Is A 400% Gain In 3 Months Sustainable For XRP? A Buyer's Guide

Table of Contents

Analyzing XRP's Recent Price Surge

Technical Analysis of XRP Charts

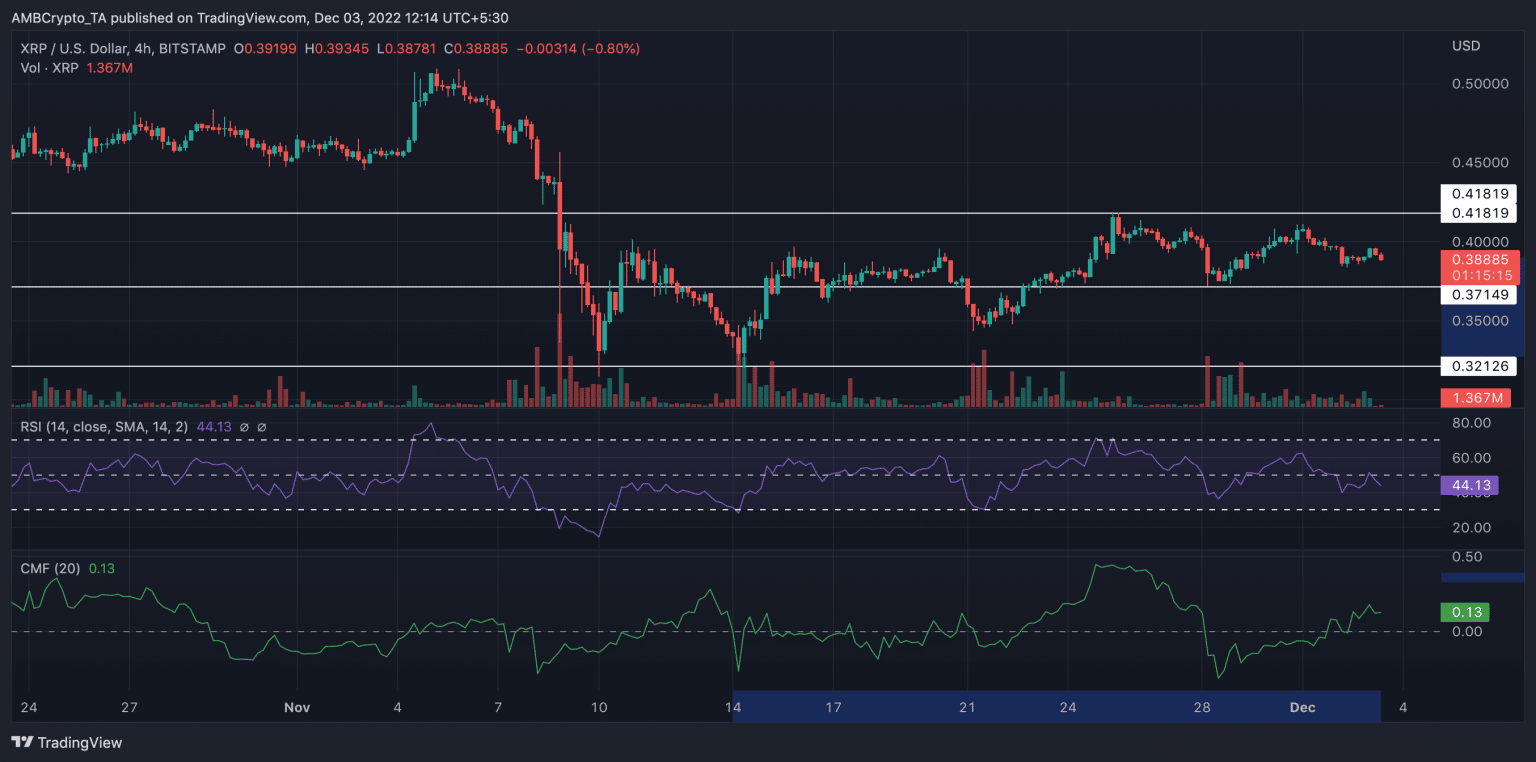

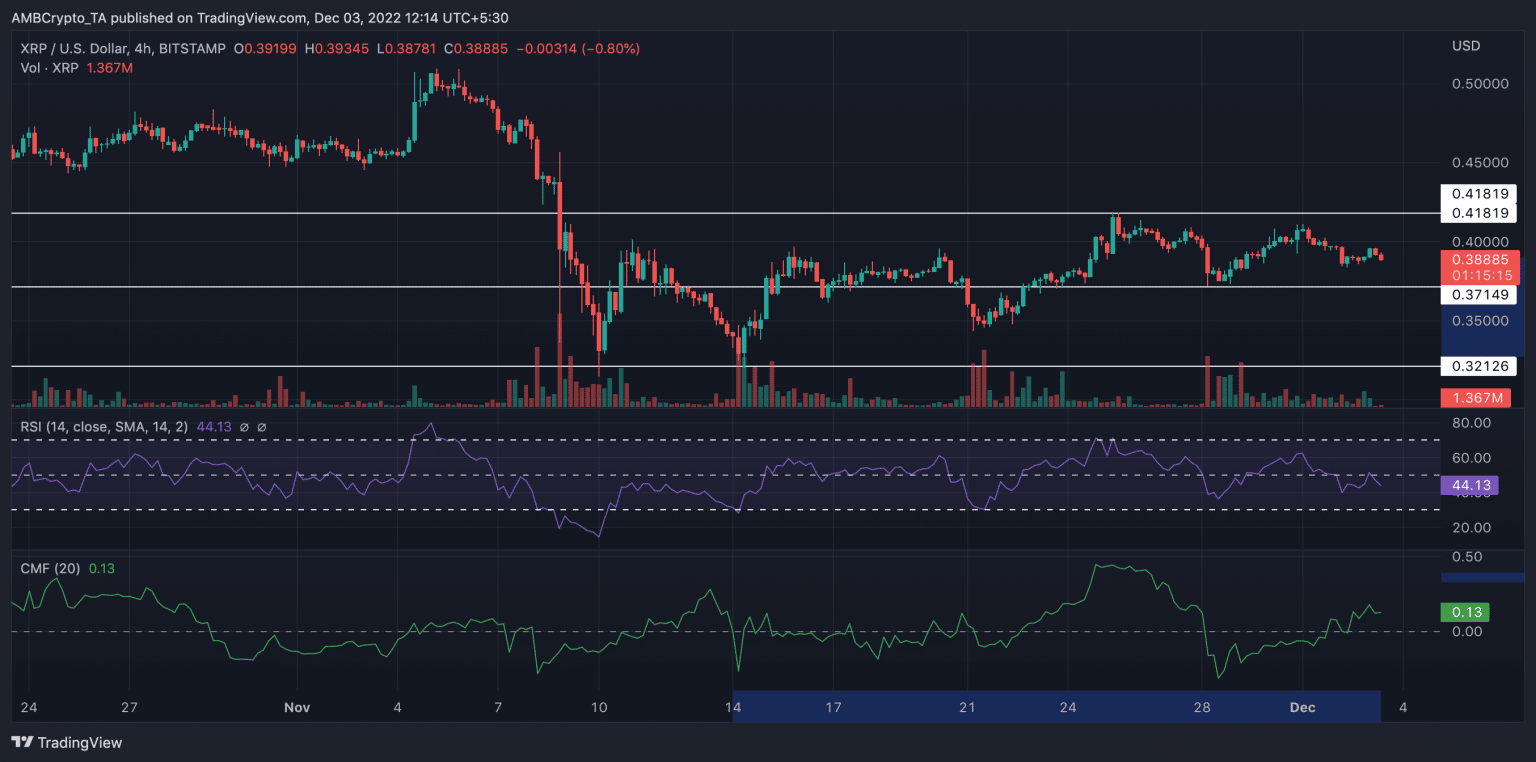

Analyzing XRP's price action using technical analysis tools is crucial for understanding its recent surge. Let's examine key indicators:

- Support and Resistance Levels: Identifying key support and resistance levels on the XRP chart helps predict potential price reversals. A break above strong resistance often indicates further upward momentum, while a fall below support suggests a potential decline. Studying historical data reveals crucial levels to watch.

- RSI (Relative Strength Index): The RSI indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 suggests XRP might be overbought and prone to a correction, while below 30 suggests it might be oversold and ripe for a rebound.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that identifies changes in the strength, direction, momentum, and duration of a trend. Bullish crossovers (MACD line crossing above the signal line) often signal buying opportunities, while bearish crossovers suggest potential selling pressure.

- Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and provide insights into the overall trend. A price crossing above the 200-day moving average is often considered a bullish signal.

- Trading Volume: High trading volume confirms price movements, suggesting strong conviction behind the price action. Conversely, low volume during a price surge might indicate manipulation or a weak trend. Analyzing volume alongside price charts gives a more comprehensive picture.

(Insert relevant charts and graphs showing RSI, MACD, moving averages, and trading volume for XRP)

Fundamental Factors Driving XRP's Price

Beyond technical analysis, fundamental factors significantly influence XRP's price:

- Ripple's Legal Battles: The ongoing legal battle between Ripple and the SEC significantly impacts investor sentiment. A positive outcome could lead to a surge in price, while a negative outcome could cause a significant drop. Staying updated on legal developments is crucial.

- Adoption Rates: The adoption of XRP by financial institutions for cross-border payments is a key fundamental driver. Increased usage by banks and payment processors strengthens its value proposition and potentially increases demand.

- Cryptocurrency Market Conditions: The overall cryptocurrency market's performance influences XRP's price. Positive market sentiment often benefits all cryptocurrencies, including XRP, while bearish markets can lead to widespread sell-offs.

- Ripple's Technological Advancements: Ripple's ongoing development and improvements to its technology, such as enhancements to the XRP Ledger, can positively affect XRP's long-term prospects. Analyzing their roadmap and technological advancements is vital.

Assessing the Sustainability of a 400% Gain

Historical Performance of XRP

Understanding XRP's historical performance provides context for its recent surge:

- Past Price Cycles: Analyzing past price cycles reveals patterns of volatility and potential cyclical behavior. Identifying similarities and differences between past bull and bear markets helps predict potential future movements.

- Bull and Bear Markets: Comparing the current price surge to previous bull and bear markets highlights the extent of the current rally and the potential for corrections. Historically, rapid price increases are often followed by periods of consolidation or retracement.

- Long-Term vs. Short-Term Strategies: Long-term investors are generally more tolerant of volatility, while short-term traders focus on quick profits and are more susceptible to market fluctuations. Understanding your investment horizon is crucial.

Risks and Potential Downsides

Investing in XRP carries inherent risks:

- Market Volatility: The cryptocurrency market is highly volatile, and XRP is no exception. Rapid price swings are common, and significant losses are possible.

- Regulatory Risks: Regulatory uncertainty remains a major risk. Changes in regulations globally can significantly impact the price of XRP and other cryptocurrencies.

- Market Corrections and Price Retracements: Rapid price increases are often followed by corrections or retracements. Being prepared for potential price drops is essential for risk management.

- Risk Management: Implementing effective risk management strategies, such as diversification and stop-loss orders, is crucial to protect your investment. Never invest more than you can afford to lose.

A Practical Buyer's Guide for XRP

Determining Your Investment Strategy

Before investing in XRP, define your investment strategy:

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of price. This strategy reduces the risk of investing a large sum at a market peak.

- Lump-Sum Investing: Lump-sum investing involves investing a significant amount of money at once. This strategy can be highly rewarding if the market continues to rise, but carries greater risk.

- Investment Goals and Risk Tolerance: Clearly defining your investment goals and risk tolerance is essential. Are you aiming for long-term growth or short-term gains? How much risk are you willing to accept?

- Portfolio Diversification: Diversifying your cryptocurrency portfolio across multiple assets reduces overall risk. Don't put all your eggs in one basket.

Safe and Secure XRP Storage

Securing your XRP is paramount:

- Hardware Wallets: Hardware wallets offer the highest level of security for storing cryptocurrencies. They are offline devices that keep your private keys secure from online threats.

- Software Wallets: Software wallets are applications installed on your computer or mobile device. While generally less secure than hardware wallets, they offer convenience.

- Choosing a Reputable Exchange: If you plan to actively trade XRP, choose a reputable and secure exchange. Research the exchange's security measures and history before depositing your funds.

- Risks of Exchange Storage: Storing XRP on exchanges exposes you to the risk of hacking and exchange insolvency. Consider transferring your XRP to a secure wallet after purchasing.

Staying Informed on XRP News and Updates

Staying informed is crucial for making informed decisions:

- Reliable News Sources: Follow reputable news sources and analytical websites that provide accurate and unbiased information about XRP and the cryptocurrency market.

- Independent Research: Always conduct your own thorough research and critically evaluate information from various sources before making any investment decisions.

- Avoiding Misinformation and Scams: Be wary of misinformation and scams that are prevalent in the cryptocurrency space. Verify information from multiple trusted sources.

Conclusion

While a 400% gain in three months for XRP is impressive, its sustainability is debatable. Thorough analysis of technical indicators, fundamental factors, and historical performance reveals both opportunities and significant risks. Before investing in XRP, it’s crucial to develop a well-informed investment strategy, understand the potential downsides, and secure your assets appropriately. This buyer's guide aims to equip you with the necessary knowledge to make prudent decisions regarding XRP investments. Remember to always conduct your own thorough research before investing in any cryptocurrency, including XRP, and only invest what you can afford to lose. Is a 400% gain in three months sustainable for XRP? The answer depends on your risk tolerance and your understanding of the market.

Featured Posts

-

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 07, 2025

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

May 07, 2025 -

Yankees 2000 Season Comeback Attempt Ends In 500 Record

May 07, 2025

Yankees 2000 Season Comeback Attempt Ends In 500 Record

May 07, 2025 -

Stephen Curry Injury Update Coach Kerr Provides Hopeful Timeline

May 07, 2025

Stephen Curry Injury Update Coach Kerr Provides Hopeful Timeline

May 07, 2025 -

Wednesday April 16 2025 Daily Lotto Winning Numbers

May 07, 2025

Wednesday April 16 2025 Daily Lotto Winning Numbers

May 07, 2025 -

Jenna Ortega Inspiracioja Ez A Szineszno

May 07, 2025

Jenna Ortega Inspiracioja Ez A Szineszno

May 07, 2025