Iron Ore Falls: China's Steel Production Cuts Impact Global Markets

Table of Contents

China's Steel Production Cuts: The Driving Forces

Several converging factors have contributed to the significant reduction in China's steel production, creating a ripple effect across the global iron ore market. These factors are interconnected and reinforce each other, creating a complex challenge for the industry.

Environmental Regulations and Carbon Emission Targets

China's commitment to reducing carbon emissions and improving environmental standards has significantly impacted its steel industry. The government's stringent environmental regulations are forcing steel mills to adapt or face penalties.

- Increased scrutiny of steel mills: Regular inspections and audits are leading to increased compliance costs and operational disruptions.

- Stricter emission standards: New, stricter emission standards are requiring substantial investments in cleaner technologies.

- Penalties for non-compliance: Heavy fines and operational shutdowns are imposed on mills failing to meet environmental regulations.

- Government incentives for greener technologies: While incentives exist, the cost of upgrading to meet new standards is still substantial for many producers, impacting their profitability and production capacity.

These regulations have forced many steel mills to curtail operations, leading to a decrease in overall steel production and a corresponding drop in iron ore demand. The transition to greener technologies is a long-term process, and in the short term, it's contributing to the current downturn.

Weakening Domestic Demand

A slowdown in China's construction sector and overall economic growth has directly impacted the demand for steel, further contributing to the production cuts.

- Reduced infrastructure projects: A decrease in government spending on infrastructure projects has reduced the need for steel.

- Slowing real estate market: The cooling real estate market, grappling with debt issues and oversupply, is significantly impacting steel consumption.

- Impact of COVID-19 on construction activity: Lingering effects from the pandemic continue to impact construction activity and overall economic recovery.

- Shift towards sustainable construction materials: A growing focus on sustainable building practices is gradually reducing the reliance on traditional steel-intensive construction methods.

The correlation between decreased domestic demand and reduced iron ore imports is undeniable. As China's economy adjusts, the demand for steel, and subsequently iron ore, is expected to fluctuate, influencing global market prices.

Government Intervention and Production Quotas

The Chinese government has also directly intervened, imposing production quotas and limitations on steel mills to manage capacity and address environmental concerns.

- Specific examples of production caps: Various regions have implemented different production caps, impacting regional steel output.

- Regional variations in policies: The implementation of these policies is not uniform across the country, leading to varied impacts on different steel producers.

- Impact of government policies on steel output: These government measures have played a significant role in curbing overall steel production, contributing to the decline in iron ore demand.

The effectiveness and long-term consequences of these government-imposed measures are still being assessed, but their immediate impact on iron ore prices is evident.

The Global Impact of Reduced Iron Ore Demand

The reduction in Chinese demand for iron ore has had a significant and far-reaching impact on global markets.

Falling Iron Ore Prices

The decreased demand has led to a significant drop in iron ore prices, creating challenges for mining companies and impacting global trade.

- Price charts illustrating the decline: Data clearly shows a steep decline in iron ore prices following the reduction in Chinese demand.

- Comparison to previous price fluctuations: This decline is significant compared to previous fluctuations, highlighting the severity of the current situation.

- Impact on mining companies' profitability: Lower prices are severely impacting the profitability of iron ore mining companies worldwide, forcing them to adjust their operations.

The volatility of the iron ore market underscores the interconnectedness of global commodity markets and highlights the importance of risk management for all stakeholders.

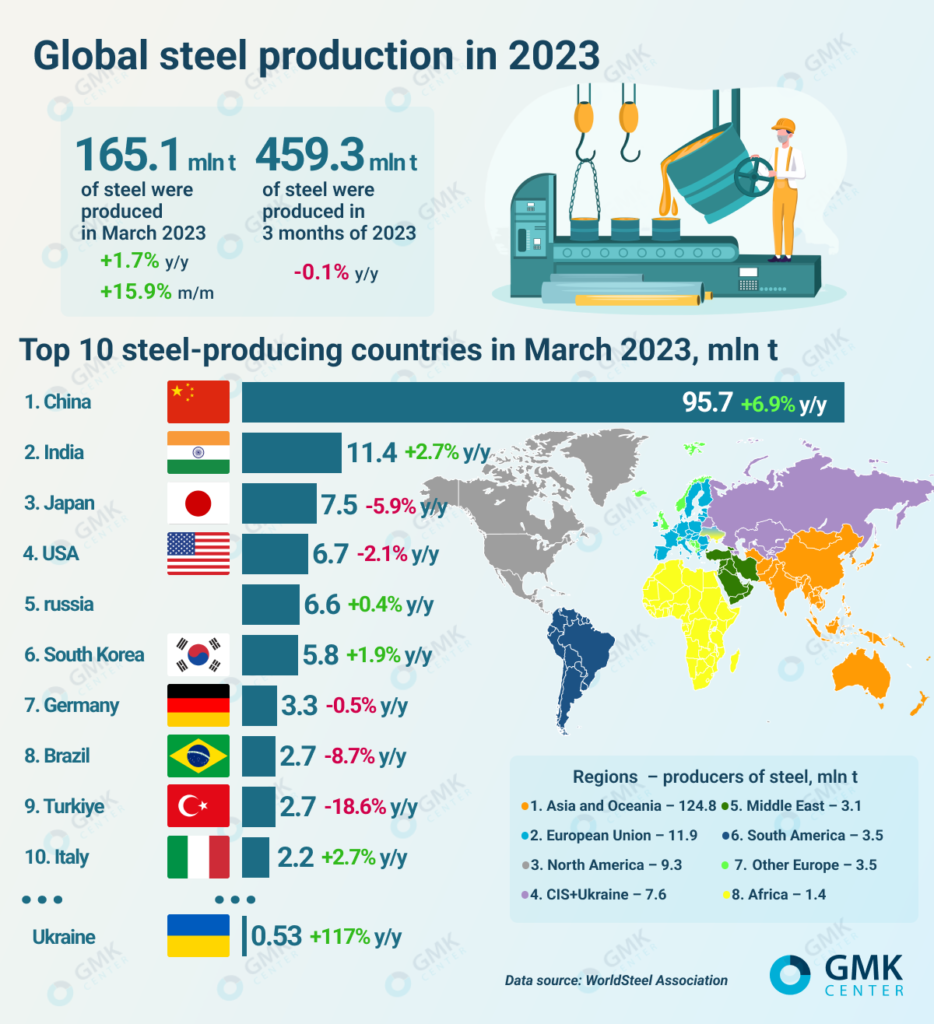

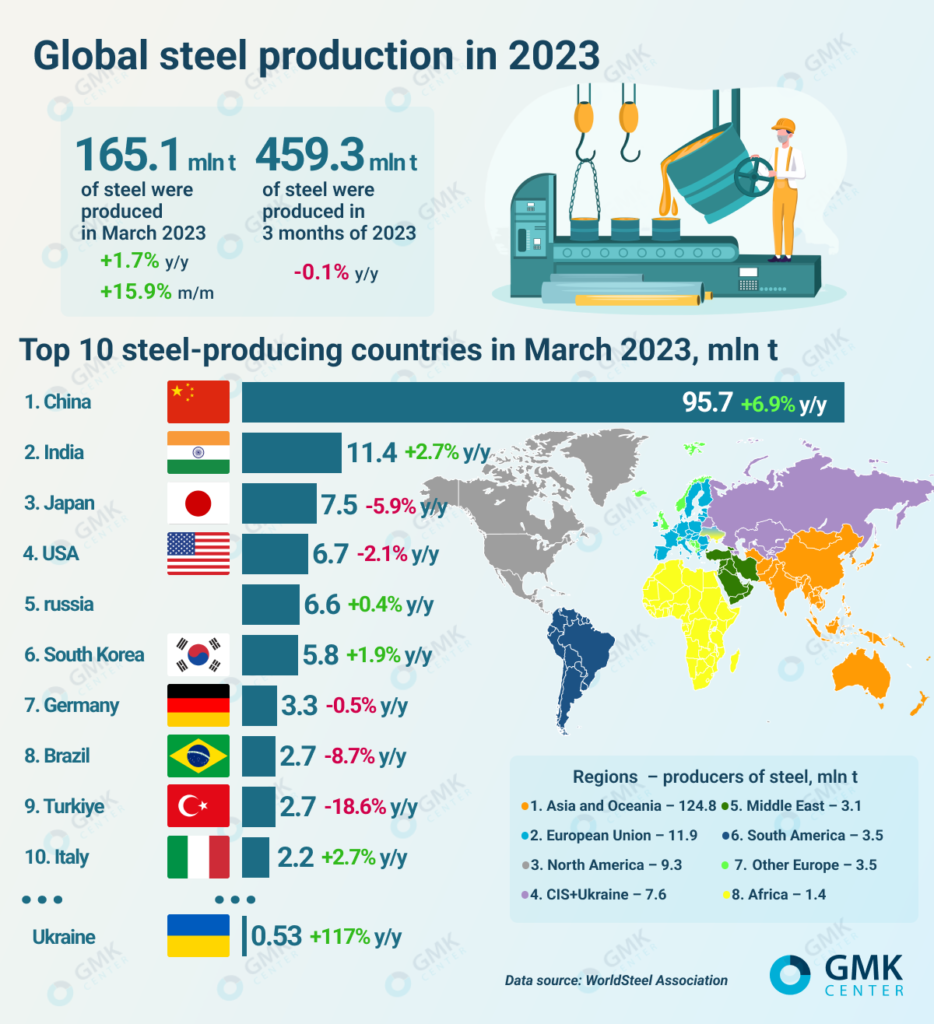

Impact on Global Steel Producers

The reduced demand from China directly impacts steel producers worldwide, forcing them to adapt to lower prices and reduced sales.

- Impact on Australian, Brazilian, and other major iron ore exporters: These countries are heavily reliant on exporting iron ore to China, and the reduced demand is causing significant economic repercussions.

- Implications for their economies: The reduced export revenues are impacting the economies of these nations, leading to potential job losses and reduced investment.

- Adjustments in production levels: Global steel producers are adjusting their production levels in response to the decreased demand and lower prices.

Steel producers are now strategizing to diversify their markets and reduce their reliance on the Chinese market.

Implications for the Mining Industry

The iron ore mining industry is facing significant challenges, including job losses, reduced investment, and a reassessment of long-term viability.

- Stock market performance of major mining companies: The stock prices of major iron ore mining companies reflect the impact of lower prices and decreased demand.

- Potential mergers and acquisitions: Consolidation within the industry is likely as companies seek to gain efficiencies and reduce costs.

- Impact on employment in the mining sector: Job losses in the mining sector are a significant concern, requiring governments and companies to develop strategies for retraining and diversification.

The long-term sustainability of the iron ore mining industry hinges on adapting to this changing landscape, including diversification of markets and investments in sustainable practices.

Conclusion

The decline in China's steel production has undeniably triggered a significant fall in iron ore prices, reverberating throughout the global steel market and impacting the wider mining industry. Environmental regulations, weakening domestic demand, and government intervention within China are the primary drivers of this downturn. Global steel producers and iron ore mining companies are facing significant challenges, necessitating strategic adjustments to navigate this period of uncertainty. Staying informed about evolving iron ore prices and China's steel production is crucial for all stakeholders. Understanding the interconnectedness of these factors is vital for making informed decisions in this dynamic market. Continue to monitor the iron ore market and its impact on global steel production to effectively manage risk and capitalize on emerging opportunities.

Featured Posts

-

Report Uk Plans To Restrict Visa Applications For Certain Nationalities

May 09, 2025

Report Uk Plans To Restrict Visa Applications For Certain Nationalities

May 09, 2025 -

Broadcoms V Mware Deal At And Ts Concerns Over A Substantial Price Increase

May 09, 2025

Broadcoms V Mware Deal At And Ts Concerns Over A Substantial Price Increase

May 09, 2025 -

6 3 Loss In Vegas Red Wings Playoff Dream Falters

May 09, 2025

6 3 Loss In Vegas Red Wings Playoff Dream Falters

May 09, 2025 -

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025

Nhl Playoff Projections Following The 2025 Trade Deadline

May 09, 2025 -

The Elon Musk Fortune Tracing The Trajectory Of The Worlds Richest Man

May 09, 2025

The Elon Musk Fortune Tracing The Trajectory Of The Worlds Richest Man

May 09, 2025

Latest Posts

-

Debate Sobre Derechos Trans Arresto De Universitaria Por Usar Bano De Mujeres

May 10, 2025

Debate Sobre Derechos Trans Arresto De Universitaria Por Usar Bano De Mujeres

May 10, 2025 -

Brian Brobbey Physical Prowess Poses Europa League Threat

May 10, 2025

Brian Brobbey Physical Prowess Poses Europa League Threat

May 10, 2025 -

Trump Executive Orders Impact On Transgender Individuals

May 10, 2025

Trump Executive Orders Impact On Transgender Individuals

May 10, 2025 -

Transznemu No Letartoztatasa Floridaban A Noi Mosdo Hasznalata Jogi Vita Targyava Valt

May 10, 2025

Transznemu No Letartoztatasa Floridaban A Noi Mosdo Hasznalata Jogi Vita Targyava Valt

May 10, 2025 -

Trump Administration Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025

Trump Administration Order Leads To Ihsaa Ban On Transgender Girls In Sports

May 10, 2025