Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham and Foundry. Gotham caters to government agencies, providing advanced data analytics for national security and intelligence purposes. Foundry, on the other hand, targets the commercial sector, offering a platform for businesses to analyze their data and gain valuable insights. This dual approach diversifies Palantir's revenue streams, although the government sector currently holds a larger share.

Analyzing revenue growth trends reveals a company experiencing substantial growth, but with some caveats. While growth is impressive, the dependence on large government contracts necessitates careful scrutiny.

- Government contracts and their impact on revenue stability: Large, multi-year government contracts provide revenue stability, but their renewal isn't guaranteed and can significantly impact quarterly earnings.

- Commercial sector growth potential and challenges: The commercial market presents significant growth potential, but securing and onboarding new clients in this competitive landscape requires considerable effort and investment.

- Recurring revenue streams and their significance: Palantir is increasingly focusing on subscription-based models, which contribute to more predictable and reliable recurring revenue. This transition is crucial for long-term financial health.

- Analysis of contract wins and losses: Tracking Palantir's contract wins and losses provides insights into its market position and future revenue projections. Public announcements and financial reports are valuable resources for this analysis.

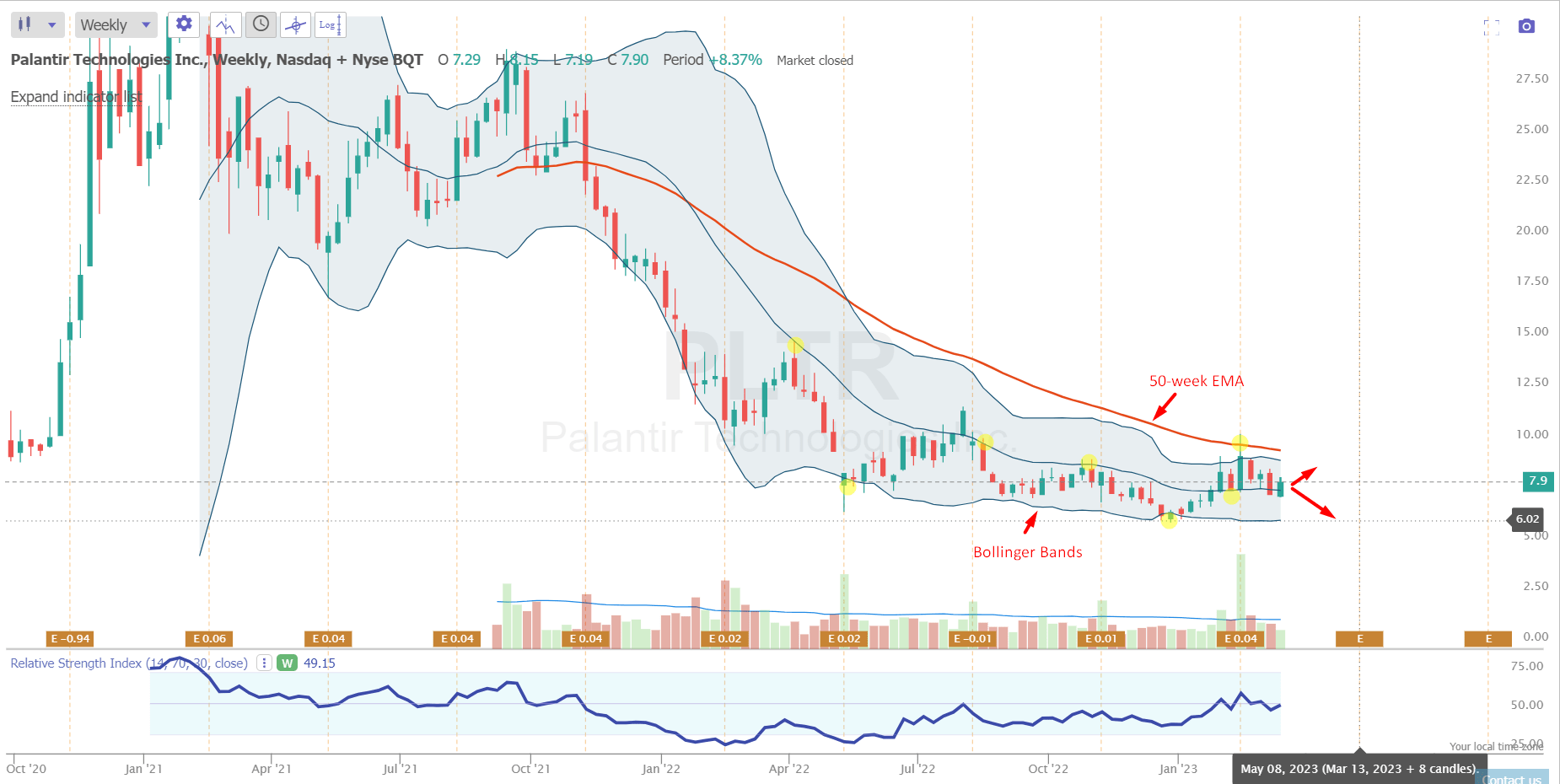

Financial Performance and Valuation

Palantir's profitability has been a point of discussion among investors. While the company isn't yet consistently profitable on a net income basis, its revenue growth and increasing recurring revenue are positive indicators. Analyzing key financial metrics provides a clearer picture.

- Profit margins and their trends: While net income may be fluctuating, monitoring gross profit margins and operating margins can reveal the effectiveness of Palantir's cost management and pricing strategies.

- Price-to-sales ratio (PSR) and its implications: The PSR is a crucial valuation metric for high-growth companies like Palantir. Comparing its PSR to competitors provides context for its current valuation.

- Debt levels and their effect on future growth: Palantir's debt levels should be carefully examined, as high debt can hinder future growth and increase financial risk.

- Comparison to similar data analytics companies: Benchmarking Palantir against competitors like Databricks and Snowflake allows for a comparative analysis of valuation, growth rates, and profitability.

Growth Prospects and Future Outlook

The data analytics market is experiencing explosive growth, fueled by the increasing amount of data generated globally and the rising need for actionable insights. This presents a significant opportunity for Palantir.

- Market size and projected growth: Researching market size projections for the data analytics sector provides a framework for understanding Palantir's potential growth trajectory.

- Palantir's technological innovation and R&D efforts: Palantir's commitment to research and development is critical for maintaining its competitive edge and offering innovative solutions.

- Competitive landscape and key competitors (e.g., Databricks, Snowflake): Understanding the competitive landscape and the strengths and weaknesses of key competitors is vital for assessing Palantir's long-term prospects.

- Geopolitical factors and their potential impact: Global political events and regulatory changes can impact Palantir's business, particularly its government contracts.

Risks and Considerations for Investors

Investing in Palantir carries inherent risks. The volatility of PLTR stock and its dependence on specific contracts require careful consideration.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending and procurement processes.

- Stock price volatility and market sentiment: Palantir's stock price is known for its volatility, influenced by market sentiment and news events.

- Competition from established players: The data analytics market is competitive, with established players and new entrants constantly vying for market share.

- Regulatory risks and compliance issues: Palantir operates in a regulated environment, and regulatory changes or compliance issues could negatively impact its business.

Conclusion

This analysis reveals that Palantir Technologies presents both significant opportunities and considerable risks. The company's growth in the data analytics market is undeniable, driven by its strong government contracts and expanding commercial reach. However, the dependence on government contracts and the inherent volatility of its stock price remain significant concerns. Whether Palantir Technologies stock is a buy now depends largely on your risk tolerance and investment horizon. While the long-term growth potential is attractive, short-term volatility should be anticipated.

Call to Action: Based on this comprehensive analysis, the decision of whether Palantir Technologies stock is a buy now rests solely with you. Conduct thorough research, understand your risk tolerance, and consult with a financial advisor before making any investment decisions. Remember, this analysis is for informational purposes only and is not financial advice. Do your own due diligence before investing in Palantir Technologies (PLTR) or any other stock.

Featured Posts

-

Elizabeth Hurleys Bikini Fashion A Maldives Vacation Diary

May 10, 2025

Elizabeth Hurleys Bikini Fashion A Maldives Vacation Diary

May 10, 2025 -

Impact Of Uk Student Visa Restrictions On Pakistani Students And Asylum Claims

May 10, 2025

Impact Of Uk Student Visa Restrictions On Pakistani Students And Asylum Claims

May 10, 2025 -

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 10, 2025

Stiven King Kritikuye Trampa Ta Maska Ostanni Novini

May 10, 2025 -

Thailands Search For A New Bot Governor Navigating Tariff Challenges

May 10, 2025

Thailands Search For A New Bot Governor Navigating Tariff Challenges

May 10, 2025 -

Wall Streets Resurgence A Look At Failed Bear Market Predictions

May 10, 2025

Wall Streets Resurgence A Look At Failed Bear Market Predictions

May 10, 2025