Investing In XRP (Ripple) In 2024: Is The Sub-$3 Price A Good Entry Point?

Table of Contents

XRP Price Analysis and Market Trends

Current Market Sentiment

The current market sentiment surrounding XRP is mixed. While some analysts see the sub-$3 price as a buying opportunity, others remain cautious due to the ongoing legal uncertainty. Recent news regarding Ripple's partnerships and technological advancements has injected some optimism, but the overall market sentiment remains largely influenced by the SEC lawsuit's progress. Monitoring social media conversations, news articles, and trading volume is crucial for gauging real-time investor sentiment regarding XRP investment.

- Positive Sentiment Indicators: Increased partnerships, technological advancements, growing institutional adoption.

- Negative Sentiment Indicators: Ongoing SEC lawsuit, regulatory uncertainty, general cryptocurrency market volatility.

Historical Price Performance

XRP's price history has been characterized by significant volatility. It experienced a meteoric rise in late 2017, reaching an all-time high, before undergoing substantial corrections. Analyzing this historical price performance, including major highs and lows, using charts and graphs, is vital for understanding its past behavior. Technical analysis, focusing on support and resistance levels, can provide insights into potential future price targets. However, remember past performance is not indicative of future results.

- Key Historical Events: Identify major price movements and correlate them with relevant news and events.

- Support and Resistance Levels: Analyze technical charts to identify potential price support and resistance areas.

Predictive Modeling and Future Price Projections

While numerous price predictions exist for XRP, it's crucial to approach them with extreme caution. The cryptocurrency market is notoriously unpredictable, and relying solely on predictions is risky. Reputable sources may offer projections, but these should be considered alongside your own research and risk assessment. Never invest more than you can afford to lose.

- Disclaimer: Clearly state that price predictions are speculative and should not be the sole basis for investment decisions.

- Diversification: Emphasize the importance of diversifying your investment portfolio to mitigate risk.

Ripple's Legal Battle and its Impact on XRP

Overview of the SEC Lawsuit

Ripple Labs faces an ongoing lawsuit filed by the Securities and Exchange Commission (SEC), alleging that XRP is an unregistered security. The outcome of this lawsuit will significantly impact XRP's price and future. Understanding the arguments presented by both sides is critical for assessing the potential implications. Consult official court documents and reputable news sources for detailed information.

- SEC Arguments: Summarize the SEC's claims regarding XRP.

- Ripple's Defense: Summarize Ripple's counter-arguments.

- Legal Experts' Opinions: Briefly mention the opinions of legal experts on the potential outcome.

Potential Scenarios and Their Implications

Several scenarios could unfold following the SEC lawsuit. A favorable ruling for Ripple could send XRP's price soaring, while an unfavorable outcome might lead to a significant drop. It's crucial to analyze these possibilities and their potential effects on XRP's value and adoption.

- Positive Outcome: Discuss the potential for price increase and increased adoption.

- Negative Outcome: Discuss the potential for price decline and decreased adoption.

- Settlement: Discuss the potential impact of a settlement between Ripple and the SEC.

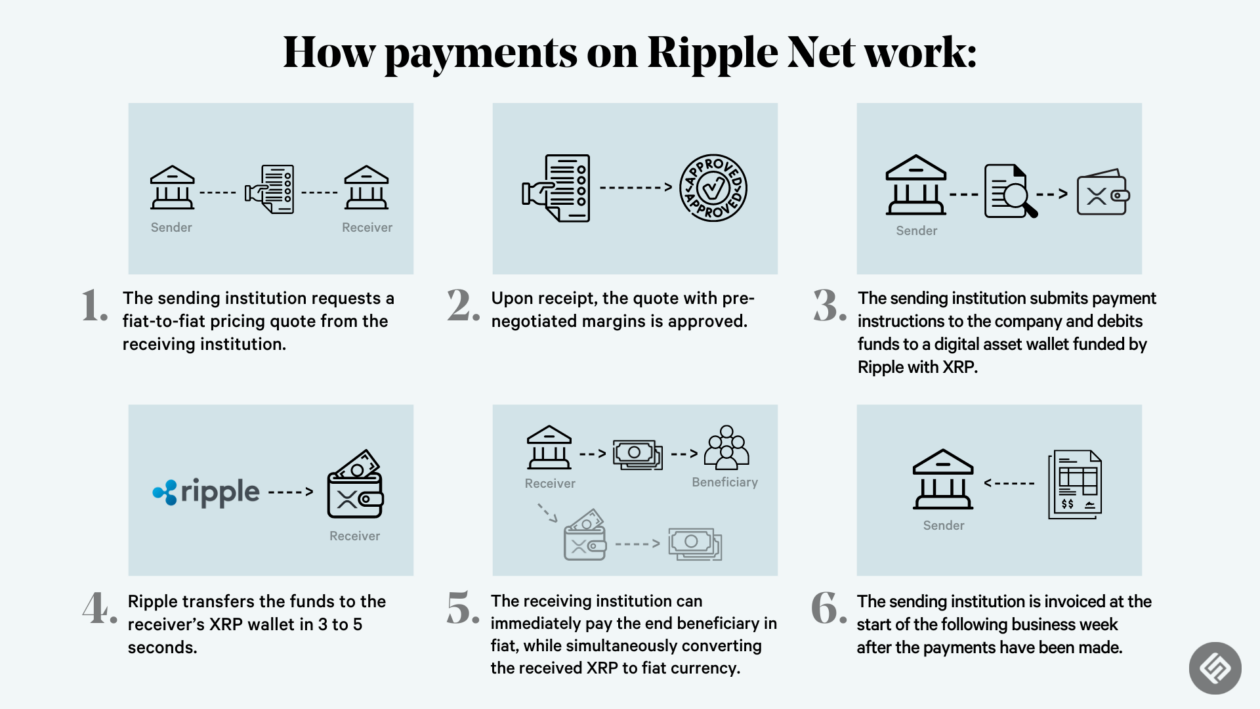

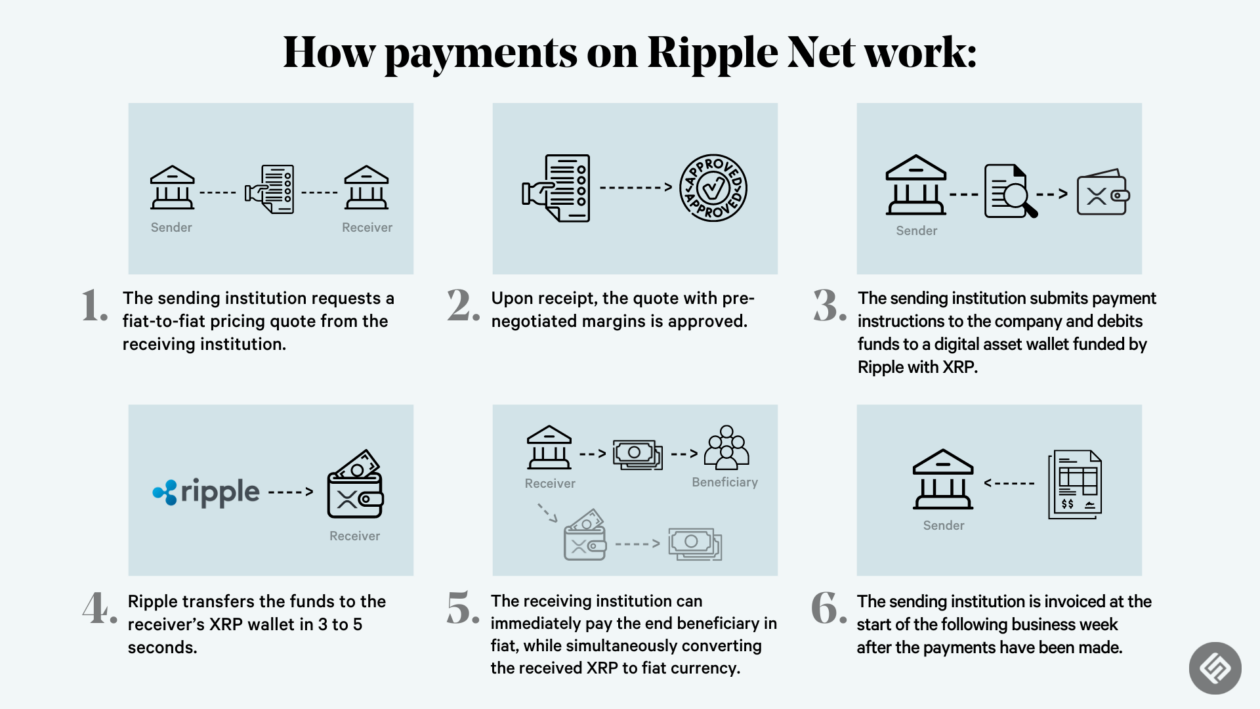

Ripple's Ongoing Developments

Despite the legal challenges, Ripple continues to develop its technology and expand its partnerships. These ongoing efforts could mitigate the negative impact of the lawsuit. Highlighting Ripple's advancements in blockchain technology, new partnerships, and growing adoption of its products can offer a more balanced perspective on the future of XRP.

- Technological Advancements: Discuss Ripple's improvements in its blockchain technology.

- Strategic Partnerships: Highlight any significant partnerships Ripple has secured.

Risks and Rewards of Investing in XRP

Volatility and Market Risk

Investing in XRP, like any cryptocurrency, involves significant volatility and market risk. Price swings can be dramatic, leading to substantial gains or losses. Proper risk management, including diversification and only investing what you can afford to lose, is paramount.

- Risk Tolerance: Emphasize the importance of assessing your personal risk tolerance.

- Stop-Loss Orders: Discuss the use of stop-loss orders to limit potential losses.

Regulatory Uncertainty

The regulatory landscape surrounding cryptocurrencies remains uncertain globally. Future regulations could significantly impact XRP's value and trading. Staying informed about regulatory developments is crucial for navigating this uncertainty.

- Regulatory Changes: Discuss potential future regulations affecting cryptocurrencies.

- Jurisdictional Differences: Highlight the differences in cryptocurrency regulation across various jurisdictions.

Potential for High Returns

Despite the risks, investing in XRP also offers the potential for high returns. If Ripple prevails in its legal battle and the adoption of its technology grows significantly, XRP's price could experience substantial growth. However, this potential must be weighed against the inherent risks.

- Long-Term Potential: Discuss the potential long-term growth of XRP.

- Successful Cryptocurrencies: Mention examples of successful cryptocurrencies that have experienced significant price appreciation.

Conclusion: Making Informed Decisions about Investing in XRP (Ripple)

Investing in XRP (Ripple) at its current sub-$3 price presents both significant risks and potential rewards. The outcome of the SEC lawsuit remains a major uncertainty, profoundly affecting XRP's future trajectory. While the potential for high returns exists, the inherent volatility and regulatory uncertainty cannot be ignored. Conducting thorough research, understanding the risks, and diversifying your investment portfolio are crucial steps before considering investing in XRP. Continue your research on Investing in XRP (Ripple) and make informed decisions based on your own risk tolerance and investment goals. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Bbcs Celebrity Traitors Production Hit By Last Minute Sibling Dropouts

May 02, 2025

Bbcs Celebrity Traitors Production Hit By Last Minute Sibling Dropouts

May 02, 2025 -

Fortnites In Game Store Epic Games Faces Another Legal Challenge

May 02, 2025

Fortnites In Game Store Epic Games Faces Another Legal Challenge

May 02, 2025 -

Geen Stroom Voor Nieuw Duurzaam Schoolgebouw In Kampen Spoedprocedure Gestart

May 02, 2025

Geen Stroom Voor Nieuw Duurzaam Schoolgebouw In Kampen Spoedprocedure Gestart

May 02, 2025 -

See The Latest Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025

See The Latest Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2

May 02, 2025 -

Get Free Captain America Items Now In The Fortnite Item Shop

May 02, 2025

Get Free Captain America Items Now In The Fortnite Item Shop

May 02, 2025

Latest Posts

-

Snls Harry Styles Impression The Singers Reaction

May 10, 2025

Snls Harry Styles Impression The Singers Reaction

May 10, 2025 -

Harry Styles Response To A Bad Snl Impression Disappointed

May 10, 2025

Harry Styles Response To A Bad Snl Impression Disappointed

May 10, 2025 -

The Snl Harry Styles Impression A Disappointing Reaction

May 10, 2025

The Snl Harry Styles Impression A Disappointing Reaction

May 10, 2025 -

Snls Failed Harry Styles Impression His Response

May 10, 2025

Snls Failed Harry Styles Impression His Response

May 10, 2025 -

Harry Styles On That Awful Snl Impression His Response

May 10, 2025

Harry Styles On That Awful Snl Impression His Response

May 10, 2025