Is Palantir Stock A Good Buy Before May 5th? A Detailed Look

Table of Contents

Palantir's Recent Financial Performance and Future Projections

Understanding Palantir's financial health is critical to assessing its investment potential. Let's delve into the details of its recent performance and future projections.

Revenue Growth and Profitability

Palantir's recent quarterly earnings reports reveal a mixed picture. While revenue growth has been positive, the company's path to profitability remains a key focus for investors. Analyzing key metrics like revenue growth, operating margins, and net income is crucial. For instance, examining the year-over-year growth percentage in revenue and comparing it to industry benchmarks provides valuable insights into Palantir's financial health. A detailed look at operating margins will reveal Palantir's efficiency in converting revenue into profit. Charting these metrics over several quarters offers a clearer picture of trends and potential future performance. The fluctuation in net income further highlights the challenges in reaching consistent profitability. Investors should carefully examine these figures, especially in relation to the company's projected growth.

Keywords: Palantir earnings, Palantir revenue growth, Palantir profitability

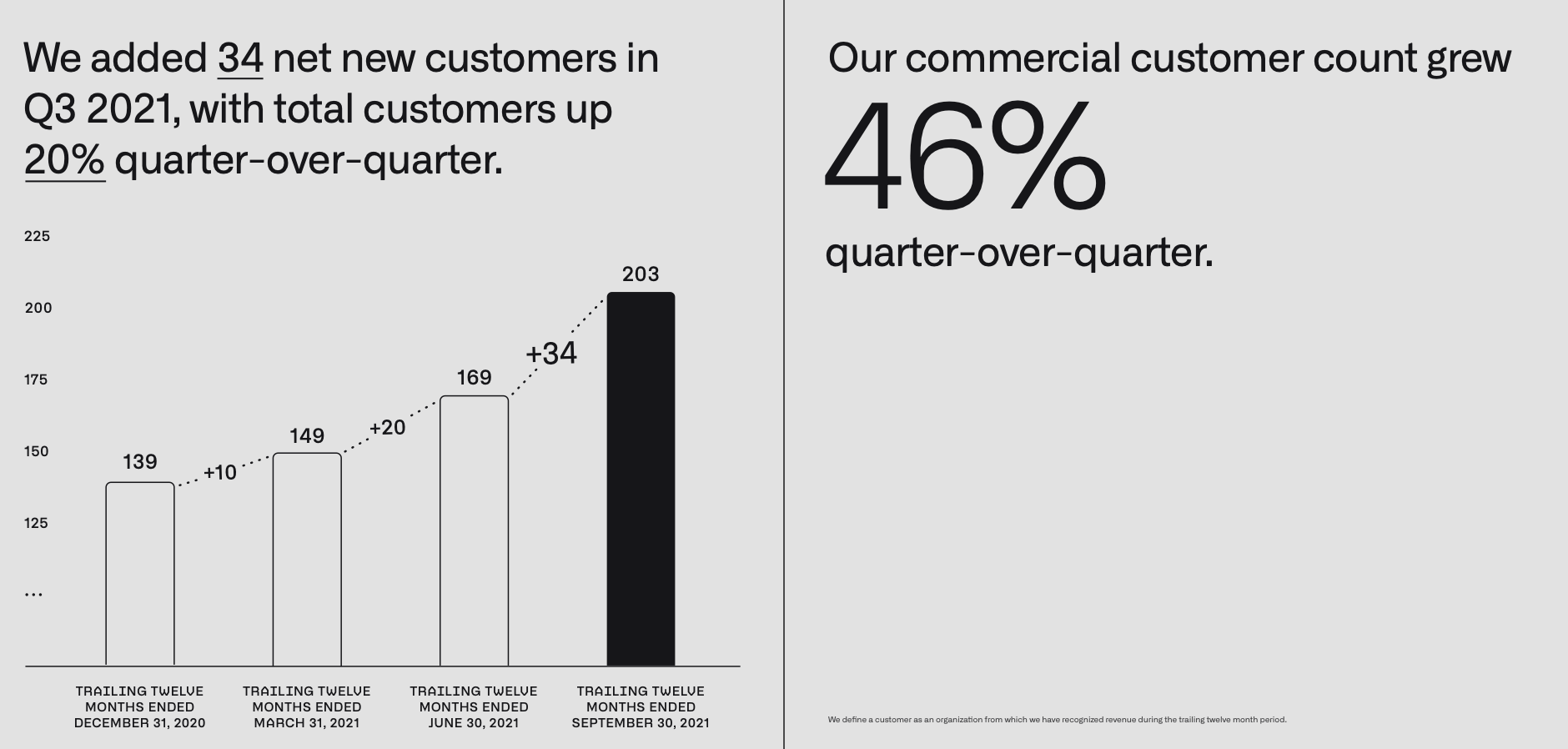

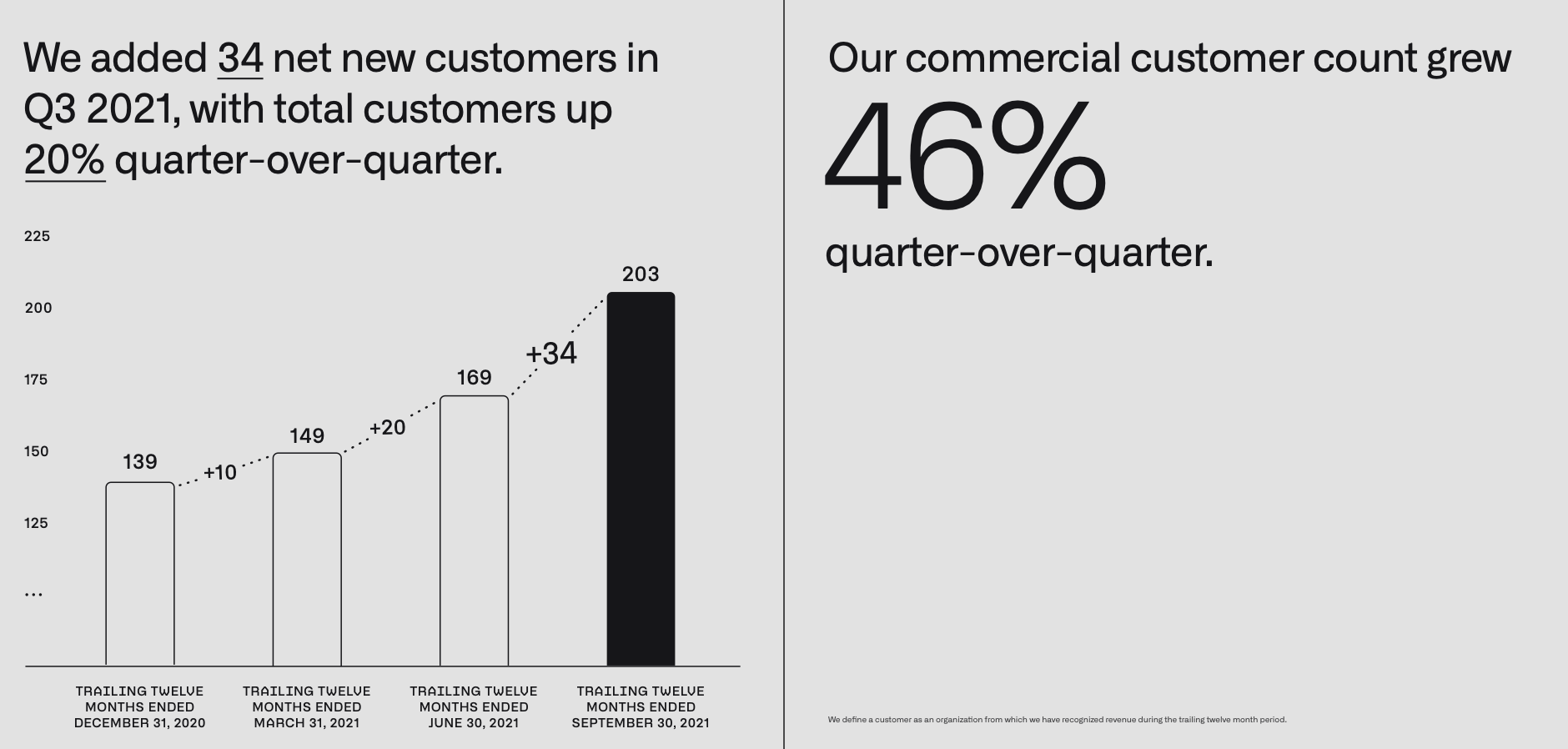

Government Contracts vs. Commercial Partnerships

Palantir's revenue streams are split between government contracts and commercial partnerships. Government contracts provide a degree of stability but might be subject to budgetary constraints and shifts in political priorities. On the other hand, commercial partnerships offer potentially higher growth but may involve more competition and greater market risk. Analyzing the percentage of revenue derived from each sector helps determine the balance between stability and growth potential. A significant reliance on government contracts might signal vulnerability to policy changes, while a strong presence in the commercial sector demonstrates market diversification and potential for future expansion.

Keywords: Palantir government contracts, Palantir commercial partnerships

Future Outlook and Guidance

Palantir's management provides guidance on its future expectations for revenue growth and profitability. Analyzing this guidance against historical performance and market trends helps gauge the realism of its projections. It's important to note that these projections are subject to uncertainties, such as economic downturns, increased competition, and shifts in government spending. Investors should carefully assess the risks and uncertainties associated with Palantir's future outlook and consider how these might impact the stock price.

Keywords: Palantir future outlook, Palantir stock forecast, Palantir guidance

- Bullet Points:

- Recent wins and losses in major government contracts (e.g., securing a large contract with a major defense agency or losing a bid to a competitor).

- Significant partnerships formed with commercial clients (e.g., collaborations with major corporations in finance or healthcare).

- Major announcements impacting financial performance (e.g., new product launches, acquisitions, or divestitures).

Market Sentiment and Analyst Opinions on Palantir Stock

Understanding the overall market sentiment toward Palantir and the views of financial analysts are crucial for assessing the stock's potential.

Stock Price Trends and Volatility

Analyzing Palantir's stock price trends and volatility is essential. Charts displaying historical price data can reveal patterns of growth, decline, and periods of high volatility. This helps understand market reaction to news and events related to the company. Identifying key support and resistance levels will aid in predicting potential price movements. Observing the correlation between the stock price and broader market movements provides valuable context for assessing the investment's risk.

Keywords: Palantir stock price, Palantir stock chart, Palantir stock volatility

Analyst Ratings and Price Targets

A review of leading financial analysts' reports on Palantir stock offers valuable insights. These reports provide price targets (forecasted stock prices), buy/sell recommendations, and justifications for their assessments. Aggregating the opinions of multiple analysts helps form a consensus view on the stock's potential. Consider the analysts' track records and the methodologies they employed to validate their findings.

Keywords: Palantir analyst ratings, Palantir price target, Palantir stock recommendation

Impact of Macroeconomic Factors

Broader economic conditions, such as inflation and interest rates, significantly influence stock prices. Inflation erodes purchasing power and impacts corporate profitability, while interest rate changes affect borrowing costs and investor sentiment. Understanding the potential impact of these factors on Palantir's business and stock price is crucial.

Keywords: Palantir stock and inflation, Palantir and interest rates, macroeconomic factors affecting Palantir

- Bullet Points:

- List of specific analyst firms and their recommendations (e.g., Goldman Sachs, Morgan Stanley, etc., and their respective buy, hold, or sell ratings).

- Price targets provided by different analysts.

- Key data points supporting analysts’ conclusions (e.g., revenue projections, earnings estimates).

Key Risks and Potential Downsides of Investing in Palantir Before May 5th

While Palantir offers growth potential, it's crucial to acknowledge potential downsides.

Competition and Market Share

Palantir faces competition from established players and emerging technology companies in the data analytics and government contracting sectors. Analyzing the competitive landscape helps determine Palantir's ability to maintain and grow its market share. The emergence of new technologies and competitors might impact Palantir's market position and profitability.

Keywords: Palantir competitors, Palantir market share, competitive landscape

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This reliance creates risks associated with fluctuations in government spending, changes in political priorities, and potential delays in contract awards. This dependence could impact revenue stability and profitability.

Keywords: Palantir government contract risk, government spending on Palantir

Geopolitical Risks

Geopolitical events can significantly impact Palantir's business, particularly in its international operations. Factors like political instability, trade disputes, and sanctions could disrupt supply chains, impact revenue streams, and negatively influence investor sentiment.

Keywords: Palantir geopolitical risk, international market impact on Palantir

- Bullet Points:

- Specific examples of key competitors (e.g., AWS, Microsoft Azure, Google Cloud).

- Potential policy changes impacting government spending on data analytics.

- Geopolitical events that could pose risks (e.g., international conflicts, trade wars).

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on this analysis, Palantir stock presents a potentially lucrative but also risky investment before May 5th. While Palantir demonstrates growth in revenue and boasts innovative technology, its reliance on government contracts and the competitive landscape create considerable uncertainty. The impact of macroeconomic factors and geopolitical risks also needs careful consideration. Remember, this analysis is not financial advice. Thorough due diligence, including considering your risk tolerance and investment goals, is paramount before investing in Palantir stock or any other security. Before investing in Palantir stock, be sure to consult a financial advisor and conduct your own comprehensive research. Learn more about Palantir stock and make an informed investment decision.

Featured Posts

-

The Fentanyl Crisis And Its Impact On Us China Trade Relations

May 09, 2025

The Fentanyl Crisis And Its Impact On Us China Trade Relations

May 09, 2025 -

Support Grows For American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025

Support Grows For American Samoan Family Accused Of Voter Fraud In Whittier

May 09, 2025 -

New Delhi And Washington To Discuss Bilateral Trade

May 09, 2025

New Delhi And Washington To Discuss Bilateral Trade

May 09, 2025 -

Elizabeth City Apartment Residents Urged To Increase Vehicle Security Following Break Ins

May 09, 2025

Elizabeth City Apartment Residents Urged To Increase Vehicle Security Following Break Ins

May 09, 2025 -

Franko Polskoe Partnerstvo Podpisanie Oboronnogo Soglasheniya Otvet Trampu I Putinu

May 09, 2025

Franko Polskoe Partnerstvo Podpisanie Oboronnogo Soglasheniya Otvet Trampu I Putinu

May 09, 2025

Latest Posts

-

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans Proceed

May 09, 2025

Fate Of Historic Broad Street Diner Sealed Hyatt Hotel Plans Proceed

May 09, 2025 -

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 09, 2025

Demolition Of Beloved Broad Street Diner For New Hyatt Hotel

May 09, 2025 -

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025

Broad Street Diners Demise Hyatt Hotel Construction To Begin

May 09, 2025 -

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025

Historic Broad Street Diner Demolition Hyatt Hotel Development

May 09, 2025 -

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025

Man Dies In Racist Stabbing Woman Arrested For Unprovoked Attack

May 09, 2025