Is A Housing Market Correction Imminent In Canada? Posthaste Analysis

Table of Contents

High Interest Rates and Their Impact

Rising interest rates are arguably the most significant factor impacting the Canadian housing market. The Bank of Canada's interest rate hikes have directly increased borrowing costs for mortgages, significantly impacting affordability and subsequently dampening housing demand. This is a key element in the Canadian housing bubble discussion.

- Increased Mortgage Payments: Higher interest rates translate to substantially increased monthly mortgage payments, making homeownership less accessible for many potential buyers. This reduced affordability is a critical factor driving down demand.

- Reduced Purchasing Power: With higher borrowing costs, potential buyers' purchasing power diminishes, leading to a decrease in the number of offers on properties and potentially lower prices. This impacts the Canadian real estate market across all segments.

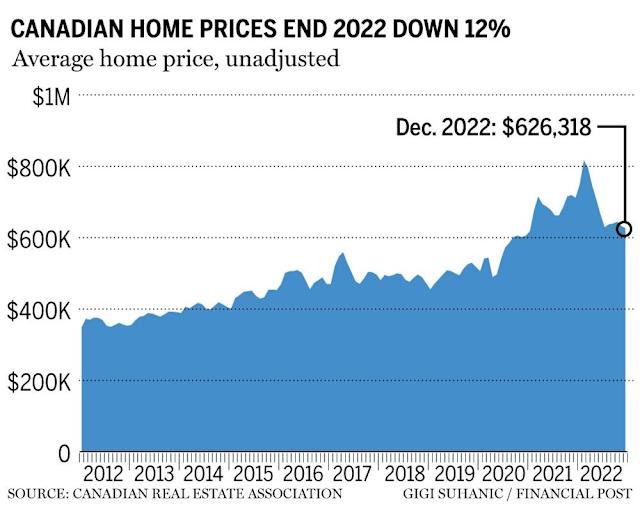

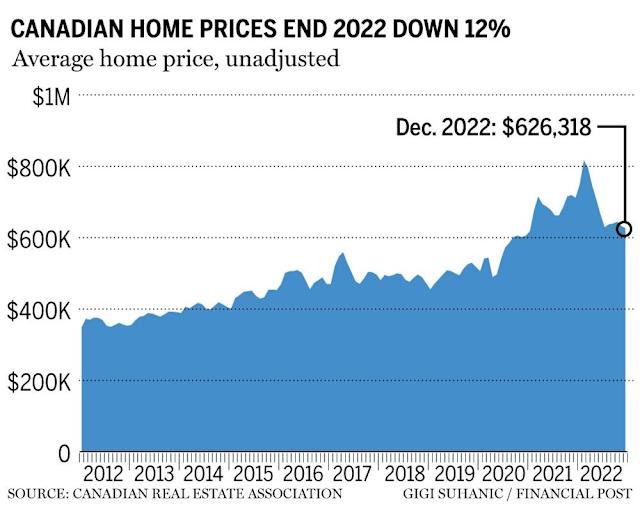

- Slowdown in Sales and Price Growth: The combination of reduced affordability and decreased demand has already started to slow down sales activity and price growth in many parts of the country. This slowdown is visible across the spectrum of Canadian housing, from condos to single-family homes.

- Impact on Different Housing Segments: The impact of rising interest rates varies depending on the housing segment. For example, the condo market, often more sensitive to interest rate changes, may experience a more pronounced slowdown compared to the single-family home market.

Overvaluation and Market Sentiment

Another crucial aspect of assessing the potential for a Canadian housing market correction is analyzing whether the market is overvalued. Indicators such as price-to-rent ratios and price-to-income ratios can reveal potential vulnerabilities. Coupled with this is the evolving market sentiment among buyers, sellers, and investors.

- Comparison with Historical Data: Comparing current housing prices to historical averages and trends reveals significant price appreciation in recent years, raising questions about sustainability. This is a key indicator often cited in discussions about a potential Canadian housing bubble.

- Price-to-Rent Ratios: Analyzing price-to-rent ratios in major Canadian cities shows that some areas are significantly more expensive relative to rental costs than historically observed, suggesting a potential overvaluation.

- Decreased Investor Activity: A decrease in investor activity, often fuelled by tighter lending conditions and reduced returns, can also contribute to a market correction by reducing demand.

- Shifting Consumer Confidence: Deteriorating consumer confidence in the housing market, driven by rising interest rates and economic uncertainty, can further accelerate a slowdown in sales and price growth.

Supply and Demand Dynamics

The interplay between housing supply and demand is another critical factor determining the stability of the Canadian housing market. Several elements influence both sides of this equation.

- New Housing Starts: The rate of new housing construction across various regions of Canada plays a significant role in meeting the growing demand. A shortage of new housing contributes to upward pressure on prices.

- Population Growth and Immigration: Population growth, driven by both natural increase and immigration, significantly fuels the demand for housing. Canada's strong immigration levels in recent years have heightened this demand.

- Government Policies: Government policies aimed at increasing housing supply, such as zoning reforms and incentives for new construction, are crucial in addressing the imbalance between supply and demand.

- Impact of Immigration: The influx of immigrants into Canada contributes substantially to housing demand, adding pressure to already tight markets in major cities.

Regional Variations in the Canadian Housing Market

The Canadian housing market is not homogenous. Regional variations in economic conditions, demographics, and housing supply significantly influence market dynamics and the potential for a correction.

- Major City Comparisons: Comparing market trends across major Canadian cities like Toronto, Vancouver, Calgary, and Montreal reveals diverse patterns of price growth, sales activity, and affordability.

- Regional Economic Factors: Regional economic factors, such as job growth and industry diversification, play a crucial role in shaping local housing markets. Stronger regional economies often support higher housing prices.

- Vulnerability to Correction: Certain regions might be more vulnerable to a housing market correction than others based on factors like overvaluation, supply shortages, and economic sensitivity.

Conclusion

Predicting the future of the Canadian housing market with complete certainty is impossible. However, understanding the complex interplay of interest rates, market sentiment, supply and demand dynamics, and regional variations is crucial for informed decision-making. The potential for a Canadian housing market correction is a legitimate concern, given the factors discussed. While a crash isn't guaranteed, a significant adjustment in prices is possible.

While predicting the future of the Canadian housing market is challenging, staying informed about current market trends and consulting with a real estate professional is essential. Continue your research into the Canadian housing market to make well-informed decisions for your financial future. Understanding the potential for a housing market correction is key to navigating the Canadian housing market effectively.

Featured Posts

-

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025

Understanding Core Weaves Crwv Significant Stock Increase Last Week

May 22, 2025 -

Zebra Mussel Problem Casper Resident Uncovers Thousands On New Lift

May 22, 2025

Zebra Mussel Problem Casper Resident Uncovers Thousands On New Lift

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Summer Travel Chaos Airlines Prepare For Increased Passenger Numbers And Potential Delays

May 22, 2025

Summer Travel Chaos Airlines Prepare For Increased Passenger Numbers And Potential Delays

May 22, 2025 -

Airlines Brace For A Difficult Summer Passenger Disruptions Predicted

May 22, 2025

Airlines Brace For A Difficult Summer Passenger Disruptions Predicted

May 22, 2025

Latest Posts

-

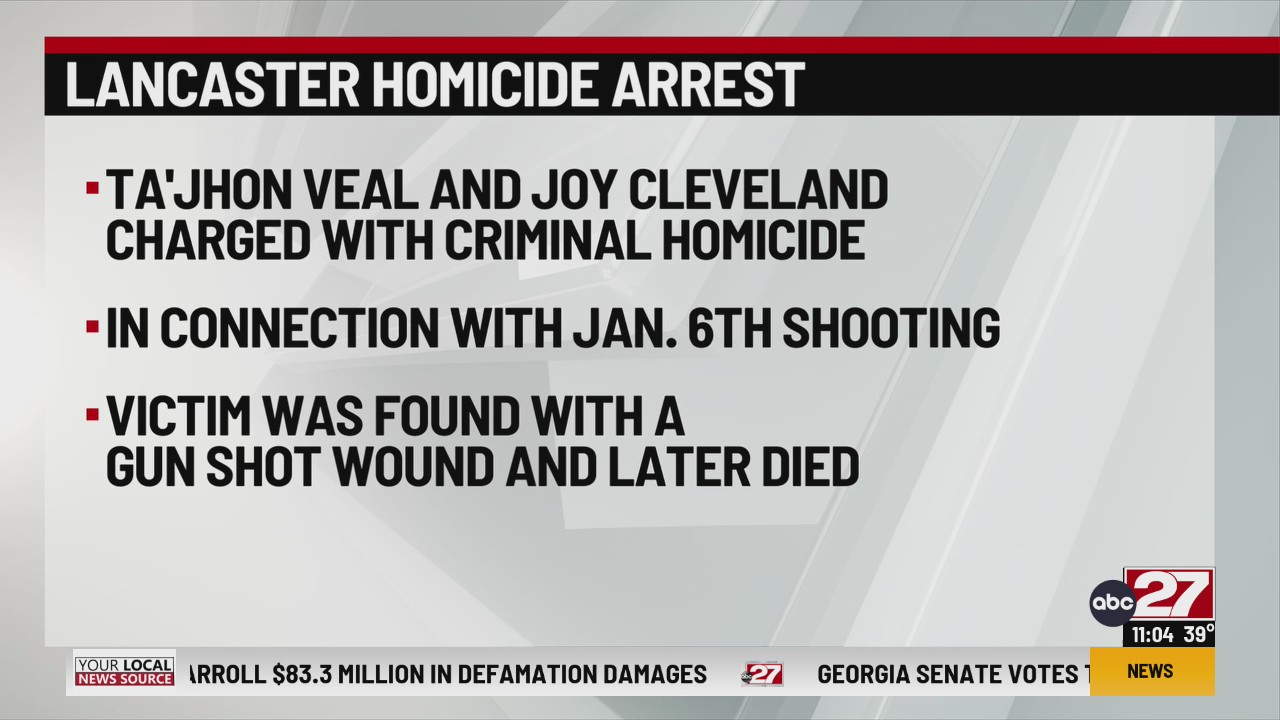

Lancaster County Pa Shooting Police Probe Ongoing

May 22, 2025

Lancaster County Pa Shooting Police Probe Ongoing

May 22, 2025 -

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025

Severe Weather Alert Thunderstorm Watch Issued For South Central Pa

May 22, 2025 -

Police Investigate Lancaster County Shooting Updates And Details

May 22, 2025

Police Investigate Lancaster County Shooting Updates And Details

May 22, 2025 -

Lancaster County Shooting Police Investigation Underway

May 22, 2025

Lancaster County Shooting Police Investigation Underway

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025