IPO Activity Halts Amid Tariff-Driven Market Chaos: A Deep Dive

Table of Contents

The Direct Impact of Tariffs on IPO Confidence

The current climate of tariff-driven market chaos directly impacts investor confidence in IPOs. This uncertainty creates a ripple effect, significantly hindering the already complex process of bringing a company public.

Investor Uncertainty and Risk Aversion

Tariffs introduce a significant layer of unpredictability into the market. This uncertainty makes investors hesitant to commit capital to new ventures, preferring safer, more established options.

- Increased volatility in stock markets directly correlates with decreased IPO activity. The unpredictable nature of tariffs leads to increased market volatility, making it difficult for investors to accurately assess risk and potential returns.

- Investors seek safer, more established options during periods of economic uncertainty. Established companies, with a proven track record, are seen as less risky investments during times of market instability caused by trade wars.

- Predictability is key for IPO success, and tariffs undermine this. A successful IPO requires a stable and predictable market environment. Tariffs introduce significant variables, making accurate forecasting extremely difficult.

Difficulty in Forecasting Future Earnings

The unpredictable nature of tariff policies makes it incredibly challenging for companies to project reliable future earnings – a crucial factor for IPO valuations.

- Uncertainty around import/export costs impacts revenue projections. Fluctuations in tariff rates directly affect a company's cost of goods sold, making accurate revenue projections almost impossible.

- Investors demand clear, stable earnings forecasts before investing. Investors need confidence in a company's ability to generate consistent profits before committing capital in an IPO.

- Inaccurate forecasts can lead to significant losses for investors. If a company's earnings projections are significantly off due to unforeseen tariff changes, investors could experience substantial losses.

The Broader Macroeconomic Effects of Trade Wars on IPO Markets

The impact of tariff-driven market chaos extends beyond direct investor concerns. The broader macroeconomic consequences of trade wars significantly impact the IPO market.

Slowing Global Economic Growth

Trade wars contribute to slower global economic growth, reducing consumer spending and impacting the overall market performance. This creates a less favorable environment for IPOs.

- Reduced consumer spending affects overall market performance. Uncertainty and increased costs associated with tariffs lead to decreased consumer spending, reducing overall demand.

- Companies postpone IPOs to wait for improved market conditions. Businesses are less likely to go public when the overall economic outlook is uncertain and market conditions are unfavorable.

- Lower GDP growth directly affects the attractiveness of IPOs. A slowing economy reduces the perceived value and attractiveness of new ventures, making IPOs less appealing to investors.

Increased Funding Costs and Reduced Access to Capital

Trade wars can impact interest rates and access to capital, making it more difficult and expensive for companies to go public.

- Higher interest rates increase the cost of borrowing for businesses. Increased interest rates make it more expensive for companies to finance their operations and prepare for an IPO.

- Investors are more selective and demand higher returns. In uncertain times, investors become more risk-averse and demand higher returns on their investments.

- Reduced access to capital can delay or even prevent IPOs. The increased cost of capital and reduced investor appetite can make securing funding for an IPO extremely challenging.

Alternative Funding Options and Their Impact

The current climate has led to a shift towards alternative funding options, such as private equity and venture capital.

Rise of Private Equity and Venture Capital

With the IPO market experiencing a slowdown, companies are increasingly turning to private funding to secure capital.

- Private funding provides greater stability and less scrutiny than public markets. Private investors often offer greater flexibility and less stringent requirements compared to public market IPOs.

- Companies may prefer private funding to avoid the volatility of the current IPO climate. The uncertainty surrounding tariffs and the overall market makes private funding a more attractive option for some companies.

- This shift reduces the number of companies going public. The increased reliance on private funding reduces the number of companies entering the public markets through IPOs.

Impact on Startup Ecosystems and Innovation

The reduced IPO activity has potential long-term consequences for innovation and the overall startup ecosystem.

- Reduced access to capital can stifle growth and innovation. Without access to public markets, startups may struggle to secure the necessary funding for growth and expansion.

- Fewer successful exits discourage entrepreneurs. A robust IPO market provides crucial exit opportunities for entrepreneurs, encouraging innovation and risk-taking.

- A healthy IPO market is crucial for a thriving startup ecosystem. The IPO market plays a vital role in supporting innovation and providing capital for growth.

Conclusion

The current halt in IPO activity is a direct consequence of the tariff-driven market chaos. Investor uncertainty, unpredictable economic conditions, and the difficulty in forecasting future earnings have all contributed to this significant downturn. The shift toward private funding underscores the severity of the issue, potentially impacting the long-term health of the startup ecosystem. Understanding the intricacies of the relationship between tariff-driven market chaos and IPO activity is crucial for navigating the current economic landscape. Stay informed on the latest developments and prepare for a potentially prolonged period of uncertainty in the IPO market. Continue to monitor future trends in IPO activity to make informed investment decisions.

Featured Posts

-

Novakove Patike Pregled Modela Vrednikh 1 500 Evra

May 14, 2025

Novakove Patike Pregled Modela Vrednikh 1 500 Evra

May 14, 2025 -

Potochinja Detski Festival Ispolnet So Khumanost

May 14, 2025

Potochinja Detski Festival Ispolnet So Khumanost

May 14, 2025 -

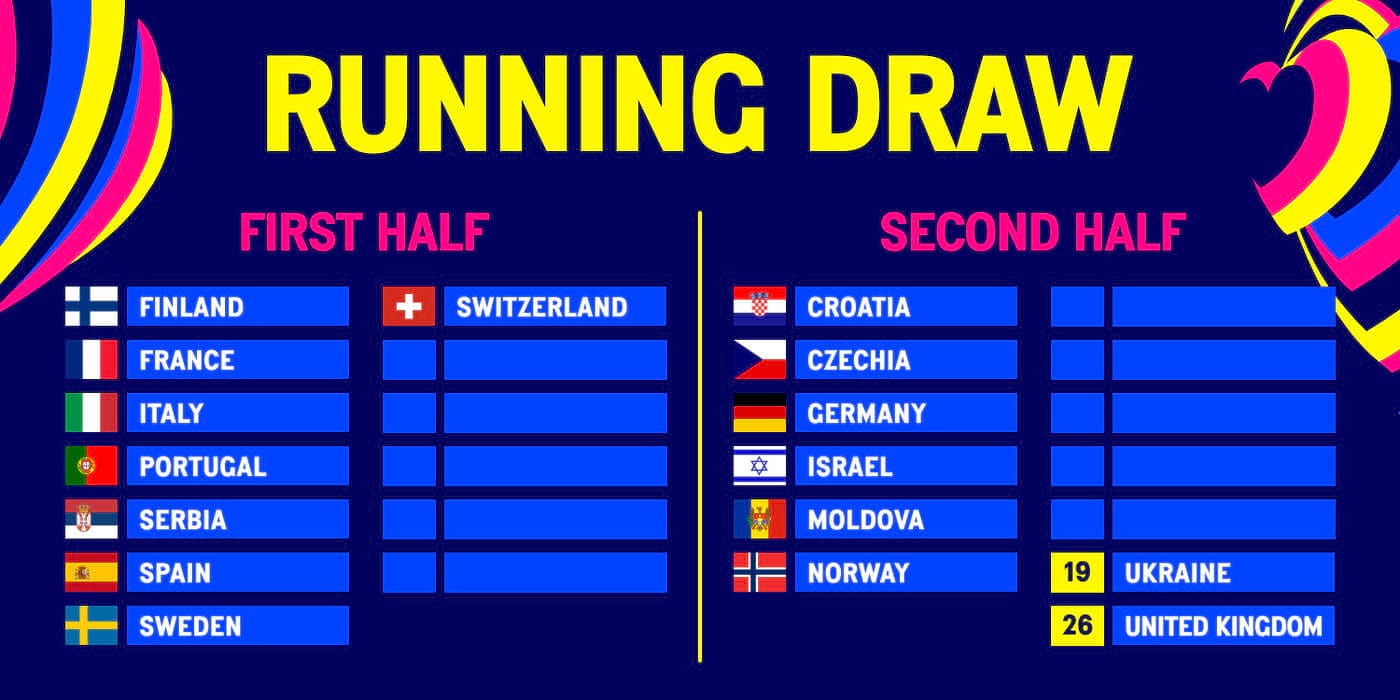

Eurovision 2025 Final Dates For The Grand Final And Semi Finals

May 14, 2025

Eurovision 2025 Final Dates For The Grand Final And Semi Finals

May 14, 2025 -

Tommy Fury Receives Speeding Fine Following Molly Mae Hague Separation

May 14, 2025

Tommy Fury Receives Speeding Fine Following Molly Mae Hague Separation

May 14, 2025 -

Suits La Episode 5 Unveiling The Harvey Mike Successors

May 14, 2025

Suits La Episode 5 Unveiling The Harvey Mike Successors

May 14, 2025