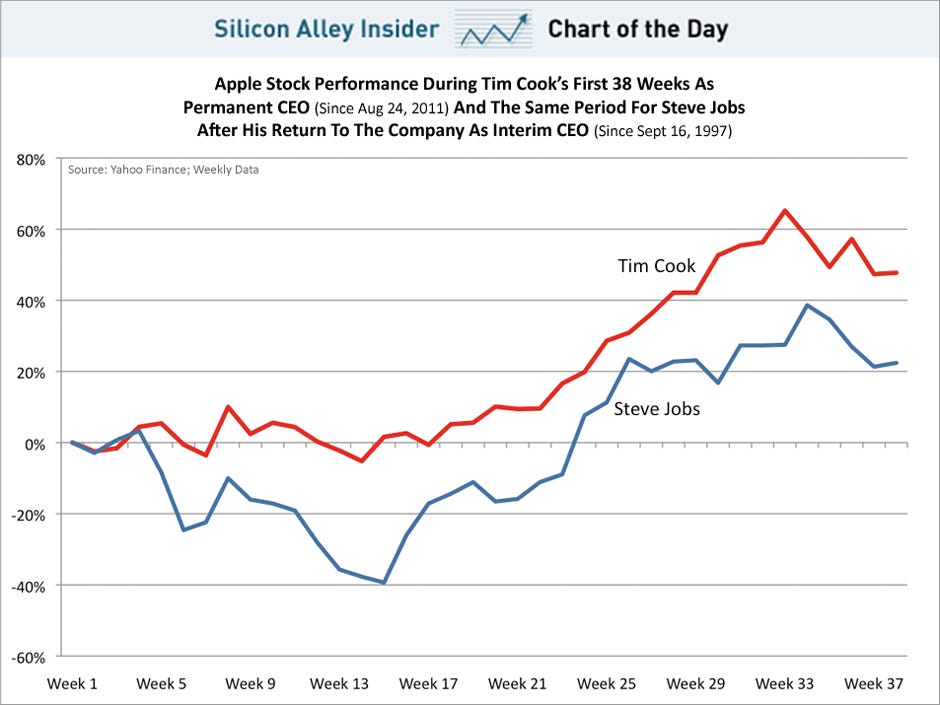

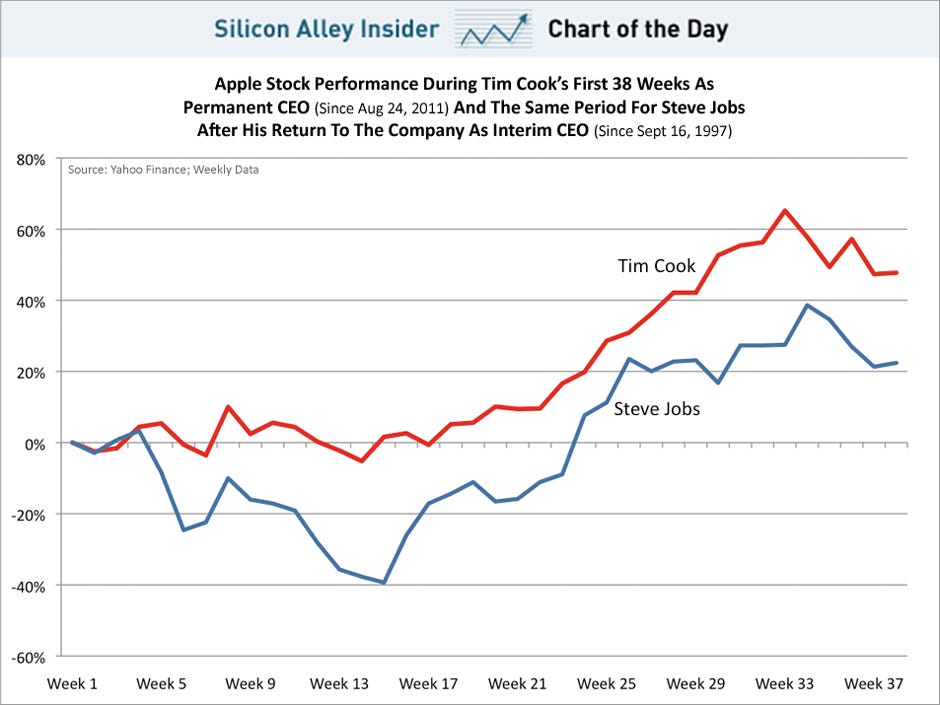

Investor Alert: Apple Stock Under Pressure Before Q2 Report

Table of Contents

Slowing iPhone Sales and Supply Chain Issues

The slowdown in iPhone sales is a major contributor to the pressure on Apple stock. This is impacting investor confidence and creating a challenging environment for the tech giant.

Diminishing Demand

Weakening demand for iPhones, particularly in crucial markets like China, is a significant concern.

- Declining Sales Figures: While precise figures are awaited until the Q2 report, preliminary reports suggest a considerable drop in iPhone unit sales compared to the same period last year. Analysts are predicting a substantial decrease in year-over-year growth.

- Increased Competition: The smartphone market is increasingly competitive, with Android manufacturers offering compelling alternatives at various price points. This competition is eroding Apple's market share, particularly in the budget and mid-range segments.

- Supply Chain Disruptions: Lingering supply chain disruptions, though less impactful than in previous years, continue to affect Apple's production capacity and timely delivery of new iPhones. This impacts overall sales and revenue projections. These disruptions are adding further uncertainty to already pessimistic forecasts. Keywords: iPhone sales, demand slowdown, China market, supply chain disruptions, Apple production, smartphone market share.

Competition in the Smartphone Market

The competitive landscape is another significant factor impacting Apple stock. Android competitors are aggressively challenging Apple's dominance.

- Market Share Erosion: Android manufacturers are steadily gaining market share, particularly in emerging markets. Apple's premium pricing strategy, while successful in the high-end segment, leaves it vulnerable to competitors offering comparable features at lower prices.

- Innovative Features: Competitors are constantly innovating, releasing devices with advanced features that directly compete with Apple’s offerings. These features, such as improved camera technology and faster processing speeds, are attracting customers seeking value for their money.

- Aggressive Pricing Strategies: Competitors are employing aggressive pricing strategies, often bundling attractive offers and deals to entice customers away from Apple products. These strategies successfully target price-sensitive consumers. Keywords: smartphone market, Android competition, market share, pricing strategies, competitive landscape.

Macroeconomic Headwinds and Inflation

The current macroeconomic environment is adding to the pressure on Apple stock. Rising inflation and global economic uncertainty are significantly impacting consumer spending.

Inflationary Pressures

Rising inflation is impacting consumer spending, particularly on discretionary items like iPhones.

- Reduced Consumer Confidence: High inflation rates have eroded consumer confidence, leading to a decrease in discretionary spending. Consumers are delaying large purchases, including electronics, opting instead to prioritize essential goods and services.

- Impact on Discretionary Spending: The impact on discretionary spending is particularly noteworthy. With inflation squeezing household budgets, consumers are less likely to upgrade their iPhones or purchase other Apple products.

- Inflation Data: Recent inflation data shows stubbornly high rates, indicating that these inflationary pressures are likely to persist for some time. Keywords: inflation, consumer spending, discretionary spending, economic slowdown, consumer confidence.

Global Economic Uncertainty

Global economic uncertainty is further impacting investor sentiment toward Apple stock.

- Geopolitical Risks: Geopolitical risks, such as the ongoing war in Ukraine and rising tensions between the US and China, contribute to global economic uncertainty. These risks impact supply chains and investor confidence, leading to market volatility.

- Interest Rate Hikes: Central banks worldwide are raising interest rates to combat inflation. These rate hikes increase borrowing costs for businesses and consumers, impacting overall economic growth and further dampening investor confidence.

- Investor Sentiment: Negative investor sentiment is contributing to a sell-off in the tech sector, which is negatively impacting Apple stock. Keywords: global economy, interest rates, geopolitical risks, investor sentiment, market volatility.

The Upcoming Q2 Earnings Report: Potential Scenarios

The upcoming Q2 earnings report will be crucial in determining the future direction of Apple stock. Analyst predictions offer a glimpse into potential scenarios.

Expectations and Analyst Predictions

Analyst predictions for Apple's Q2 earnings vary, reflecting the uncertainty surrounding the company's performance.

- Earnings Per Share (EPS): Analyst estimates for EPS are currently below expectations compared to the same quarter last year, reflecting the anticipated slowdown in sales. However, some analysts anticipate positive surprises.

- Revenue Growth: Analysts predict a significant slowdown in revenue growth compared to the previous year. This reflects the impact of slowing iPhone sales and macroeconomic headwinds.

- Market Reaction: The market's reaction to the Q2 earnings report will heavily depend on whether the results meet or exceed expectations. A significant shortfall could trigger further sell-offs, while positive surprises may boost investor confidence. Keywords: Q2 earnings, earnings per share (EPS), revenue growth, analyst predictions, earnings surprise.

Strategic Initiatives and Future Outlook

Apple's strategic initiatives could mitigate some of the current headwinds.

- Services Revenue Growth: Apple's services segment, encompassing subscriptions like Apple Music and iCloud, is expected to continue its growth trajectory, partially offsetting the decline in hardware sales.

- Product Innovation: The launch of new products and services, such as new iPhones, Macs, and software updates, could stimulate demand and boost investor confidence. Successful product launches will be crucial for Apple's future growth.

- Market Expansion: Expansion into new markets and demographics could offer new avenues for growth. However, this requires significant investment and successful localization strategies. Keywords: services revenue, product innovation, market expansion, long-term growth.

Conclusion

Apple stock is undeniably facing pressure before its Q2 earnings report. Slowing iPhone sales, macroeconomic uncertainties, and strong competition are creating a challenging environment. While the upcoming report will offer crucial insights, investors should carefully weigh the risks and opportunities. Thoroughly analyzing the factors discussed above, including assessing analyst predictions and considering Apple's long-term strategies, is vital for informed investment decisions. Understanding the complexities surrounding Apple stock and its current market position is crucial. Stay informed about the Q2 report and continue to monitor the situation to make the best choices for your portfolio. Remember to consult with a financial advisor before making any significant investment decisions concerning Apple stock or any other investment.

Featured Posts

-

Applying For Bbc Big Weekend 2025 Tickets Sefton Park

May 25, 2025

Applying For Bbc Big Weekend 2025 Tickets Sefton Park

May 25, 2025 -

Will Ronan Farrow Orchestrate Mia Farrows Return To The Spotlight

May 25, 2025

Will Ronan Farrow Orchestrate Mia Farrows Return To The Spotlight

May 25, 2025 -

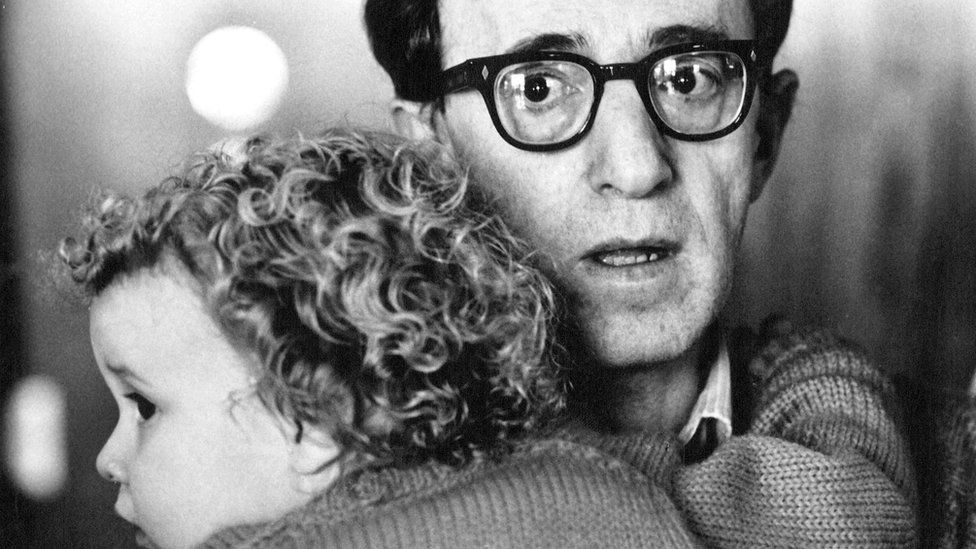

The Sean Penn Woody Allen Dylan Farrow Controversy A Summary Of Doubts

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Summary Of Doubts

May 25, 2025 -

Monday Night Tv 10 Streaming And Broadcast Recommendations

May 25, 2025

Monday Night Tv 10 Streaming And Broadcast Recommendations

May 25, 2025 -

Jenson Button Relives His 2009 Championship Season In Brawn Gp

May 25, 2025

Jenson Button Relives His 2009 Championship Season In Brawn Gp

May 25, 2025