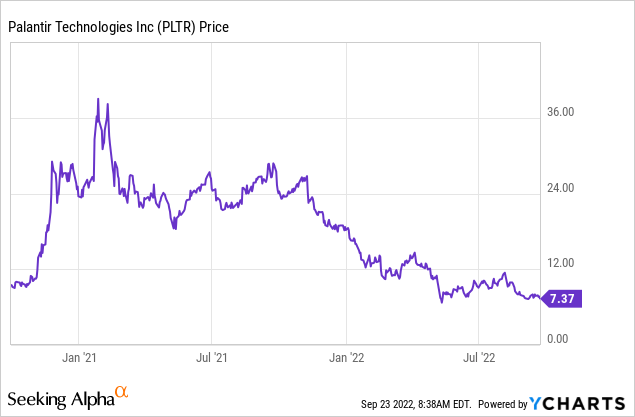

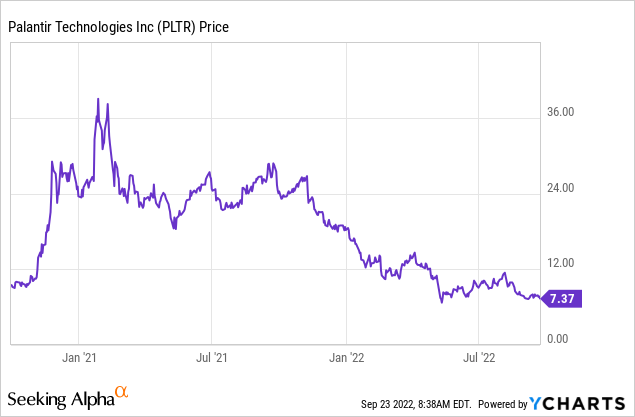

Is Palantir Overvalued? Analyzing The Stock's Performance And Market Sentiment

Table of Contents

Palantir's Financial Performance: A Detailed Look

Revenue Growth and Profitability

Analyzing Palantir's financial performance requires a close look at its revenue growth and profitability trends. Year-over-year comparisons are crucial for understanding the company's trajectory. While Palantir has demonstrated impressive revenue growth, sustained profitability remains a key area of focus for investors. The balance between government contracts and commercial contracts significantly impacts its financial performance. Government contracts often provide a stable revenue stream but may have lower margins compared to commercial contracts, which offer higher growth potential.

- Key Financial Ratios: Analyzing key financial ratios provides a clearer picture. We will examine:

- Revenue Growth Rate: The percentage increase in revenue year over year.

- Operating Margin: Operating income as a percentage of revenue, reflecting operational efficiency.

- Net Income Margin: Net income as a percentage of revenue, showcasing overall profitability.

(Insert relevant charts and graphs showcasing Palantir revenue, Palantir profitability, and key financial ratios here. Source the data appropriately.)

Using data from Palantir's financial statements, we can track these metrics over time and assess their impact on the company's overall valuation. Keywords like Palantir revenue, Palantir profitability, Palantir financial statements, and PLTR earnings will be strategically used throughout this section to optimize for search engines.

Cash Flow and Debt

Understanding Palantir's cash flow and debt levels is vital for evaluating its financial health and long-term sustainability. We'll examine:

- Cash Flow from Operations: This indicates the cash generated from the company's core business activities. Strong positive cash flow is a positive indicator.

- Cash Flow from Investing Activities: This reveals Palantir's investments in capital expenditures and acquisitions.

- Debt Levels: The amount of debt Palantir carries influences its financial flexibility and risk profile. High debt levels can increase financial vulnerability.

- Debt Service Coverage Ratio: This measures Palantir's ability to meet its debt obligations.

(Insert relevant charts and graphs illustrating Palantir cash flow and debt levels here. Source the data appropriately.)

Analyzing Palantir cash flow, Palantir debt, and the data from PLTR balance sheet helps us gauge the company's financial strength and its capacity to fund future growth and repay its obligations. This analysis is crucial for assessing the long-term viability of the company and its impact on its stock valuation.

Market Sentiment and Investor Perception

Analyst Ratings and Price Targets

Understanding the market sentiment surrounding Palantir involves examining analyst ratings and price targets. The consensus view of financial analysts provides a valuable benchmark for assessing investor expectations.

- Analyst Ratings: We'll review ratings from prominent financial institutions, noting the distribution between buy, hold, and sell recommendations.

- Price Targets: The range of price targets set by analysts indicates their expected future price for the stock. A wide range suggests significant uncertainty.

(Summarize the consensus view and range of price targets here. Cite your sources.)

Changes in analyst ratings (upgrades or downgrades) can significantly impact Palantir's stock price. Keywords such as Palantir analyst ratings, PLTR price target, and Palantir stock forecast are vital for SEO optimization in this section.

Social Media Sentiment and News Coverage

Social media platforms and news coverage provide valuable insights into the overall public sentiment towards Palantir.

- Social Media Sentiment: Analyzing social media mentions (e.g., Twitter, Reddit) helps gauge public opinion and identify emerging trends.

- News Coverage: Reviewing recent news articles and press releases provides a comprehensive picture of Palantir's performance, announcements, and market reactions.

(Summarize the key findings from social media and news coverage here. Cite your sources appropriately.)

The combined influence of Palantir social media sentiment, Palantir news, and PLTR media coverage can significantly impact investor perception and trading activity.

Valuation Metrics and Comparison to Peers

Price-to-Sales (P/S) Ratio

The Price-to-Sales (P/S) ratio is a crucial valuation metric for high-growth companies like Palantir, particularly those with fluctuating profitability.

- Calculation: We will calculate Palantir's P/S ratio by dividing its market capitalization by its revenue.

- Comparison: We'll compare Palantir's P/S ratio to those of its competitors in the big data analytics industry. A higher P/S ratio might indicate that the market anticipates higher future growth for Palantir compared to its peers.

(Calculate and compare Palantir's P/S ratio to its competitors here. Cite your sources.)

Understanding Palantir valuation and its Palantir P/S ratio in relation to its competitors allows for a more robust assessment of whether its current valuation is justified. The keyword PLTR stock valuation is also relevant here.

Other Key Valuation Metrics

While the P/S ratio is important, other valuation metrics provide a more holistic view. Where applicable, we will also consider:

- Price-to-Earnings (P/E) Ratio: This is a widely used valuation metric, but its applicability to Palantir depends on its current profitability.

- Other Multiples: Other relevant valuation multiples might be considered based on available data.

(Analyze other relevant valuation metrics and compare them to industry averages here. Cite your sources.)

Analyzing Palantir P/E ratio (if applicable) and Palantir valuation multiples provides a more complete picture of the stock's valuation and its relationship to industry benchmarks and its growth prospects. PLTR competitive analysis will further enhance the article's SEO optimization.

Conclusion

This analysis has examined Palantir's financial performance, market sentiment, and key valuation metrics to assess whether the stock is overvalued. We have considered revenue growth, profitability, cash flow, analyst ratings, and comparisons to its peers. The findings suggest that Palantir's valuation is currently [insert conclusion: overvalued, undervalued, or fairly valued, and support this conclusion with data from the analysis]. The high growth potential of the company is balanced by its current profitability and debt levels.

Call to Action: While this analysis provides valuable insights into the question of whether Palantir is overvalued, further independent research is crucial before making any investment decisions. Continue your due diligence by thoroughly researching Palantir's competitive landscape and future growth opportunities to arrive at an informed decision regarding Palantir's stock. Remember to carefully consider your own risk tolerance and investment goals before investing in Palantir or any other stock.

Featured Posts

-

Lotto Plus 1 And 2 Results Check The Latest Winning Numbers From Lotto

May 07, 2025

Lotto Plus 1 And 2 Results Check The Latest Winning Numbers From Lotto

May 07, 2025 -

Game 4 Thriller Warriors Defeat Rockets Lead Series 3 1

May 07, 2025

Game 4 Thriller Warriors Defeat Rockets Lead Series 3 1

May 07, 2025 -

Cavaliers 16 Game Winning Streak Evan Mobleys Crucial Role In Historic Victory

May 07, 2025

Cavaliers 16 Game Winning Streak Evan Mobleys Crucial Role In Historic Victory

May 07, 2025 -

Why Jenna Ortega Is Horrors Next Scream Queen

May 07, 2025

Why Jenna Ortega Is Horrors Next Scream Queen

May 07, 2025 -

Ps 5 Pro Whats New In Sonys Latest Upgrade

May 07, 2025

Ps 5 Pro Whats New In Sonys Latest Upgrade

May 07, 2025