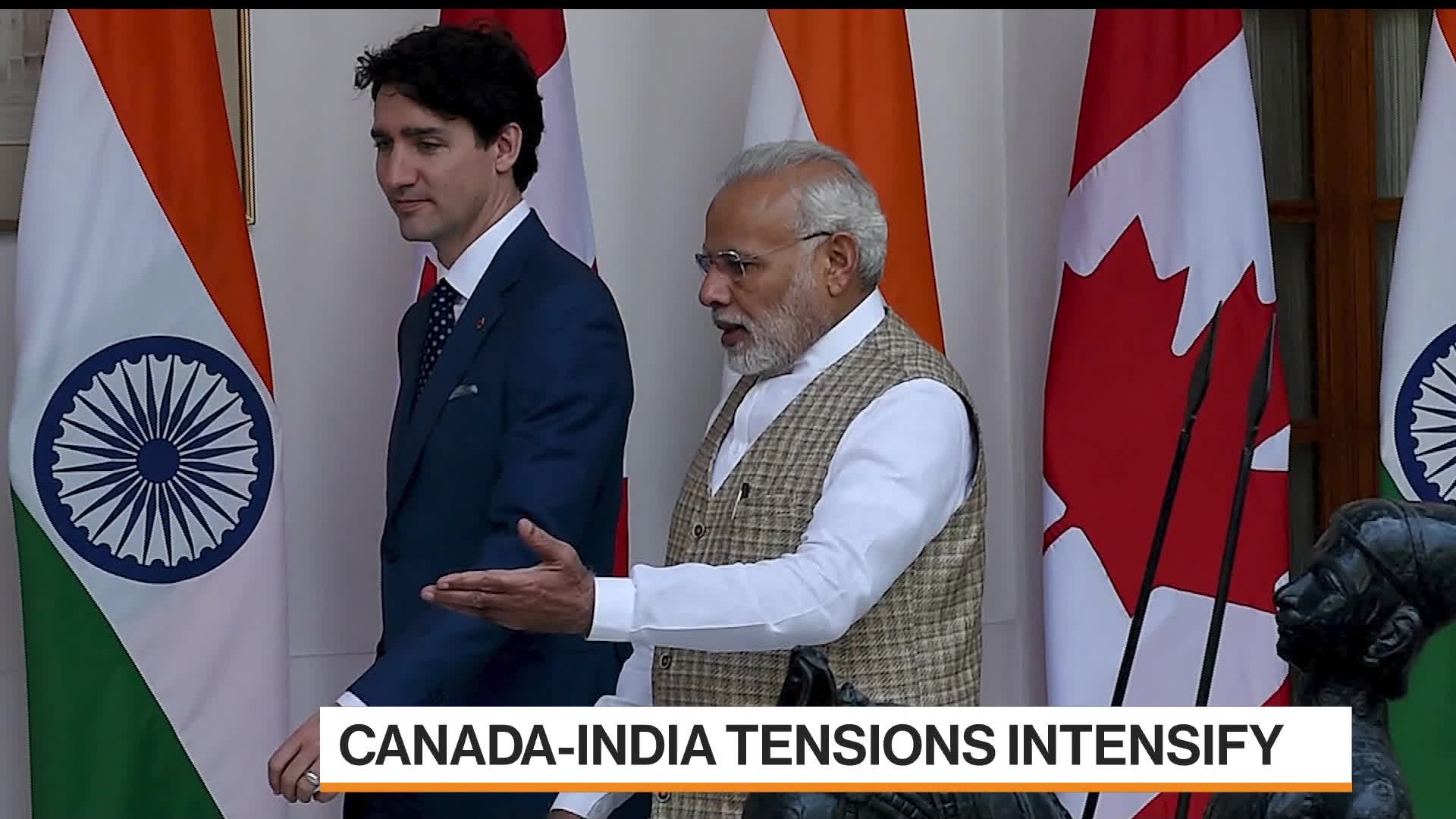

Canola Trade Diversification Chinas Response To Canada Tensions

May 09, 2025

Canola Trade Diversification Chinas Response To Canada Tensions

May 09, 2025 -

High Potential Season 2 Predicting The Fate Of Season 1s Unsung Hero

May 09, 2025

High Potential Season 2 Predicting The Fate Of Season 1s Unsung Hero

May 09, 2025 -

Tang Cuong Giam Sat Ngan Chan Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

Tang Cuong Giam Sat Ngan Chan Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025 -

Solve Nyt Strands Game 405 April 12th Complete Guide

May 09, 2025

Solve Nyt Strands Game 405 April 12th Complete Guide

May 09, 2025 -

Dakota Johnsons Figure Hugging Dress A Red Carpet Highlight

May 09, 2025

Dakota Johnsons Figure Hugging Dress A Red Carpet Highlight

May 09, 2025

Latest Posts

-

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025

Hlm Barys San Jyrman Alttwyj Blqb Dwry Abtal Awrwba

May 09, 2025 -

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025

Barys San Jyrman Hl Yktb Altarykh Fy Dwry Abtal Awrwba

May 09, 2025 -

Analyzing Luis Enriques Success Psgs Ligue 1 Victory

May 09, 2025

Analyzing Luis Enriques Success Psgs Ligue 1 Victory

May 09, 2025 -

Paris Saint Germains Triumph Luis Enriques Impact On Ligue 1

May 09, 2025

Paris Saint Germains Triumph Luis Enriques Impact On Ligue 1

May 09, 2025 -

The Unexpected Rise From Wolves Reject To Europes Best

May 09, 2025

The Unexpected Rise From Wolves Reject To Europes Best

May 09, 2025