Is Elon Musk's Anger Good For Tesla Stock?

Table of Contents

The Positive Arguments: Does Anger Fuel Innovation and Brand Recognition?

Some argue that Elon Musk's anger, or at least his aggressive and disruptive style, is intrinsically linked to Tesla's success. This perspective paints a picture of a "disruptive genius" whose unconventional methods drive innovation and brand recognition.

The "Disruptive Genius" Narrative:

Musk's aggressive style is often portrayed as a crucial element in Tesla's groundbreaking achievements. He challenges established automotive norms, pushing the boundaries of electric vehicle technology and renewable energy.

- Challenges established automotive norms: Musk consistently challenges the status quo in the automotive industry, forcing competitors to adapt and innovate.

- Drives relentless innovation and efficiency: His demanding nature pushes his teams to achieve seemingly impossible goals, resulting in rapid advancements in battery technology, autonomous driving, and manufacturing processes.

- Creates a cult-like following among investors and consumers: Musk's charisma and ambitious vision have cultivated a dedicated following, attracting both investors eager to participate in Tesla's growth and consumers drawn to the brand's image of innovation and prestige.

Supporting Detail: Musk's relentless pursuit of ambitious goals, such as achieving fully autonomous driving or building a sustainable energy ecosystem, has arguably pushed Tesla to the forefront of technological advancement, directly impacting Tesla stock valuations, although the volatility introduced is undeniable.

Increased Media Attention and Brand Visibility:

Musk's controversial statements and actions generate substantial media coverage, offering Tesla significant free marketing. Even negative publicity can inadvertently boost brand visibility, maintaining Tesla's constant presence in the public consciousness.

- Free marketing through news cycles and social media: Musk’s tweets and public pronouncements, regardless of their content, are frequently picked up by major news outlets and social media platforms, generating widespread brand awareness.

- Maintains a constant presence in the public consciousness: This sustained media presence keeps Tesla in the conversation, creating a sense of ongoing excitement and anticipation around the company and its products.

- Attracts potential investors and customers: The high level of visibility and media buzz helps attract the attention of potential investors, influencing stock prices, and also draws in consumers intrigued by the innovative image and the controversies surrounding the brand.

Supporting Detail: Analyze instances like the initial unveiling of the Cybertruck or announcements about new battery technologies; these events often led to surges in web traffic, social media engagement, and, consequently, short-term spikes in Tesla stock prices.

The Negative Arguments: How Anger Damages Tesla's Stock Price and Reputation?

Conversely, Musk's anger and erratic behavior pose significant risks to Tesla's stock price and long-term success. Investor uncertainty, reputational damage, and regulatory scrutiny all contribute to the negative consequences of his public persona.

Investor Uncertainty and Market Volatility:

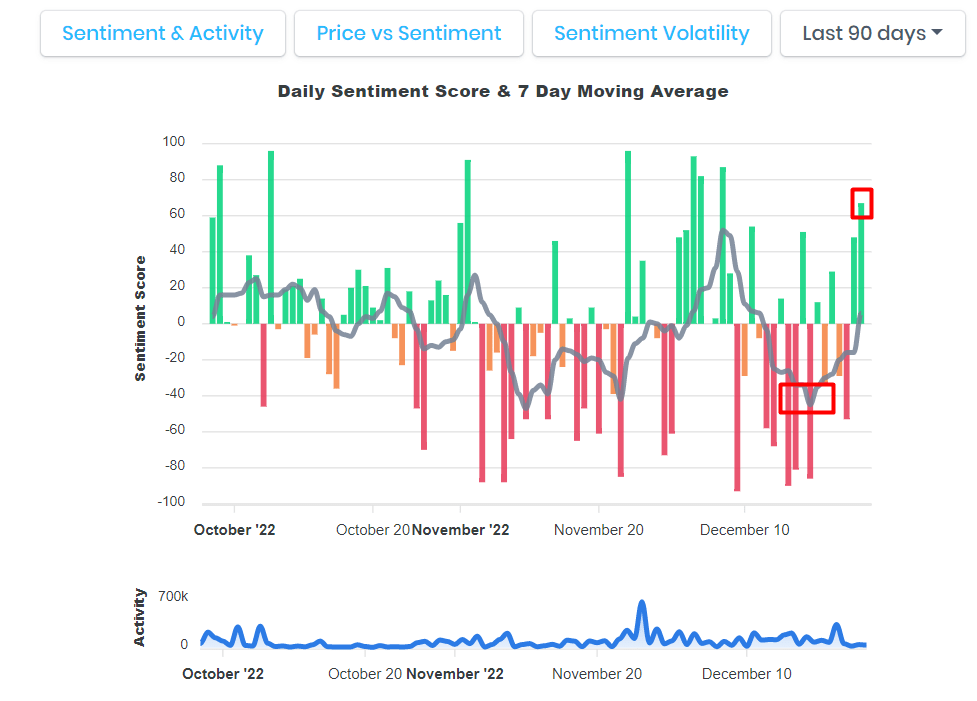

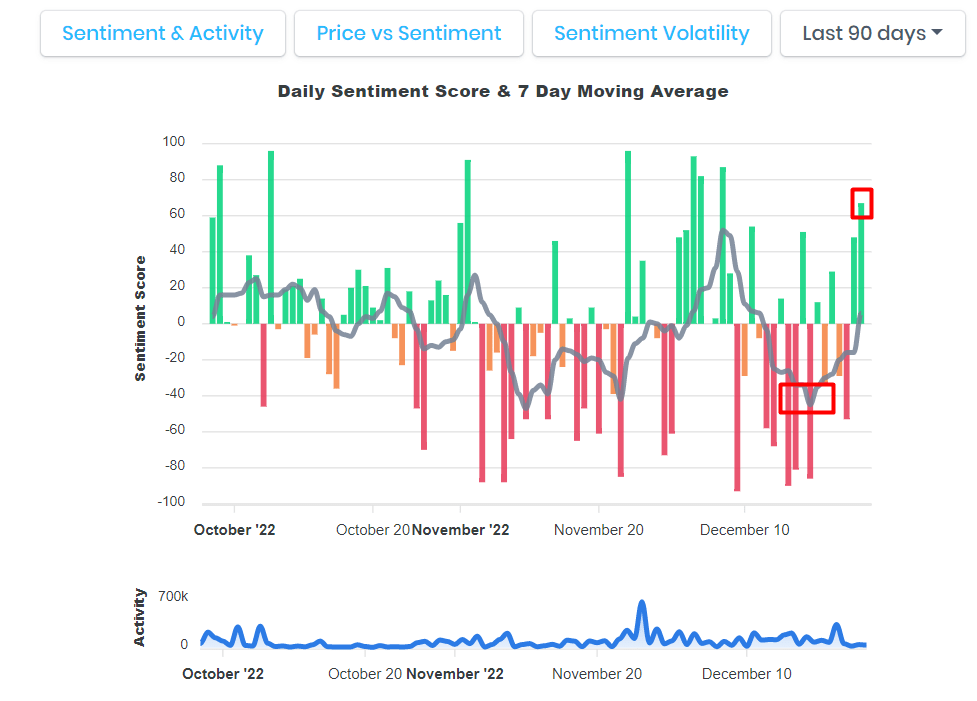

Musk's impulsive decisions and controversial statements can create significant uncertainty among investors, leading to substantial stock price fluctuations. This volatility makes Tesla stock a riskier investment.

- Negative tweets and impulsive decisions trigger sell-offs: Musk's tweets, especially those expressing controversial opinions or announcing sudden changes in company strategy, frequently result in immediate drops in Tesla's stock value.

- Damages investor confidence and long-term stability: The constant uncertainty surrounding Musk's actions erodes investor confidence, making it harder to attract long-term investments crucial for sustainable growth.

- Creates a riskier investment profile for Tesla: The volatility linked to Musk's behavior increases the risk perception associated with investing in Tesla, deterring some investors seeking greater stability.

Supporting Detail: Numerous instances exist where a controversial tweet or public statement by Musk has been followed by a significant drop in Tesla's stock price.

Damage to Brand Image and Corporate Reputation:

Musk's angry outbursts and controversial behavior can alienate potential customers and damage Tesla's carefully constructed brand image. This negative publicity can significantly impact consumer trust and brand loyalty.

- Negative PR surrounding controversies and public outbursts: The negative media coverage surrounding Musk's controversies and angry pronouncements can affect the public's perception of Tesla, potentially impacting sales.

- Potential impact on consumer trust and brand loyalty: Repeated instances of negative publicity can erode consumer trust in the brand, leading to decreased customer loyalty and a reluctance to purchase Tesla products.

- Risk of boycotts or decreased demand for Tesla products: Negative publicity can result in calls for boycotts or simply a decrease in consumer demand, harming Tesla's sales figures and consequently influencing its stock value.

Supporting Detail: The impact of negative publicity on consumer perception needs detailed analysis to assess the long-term effects on sales and brand value.

Regulatory Scrutiny and Legal Ramifications:

Musk's actions have attracted increased regulatory scrutiny and potential legal repercussions, creating further challenges for Tesla.

- SEC investigations and fines related to public statements: Musk's past run-ins with the Securities and Exchange Commission (SEC) due to his public statements serve as a reminder of the potential legal consequences of his actions.

- Potential impact on Tesla's operations and future growth: Legal battles and regulatory investigations can divert resources and distract from core business activities, potentially hindering Tesla's growth.

- Increased legal costs and reputational damage: The cost of defending against legal challenges and the associated reputational damage can negatively impact Tesla's financial performance and investor sentiment.

Supporting Detail: Detailed examination of specific legal cases and regulatory actions against Tesla and Musk is crucial to fully understand the potential ramifications.

Conclusion:

Elon Musk's anger presents a double-edged sword for Tesla's stock. While his aggressive style might fuel innovation and attract attention, creating short-term stock gains, it also creates substantial risks. Investor uncertainty, reputational damage, and regulatory scrutiny can significantly impact Tesla's stock performance. The long-term effects of Musk's personality on Tesla’s success and stock value remain to be seen and are subject to ongoing analysis by investors and financial experts.

Call to Action: Understanding the complex relationship between Elon Musk's personality and Tesla stock is crucial for informed investment decisions. Continue to research and analyze Tesla's performance in light of Musk's public image to make well-informed choices about your Tesla stock investments. Monitor news concerning Elon Musk, Tesla stock, and related keywords for up-to-date information impacting your investment strategy.

Featured Posts

-

Exploring The Cinematic World Of Max Payne

May 27, 2025

Exploring The Cinematic World Of Max Payne

May 27, 2025 -

The Nora Fatehi Rasha Thadani Pr Agency Feud A Reddit Deep Dive Into The 100 Noras Controversy

May 27, 2025

The Nora Fatehi Rasha Thadani Pr Agency Feud A Reddit Deep Dive Into The 100 Noras Controversy

May 27, 2025 -

Zamfara Security Forces Thwart Bandit Attack Eliminate Key Figure

May 27, 2025

Zamfara Security Forces Thwart Bandit Attack Eliminate Key Figure

May 27, 2025 -

Ajcs New Global Map Tracking And Combating Antisemitism

May 27, 2025

Ajcs New Global Map Tracking And Combating Antisemitism

May 27, 2025 -

Ice Cube To Write And Star In New Last Friday Movie

May 27, 2025

Ice Cube To Write And Star In New Last Friday Movie

May 27, 2025

Latest Posts

-

Live Nation Antitrust Lawsuit Progress Under The Trump Presidency

May 29, 2025

Live Nation Antitrust Lawsuit Progress Under The Trump Presidency

May 29, 2025 -

Food Startup Failure Common Mistakes And Strategies For Success

May 29, 2025

Food Startup Failure Common Mistakes And Strategies For Success

May 29, 2025 -

Trump Administrations Impact On Live Nation Antitrust Case

May 29, 2025

Trump Administrations Impact On Live Nation Antitrust Case

May 29, 2025 -

Bell Shakespeares Henry V Vitality Pace And A Powerful Performance

May 29, 2025

Bell Shakespeares Henry V Vitality Pace And A Powerful Performance

May 29, 2025 -

Live Nation Faces Renewed Antitrust Scrutiny Under Trump

May 29, 2025

Live Nation Faces Renewed Antitrust Scrutiny Under Trump

May 29, 2025