Investor Uncertainty Grows Amidst Japan's Steepening Bond Curve

Table of Contents

The steepening yield curve, characterized by a widening gap between short-term and long-term bond yields, signifies a shift in market expectations. In Japan, this typically reflects changes in anticipated inflation, monetary policy, and overall economic growth. A steepening curve can signal both opportunities and risks, making it crucial for investors to understand its implications for their portfolios. This article argues that the current steepening of Japan's bond curve is creating significant uncertainty and demanding a reassessment of investment strategies within the Japanese market.

Rising Bond Yields and Their Implications

The recent rise in JGB yields represents a notable departure from the prolonged period of ultra-low interest rates maintained by the Bank of Japan (BOJ). Several factors contribute to this steepening yield curve:

- Bank of Japan (BOJ) Policy Adjustments: The BOJ's gradual shift away from its yield curve control (YCC) policy, although still subtle, has allowed yields to rise more freely. This marks a significant change in the landscape after years of suppressing yields.

- Increased Inflation Pressures: While still relatively moderate compared to other developed nations, inflation in Japan is steadily increasing, prompting market expectations of higher future interest rates.

- Global Interest Rate Hikes: The global trend of rising interest rates, driven by central banks combating inflation worldwide, has indirectly influenced JGB yields. Global investors are seeking higher returns, putting upward pressure on Japanese yields.

- Increased Demand for Higher-Yielding Assets: As yields rise, investors are increasingly drawn to higher-yielding assets, further contributing to the steepening curve. This increased demand pushes yields even higher.

These factors collectively impact Japanese pension funds and other long-term investors heavily reliant on JGBs for stable returns. The rising yields reduce the value of their existing holdings and necessitate a re-evaluation of their investment strategies. Furthermore, the ripple effect extends to other asset classes, potentially impacting the equity market and real estate sector.

Uncertainty in the Japanese Investment Landscape

The rising yields are creating palpable uncertainty in the Japanese investment landscape. This uncertainty manifests itself in several ways:

- Increased Volatility: The JGB market, once known for its stability, is experiencing significantly increased volatility, making it challenging for investors to predict price movements.

- Challenges for Investors: Investors face difficulties in:

- Forecasting Future Yields: Accurately predicting the future trajectory of JGB yields is exceptionally challenging given the interplay of domestic and global factors.

- Increased Risk of Capital Losses: Rising yields increase the risk of capital losses for investors holding long-term JGBs.

- Portfolio Adjustments: Investors need to make significant adjustments to their portfolios to mitigate the risks associated with the changing yield curve.

The impact extends to foreign investment in Japanese assets. The increased uncertainty is likely to deter some foreign investors, while attracting others seeking higher yields, creating a complex dynamic.

The BOJ's Response and Future Outlook

The BOJ's recent policy decisions, while not a complete abandonment of YCC, represent a cautious approach to adapting to the changing market environment. Future policy adjustments remain a key uncertainty. Expert opinions vary widely, with some forecasting a continued steepening of the curve, others predicting stabilization, and some even suggesting a potential reversal. Analyzing these scenarios is crucial for making informed investment decisions. The path forward for the BOJ hinges on inflation data, economic growth prospects, and global monetary policy developments.

Strategies for Navigating the Uncertainty

Navigating the uncertainty in Japan's bond market requires a proactive and carefully considered approach. Investors can employ various strategies to manage their exposure to JGBs:

- Diversification: Diversifying investments across different asset classes, including international bonds and equities, is critical to mitigate risk.

- Hedging Techniques: Employing hedging strategies, such as interest rate swaps, can help reduce exposure to fluctuations in bond yields.

- Re-evaluation of Risk Tolerance: Investors should reassess their risk tolerance and adjust their portfolios accordingly, potentially shifting towards lower-risk investments.

While the current environment presents challenges, it also creates opportunities for savvy investors. Careful analysis, understanding the interplay of global and domestic factors, and a well-defined investment strategy are paramount to success. Seeking professional financial advice is crucial for navigating this complex landscape.

Conclusion: Investor Uncertainty and Japan's Steepening Bond Curve: A Call to Action

The steepening of Japan's bond curve has created significant uncertainty in the Japanese investment market, impacting investor confidence and necessitating a re-evaluation of investment strategies. The interplay of BOJ policy adjustments, inflation pressures, global interest rate hikes, and increased demand for higher-yielding assets has fueled this volatility. Investors face challenges in forecasting yields, managing capital losses, and adapting their portfolios to the changing landscape.

Navigating this environment requires diversification, hedging, and a thorough reassessment of risk tolerance. While uncertainty remains, opportunities exist for those equipped with the right knowledge and strategies. Staying informed about developments in Japan's bond market and seeking professional financial advice are essential steps in mitigating potential risks and capitalizing on emerging opportunities within Japan's evolving bond market. For personalized guidance on navigating this complex landscape, [link to financial advisor/resource].

Featured Posts

-

Week 26 Update 2024 25 High School Confidential

May 17, 2025

Week 26 Update 2024 25 High School Confidential

May 17, 2025 -

R1 2 Lakh Ultraviolette Tesseract High Performance Electric Scooter With 261km Range

May 17, 2025

R1 2 Lakh Ultraviolette Tesseract High Performance Electric Scooter With 261km Range

May 17, 2025 -

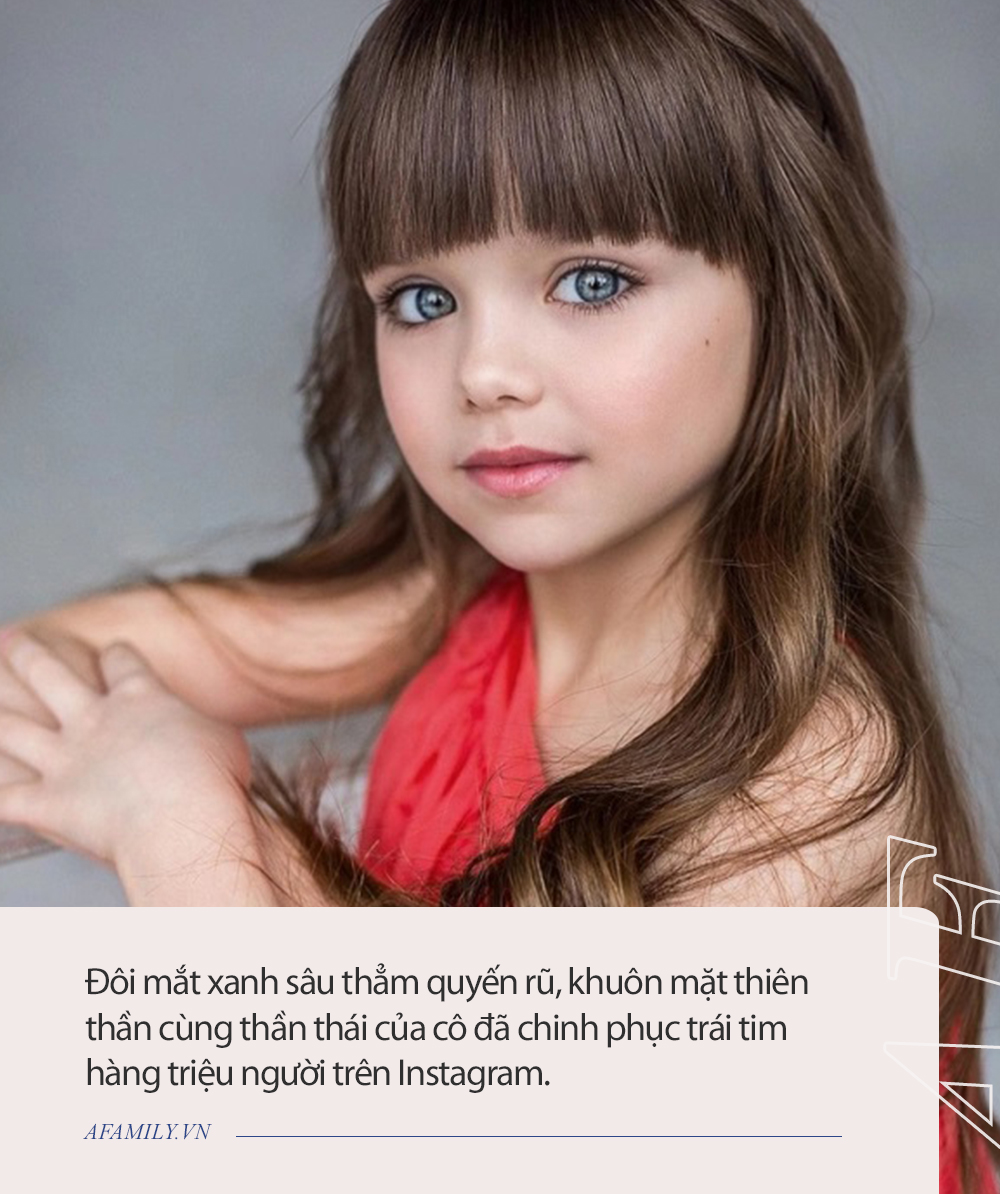

Co Gai 17 Tuoi Nguoi Nga Lam Nen Lich Su Tai Indian Wells

May 17, 2025

Co Gai 17 Tuoi Nguoi Nga Lam Nen Lich Su Tai Indian Wells

May 17, 2025 -

Will We See A Severance Season 3 A Look At The Possibilities

May 17, 2025

Will We See A Severance Season 3 A Look At The Possibilities

May 17, 2025 -

Finala Cupei Germaniei Vf B Stuttgart Spera La Revenirea Lui Stiller

May 17, 2025

Finala Cupei Germaniei Vf B Stuttgart Spera La Revenirea Lui Stiller

May 17, 2025