Investing In Riot Platforms (RIOT): Risks And Rewards Compared To Coinbase (COIN)

Table of Contents

The cryptocurrency market offers diverse investment opportunities, but choosing the right stock requires careful consideration. This article directly compares two prominent players: Riot Platforms (RIOT), a Bitcoin mining company, and Coinbase (COIN), a leading cryptocurrency exchange. We'll delve into the unique risks and rewards associated with each, helping you make an informed investment decision.

Riot Platforms (RIOT): Bitcoin Mining's Potential and Pitfalls

Understanding Riot Platforms' Business Model

Riot Platforms' business model centers around Bitcoin mining. This involves using powerful computers to solve complex mathematical problems, earning Bitcoin as a reward. The efficiency of this process is measured by the hash rate, which represents the computational power dedicated to mining. Higher hash rates generally lead to more Bitcoin mined. However, energy consumption is a significant factor; mining requires substantial electricity, impacting profitability.

- Bitcoin Mining Process: Involves specialized hardware (ASIC miners) competing to solve cryptographic puzzles.

- Hash Rate Importance: A higher hash rate increases the likelihood of successfully mining Bitcoin.

- Energy Costs Impact: Electricity prices significantly influence the profitability of Bitcoin mining operations.

Riot Platforms operates large-scale mining facilities, continually expanding its capacity and forming strategic partnerships to secure access to affordable energy and advanced mining equipment. Their expansion plans and technological advancements are key factors influencing the RIOT price prediction. Understanding these aspects is crucial for assessing the potential of Riot Platforms stock.

Risks Associated with Investing in RIOT

Investing in RIOT carries inherent risks:

- Bitcoin Price Volatility: The price of Bitcoin is highly volatile, directly impacting RIOT's stock price. A Bitcoin price drop can significantly reduce RIOT's profitability and stock value.

- Regulatory Changes: Government regulations on Bitcoin mining can affect operations, potentially limiting expansion or increasing costs. Changes in regulations represent a significant regulatory risk.

- Operational Challenges: Hardware malfunctions, energy price fluctuations, and competition within the Bitcoin mining space all pose operational risks.

Rewards of Investing in RIOT

Despite the risks, investing in RIOT offers potential rewards:

- Bitcoin Price Appreciation: If the price of Bitcoin increases significantly, RIOT's profits and stock price are likely to rise substantially.

- High-Growth Potential: The growth potential of the Bitcoin mining industry and Riot's strategic positioning within that market can lead to significant returns on investment.

- Mining Profitability: Efficient mining operations and access to affordable energy can maximize profitability, translating into higher returns for investors.

Coinbase (COIN): Navigating the Cryptocurrency Exchange Landscape

Understanding Coinbase's Business Model

Coinbase operates as a leading cryptocurrency exchange, facilitating the buying, selling, and trading of various cryptocurrencies. Its revenue streams primarily come from trading fees charged on transactions. Coinbase also offers custody services, staking rewards, and other services generating additional income.

- Coinbase Services: Trading, custody, staking, and other cryptocurrency-related services.

- Fee Structures: Revenue is generated through fees charged on cryptocurrency transactions.

- User Base and Market Share: Coinbase boasts a large user base and substantial market share within the cryptocurrency exchange industry.

Risks Associated with Investing in COIN

Investing in COIN also entails several risks:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrency exchanges is constantly evolving, introducing uncertainty and potential legal challenges. This regulatory uncertainty is a primary risk for COIN.

- Cybersecurity Risks: Cryptocurrency exchanges are prime targets for cyberattacks, with potential for significant financial losses and reputational damage.

- Exchange Competition: The cryptocurrency exchange market is highly competitive, with new entrants constantly challenging established players like Coinbase.

Rewards of Investing in COIN

Despite these risks, investing in COIN offers potential rewards:

- Cryptocurrency Market Growth: The increasing adoption of cryptocurrencies worldwide suggests significant growth potential for the cryptocurrency exchange market.

- Coinbase Market Share: Coinbase's established position as a leading exchange offers a degree of stability and market dominance.

- Expansion and New Products: Coinbase's continuous expansion into new markets and product offerings contributes to its growth potential.

Direct Comparison: RIOT vs. COIN

| Feature | Riot Platforms (RIOT) | Coinbase (COIN) |

|---|---|---|

| Investment Type | Bitcoin mining company | Cryptocurrency exchange |

| Primary Risk | Bitcoin price volatility, regulatory risk | Regulatory uncertainty, cybersecurity risk |

| Return Potential | High, but highly volatile | Moderate to high, less volatile |

| Market Exposure | Primarily Bitcoin | Diversified cryptocurrency market |

| Risk Tolerance | High | Moderate |

RIOT presents a higher-risk, higher-reward investment strategy directly tied to Bitcoin's price. COIN offers a more diversified approach within the broader cryptocurrency market, with potentially more moderate returns but lower volatility.

Conclusion

This comparison of Riot Platforms (RIOT) and Coinbase (COIN) reveals distinct investment profiles. RIOT offers exposure to Bitcoin mining's volatility and potential for high returns, while COIN represents a more diversified approach to the cryptocurrency market. The best choice depends on your individual risk tolerance and investment goals.

Call to Action: Carefully consider your risk tolerance and investment strategy before investing in either Riot Platforms (RIOT) or Coinbase (COIN). Conduct thorough research and consult with a financial advisor before making any investment decisions in the volatile cryptocurrency market. Learn more about cryptocurrency investing and the specific risks and rewards associated with Riot Platforms (RIOT) and Coinbase (COIN) before you invest.

Featured Posts

-

Priscilla Pointer Dalla Star Dies At 100 A Legacy Remembered

May 02, 2025

Priscilla Pointer Dalla Star Dies At 100 A Legacy Remembered

May 02, 2025 -

The Walking Deads Negan Jeffrey Dean Morgans Fortnite Experience

May 02, 2025

The Walking Deads Negan Jeffrey Dean Morgans Fortnite Experience

May 02, 2025 -

Hazing Scandal 11 Syracuse Lacrosse Players Avoid Kidnapping Charges

May 02, 2025

Hazing Scandal 11 Syracuse Lacrosse Players Avoid Kidnapping Charges

May 02, 2025 -

Christina Aguileras New Look Sparks Debate Photoshopped Or Not

May 02, 2025

Christina Aguileras New Look Sparks Debate Photoshopped Or Not

May 02, 2025 -

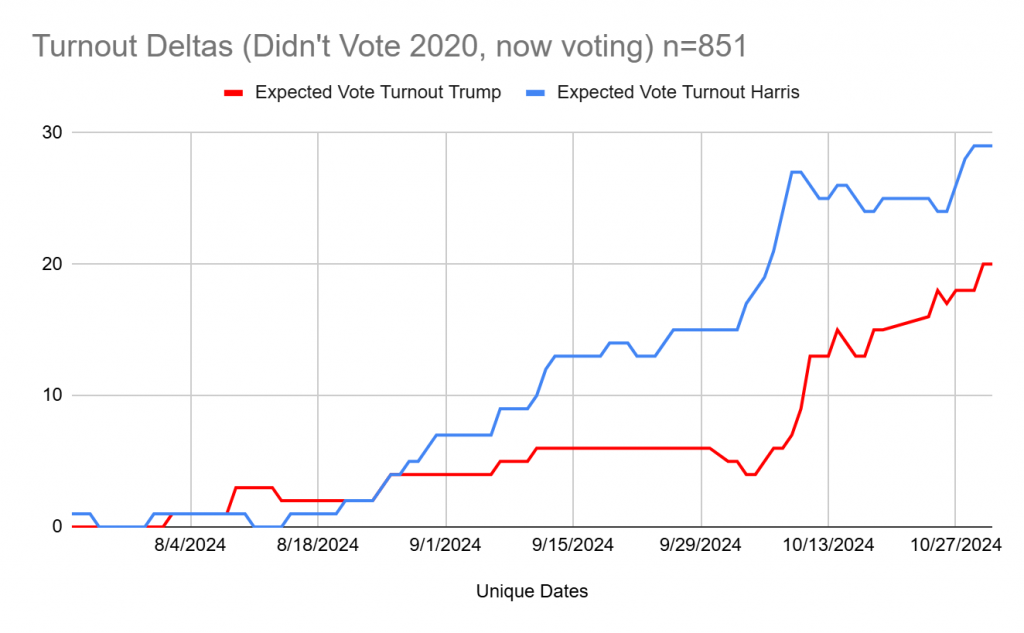

Florida And Wisconsins Election Turnout A Reflection Of Current Political Dynamics

May 02, 2025

Florida And Wisconsins Election Turnout A Reflection Of Current Political Dynamics

May 02, 2025

Latest Posts

-

Edmontons Nordic Spa Closer To Reality Following Rezoning Approval

May 10, 2025

Edmontons Nordic Spa Closer To Reality Following Rezoning Approval

May 10, 2025 -

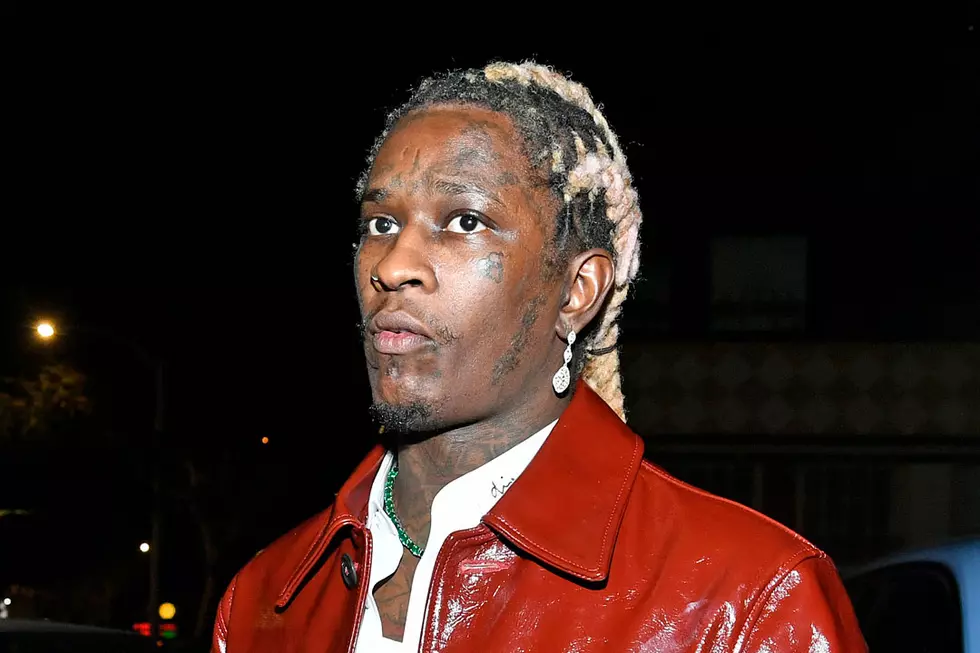

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025

Young Thugs Uy Scuti Release Date Hints And Album Expectations

May 10, 2025 -

Uy Scuti Release Date Young Thug Offers Clues On New Album

May 10, 2025

Uy Scuti Release Date Young Thug Offers Clues On New Album

May 10, 2025 -

Young Thugs Uy Scuti Release Date Teased

May 10, 2025

Young Thugs Uy Scuti Release Date Teased

May 10, 2025 -

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025

Young Thugs Uy Scuti Album Expected Release Date And Tracklist Rumors

May 10, 2025