Is Palantir Stock A Good Investment In 2024? Pros, Cons & Predictions

Table of Contents

Palantir Technologies: A Company Overview (Understanding Palantir's Business)

Palantir Technologies is a prominent player in the big data analytics market. Its core business revolves around two primary software platforms: Gotham, catering primarily to government clients, and Foundry, designed for commercial applications. Palantir's software empowers organizations to integrate, analyze, and derive actionable insights from massive datasets.

Key clients span diverse sectors including government agencies (CIA, defense departments globally), financial institutions, and healthcare providers. Palantir's competitive advantages stem from its advanced data integration capabilities, robust security protocols, and a focus on complex problem-solving. Its unique selling proposition lies in its ability to handle and analyze data of unprecedented scale and complexity, providing clients with a significant edge in their respective fields.

- Data analytics platform: Palantir's platforms offer powerful tools for data integration, analysis, and visualization, making complex data accessible and understandable.

- Government and commercial partnerships: Palantir boasts a strong portfolio of government contracts and is increasingly penetrating the commercial market.

- Data security and integration: A cornerstone of Palantir's offerings is its commitment to secure data handling and integration across diverse systems.

- AI and machine learning integration: Palantir is actively incorporating AI and machine learning capabilities into its platforms to enhance analytical power and automation.

Pros of Investing in Palantir Stock in 2024

While Palantir stock carries risk, several factors suggest potential for growth:

Strong Growth Potential

Palantir's revenue growth projections are promising, driven by both expansion into new commercial markets and innovation within its existing product suite. Analyst opinions vary, but many anticipate continued growth, particularly as Palantir further integrates AI and machine learning capabilities into its offerings. This translates to potential for significant long-term returns on Palantir stock investment.

First-Mover Advantage

Palantir holds a pioneering position in the big data analytics space, particularly concerning the scale and complexity of datasets it handles. This first-mover advantage, coupled with continuous innovation, establishes a significant competitive barrier. This leadership position is a key factor in evaluating Palantir stock as an investment.

Government Contracts and Stability

Palantir's substantial government contracts provide a degree of revenue stability, mitigating some of the inherent volatility associated with the tech sector. These long-term contracts offer a predictable revenue stream and contribute to the overall stability of the company’s financial standing, enhancing the appeal of Palantir stock for risk-averse investors.

- Expanding commercial market: Palantir's increasing presence in the commercial sector diversifies its revenue streams and reduces reliance on government contracts.

- New product development and AI advancements: Continuous innovation enhances the competitiveness and appeal of Palantir’s offerings.

- High-value government contracts: These provide a reliable revenue base and contribute to long-term stability.

- Potential for disruptive technology leadership: Palantir’s innovative technology positions it for continued growth and leadership in the evolving data analytics landscape.

Cons of Investing in Palantir Stock in 2024

Despite the potential upsides, investing in Palantir stock involves significant risks:

High Valuation and Volatility

Palantir's stock price has exhibited substantial volatility. This high volatility reflects the inherent risk associated with investing in a growth stock, particularly one operating in a rapidly evolving technological landscape. Investors need a high risk tolerance to consider Palantir stock.

Dependence on Government Contracts

A significant portion of Palantir's revenue comes from government contracts. This dependence introduces vulnerabilities to budget cuts, shifts in government priorities, and geopolitical instability. This risk needs careful consideration when assessing Palantir stock.

Competition in the Data Analytics Market

The data analytics market is highly competitive, with established tech giants and emerging startups vying for market share. Palantir faces stiff competition, requiring continuous innovation to maintain its competitive edge.

- Stock price fluctuations: The inherent volatility of Palantir stock requires careful risk assessment.

- Risk associated with government funding: Changes in government policies or budgets could impact Palantir's revenue.

- Competition from established tech giants: Companies like Google, Amazon, and Microsoft pose a formidable competitive challenge.

- Potential for slower-than-expected growth: Market dynamics and competitive pressures could impact growth projections.

Palantir Stock Predictions for 2024 and Beyond

Predicting Palantir's stock price is inherently speculative. Analyst opinions vary widely, reflecting the uncertainties inherent in the market and Palantir’s trajectory. Factors influencing future performance include broader market trends, Palantir’s success in expanding into new markets, and any significant geopolitical events. While some analysts predict substantial growth, others express caution due to the risks outlined above. Therefore, any predictions should be viewed with healthy skepticism.

- Analyst price targets: Consult various financial news sources for a range of analyst predictions.

- Potential market catalysts: New product launches, successful acquisitions, or significant commercial contract wins could drive stock price appreciation.

- Risks and uncertainties: Geopolitical events, economic downturns, and increased competition could negatively impact performance.

- Long-term growth outlook: While the long-term potential is substantial, it's crucial to acknowledge the associated risks.

Conclusion: Is Palantir Stock Right for You in 2024?

Investing in Palantir stock presents a compelling opportunity for growth, driven by its innovative technology, strong government contracts, and expansion into the commercial sector. However, the high valuation, volatility, and competitive market landscape introduce substantial risks. Before investing in Palantir, conduct thorough due diligence, considering your own risk tolerance and investment goals. Is investing in Palantir aligned with your long-term investment strategy? Should you buy Palantir stock? The answer depends on your individual circumstances and a comprehensive understanding of the company’s prospects and inherent risks. Remember, this analysis is not financial advice; consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

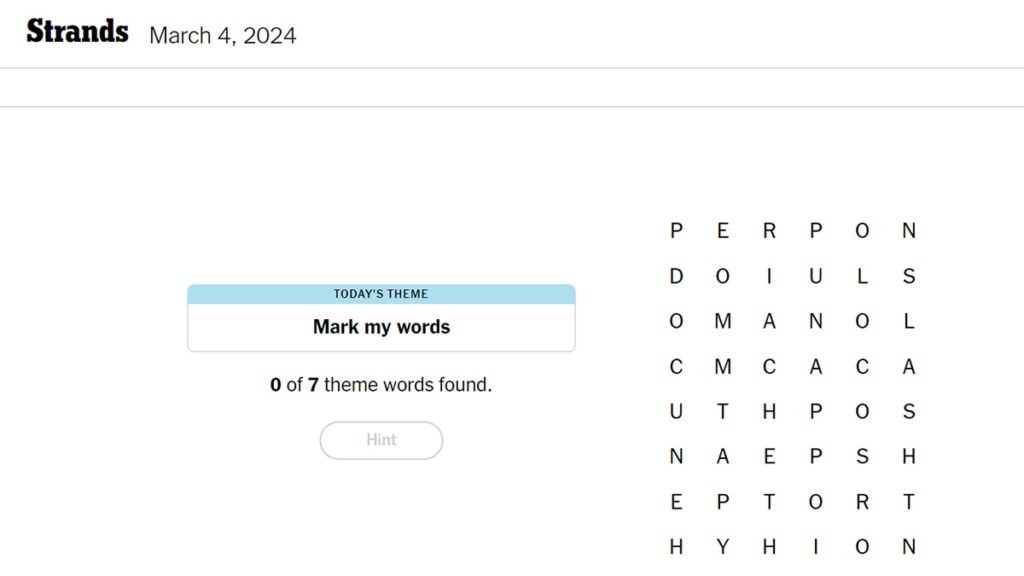

Solve Nyt Strands Puzzle 376 March 14 Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 376 March 14 Hints And Answers

May 10, 2025 -

Is Putins Victory Day Ceasefire Genuine An Assessment

May 10, 2025

Is Putins Victory Day Ceasefire Genuine An Assessment

May 10, 2025 -

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025 -

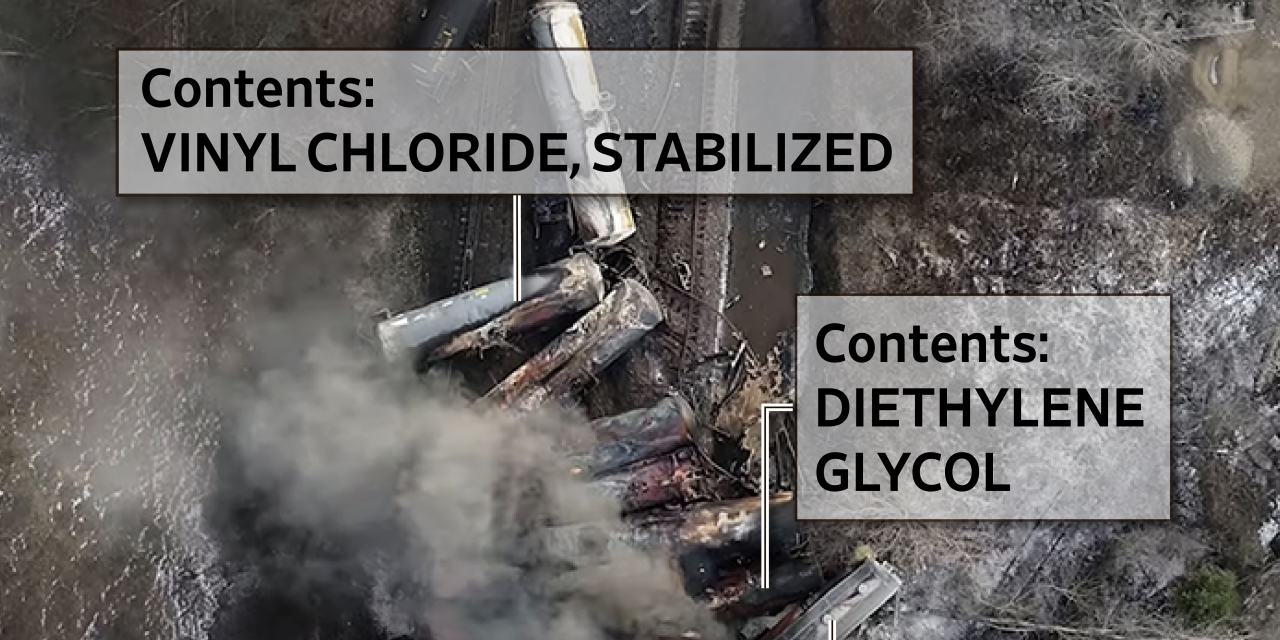

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Wheelchair Accessibility Issues And Solutions On The Elizabeth Line

May 10, 2025

Wheelchair Accessibility Issues And Solutions On The Elizabeth Line

May 10, 2025