Is $10 Realistic? XRP Price Prediction Following Key Resistance Break

Table of Contents

Technical Analysis: Chart Patterns and Indicators Suggesting Further Growth

Analyzing XRP's price charts reveals compelling evidence suggesting further growth. The recent breakout from a key resistance level provides a strong bullish signal.

Breakdown of Key Resistance Levels

The recent breakthrough of the $0.50 resistance level is significant. This level had acted as a strong barrier for several months, repeatedly repelling upward price momentum. Breaking through this level suggests a shift in market sentiment and increased buying pressure.

- $0.50: This level marked a significant psychological barrier and previous high. Its breach indicates strong bullish momentum.

- $0.60 - $0.70: These levels represent the next significant resistance areas. Overcoming them would further solidify the bullish trend.

- Technical Indicators: The Relative Strength Index (RSI) shows a reading above 70, indicating overbought conditions, but this is often seen during strong upward trends. The Moving Average Convergence Divergence (MACD) is displaying a bullish crossover, reinforcing the positive momentum.

Identifying Potential Support Levels

While the outlook appears bullish, identifying potential support levels is crucial. These levels could act as buffers against significant price drops.

- $0.45 - $0.50: This range represents the recently broken resistance level, now acting as a strong support area. A retracement to this level would likely be viewed as a buying opportunity.

- $0.35 - $0.40: This range represents a more significant support area based on previous price action and Fibonacci retracement levels.

- Fibonacci Retracements: Applying Fibonacci retracement analysis to XRP's recent price movement identifies potential support levels at approximately 38.2% and 61.8% retracement levels.

Fundamental Factors Influencing XRP's Price

Technical analysis alone is insufficient. Fundamental factors play a crucial role in determining XRP's long-term price trajectory.

Ripple's Legal Battle and its Impact

The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price. A favorable outcome could trigger a significant price surge, while an unfavorable outcome could lead to a substantial drop.

- Positive Scenario: A favorable ruling could lead to increased regulatory clarity and widespread adoption, potentially driving XRP's price significantly higher.

- Negative Scenario: An unfavorable ruling could dampen investor confidence and result in a price decline. However, the market has shown resilience in the face of ongoing uncertainty.

- Expert Opinions: Several legal experts believe Ripple has a strong case, suggesting a positive outcome is possible, although nothing is certain.

Adoption and Partnerships

Growing adoption by financial institutions and strategic partnerships are vital for XRP's long-term success.

- Partnerships: Ripple has established numerous partnerships with major financial institutions globally, facilitating cross-border payments using XRP.

- Transaction Volume: XRP’s transaction volume has shown significant growth in recent times, indicating increasing usage.

Market Sentiment and Investor Confidence

Positive market sentiment and investor confidence are essential for driving price appreciation.

- Social Media Sentiment: Social media sentiment towards XRP has been generally positive following the recent price surge.

- Trading Volume: Increased trading volume indicates growing investor interest.

Realistic XRP Price Prediction: Can XRP Reach $10?

Considering the technical and fundamental analysis, a $10 XRP price is a significant target.

Considering the Bullish and Bearish Scenarios

- Bullish Scenario: A favorable outcome in the Ripple lawsuit, coupled with continued adoption and positive market sentiment, could potentially push XRP towards $10 within 2-3 years.

- Bearish Scenario: An unfavorable legal outcome or a broader cryptocurrency market downturn could significantly hinder XRP's price appreciation. A more conservative estimate under this scenario might see XRP reach $2-$3 in the same timeframe.

Factors that Could Affect the Prediction

Several factors could significantly affect the prediction:

- Regulatory Changes: Changes in cryptocurrency regulations globally could significantly impact XRP's price.

- Market Crashes: A broader cryptocurrency market crash could negatively affect XRP's price, irrespective of its underlying fundamentals.

- Competition: Competition from other cryptocurrencies could also influence XRP's price.

Conclusion

A $10 XRP price is an ambitious but not entirely impossible target. The recent price surge, coupled with positive technical indicators and a potentially favorable outcome in the Ripple lawsuit, provides a bullish outlook. However, the ongoing legal battle, regulatory uncertainty, and the inherent volatility of the cryptocurrency market present significant risks. While a swift rise to $10 is unlikely, sustained growth and positive developments could bring us closer to that target over the long term.

What do YOU think? Is a $10 XRP price realistic? Share your predictions and analysis in the comments below!

Featured Posts

-

Le Periple De 8000 Km De Trois Jeunes Du Bocage Ornais Un Recit Sans Stress

May 02, 2025

Le Periple De 8000 Km De Trois Jeunes Du Bocage Ornais Un Recit Sans Stress

May 02, 2025 -

Mental Health Services Gaps Needs And Potential Improvements

May 02, 2025

Mental Health Services Gaps Needs And Potential Improvements

May 02, 2025 -

The Passing Of Priscilla Pointer A Legacy In Acting

May 02, 2025

The Passing Of Priscilla Pointer A Legacy In Acting

May 02, 2025 -

Duurzaam Schoolgebouw Kampen Stroomnet Aansluiting Geweigerd Kort Geding Volgt

May 02, 2025

Duurzaam Schoolgebouw Kampen Stroomnet Aansluiting Geweigerd Kort Geding Volgt

May 02, 2025 -

Trumps Tariffs A Judges Power To Review Challenged

May 02, 2025

Trumps Tariffs A Judges Power To Review Challenged

May 02, 2025

Latest Posts

-

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

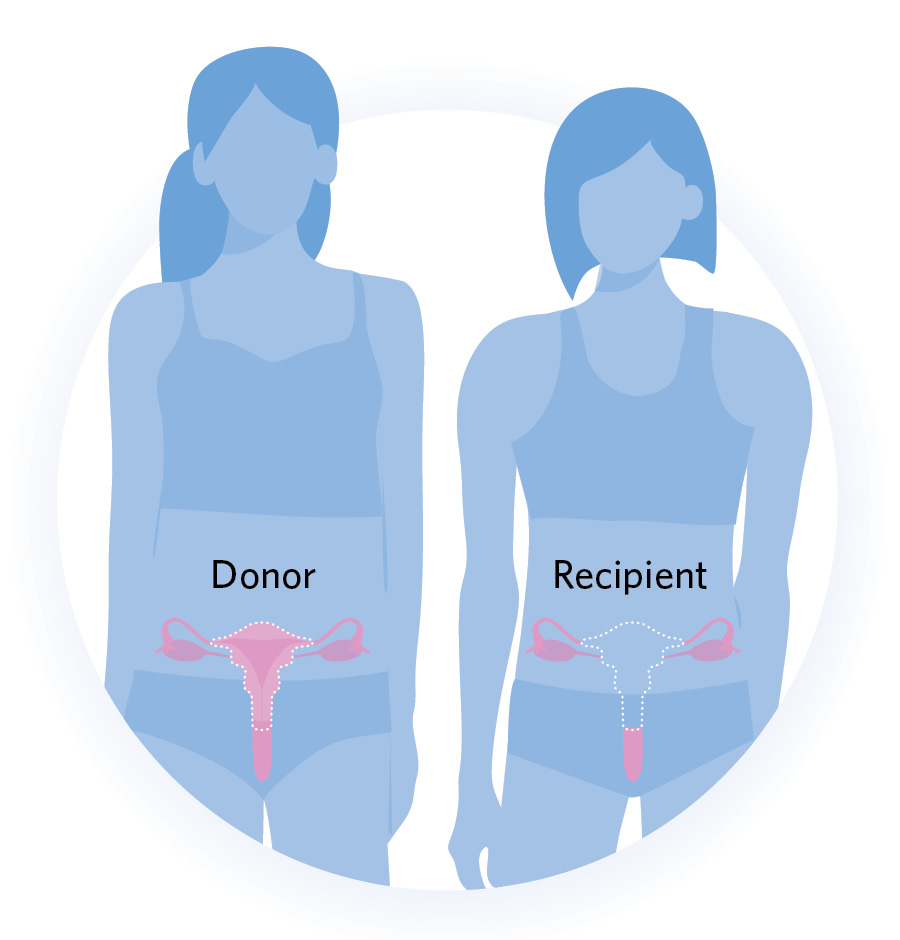

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025 -

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025 -

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025