Investing In Quantum Computing: Is D-Wave (QBTS) The Right Choice?

Table of Contents

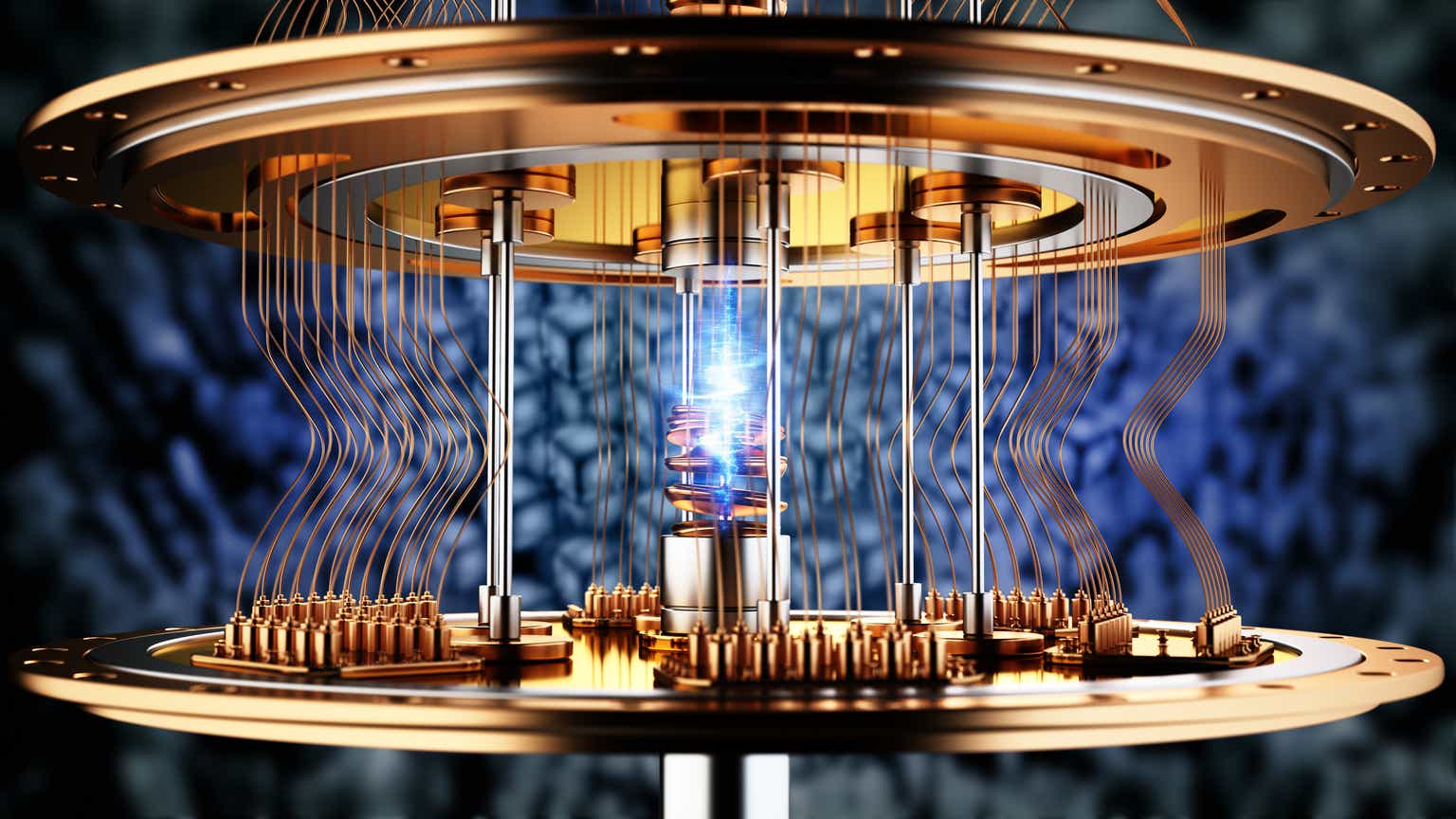

Understanding D-Wave's Quantum Annealing Technology

What is Quantum Annealing?

Quantum annealing is a type of quantum computing that leverages the principles of quantum mechanics to solve complex optimization problems. Unlike gate-based quantum computing, which uses quantum bits (qubits) to perform arbitrary computations, quantum annealing specializes in finding the lowest energy state of a system, which often corresponds to the optimal solution for a given problem.

-

Applications suited to quantum annealing:

- Logistics optimization (e.g., route planning, supply chain management)

- Financial modeling (e.g., portfolio optimization, risk management)

- Materials science (e.g., drug discovery, material design)

- Machine learning (e.g., training algorithms, pattern recognition)

-

Limitations compared to gate-based approaches:

- Quantum annealing is not a general-purpose computing method; it's best suited for specific types of problems.

- The scalability of quantum annealing technology is still under development.

- The accuracy of solutions obtained through quantum annealing can be limited.

D-Wave's Technological Advantages and Disadvantages

D-Wave Systems has been a leader in developing and deploying quantum annealers. Their advantage lies in having commercially available quantum computers for several years, giving them a head start in building a customer base and accumulating valuable real-world experience. However, their technology faces challenges against gate-based approaches.

-

Key technological differentiators:

- Large-scale quantum processors with hundreds of qubits.

- Established ecosystem with software and tools for quantum annealing.

- Focus on practical applications and real-world problem solving.

-

Potential limitations and challenges:

- Quantum annealing is not as versatile as gate-based quantum computing.

- Competition from gate-based approaches is intensifying.

- Scalability and error correction remain ongoing research areas.

- Direct comparison with competitors like IBM (with their gate-based systems), Google (also gate-based), and Rigetti (hybrid approaches) reveals both strengths and significant limitations in D-Wave's current technology.

D-Wave's Business Model and Market Position

Revenue Streams and Growth Prospects

D-Wave's primary revenue streams come from selling access to their quantum computers through cloud-based services and on-premises systems. They are also actively pursuing partnerships with various industries to develop and implement quantum computing solutions for specific problems. Their target market encompasses organizations with complex optimization challenges, such as those in the finance, logistics, and materials science sectors.

-

Key partnerships and collaborations:

- Collaborations with major corporations across multiple industries.

- Government contracts for research and development.

- Strategic partnerships to expand market reach and applications.

-

Projecting future revenue streams and potential market share: The potential market for quantum computing is enormous, but capturing significant market share depends on technological advancements, competition, and the adoption rate by businesses. Estimating future revenue requires careful consideration of these factors, as well as ongoing investments and potential for new revenue streams.

Competitive Landscape and Risks

The quantum computing market is rapidly evolving, with several players competing to develop and commercialize superior technologies. D-Wave faces competition from companies developing gate-based quantum computers, as well as from those pursuing hybrid approaches combining classical and quantum computing.

-

Potential market disruptions: The emergence of more powerful and versatile gate-based quantum computers could significantly impact D-Wave’s market position. Improvements in classical algorithms could also reduce the demand for quantum annealing.

-

Financial risks associated with QBTS stock: Investing in QBTS is inherently risky, due to the early stage of the quantum computing industry, the company's current financial performance, and its dependence on future technological breakthroughs and market adoption.

Investing in QBTS: A Risk/Reward Assessment

Factors to Consider Before Investing

Investing in QBTS requires a careful assessment of the risks and potential rewards. This is not a traditional investment, and the potential returns must be weighed against the possibility of significant losses.

-

Long-term growth potential vs. short-term volatility: The quantum computing market has significant long-term potential but is currently characterized by high volatility. Investors must have a long-term horizon.

-

High-risk/high-reward nature of this investment: The potential rewards could be substantial, but the risks are also significant. Only investors with a high risk tolerance should consider investing in QBTS.

Alternative Investment Strategies

Diversification is crucial when investing in emerging technologies. Investing solely in QBTS is not recommended.

-

Diversification strategies for managing risk: Consider a diversified portfolio including other quantum computing companies or ETFs that cover the broader technology sector.

-

Resources for further research: Thorough due diligence is essential before investing. Consult financial reports, industry analysis, and expert opinions before making any investment decisions.

Conclusion

This article explored the question of whether D-Wave (QBTS) is a worthwhile investment in the exciting, albeit risky, field of quantum computing. While D-Wave holds a unique position with its quantum annealing technology, significant risks and competitive pressures exist. Investors should carefully weigh the potential for long-term growth against the substantial volatility associated with this emerging technology.

Call to Action: Investing in quantum computing requires careful research and consideration. Before making any investment decisions regarding D-Wave (QBTS) or other quantum computing ventures, conduct thorough due diligence and consider consulting with a qualified financial advisor. Learn more about navigating the complexities of quantum computing investments and determining if D-Wave aligns with your risk tolerance and investment goals.

Featured Posts

-

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025 -

Agatha Christies Towards Zero Episode 1 A Murder Free Mystery

May 20, 2025

Agatha Christies Towards Zero Episode 1 A Murder Free Mystery

May 20, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 20, 2025

Lorraine Kelly Reacts To David Walliams Controversial Comment

May 20, 2025 -

Where Is Lewis Hamilton Underperforming Compared To Charles Leclerc

May 20, 2025

Where Is Lewis Hamilton Underperforming Compared To Charles Leclerc

May 20, 2025 -

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025

Robert Pattinson And Suki Waterhouse A Look At Twilight Star Relationships

May 20, 2025