Investor Concerns About Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations is nuanced, acknowledging both strengths and weaknesses in the market. While not explicitly labeling valuations as unequivocally "high," "low," or "fair," their analysis points toward a cautious optimism. They emphasize a need for careful consideration of several key factors before making investment decisions.

-

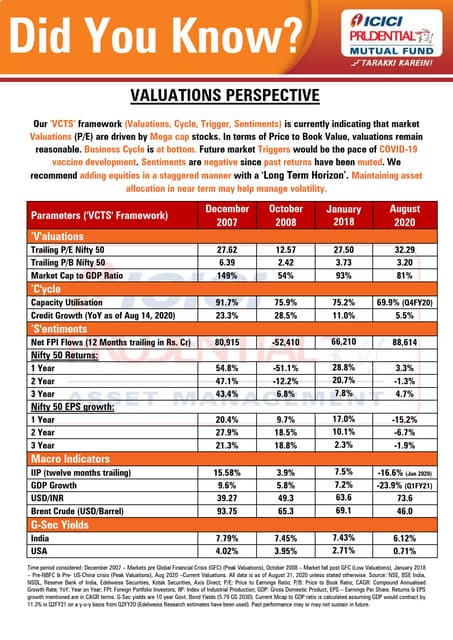

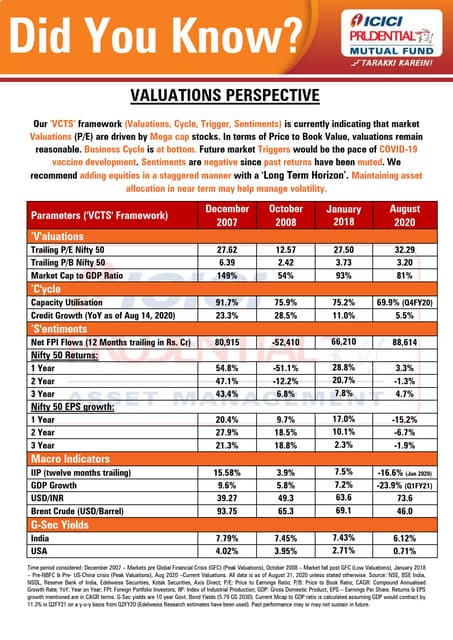

Specific Metrics: BofA employs a variety of metrics to gauge valuations, including traditional Price-to-Earnings (P/E) ratios and the more cyclical Shiller PE (CAPE) ratio, which considers inflation-adjusted earnings over a longer period. They also analyze sector-specific valuations, identifying pockets of overvaluation and undervaluation.

-

Historical Comparisons: BofA's analysis often compares current valuations to historical averages, providing context for the current market situation. This comparison helps to determine whether current valuations are significantly above or below their historical norms.

-

Sector-Specific Concerns: While overall market valuations may appear within a reasonable range, BofA frequently highlights sector-specific valuation concerns. For instance, certain high-growth technology sectors might be deemed overvalued relative to their projected earnings potential, while other, more defensive sectors might appear undervalued.

-

BofA Reports: To access the most up-to-date information, refer to BofA's regularly published research reports and market commentaries. These reports often include detailed breakdowns of valuation metrics and sector-specific analyses.

Key Investor Concerns Highlighted by BofA

BofA’s analysis pinpoints several key concerns currently weighing on investor sentiment and impacting stock market valuations.

Inflationary Pressures and Their Impact on Valuations

BofA acknowledges that inflationary pressures represent a significant headwind for stock valuations. High inflation leads to several negative consequences:

-

Interest Rates and Discount Rates: Inflation compels central banks, like the Federal Reserve, to raise interest rates. Higher interest rates increase discount rates used in valuation models, reducing the present value of future earnings and thereby lowering stock valuations.

-

Impact on Corporate Earnings: Inflation increases input costs for businesses, potentially squeezing profit margins and impacting future earnings growth projections. This makes future earnings less certain and reduces their present value.

-

BofA's Inflation Predictions: BofA regularly publishes forecasts for inflation, offering insights into the potential duration and intensity of inflationary pressures. These forecasts significantly influence their valuation assessments.

Geopolitical Risks and Market Volatility

Geopolitical instability significantly impacts investor sentiment and market volatility, both key components of stock market valuations.

-

Influential Geopolitical Events: BofA meticulously analyzes the effects of geopolitical events, such as wars, trade tensions, and political upheaval, on global markets and individual companies. Their analyses incorporate the potential impacts on supply chains, investor confidence, and overall economic growth.

-

Impact on Investor Sentiment: Uncertainty stemming from geopolitical events typically leads to risk aversion among investors, causing them to reduce their equity holdings and impacting stock prices.

-

Navigating Geopolitical Uncertainty: BofA outlines strategies for navigating geopolitical uncertainty, often suggesting diversification and a focus on more resilient assets during periods of heightened risk.

Interest Rate Hikes and Their Effects on Stock Prices

The Federal Reserve's monetary policy, specifically interest rate hikes, plays a crucial role in shaping stock market valuations.

-

Impact on Borrowing Costs: Higher interest rates increase borrowing costs for companies, potentially limiting investment and expansion opportunities. This can hinder earnings growth and negatively affect valuations.

-

Interest Rates vs. Bond Yields: Higher interest rates make bonds more attractive relative to stocks, potentially diverting investment away from equities. BofA analyzes the relationship between interest rates, bond yields, and stock returns to assess the attractiveness of various asset classes.

-

Predictions for Future Rate Adjustments: BofA provides forecasts for future interest rate adjustments, influencing their recommendations to investors on portfolio positioning.

BofA's Recommendations for Investors

Based on their valuation analysis and assessment of investor concerns, BofA typically suggests a prudent and diversified investment approach.

-

Portfolio Adjustments: BofA may recommend adjustments to portfolio allocations, suggesting diversification across different asset classes and sectors. Sector rotation—moving investments from overvalued sectors to undervalued ones—may be advised.

-

Asset Allocation Strategies: Their recommendations often include a strategic approach to asset allocation, balancing risk and return objectives within the prevailing market conditions.

-

Risk Management: BofA emphasizes the importance of robust risk management strategies, particularly in uncertain market environments. This might include hedging strategies or adjusting investment time horizons.

Understanding and Addressing Investor Concerns About Stock Market Valuations – A BofA Perspective

BofA's analysis reveals that while some sectors might exhibit overvaluation, a blanket judgment on the entire market is premature. Inflation, geopolitical risks, and interest rate hikes are key concerns impacting valuations. BofA emphasizes diversification, strategic asset allocation, and robust risk management as crucial elements of navigating the current market. Stay informed about BofA's ongoing analysis of stock market valuations to make well-informed investment decisions. Visit BofA's website or consult your financial advisor for further information on managing stock market valuations and mitigating investor concerns. Remember, this information is for educational purposes only and does not constitute financial advice.

Featured Posts

-

Citizen Science Project Investigates Whidbey Clams

May 30, 2025

Citizen Science Project Investigates Whidbey Clams

May 30, 2025 -

Jon Jones Return A Heavyweight Contender Speaks Out

May 30, 2025

Jon Jones Return A Heavyweight Contender Speaks Out

May 30, 2025 -

Kasper Dolberg Naeste Stop London

May 30, 2025

Kasper Dolberg Naeste Stop London

May 30, 2025 -

The Bts Reunion Teaser A Deep Dive Into Comeback Clues

May 30, 2025

The Bts Reunion Teaser A Deep Dive Into Comeback Clues

May 30, 2025 -

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025

Revenirea Lui Andre Agassi Primul Meci De Pickleball

May 30, 2025

Latest Posts

-

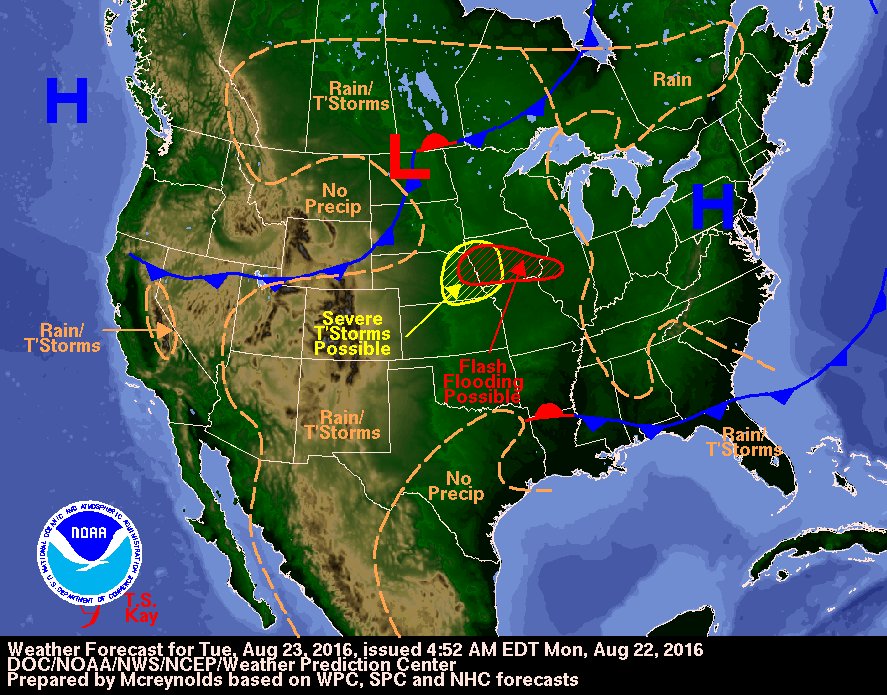

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025 -

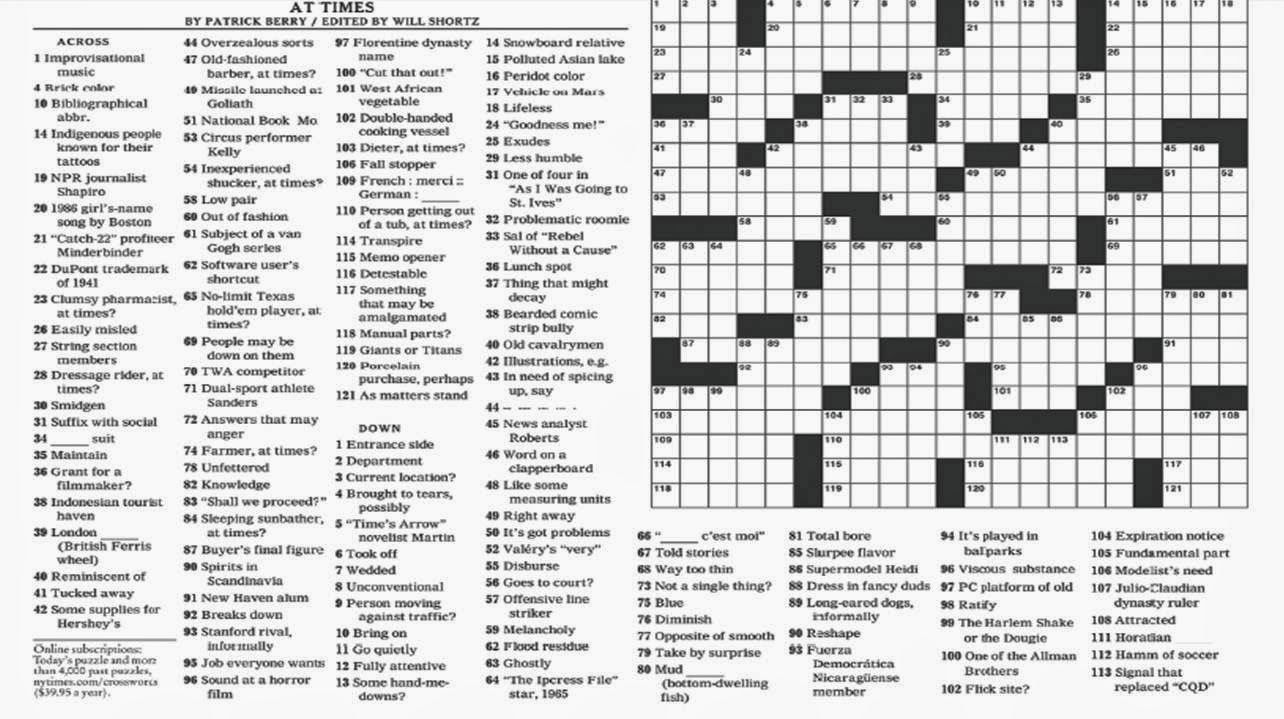

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025 -

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Find The Answers Nyt Mini Crossword Saturday April 19th

May 31, 2025

Find The Answers Nyt Mini Crossword Saturday April 19th

May 31, 2025