Is Betting On Wildfires A Sign Of The Times? The Los Angeles Case

Table of Contents

The Mechanics of Wildfire Betting and its Accessibility

While direct betting on the precise location or intensity of wildfires might not yet be a widespread phenomenon, forms of related financial speculation exist. This could involve investing in companies that profit from disaster relief, such as construction or insurance firms, or even speculating on the price fluctuations of stocks related to firefighting equipment or timber. The accessibility of such betting is largely determined by the accessibility of financial markets themselves. Online trading platforms provide easy access, particularly for those with some level of financial literacy.

- Examples of Methods: Investing in disaster relief stocks, options trading on related companies, or even utilizing derivatives markets (though extremely complex and risky).

- Legal Aspects: The legality depends heavily on the specific instrument used and jurisdiction. While investing in publicly traded companies is generally legal, manipulative or fraudulent trading practices around disaster events are strictly prohibited.

- Accessibility: Online platforms lower the barrier to entry, but it remains largely accessible to those with the financial means and understanding of these complex financial instruments.

The Ethical and Social Implications of Wildfire Betting in Los Angeles

The ethical implications of profiting from natural disasters are profound. Turning a wildfire, with its inherent human suffering and environmental devastation, into a financial opportunity raises serious moral questions. Does such behavior trivialize the pain and loss experienced by victims?

- Increased Risk-Taking: The potential for significant financial gain might incentivize irresponsible behaviors, potentially even influencing land management practices or emergency response decisions.

- Impact on Insurance and Response: The manipulation of insurance markets through wildfire betting could destabilize the system, potentially making it harder for genuine victims to receive necessary compensation.

- Media Influence: Sensationalized media coverage of wildfires, while aiming to raise awareness, could unintentionally contribute to the perception of wildfire events as predictable and thus bettable, further normalizing this morally questionable activity.

The Los Angeles Context: Vulnerability and Wildfire Risk

Los Angeles's unique geography, characterized by chaparral vegetation and a Mediterranean climate prone to dry periods, coupled with the urban sprawl encroaching on wildlands, makes it exceptionally susceptible to wildfires. The socioeconomic impact is significant, disproportionately affecting low-income communities often situated in high-risk areas.

- Statistics: Los Angeles County consistently ranks high in wildfire incidents and associated property damage in California.

- Recent Wildfires: The Woolsey Fire (2018), the Getty Fire (2019), and the recent Bobcat Fire exemplify the region's recurring struggle with devastating wildfires.

- Socioeconomic Disparities: Vulnerable populations often lack the resources to adequately prepare for or recover from wildfires, making them disproportionately susceptible to the consequences of these events.

Alternative Perspectives and Responsible Approaches

While the primary focus should be on condemning the exploitation inherent in "betting on wildfires," it's worth considering whether financial instruments could play a role in disaster preparedness and mitigation. For instance, insurance markets and catastrophe bonds can help manage risk, although their efficacy depends on transparency and responsible management.

- Community Resilience: Investing in community-based wildfire prevention and response strategies is crucial.

- Responsible Media: Accurate and responsible reporting can raise public awareness without inadvertently contributing to the perception of wildfires as predictable events for speculation.

- Government Regulation: Stronger regulation can help to prevent manipulative practices in financial markets related to natural disasters.

Conclusion: The Future of Wildfire Betting and Responsible Action

The emergence of "betting on wildfires," even in its indirect forms, highlights a disturbing trend that trivializes human suffering and potentially exacerbates the risks associated with these devastating events. The ethical concerns surrounding profiting from disaster are undeniable, especially in a vulnerable region like Los Angeles. We must actively discourage this behavior and advocate for responsible actions: investing in community resilience, promoting responsible media coverage, and urging for effective government regulation. Let’s focus our energy on mitigating wildfire risk, not on "betting on wildfires," and ensure a safer future for Los Angeles and beyond.

Featured Posts

-

April 7 2025 Space X Launches 27 Starlink Satellites From Vandenberg

May 29, 2025

April 7 2025 Space X Launches 27 Starlink Satellites From Vandenberg

May 29, 2025 -

Human Trafficking Joshlin Smiths Sentencing Hearing Scheduled

May 29, 2025

Human Trafficking Joshlin Smiths Sentencing Hearing Scheduled

May 29, 2025 -

Stranger Things 5 2025 Premiere Date Cast Updates And Final Season Hints

May 29, 2025

Stranger Things 5 2025 Premiere Date Cast Updates And Final Season Hints

May 29, 2025 -

Tyler Perrys Uninterrupted Success On Bet Eight Shows Six Years No Cancellations

May 29, 2025

Tyler Perrys Uninterrupted Success On Bet Eight Shows Six Years No Cancellations

May 29, 2025 -

Nike Sneakers May 2025 Release Dates And Where To Buy

May 29, 2025

Nike Sneakers May 2025 Release Dates And Where To Buy

May 29, 2025

Latest Posts

-

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025

Federal Charges Millions Made From Executive Office365 Account Hacks

May 31, 2025 -

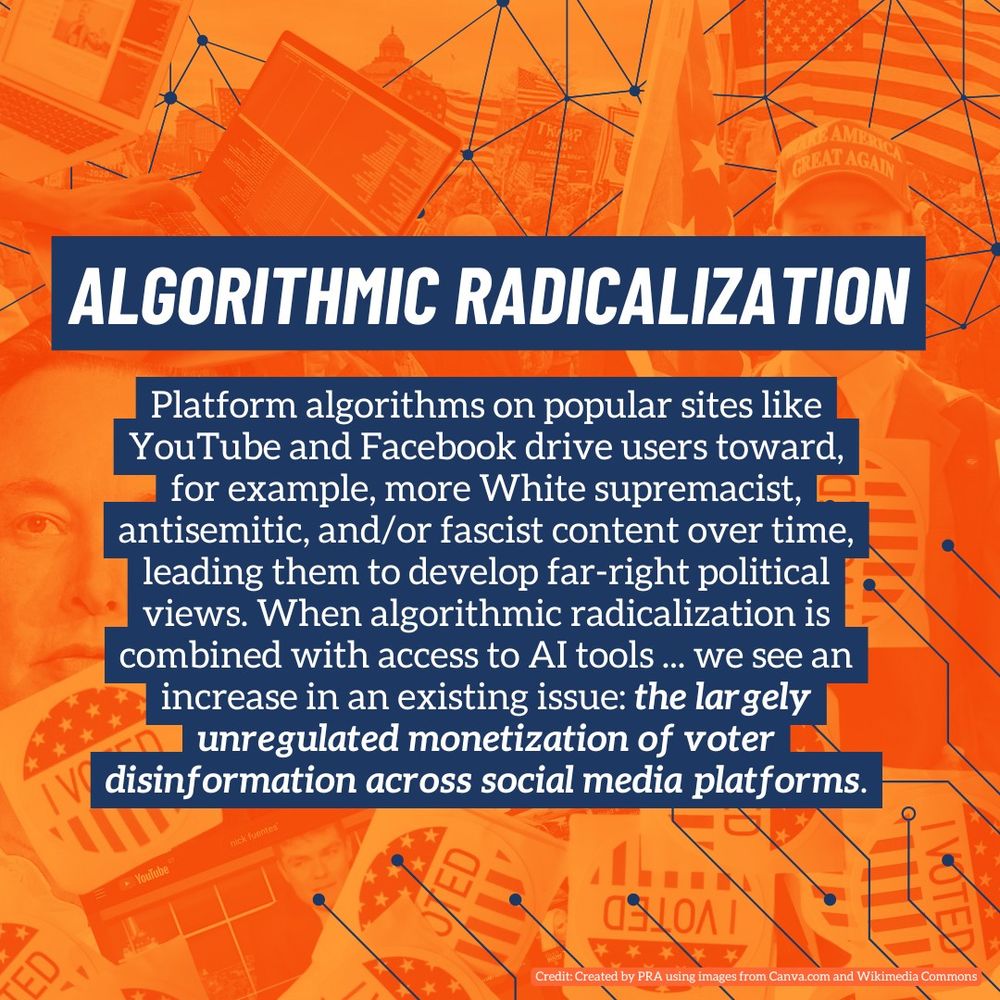

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025

Tech Companies And Mass Shootings The Impact Of Algorithmic Radicalization

May 31, 2025 -

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025

Office365 Hacker Accused Of Millions In Exec Inbox Breaches

May 31, 2025 -

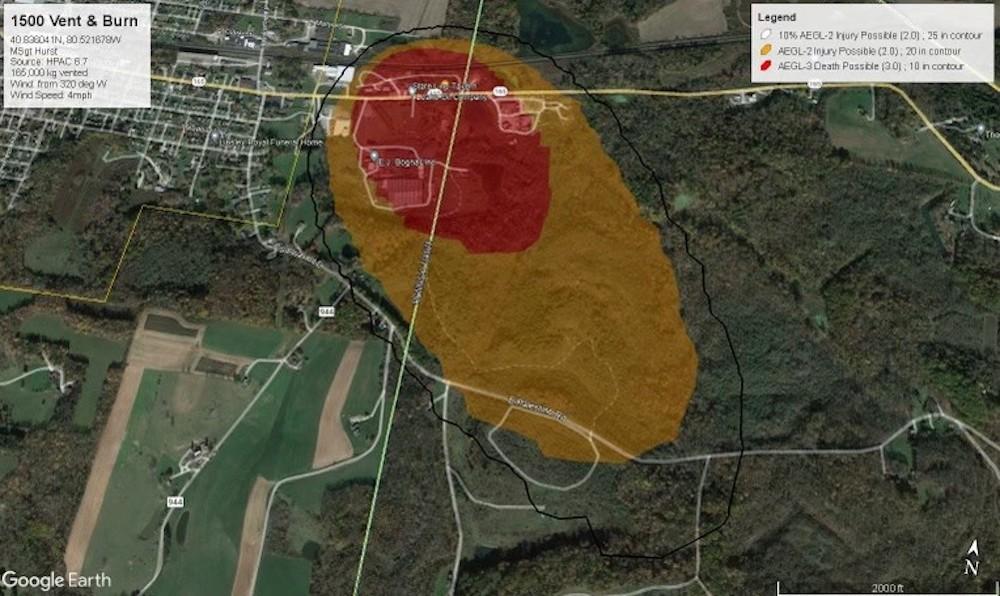

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

May 31, 2025

Investigation Into Lingering Toxic Chemicals In Buildings Following Ohio Train Derailment

May 31, 2025 -

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 31, 2025

Ohio Train Derailment The Prolonged Impact Of Toxic Chemical Contamination On Buildings

May 31, 2025