Investor Guide: Understanding And Addressing High Stock Market Valuations (BofA)

Table of Contents

Defining High Stock Market Valuations

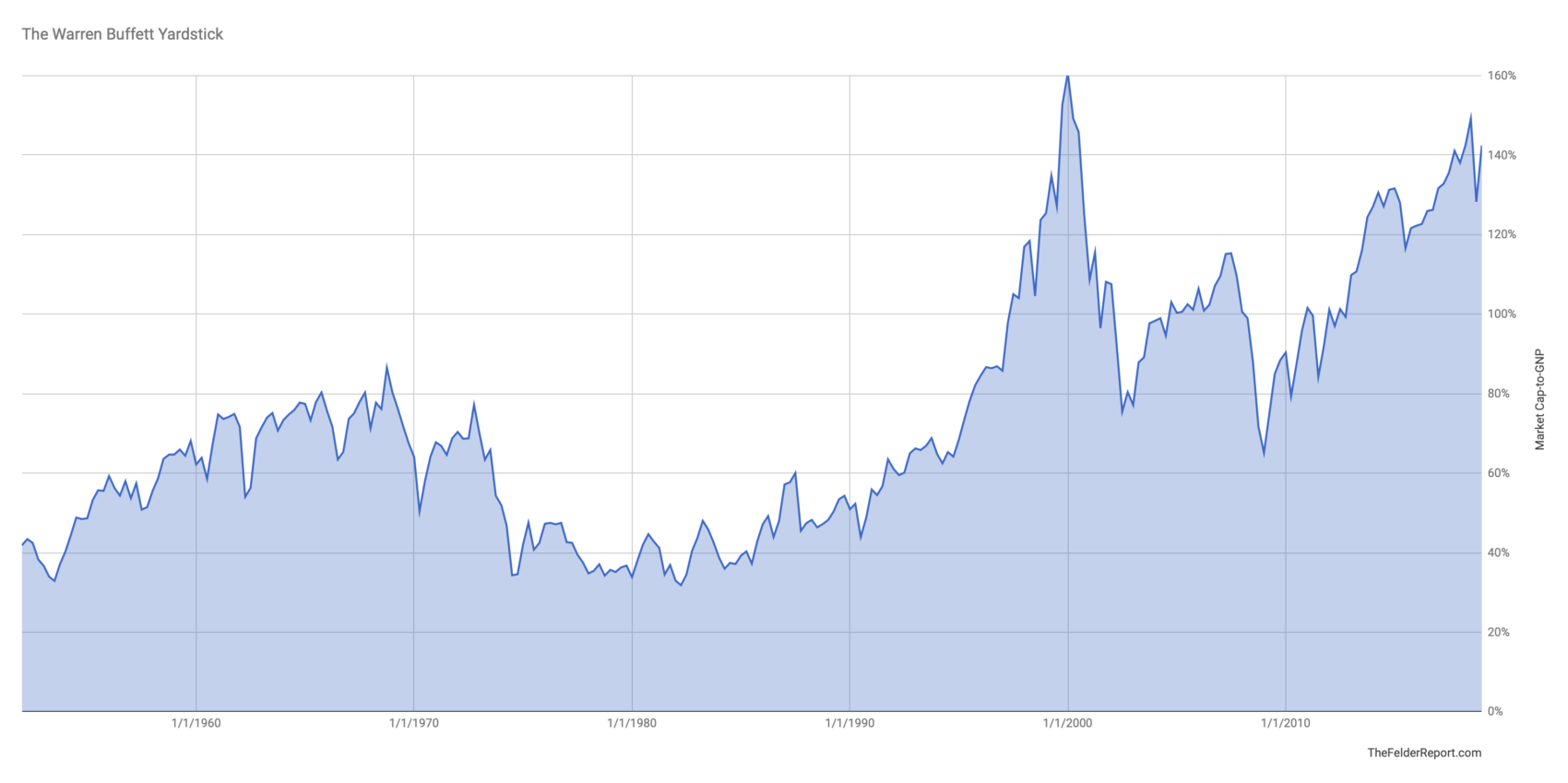

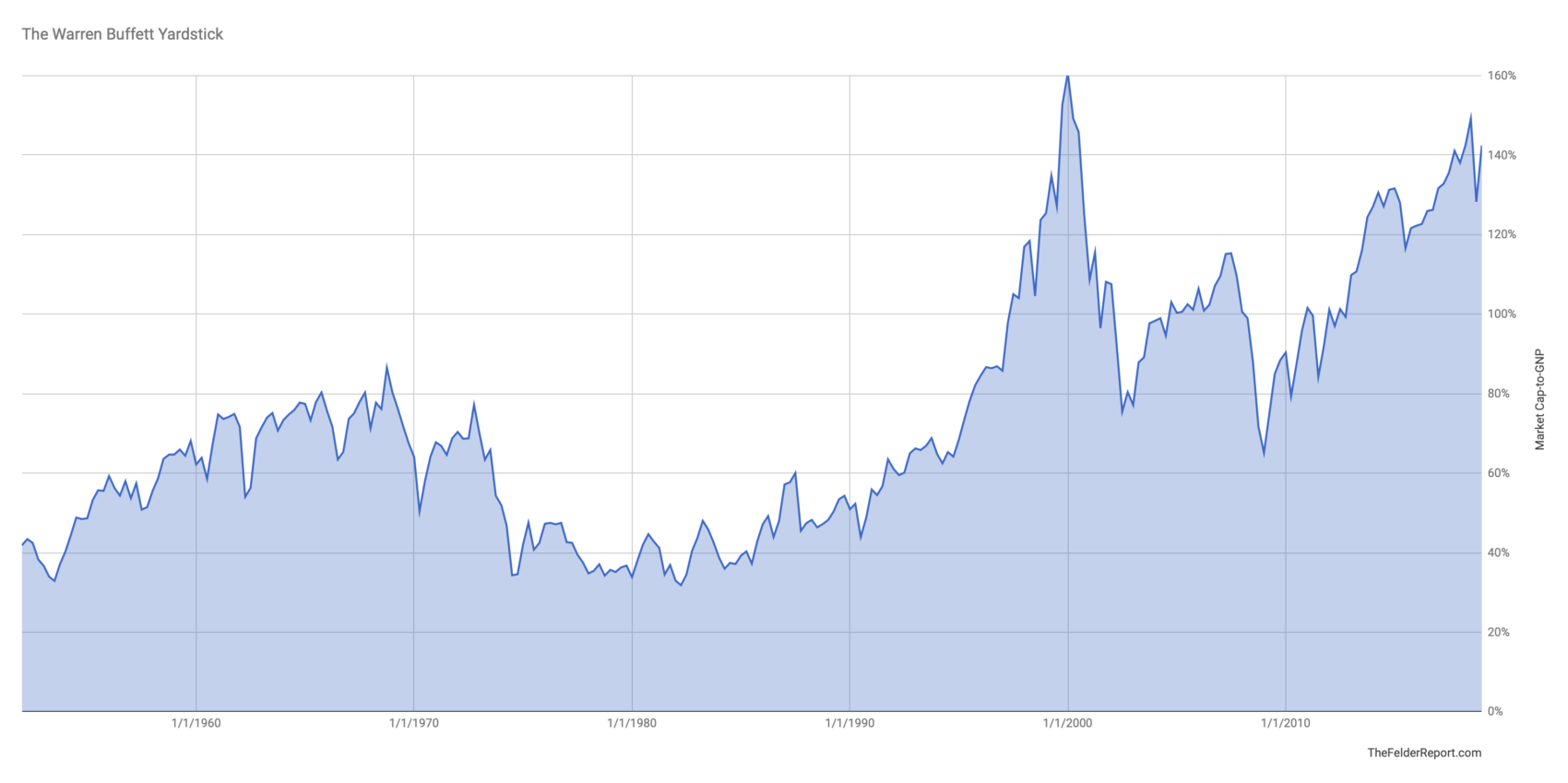

Determining whether current stock market valuations are truly "high" requires a nuanced approach, relying on several key valuation metrics. These metrics provide a relative measure of how expensive or cheap the market is compared to its historical performance and future earnings expectations.

- Price-to-Earnings Ratio (P/E Ratio): This classic metric compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are paying a premium for each dollar of earnings, indicating potentially high expectations for future growth. However, a high P/E ratio can also be a sign of overvaluation.

- Price-to-Sales Ratio (P/S Ratio): This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with no or negative earnings. A high P/S ratio might signify high expectations for future revenue growth but could also indicate overvaluation.

- Shiller PE Ratio (CAPE Ratio): The Cyclically Adjusted Price-to-Earnings Ratio, developed by Nobel laureate Robert Shiller, smooths out earnings fluctuations over a 10-year period. This provides a more stable measure of valuation, less susceptible to short-term earnings volatility. A high CAPE ratio can signal a potentially overvalued market.

Limitations of Valuation Metrics:

- These metrics are just indicators, not definitive predictors of future market performance.

- They can be influenced by accounting practices and industry-specific factors.

- Comparing metrics across different sectors requires caution due to varying profit margins and growth rates.

Historical Context: Comparing current valuations to historical averages provides crucial context. Examining periods like the dot-com bubble (high tech stock valuations) and the 2008 financial crisis (overall market valuations) highlights the potential dangers of excessively high valuations and the subsequent market corrections that often follow. Analyzing historical market data reveals the cyclical nature of market valuations, helping investors understand current valuations within a broader historical perspective.

Identifying Risks Associated with High Valuations

Investing in a highly valued market presents several significant risks:

- Market Correction or Crash: High valuations often precede market corrections or even crashes. When investor confidence wanes, a sharp decline in stock prices can occur, potentially wiping out significant investment gains.

- Lower Potential for Future Returns: Historically, periods of high valuations have been followed by lower average returns compared to periods with lower valuations. This is because high prices often imply that much of the future growth is already priced into the market.

- Increased Volatility: Highly valued markets tend to be more volatile, experiencing larger price swings both up and down. This increased volatility can be unsettling for investors and requires a higher risk tolerance.

- Impact of Rising Interest Rates: Higher interest rates increase borrowing costs for companies and make bonds more attractive relative to stocks, potentially reducing demand for equities and putting downward pressure on valuations.

- Inflation Risk: Inflation erodes the purchasing power of future earnings, potentially affecting the perceived value of stocks. High inflation can lead to higher interest rates and further negatively impact stock prices.

Strategies for Navigating High Stock Market Valuations

Several strategies can help investors manage their portfolios during periods of high stock market valuations:

- Portfolio Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, commodities) to reduce overall portfolio risk. This helps mitigate potential losses in any single asset class.

- Value Investing: Focus on identifying undervalued companies with strong fundamentals and a potential for future growth. This involves a thorough analysis of financial statements and a longer-term investment horizon.

- Sector Rotation: Shift investments from overvalued sectors to potentially undervalued ones. This requires careful analysis of industry trends and economic forecasts.

- Defensive Investing: Invest in defensive stocks like consumer staples and utilities, which are less sensitive to economic downturns. These companies tend to provide more stable returns during periods of market uncertainty.

- Alternative Investments: Explore alternative investments like bonds, real estate, or private equity to diversify your portfolio beyond traditional stocks.

The Role of Bank of America (BofA) Market Analysis

BofA's research and analysis provide valuable insights for investors navigating high stock market valuations. Their market strategists offer perspectives on macroeconomic trends, sector-specific outlooks, and investment strategies tailored to various market environments. Accessing their reports and publications can help you refine your investment approach and make more informed decisions. (Note: A link to relevant BofA resources would be included here if permitted).

Conclusion

Understanding and addressing high stock market valuations requires a careful assessment of various factors, including valuation metrics, potential risks, and available investment strategies. By employing a diversified approach, utilizing appropriate valuation metrics like the P/E ratio, CAPE ratio, and P/S ratio, and staying informed through resources like BofA's market analysis, investors can navigate this challenging environment more effectively. Remember, proactively managing your portfolio in the face of high stock market valuations is crucial for long-term success. Continue to educate yourself on managing your investments during periods of high stock market valuations and adapt your strategy as market conditions evolve.

Featured Posts

-

Medicaid Cuts A Republican Internal Struggle

May 18, 2025

Medicaid Cuts A Republican Internal Struggle

May 18, 2025 -

Bostons Bullpen Upgrade A Deep Dive Into The Cardinals Deal

May 18, 2025

Bostons Bullpen Upgrade A Deep Dive Into The Cardinals Deal

May 18, 2025 -

Source Reveals Carrie Underwoods Move Against Taylor Swift

May 18, 2025

Source Reveals Carrie Underwoods Move Against Taylor Swift

May 18, 2025 -

Trumps Sharp Rebuke Of Springsteen Following Treasonous Label

May 18, 2025

Trumps Sharp Rebuke Of Springsteen Following Treasonous Label

May 18, 2025 -

Riley Greene Two Homers In Ninth Inning Lead Tigers To Victory Over Angels

May 18, 2025

Riley Greene Two Homers In Ninth Inning Lead Tigers To Victory Over Angels

May 18, 2025

Latest Posts

-

Florida Space Coast Economic Development Commission Secures 800 000

May 18, 2025

Florida Space Coast Economic Development Commission Secures 800 000

May 18, 2025 -

Economic Development Funding Florida Space Coast Awarded 800 K

May 18, 2025

Economic Development Funding Florida Space Coast Awarded 800 K

May 18, 2025 -

Florida Space Coast Receives 800 K Economic Development Grant

May 18, 2025

Florida Space Coast Receives 800 K Economic Development Grant

May 18, 2025 -

800 000 Boost For Florida Space Coast Economic Development

May 18, 2025

800 000 Boost For Florida Space Coast Economic Development

May 18, 2025 -

Is Amanda Bynes Only Fans Account A Success

May 18, 2025

Is Amanda Bynes Only Fans Account A Success

May 18, 2025