Is A Bond Market Crisis Brewing? Understanding The Risks

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

H3: Inverse Relationship Explained: Bonds and interest rates share an inverse relationship. This means that when interest rates rise, the value of existing bonds falls. This is because newly issued bonds offer higher yields, making older bonds with lower coupon payments less attractive. This inverse relationship is a fundamental principle of bond valuation and a primary source of interest rate risk.

- Impact on bond yields: Rising interest rates directly impact bond yields. As rates increase, the yield on newly issued bonds increases, making existing bonds less appealing.

- The role of the Federal Reserve (or equivalent central bank): Central banks play a crucial role in influencing interest rates. Their decisions on monetary policy, such as raising or lowering the federal funds rate, directly affect bond yields and market prices.

- Examples of historical instances where rising rates triggered bond market turmoil: The early 1980s saw a significant rise in interest rates, leading to substantial losses in the bond market. Similar volatility was observed during the early 2000s. Understanding these historical precedents is essential for anticipating future trends.

Inflation's Squeeze on Bond Returns

H3: Inflation's Erosive Effect: High inflation significantly erodes the purchasing power of fixed-income investments like bonds. Even if a bond pays a seemingly attractive yield, high inflation can eat into those returns, leaving investors with less real value.

- Real vs. nominal yields: It's crucial to distinguish between nominal yield (the stated interest rate) and real yield (the nominal yield adjusted for inflation). High inflation can turn a positive nominal yield into a negative real yield.

- The impact of unexpected inflation spikes: Unexpected surges in inflation can cause significant losses for bondholders, as the purchasing power of their future payments is diminished.

- Strategies for mitigating inflation risk in a bond portfolio: Investors can mitigate inflation risk through diversification, including inflation-protected securities (TIPS) or investments in assets that tend to perform well during inflationary periods, such as commodities.

Sovereign Debt Concerns and Default Risks

H3: Assessing Government Debt Levels: Soaring government debt levels in many countries pose a significant risk to the stability of the bond market. If a government defaults on its debt obligations, it can trigger a domino effect, impacting the entire bond market.

- The impact of geopolitical instability: Geopolitical events and conflicts can significantly affect sovereign debt markets. Uncertainty and instability can lead to higher borrowing costs and increased default risk for governments.

- Credit rating downgrades and their implications: Credit rating agencies assess the creditworthiness of governments and their bonds. Downgrades can lead to higher borrowing costs and reduced investor confidence.

- Examples of countries with high debt burdens: Several countries are grappling with high levels of government debt, increasing the risk of sovereign debt crises. Careful monitoring of these countries' debt situations is crucial.

Liquidity Concerns and Market Volatility

H3: The Role of Liquidity: Reduced liquidity in the bond market can amplify negative events, leading to increased volatility and price swings. When liquidity is low, it becomes harder to buy or sell bonds quickly without significantly impacting their prices.

- The impact of forced selling: When investors need to sell bonds quickly due to unforeseen circumstances, forced selling can further depress prices in an already illiquid market.

- The role of bond market trading volumes: Low trading volumes are an indicator of low liquidity. Thinly traded bond markets are more susceptible to sharp price fluctuations.

- The challenges of pricing bonds in illiquid markets: Accurately pricing bonds becomes more difficult in illiquid markets, leading to greater uncertainty and risk for investors.

Conclusion

Several factors – rising interest rates, inflation, sovereign debt concerns, and liquidity issues – could contribute to a significant bond market crisis. The interplay of these elements creates a complex and risky environment for investors. Understanding the potential for a bond market crisis is essential for navigating the current economic climate. By staying informed about these risks and diversifying your investments, you can better protect your portfolio. Continue your research on bond market trends and strategies to manage bond market crisis risks.

Featured Posts

-

Ramalan Cuaca Akurat Hujan Di Denpasar Bali Besok

May 28, 2025

Ramalan Cuaca Akurat Hujan Di Denpasar Bali Besok

May 28, 2025 -

Hailee Steinfelds Gma Outfit A Closer Look

May 28, 2025

Hailee Steinfelds Gma Outfit A Closer Look

May 28, 2025 -

Test Et Avis Samsung Galaxy S25 512 Go 985 56 E Bon Plan

May 28, 2025

Test Et Avis Samsung Galaxy S25 512 Go 985 56 E Bon Plan

May 28, 2025 -

Indiana Pacers Mathurin Ejected For Hitting Clevelands Hunter

May 28, 2025

Indiana Pacers Mathurin Ejected For Hitting Clevelands Hunter

May 28, 2025 -

Tyrese Haliburton Girlfriend Reacts To Wild Game 1 Finish

May 28, 2025

Tyrese Haliburton Girlfriend Reacts To Wild Game 1 Finish

May 28, 2025

Latest Posts

-

Entwicklung Des Bodensee Wasserstands Ein Umfassender Ueberblick

May 31, 2025

Entwicklung Des Bodensee Wasserstands Ein Umfassender Ueberblick

May 31, 2025 -

Der Aktuelle Wasserstand Des Bodensees Fakten Daten Und Interpretation

May 31, 2025

Der Aktuelle Wasserstand Des Bodensees Fakten Daten Und Interpretation

May 31, 2025 -

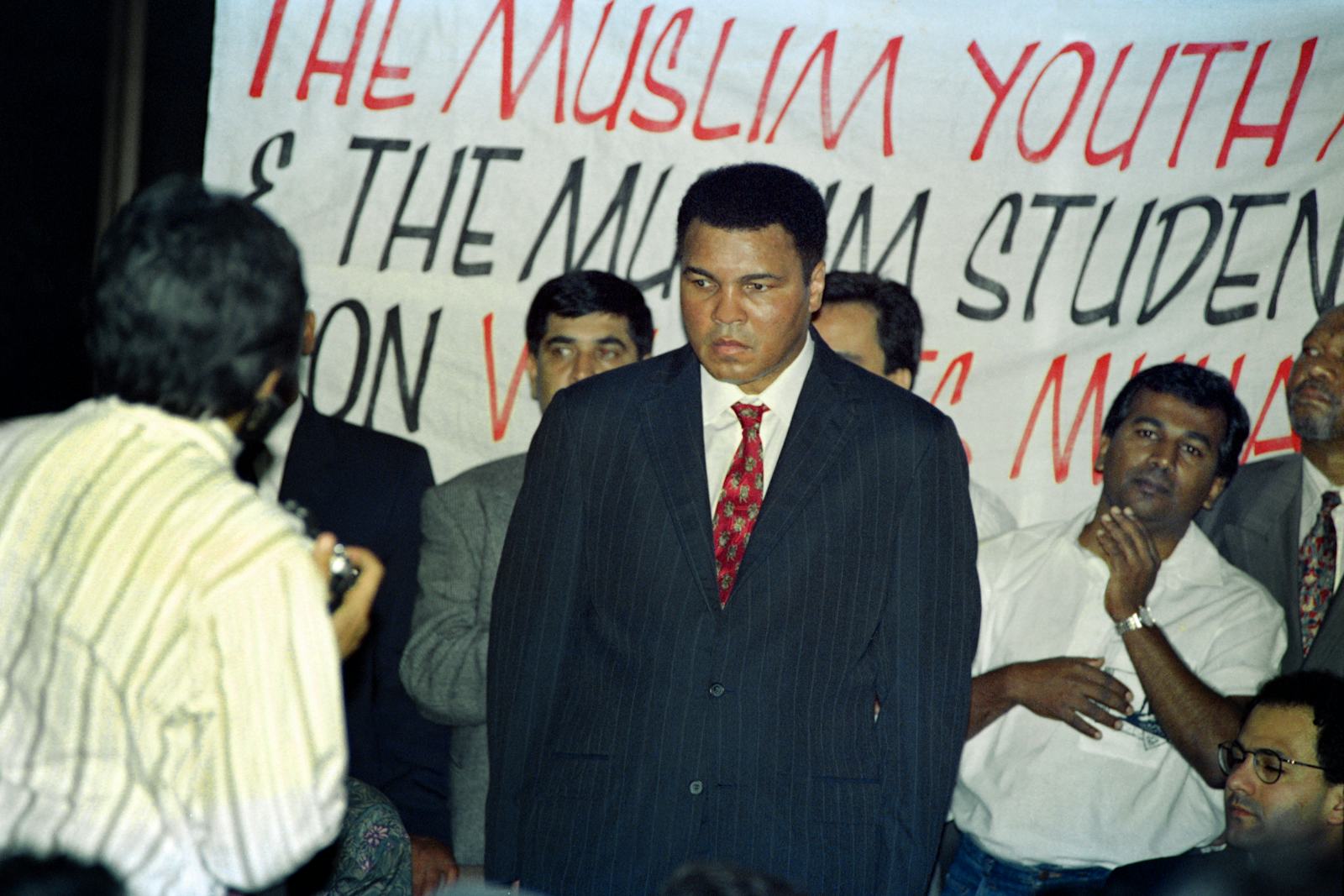

France Far Left Reaction To Muslim Mans Death Highlights Islamophobia Concerns

May 31, 2025

France Far Left Reaction To Muslim Mans Death Highlights Islamophobia Concerns

May 31, 2025 -

Killing Of Muslim Man In France Far Lefts Response And Islamophobia Debate

May 31, 2025

Killing Of Muslim Man In France Far Lefts Response And Islamophobia Debate

May 31, 2025 -

French Far Left Seizes On Murder To Fuel Anti Islamophobia Narrative

May 31, 2025

French Far Left Seizes On Murder To Fuel Anti Islamophobia Narrative

May 31, 2025