Investing In The Future Of Uber: Driverless Technology And ETFs

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's Investments in Self-Driving Technology

Uber has heavily invested in autonomous vehicle (AV) technology, aiming to redefine its ride-hailing service and expand into new areas like autonomous delivery. This strategic push involves substantial research and development, strategic partnerships, and acquisitions.

- Key Milestones: Uber's Advanced Technologies Group (ATG) has been instrumental in developing its self-driving technology, undergoing rigorous testing and accumulating significant mileage on autonomous vehicles.

- Collaborations: Partnerships with leading tech companies and research institutions have accelerated Uber's technological advancements.

- Specific Technologies: Uber utilizes a combination of technologies, including advanced sensor systems (LiDAR, radar, cameras), sophisticated mapping systems, and powerful AI algorithms for perception, decision-making, and control.

The Potential Impact of Driverless Cars on Uber's Business Model

The successful integration of driverless cars could dramatically reshape Uber's business. By eliminating driver costs, a significant portion of operational expenses would be reduced, potentially leading to significantly higher profit margins. This could also unlock new revenue streams through expanded services and greater efficiency.

- Increased Profitability: Automated vehicles could dramatically increase Uber's profitability by lowering operating costs and increasing the number of rides offered per vehicle.

- Challenges: Regulatory approvals, public acceptance of autonomous vehicles, and unforeseen technological hurdles remain significant obstacles. Ensuring public safety and addressing ethical concerns are paramount.

Risks and Uncertainties Associated with Autonomous Vehicle Technology

Investing in the autonomous vehicle sector carries inherent risks. Technological challenges, safety concerns, and regulatory uncertainties could significantly impact the success of Uber's driverless ambitions.

- Technological Setbacks: The development of fully autonomous vehicles is complex, and unexpected delays or technical failures could negatively affect Uber's progress and investment returns.

- Safety Concerns: Public safety is paramount. Accidents involving autonomous vehicles could damage public trust and hinder regulatory approval.

- Regulatory Hurdles: Government regulations vary across different jurisdictions, creating complexities and potential delays in deploying autonomous vehicles.

ETFs and Investing in the Autonomous Vehicle Market

Identifying Relevant ETFs

Investing in Uber's driverless future doesn't necessarily require direct investment in Uber stock. Many ETFs offer exposure to the broader autonomous vehicle market, providing diversified access to companies involved in various aspects of this technology.

- Examples: While specific ETF tickers change and new ones emerge, research ETFs focusing on robotics, artificial intelligence (AI), and technology sectors. Look for those with significant holdings in companies developing autonomous driving technology, sensor technology, mapping software, and related fields. Consult a financial professional for current recommendations.

Analyzing ETF Holdings

Before investing in any ETF, carefully examine its holdings. Identify the companies directly or indirectly contributing to the autonomous vehicle ecosystem. This allows you to assess the ETF's alignment with your investment strategy regarding Uber's driverless technology.

- Weighting: Pay close attention to the weighting of companies within the ETF. A heavily weighted position in a single company introduces higher risk than a more diversified portfolio.

Risk Management and Diversification

The autonomous vehicle sector is relatively new and volatile. Diversification is crucial for mitigating risk. Spread investments across multiple ETFs and asset classes to reduce exposure to the specific risks of this emerging industry.

- Diversification Strategies: Consider combining ETFs focused on different aspects of the AV industry, alongside investments in more established sectors, to achieve a balanced portfolio.

Alternative Investment Strategies for Uber's Driverless Future

Direct Investment in Uber Stock (UBER)

Investing directly in Uber stock (UBER) offers a more concentrated bet on the company's success in the autonomous vehicle market. However, this strategy carries higher risk compared to ETF investing.

- Pros and Cons: Direct investment offers higher potential returns but also increased vulnerability to company-specific challenges.

Investing in Related Companies

Consider investing in companies that supply technology or services to the autonomous vehicle industry. This could include companies specializing in mapping, sensor technology, AI software, or cloud computing.

- Examples: Research companies that are key suppliers to Uber or other major players in the AV sector.

Driving Your Investment Strategy: The Future of Uber and Driverless Technology ETFs

Investing in Uber's driverless future through ETFs offers a compelling pathway to participate in this transformative technology. However, understanding the inherent risks and rewards is essential. Thorough research and diversification are crucial for mitigating potential losses. Remember to carefully assess your risk tolerance and seek advice from a qualified financial advisor before making any investment decisions. Start exploring investing in the future of Uber: driverless technology and ETFs today, but remember to make informed choices based on your personal financial situation.

Featured Posts

-

Jack Bit Review Top Bitcoin Casino With Instant Withdrawals

May 17, 2025

Jack Bit Review Top Bitcoin Casino With Instant Withdrawals

May 17, 2025 -

Andor Book Project Scrapped Ai Fears Halt Publication

May 17, 2025

Andor Book Project Scrapped Ai Fears Halt Publication

May 17, 2025 -

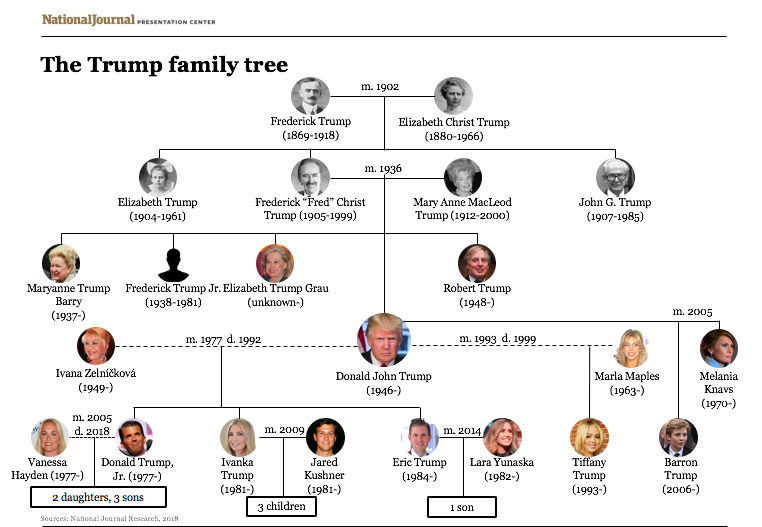

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025

Trump Family Tree A Comprehensive Guide To The Trump Family

May 17, 2025 -

Nos Emirados Arabes Ex Jogador Do Vasco Comemora Camisa 10 E Mira A Copa 2026

May 17, 2025

Nos Emirados Arabes Ex Jogador Do Vasco Comemora Camisa 10 E Mira A Copa 2026

May 17, 2025 -

Kak Dubay Stal Vtoroy Moskvoy Trudnosti I Vozmozhnosti Dlya Rossiyan V 2025 Godu

May 17, 2025

Kak Dubay Stal Vtoroy Moskvoy Trudnosti I Vozmozhnosti Dlya Rossiyan V 2025 Godu

May 17, 2025