Investor Confidence And Uber's April Stock Performance

Table of Contents

Macroeconomic Factors Affecting Uber's April Stock Performance

Several macroeconomic headwinds significantly impacted investor sentiment towards growth stocks like Uber in April.

Inflation and Interest Rates

Rising inflation and subsequent interest rate hikes by central banks globally created a challenging environment for tech companies.

- Correlation: Higher interest rates increase borrowing costs for companies, reducing investment in expansion and innovation. This directly impacts growth stocks like Uber, which are valued based on future potential rather than current profitability.

- Economic Indicators: April saw inflation figures remain stubbornly high in many countries, exceeding expectations in some cases. Simultaneously, central banks continued to raise interest rates to combat inflation, further dampening investor enthusiasm for high-growth, yet often unprofitable, sectors.

- Data/Statistics: For instance, the US inflation rate remained above the Federal Reserve's target in April, leading to another interest rate increase. This contributed to a general sell-off in the tech sector, impacting Uber's stock price.

Geopolitical Uncertainty

Global uncertainties, such as the ongoing war in Ukraine and persistent political instability in certain regions, added to investor anxieties.

- Risk Appetite: Geopolitical events often lead to decreased investor risk appetite, causing investors to shift towards safer investments and away from riskier assets like Uber stock.

- Market Volatility: The uncertainty surrounding global events creates market volatility, making it challenging to predict stock price movements accurately. This uncertainty directly affected investor confidence in Uber's future prospects.

- Data/Statistics: Major market indices experienced increased volatility during April, reflecting the overall impact of geopolitical instability on investor sentiment. This volatility negatively correlated with Uber's stock performance.

Uber-Specific Factors Influencing April Stock Performance

Beyond macroeconomic conditions, several Uber-specific factors contributed to the April stock performance.

Q1 Earnings Report

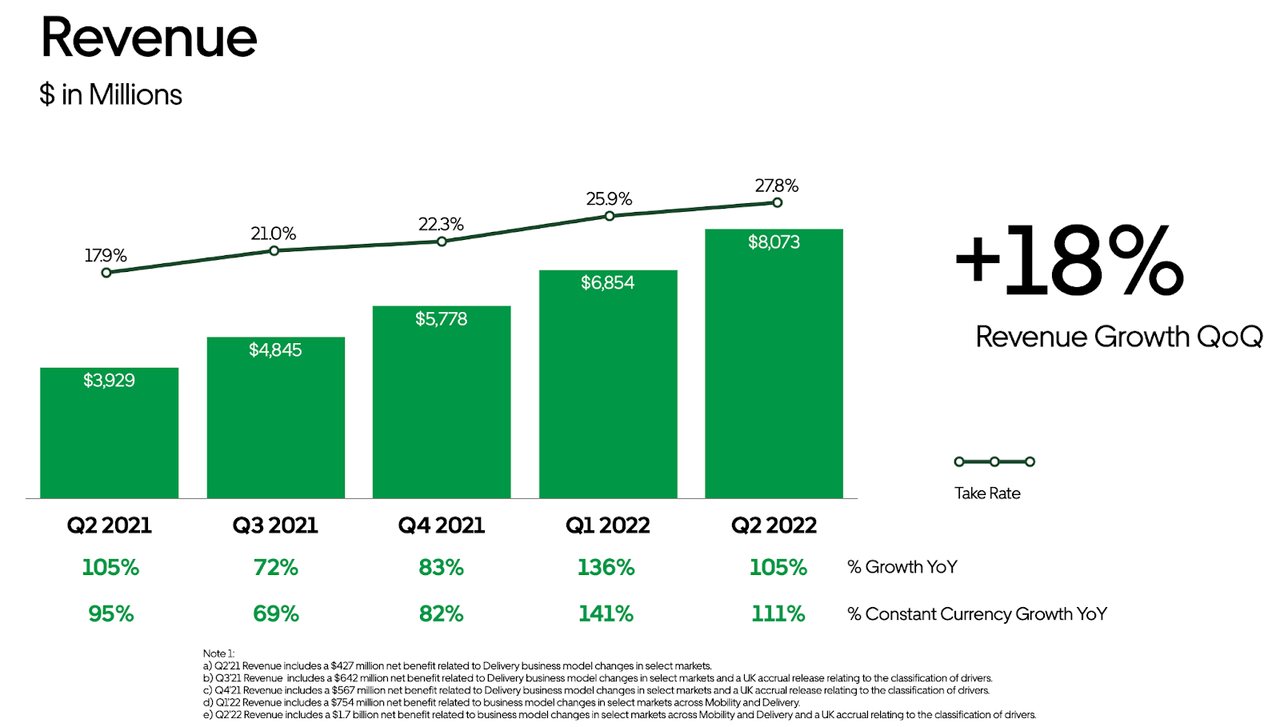

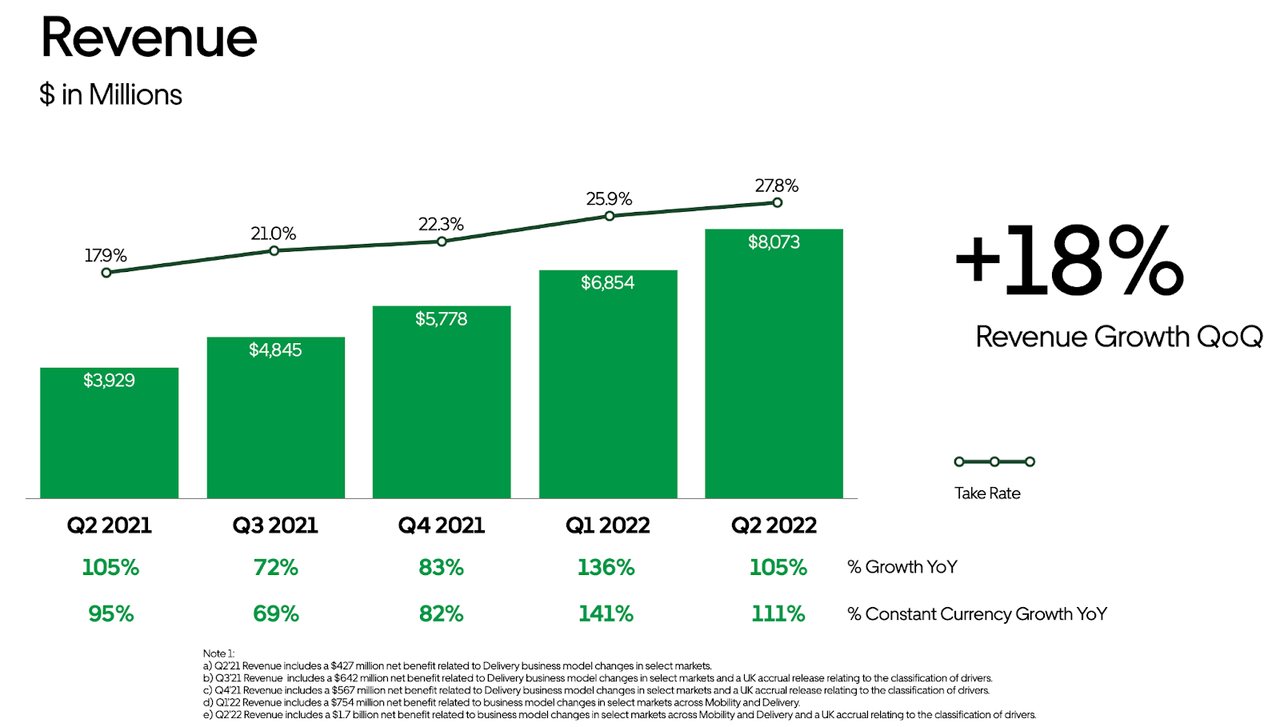

Uber's Q1 2024 earnings report played a crucial role in shaping investor confidence.

- Key Metrics: While the report showed revenue growth, the profit margin might have fallen short of analyst expectations. This discrepancy could have negatively impacted investor sentiment.

- Positive Aspects: [Mention any positive aspects of the report, e.g., growth in a specific segment].

- Negative Aspects: [Mention any negative aspects of the report, e.g., increased operating expenses].

- Data/Statistics: For example, if Uber reported a revenue increase of X% but a profit margin decrease of Y%, this information needs to be included and analyzed for its impact on investor confidence.

Company Announcements and News

Any significant announcements, partnerships, or news related to Uber during April directly influenced its stock price.

- New Initiatives: [Mention any new initiatives launched by Uber in April, e.g., expansion into new markets, new service offerings]. Analyze the market's reaction to these announcements.

- Product Launches: [Mention any new product launches, and analyze investor response].

- Regulatory Changes: [Discuss any regulatory changes impacting Uber and their effect on investor confidence].

- Data/Statistics: Quantify the impact of these announcements on Uber's stock price, if possible. For example, "The announcement of a new partnership caused a Z% increase in stock price."

Competition and Market Share

Uber's competitive landscape and market share dynamics significantly influence investor perception.

- Key Competitors: Lyft remains a major competitor, and the performance of other ride-hailing services and traditional taxi services affects Uber's market position.

- Market Share Dynamics: Any shift in market share, either positive or negative, would influence investor confidence.

- Data/Statistics: Include data on Uber's market share compared to its competitors, demonstrating the competitive landscape.

Analyzing Investor Sentiment and Trading Activity in April

Understanding investor sentiment and trading activity offers valuable insights into Uber's April stock performance.

Social Media Sentiment

Social media sentiment analysis can reveal the overall tone surrounding Uber during April.

- Positive/Negative/Neutral: Analyzing social media posts and comments about Uber reveals the prevailing sentiment. A predominantly negative sentiment could indicate waning investor confidence.

- Correlation with Stock Price: Compare social media sentiment trends to Uber's stock price movements to identify any correlations.

- Data/Statistics: Include data from social media sentiment analysis tools, if available.

Trading Volume and Volatility

High trading volume and volatility indicate increased investor activity and uncertainty.

- High Trading Volume: High trading volume often suggests increased investor interest, but it can also be a sign of uncertainty or speculation.

- Volatility: Significant price fluctuations indicate uncertainty about Uber's future prospects, impacting investor confidence.

- Data/Statistics: Include charts and graphs illustrating trading volume and price fluctuations during April.

Conclusion: Investor Confidence and the Future of Uber's Stock

Several factors influenced investor confidence and Uber's April stock performance. Macroeconomic headwinds, Uber's Q1 earnings report, company announcements, competitive pressures, and investor sentiment all played a role. The interplay of these factors created a volatile environment for Uber's stock. The future outlook depends on how Uber addresses these challenges and navigates the evolving macroeconomic landscape. Will investor confidence rebound as Uber demonstrates sustained growth and profitability? Only time will tell.

To stay informed about the latest developments impacting investor confidence and Uber's stock performance, follow our publication for regular updates and analysis on this dynamic sector. Continue to monitor "Investor Confidence and Uber's Stock Performance" for crucial insights.

Featured Posts

-

Open Ais Chat Gpt Under Ftc Scrutiny Data Privacy Concerns

May 17, 2025

Open Ais Chat Gpt Under Ftc Scrutiny Data Privacy Concerns

May 17, 2025 -

Derrota De Penarol Ante Olimpia 0 2 Resumen Y Goles Del Partido

May 17, 2025

Derrota De Penarol Ante Olimpia 0 2 Resumen Y Goles Del Partido

May 17, 2025 -

Fiesta Del Cine 2025 3000 Peliculas Horarios Y Como Conseguir Entradas

May 17, 2025

Fiesta Del Cine 2025 3000 Peliculas Horarios Y Como Conseguir Entradas

May 17, 2025 -

Ncaa Tournament Angel Reeses Reaction To Caitlin Clark Question

May 17, 2025

Ncaa Tournament Angel Reeses Reaction To Caitlin Clark Question

May 17, 2025 -

Why Did Uber Stock Rally Over 10 In April

May 17, 2025

Why Did Uber Stock Rally Over 10 In April

May 17, 2025