Is Apple Stock A Buy Ahead Of Q2 Earnings?

Table of Contents

Apple (AAPL) is gearing up to report its Q2 earnings, leaving investors wondering: is now the time to buy? This article analyzes key factors impacting Apple's stock price to help you determine if Apple stock is a worthwhile investment before the upcoming announcement. We'll examine recent market performance, future product launches, and the overall economic landscape to provide a comprehensive perspective. Investing in Apple stock requires careful consideration, and this deep dive aims to equip you with the information needed to make an informed decision.

Apple's Recent Performance and Market Trends

Q1 2024 Earnings Analysis

Apple's Q1 2024 earnings report revealed a mixed bag. While the company exceeded expectations in some areas, others fell short. Let's delve into the specifics:

- Revenue: [Insert Actual Q1 Revenue Figure]. This represents a [Percentage Change] compared to the same quarter last year.

- Earnings Per Share (EPS): [Insert Actual Q1 EPS Figure]. This is [Percentage Change] compared to Q1 of the previous year.

- Guidance: Apple provided guidance for Q2, indicating expectations of [Summarize the guidance provided, including any notable changes or surprises].

- Product Performance: iPhone sales remained strong, contributing [Percentage] to overall revenue. Mac sales experienced a [Percentage Change], while Services revenue showed continued growth at [Percentage Change].

Analyst reactions were varied, with some praising Apple's resilience in a challenging market, while others expressed concerns about [mention specific concerns raised by analysts].

Current Market Sentiment Towards Tech Stocks

The current market sentiment toward tech stocks is cautious. Macroeconomic factors are playing a significant role:

- Inflation: Persistent inflation continues to impact consumer spending and corporate profitability.

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially slowing down growth.

- Competitor Performance: Competitors in the tech space are also facing headwinds, impacting overall investor confidence in the sector.

- Investor Confidence: General investor confidence is wavering due to the uncertain economic outlook.

This cautious sentiment affects Apple, as it's a major player in the tech sector, making a thorough analysis of the current climate crucial before buying Apple stock.

Apple's Stock Price Volatility

Apple's stock price has exhibited significant volatility recently.

- Chart Analysis: [Briefly describe recent price trends – e.g., significant upward or downward movements, consolidation periods].

- Major Price Swings: Major price swings can be attributed to factors such as earnings reports, news about future products, and broader market fluctuations.

- Explanations for Volatility: The volatility reflects the uncertainty surrounding the company's future performance in a complex economic environment.

Analyzing Apple's Future Prospects

Upcoming Product Launches and Their Potential Impact

Anticipated product launches, such as the next generation of iPhones and the much-anticipated AR/VR headset, could significantly impact Apple's stock price.

- Potential Demand: The new iPhones are expected to generate high demand, particularly in emerging markets. The AR/VR headset represents a foray into a new market with high growth potential.

- Revenue Projections: Analysts predict significant revenue boosts from these new products, potentially driving stock prices higher.

- Market Disruption: Successful product launches could further solidify Apple's position in the market and disrupt competitors.

Growth in Services Revenue

Apple's services revenue stream is a crucial element of its long-term financial health.

- Apple Music, iCloud, App Store: These services are showing consistent growth, contributing significantly to overall revenue and profitability.

- Recurring Revenue Model: The subscription-based nature of these services provides a stable and predictable revenue stream.

- Long-Term Implications: The continued expansion of Apple's services business positions the company for sustainable growth in the years to come.

Supply Chain and Manufacturing Considerations

Supply chain disruptions and manufacturing challenges remain a potential risk for Apple.

- Geopolitical Factors: Geopolitical tensions and trade disputes could impact the availability of key components.

- Material Costs: Rising material costs could squeeze profit margins.

- Production Efficiency: Maintaining efficient production processes is crucial to meet consumer demand and manage costs.

Risks and Considerations Before Investing in Apple Stock

Competition in the Tech Market

Apple faces intense competition from several tech giants.

- Samsung: A major competitor in smartphones and other consumer electronics.

- Google: A dominant player in search, mobile operating systems, and cloud services.

- Other Tech Giants: Companies like Amazon, Microsoft, and Meta also pose challenges in various market segments.

Economic Uncertainty and its Impact on Consumer Spending

Economic uncertainty and potential downturns could negatively impact consumer spending on Apple products.

- Recessionary Risks: A recession could lead to reduced consumer demand for discretionary items like Apple products.

- Impact on Revenue: Decreased consumer spending could significantly affect Apple's revenue and profitability.

Geopolitical Risks

Geopolitical risks could disrupt Apple's business operations and financial performance.

- International Trade Tensions: Trade disputes and tariffs could increase costs and limit market access.

- Regulatory Hurdles: Increasing regulatory scrutiny in various markets could impact Apple's operations.

- Political Instability: Political instability in key markets could create uncertainty and disrupt supply chains.

Conclusion

Analyzing Apple's performance, future prospects, and potential risks, we see a mixed outlook. While strong services revenue and anticipated new product launches offer potential upside, macroeconomic headwinds, competition, and geopolitical uncertainty introduce considerable risk. Whether Apple stock is a buy ahead of Q2 earnings is a complex question with no simple answer.

Call to Action: Based on this analysis, the decision of whether to buy Apple stock before Q2 earnings rests on your individual risk tolerance and investment strategy. Thorough research, considering the information presented here, is crucial before making any investment decisions. Continue your due diligence by researching Apple stock (AAPL) further and consider all factors before investing.

Featured Posts

-

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025 -

Deciphering The Hells Angels Facts And Misconceptions

May 25, 2025

Deciphering The Hells Angels Facts And Misconceptions

May 25, 2025 -

Pride And Prejudice Returns Donald Sutherlands Performance Re Examined

May 25, 2025

Pride And Prejudice Returns Donald Sutherlands Performance Re Examined

May 25, 2025 -

Hells Angels Motorcycle Club Memorial For Craig Mc Ilquham This Sunday

May 25, 2025

Hells Angels Motorcycle Club Memorial For Craig Mc Ilquham This Sunday

May 25, 2025 -

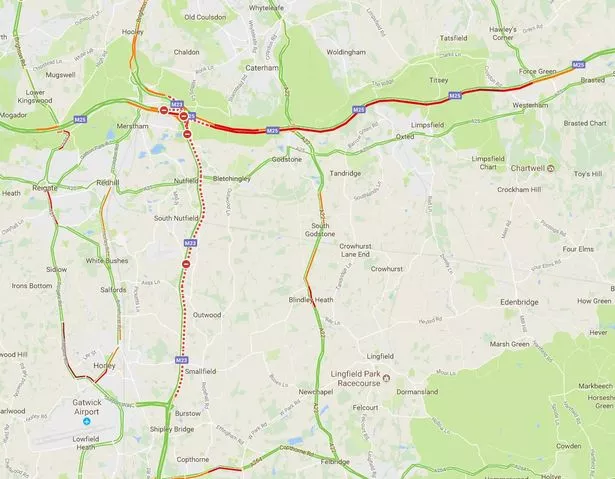

M56 Traffic Updates Motorway Closure Due To Serious Crash

May 25, 2025

M56 Traffic Updates Motorway Closure Due To Serious Crash

May 25, 2025