Investing In The Amundi DJIA UCITS ETF: Monitoring The Net Asset Value (NAV)

Table of Contents

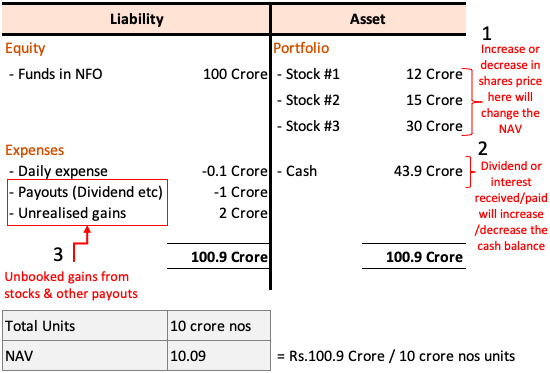

Understanding the Amundi DJIA UCITS ETF NAV

The Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. Simply put, it's the total value of the ETF's holdings (stocks in the case of the Amundi DJIA UCITS ETF, mirroring the DJIA) minus liabilities, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, the NAV is calculated daily by Amundi, taking into account the closing prices of all 30 constituent stocks of the Dow Jones Industrial Average.

Several factors influence the daily fluctuations of the Amundi DJIA UCITS ETF NAV. These include:

- Market movements of the underlying DJIA components: The primary driver of NAV changes is the performance of the individual stocks within the DJIA. If these stocks generally increase in value, so will the ETF's NAV. Conversely, a decline in the underlying stocks will lead to a lower NAV.

- Currency exchange rates (if applicable): If the ETF holds assets denominated in a currency different from the ETF's base currency, fluctuations in exchange rates can affect the NAV.

Bullet Points:

- Definition of NAV: The net asset value of an ETF's assets per share.

- Calculation methodology: Daily calculation based on the closing prices of the underlying DJIA components.

- Key influencing factors: DJIA component performance, currency exchange rates.

- Relationship between NAV and ETF share price: The NAV should closely track the ETF's market price, although minor discrepancies can occur due to supply and demand.

Accessing Amundi DJIA UCITS ETF NAV Information

Obtaining real-time and historical Amundi DJIA UCITS ETF NAV data is straightforward thanks to various reliable sources:

- Brokerage platforms: Most brokerage accounts will display the current NAV of ETFs held within your portfolio.

- ETF provider website (Amundi's website): Amundi, the ETF provider, typically publishes NAV data on its website.

- Financial news websites: Many financial news websites and data providers offer real-time and historical ETF NAV data.

- Data aggregator sites: Specialized sites aggregate financial data from multiple sources, providing a comprehensive view of ETF NAVs.

Bullet Points:

- Brokerage platforms: Convenient access if you already hold the ETF.

- ETF provider website (Amundi's website): The official source for NAV information.

- Financial news websites: A widely accessible resource for market data.

- Data aggregator sites: Offer consolidated data from various sources.

- Importance of verifying data from multiple sources: Cross-checking data ensures accuracy and reliability.

Interpreting NAV Changes and Making Informed Decisions

Interpreting Amundi DJIA UCITS ETF NAV movements requires understanding market trends. A significant increase in NAV usually reflects positive market performance of the DJIA components. Conversely, a substantial decrease indicates negative market performance. It's crucial to compare the NAV to the ETF's market price (considering the bid-ask spread) to identify potential discrepancies and arbitrage opportunities.

Bullet Points:

- Analyzing NAV trends over time: Charting NAV over time reveals long-term performance trends.

- Understanding the impact of market events: Major economic events or geopolitical developments can significantly impact the NAV.

- Comparing NAV to market price: This helps identify potential buying or selling opportunities.

- Identifying potential buying or selling opportunities based on NAV analysis: Understanding NAV helps in strategic investment decisions.

- The role of NAV in long-term investment strategies: Regular NAV monitoring aids in assessing long-term performance.

Long-Term Investment Strategies and NAV Monitoring

Regularly monitoring the Amundi DJIA UCITS ETF NAV is essential for long-term investors. It helps track portfolio performance, assess the success of diversification strategies, and provides valuable insight into the overall health of your investment. Remember to consider NAV in conjunction with other investment metrics like expense ratios and historical performance for a complete assessment.

Bullet Points:

- Long-term performance tracking via NAV: Provides a clear picture of long-term investment returns.

- NAV in portfolio diversification strategies: Helps assess the relative performance of different asset classes.

- NAV as part of a holistic investment assessment: A crucial component of comprehensive investment analysis.

Risks Associated with Investing in the Amundi DJIA UCITS ETF

Like all investments, investing in the Amundi DJIA UCITS ETF carries inherent risks:

Bullet Points:

- Market risk: The DJIA can experience significant fluctuations, impacting the ETF's NAV.

- Currency risk (if applicable): Exchange rate fluctuations can impact returns if the ETF holds assets in multiple currencies.

- Liquidity risk: Although generally liquid, there might be times when selling the ETF could be challenging.

- Tracking error: The ETF's performance may not perfectly mirror the DJIA's due to various factors.

Conclusion

Diligent monitoring of the Amundi DJIA UCITS ETF NAV is paramount for informed investment decisions. Understanding how the NAV is calculated, accessing reliable data sources, and interpreting NAV changes in relation to market trends are all crucial skills for successful investing. By actively managing your investment in the Amundi DJIA UCITS ETF and monitoring its NAV, you can make more informed decisions, potentially optimizing your returns and mitigating risks. Start actively monitoring your Amundi DJIA UCITS ETF NAV today and take control of your investment strategy. Remember to consider your risk tolerance and consult a financial advisor before making any investment decisions.

Featured Posts

-

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 25, 2025 -

The Passing Of George L Russell Jr Reflecting On A Life Dedicated To Law And Social Justice In Maryland

May 25, 2025

The Passing Of George L Russell Jr Reflecting On A Life Dedicated To Law And Social Justice In Maryland

May 25, 2025 -

Successful Italian Open Start For Alcaraz And Sabalenka

May 25, 2025

Successful Italian Open Start For Alcaraz And Sabalenka

May 25, 2025 -

European Stock Market Update Tariff Relief Hopes And Lvmh Decline

May 25, 2025

European Stock Market Update Tariff Relief Hopes And Lvmh Decline

May 25, 2025 -

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 25, 2025

Yevrobachennya 2025 Konchita Vurst Nazvala Chotirokh Potentsiynikh Peremozhtsiv

May 25, 2025