Is A Bond Market Crisis Brewing? Understanding The Risks For Investors

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The Inverse Relationship Between Interest Rates and Bond Prices

A fundamental principle of bond investing is the inverse relationship between interest rates and bond prices. This means that when interest rates rise, bond prices generally fall, and vice-versa. This occurs because newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive.

- Rising interest rates lead to lower bond prices. As rates increase, the present value of a bond's future cash flows decreases, thus reducing its market price.

- Existing bonds become less attractive compared to newly issued bonds with higher yields. Investors will shift their investment towards newer, higher-yielding bonds.

- This can trigger capital losses for bondholders. If bondholders need to sell their bonds before maturity, they may experience a loss due to the lower market price.

- Impact on different types of bonds (government bonds, corporate bonds, etc.). While all bonds are susceptible, the impact varies based on factors like credit quality, maturity, and call provisions. Longer-maturity bonds are generally more sensitive to interest rate changes.

The inverse relationship can be illustrated with a simple example: If a bond with a 3% coupon rate is trading when prevailing interest rates are also 3%, it will trade at par (face value). However, if interest rates subsequently jump to 5%, the bond's 3% coupon becomes less attractive, causing its price to fall to reflect the lower yield relative to new bonds. The bond's duration, a measure of its price sensitivity to interest rate changes, is a crucial factor in determining this price movement. Longer duration bonds exhibit greater price volatility.

Inflation's Erosive Effect on Bond Yields

Real vs. Nominal Yields

Understanding the difference between real and nominal yields is crucial during inflationary periods. Nominal yield is the stated interest rate on a bond. Real yield, however, accounts for the impact of inflation on the bond's return. It represents the actual purchasing power of the bond's yield.

- High inflation erodes the purchasing power of bond yields. If inflation rises faster than the bond's nominal yield, the real return will be negative, meaning the investor is losing purchasing power.

- Investors demand higher yields to compensate for inflation. To protect their purchasing power, investors demand higher nominal yields to offset the anticipated inflation.

- This can lead to increased bond yields, but also higher borrowing costs for governments and corporations. The increased demand for higher yields makes borrowing more expensive.

- Impact on investor returns, particularly those holding long-term bonds. Long-term bonds are significantly more vulnerable to inflation's erosive effect.

Unexpected inflation significantly impacts bond returns. If inflation is higher than anticipated, the real return will be lower than expected, potentially leading to substantial losses for bondholders, especially those holding long-term bonds. Inflation-indexed bonds, or TIPS (Treasury Inflation-Protected Securities), offer a measure of protection against inflation as their principal adjusts with inflation, thereby maintaining the real value of the investment.

Geopolitical Risks and Their Influence on Bond Markets

Global Uncertainty and Flight to Safety

Geopolitical events introduce significant uncertainty into financial markets, frequently triggering a "flight to safety."

- Wars, political instability, and economic sanctions can significantly impact bond markets. These events create uncertainty, leading to increased volatility.

- Investors may seek safe-haven assets like government bonds of stable economies. During times of uncertainty, investors often favor the perceived safety of government bonds issued by countries with strong economies and political stability (e.g., US Treasury bonds).

- This can lead to fluctuations in bond yields and prices across different countries. Demand for safe-haven assets can drive down yields on those bonds and increase yields on bonds from riskier countries.

- Impact on emerging market bonds. Emerging market bonds are particularly vulnerable to geopolitical risks due to their higher inherent risk profiles.

Recent geopolitical events, such as the war in Ukraine and rising global tensions, have demonstrably impacted bond markets. These events fueled uncertainty, leading to increased demand for safe-haven assets and causing significant fluctuations in bond yields and prices across various countries. Emerging market bonds, often perceived as riskier, experienced substantial outflows as investors sought the relative safety of developed market bonds.

Strategies for Mitigating Bond Market Risks

Diversification and Portfolio Management

Diversification is crucial for mitigating bond market risks. A well-diversified portfolio can help to reduce the impact of adverse events on overall portfolio performance.

- Diversify across different bond types (government, corporate, municipal). This reduces the impact of sector-specific risks.

- Consider bonds with different maturities to manage interest rate risk. A mix of short, medium, and long-term bonds can help reduce the impact of interest rate changes.

- Invest in inflation-protected securities. TIPS provide a hedge against inflation, preserving purchasing power.

- Regularly rebalance your portfolio. Rebalancing helps to maintain the desired asset allocation and manage risk over time.

Effective portfolio management involves assessing your risk tolerance and establishing a bond portfolio that aligns with your investment goals. Consider consulting with a financial advisor to create a diversified bond portfolio tailored to your specific needs and risk profile. Carefully evaluating your individual circumstances and risk appetite is critical in managing potential losses within a dynamic bond market environment.

Conclusion

The potential for a bond market crisis is a genuine concern for investors. The combined pressure of rising interest rates, persistent inflation, and escalating geopolitical risks creates a volatile and complex investment environment. Understanding the intricate interplay of these factors and implementing effective risk mitigation strategies, such as diversification and diligent portfolio management, is critical for navigating these challenging times. By remaining informed about potential risks and adapting your investment strategy accordingly, you can significantly enhance your portfolio's resilience against the potential impact of a bond market crisis. Don't ignore the warning signs; actively monitor the bond market and proactively adjust your investments to mitigate the potential risks associated with a brewing bond market crisis.

Featured Posts

-

Let Him Cook Kaka Empire And Bio Foods Fresh Culinary Series

May 29, 2025

Let Him Cook Kaka Empire And Bio Foods Fresh Culinary Series

May 29, 2025 -

Tracing Liverpools Premier League Success Last Time At The Summit

May 29, 2025

Tracing Liverpools Premier League Success Last Time At The Summit

May 29, 2025 -

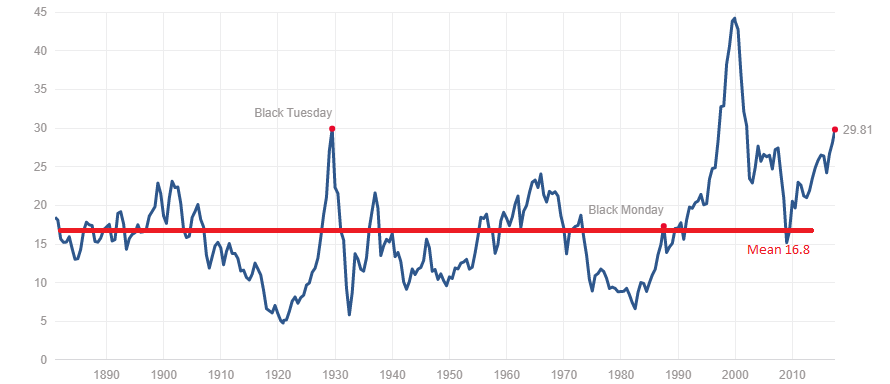

Investor Concerns About High Stock Market Valuations Bof As Analysis

May 29, 2025

Investor Concerns About High Stock Market Valuations Bof As Analysis

May 29, 2025 -

Reactie Van Der Gijp Op Potentiele Farioli Opvolger

May 29, 2025

Reactie Van Der Gijp Op Potentiele Farioli Opvolger

May 29, 2025 -

Sander Westerveld Questions Mamardashvilis Season

May 29, 2025

Sander Westerveld Questions Mamardashvilis Season

May 29, 2025