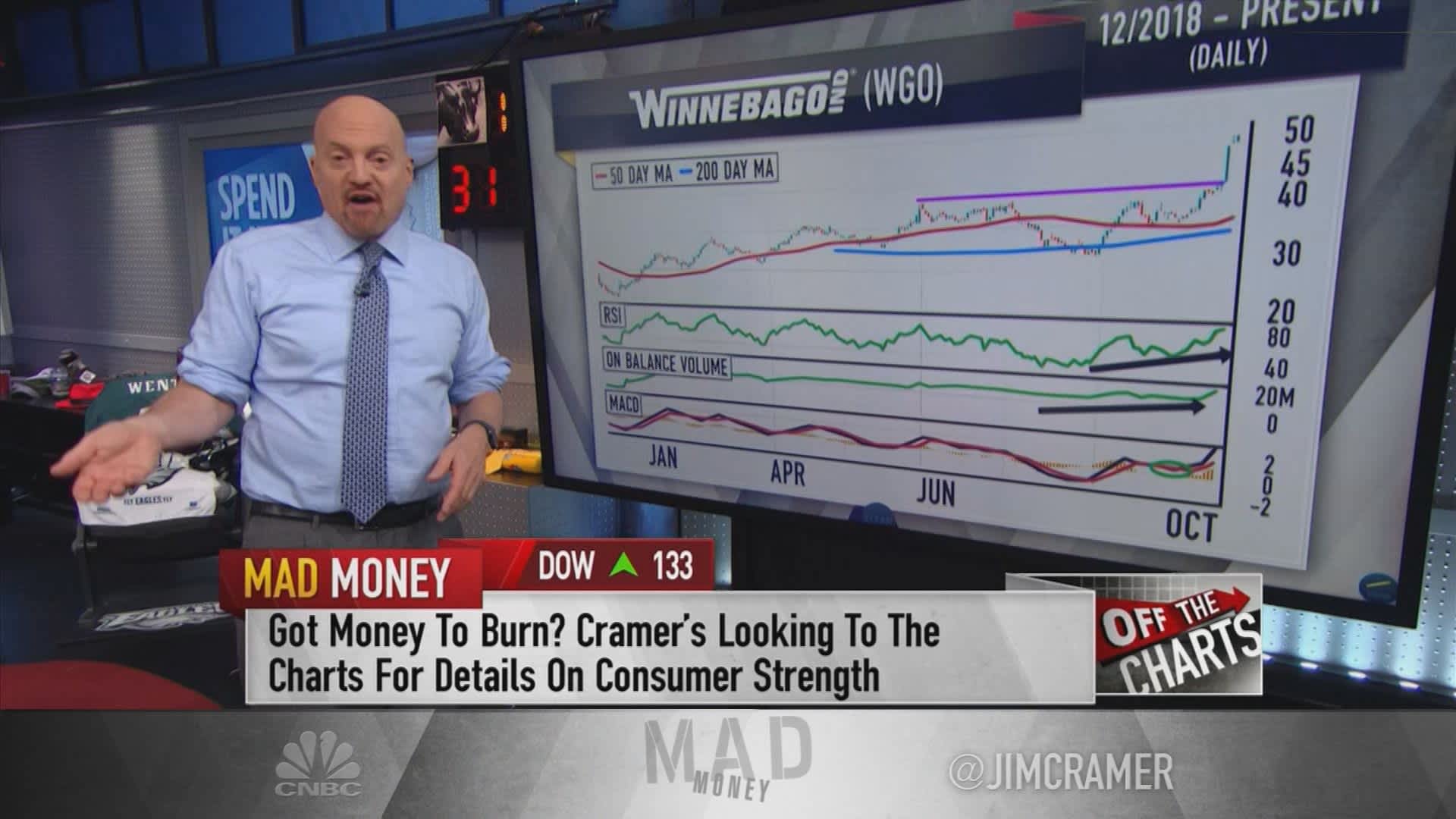

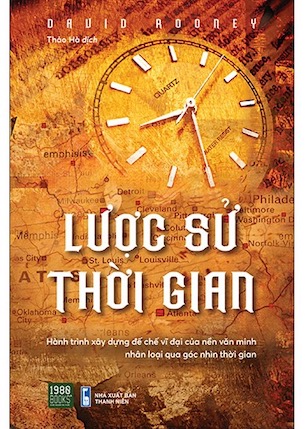

Is Foot Locker (FL) A Genuine Winner According To Jim Cramer?

Table of Contents

Cramer's Past Statements on Foot Locker (FL): A Historical Perspective

Pinpointing specific dates and detailed statements about Foot Locker from Jim Cramer requires extensive archival research of Mad Money episodes. Unfortunately, readily available, indexed transcripts covering every mention of FL are not consistently accessible. However, anecdotal evidence suggests that Cramer’s commentary on Foot Locker has likely reflected the broader market sentiment and Foot Locker's performance at the time. His opinions likely shifted alongside the company's fluctuating fortunes.

- Positive Comments (Hypothetical): In periods of strong Foot Locker performance (e.g., successful product launches, strong holiday sales), Cramer might have expressed bullish sentiments, possibly referring to FL as a "buy" or a "strong buy," highlighting its potential for growth within the athletic footwear sector.

- Negative Comments (Hypothetical): Conversely, during periods of declining sales or negative market trends affecting the retail sector, he may have expressed concerns, possibly suggesting a "hold" or even a "sell" rating, citing competitive pressures from direct-to-consumer brands or broader economic headwinds impacting discretionary spending.

- Context is Key: Any assessment of Cramer's past opinions needs to consider the prevailing market conditions. A "buy" recommendation during a market downturn would carry a different weight than one made during a bull market.

- Finding Past Statements: To find direct quotes or video clips, searching Mad Money archives using keywords like "Foot Locker," "FL stock," or "Foot Locker Jim Cramer" might yield some results.

Foot Locker's Current Financial Performance: A Deep Dive

Analyzing Foot Locker's current financial health requires examining recent quarterly and annual reports. These reports provide crucial insights into the company's revenue, profitability, and overall financial stability. Key indicators to consider include:

- Revenue Growth/Decline: A consistent upward trend indicates strong sales, while a decline may signal weakening market share or changing consumer preferences. Analyzing year-over-year revenue changes offers valuable perspective.

- Profitability (Net Income, Margins): Healthy net income and profit margins demonstrate the company's ability to generate profits. A shrinking margin indicates increasing costs or decreased pricing power.

- Key Performance Indicators (KPIs): Same-store sales are particularly important for retail businesses like Foot Locker. An increase suggests improved sales within existing stores, showcasing strong customer demand and effective store management.

- Stock Price Performance: The stock price reflects investor sentiment. Tracking its movement over time helps understand the market's perception of Foot Locker’s prospects.

- Partnerships and Collaborations: Strategic partnerships with popular brands can significantly impact Foot Locker’s sales and market presence.

Competition and Market Trends in the Athletic Footwear Industry

Foot Locker operates in a fiercely competitive market dominated by giants like Nike, Adidas, and Under Armour. Analyzing these competitive dynamics is crucial for understanding Foot Locker's prospects.

- Market Share: Foot Locker's market share relative to its competitors provides a clear picture of its position within the industry. A shrinking market share may suggest a need for strategic adjustments.

- Competitive Pressures: The industry faces pressure from direct-to-consumer brands that sell directly to consumers, bypassing traditional retailers like Foot Locker. This cuts into Foot Locker's margins.

- Emerging Trends: Trends like sustainable footwear and the ever-growing athleisure market influence consumer preferences and demand. Foot Locker's ability to adapt to these trends is vital for its success.

- Competitive Advantages: Foot Locker's vast retail network and strong brand recognition remain key advantages. However, its ability to leverage its expertise and technological advancements will determine its future competitiveness.

Expert Opinions Beyond Jim Cramer: Diversifying the Perspective

While Jim Cramer’s opinion is valuable, relying solely on one source is risky. Seeking perspectives from other financial analysts and experts provides a well-rounded view.

- Analyst Ratings: Check reputable financial websites for ratings (buy, hold, sell) from various analysts. A consensus among several analysts suggests a stronger likelihood of a particular outcome.

- Reasoning Behind Ratings: Understand the rationale behind these ratings. Analysts often base their recommendations on in-depth financial analysis, industry trends, and competitive dynamics.

- Reputable Sources: Ensure that you're referencing sources with established track records of credible financial analysis.

Is Foot Locker a Buy, Sell, or Hold? A Balanced Assessment

Synthesizing the information above requires weighing the positives and negatives. Foot Locker's established brand, retail presence, and potential to adapt to evolving trends are positives. However, fierce competition and potential economic headwinds present challenges. A balanced assessment needs to consider your personal risk tolerance and investment objectives. The overall outlook depends on numerous factors beyond the scope of this article, including broader economic conditions.

Conclusion

Determining whether Foot Locker (FL) aligns with Jim Cramer's investment philosophy requires a comprehensive analysis of its financial health, competitive landscape, and the opinions of various financial experts. While this article provides valuable insight, it doesn't represent a definitive answer. Foot Locker's future performance depends on numerous dynamic factors.

Call to Action: While this article offers valuable insight into whether Foot Locker (FL) is a genuine winner, remember to conduct thorough research and consult with a qualified financial advisor before making any investment decisions related to Foot Locker (FL) or any other stock. Do your own due diligence on Foot Locker (FL) and decide if it's a genuine winner for your portfolio.

Featured Posts

-

Get Your Free Game Now A Steam Review

May 16, 2025

Get Your Free Game Now A Steam Review

May 16, 2025 -

Thoi Gian Ly Tuong De Xong Hoi Va Nhung Luu Y Quan Trong

May 16, 2025

Thoi Gian Ly Tuong De Xong Hoi Va Nhung Luu Y Quan Trong

May 16, 2025 -

Foot Locker Fl Q4 2024 Earnings Analysis Of The Lace Up Plan Progress

May 16, 2025

Foot Locker Fl Q4 2024 Earnings Analysis Of The Lace Up Plan Progress

May 16, 2025 -

Hutson A T Il Le Niveau Pour Etre Un Defenseur Elite En Lnh

May 16, 2025

Hutson A T Il Le Niveau Pour Etre Un Defenseur Elite En Lnh

May 16, 2025 -

The Impact Of Ha Seong Kim And Blake Snells Bond On Korean Mlb Players

May 16, 2025

The Impact Of Ha Seong Kim And Blake Snells Bond On Korean Mlb Players

May 16, 2025