Is The Bitcoin Price Rebound Sustainable? Experts Weigh In

Table of Contents

Analyzing the Recent Bitcoin Price Surge

Understanding the sustainability of the current Bitcoin price rebound requires a multifaceted approach. We need to examine both the technical patterns and the fundamental factors driving this price movement.

Technical Analysis

Technical analysis provides valuable insights into the short-term trajectory of Bitcoin's price. By studying chart patterns, support and resistance levels, and trading volume, we can assess the strength and potential longevity of the recent rebound.

- Chart Patterns: Recent charts have shown a potential "double bottom" pattern, suggesting a possible reversal of the previous downtrend. However, the absence of a clear breakout above key resistance levels warrants caution. The formation of a "head and shoulders" pattern, on the other hand, could signal a bearish reversal. Careful observation is crucial.

- Support and Resistance Levels: Identifying key support and resistance levels is essential. A sustained break above a significant resistance level would significantly strengthen the bullish case, while a failure to hold above support levels could indicate a potential downturn.

- Trading Volume: Increased trading volume accompanying the price rise generally suggests stronger conviction behind the move. Conversely, a lack of volume could signal weak momentum and a potential for a price correction. Analyzing volume spikes in relation to price movements is crucial for interpreting the strength of the trend. High volume during price increases points to strong buying pressure.

Fundamental Factors Influencing Bitcoin's Price

Beyond technical analysis, fundamental factors play a critical role in shaping Bitcoin's long-term price trajectory. These factors can significantly influence the sustainability of any price rebound.

- Increased Institutional Adoption: Growing institutional investment in Bitcoin signifies increasing mainstream acceptance and potentially more stable price support.

- Regulatory Developments: Positive regulatory developments, such as clearer regulatory frameworks or the approval of Bitcoin ETFs, can boost investor confidence and drive price appreciation. Conversely, negative news around regulation can cause significant price drops.

- Macroeconomic Conditions: Global macroeconomic factors, such as inflation rates and interest rate policies, can significantly impact the cryptocurrency market. High inflation might increase Bitcoin's appeal as a hedge against inflation, driving demand.

- Network Upgrades: Improvements to the Bitcoin network, such as enhanced scalability through the Lightning Network, can improve its functionality and attract further adoption, positively affecting its price.

- Bitcoin Halving Cycles: The Bitcoin halving, which reduces the rate of new Bitcoin creation, historically has led to price increases in the long term. This event, although cyclical and predictable, influences price expectations and market sentiment.

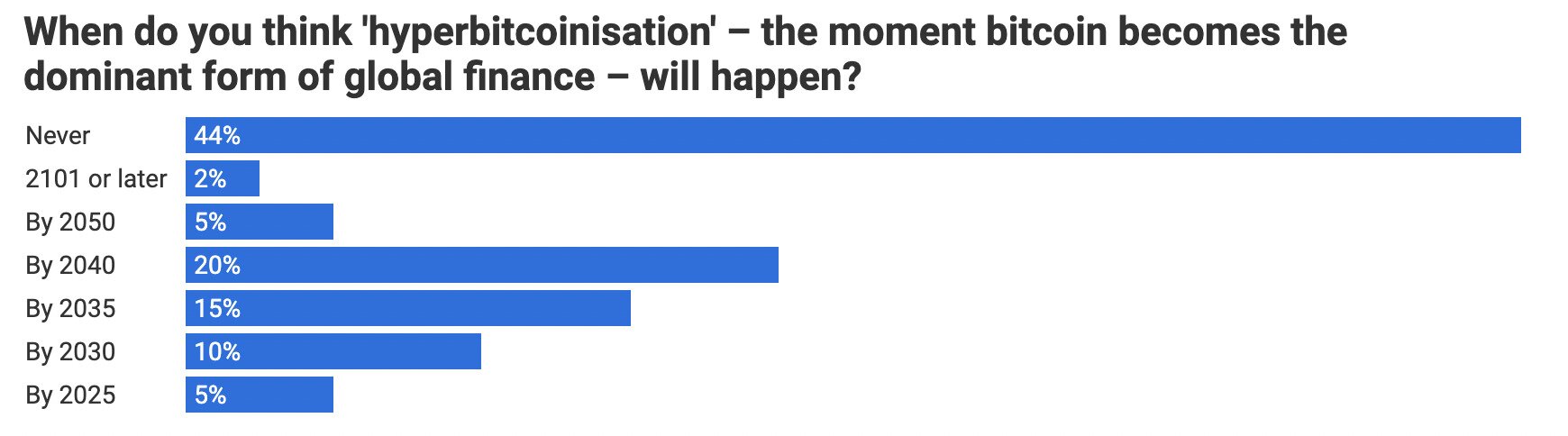

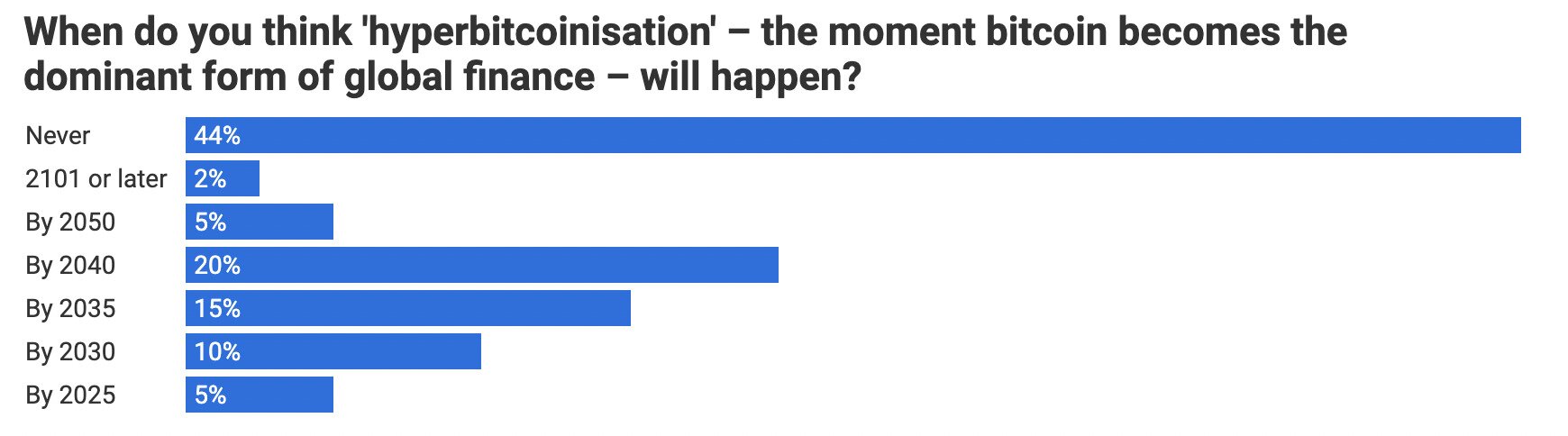

Expert Opinions and Predictions

The cryptocurrency market is known for its volatility, making expert predictions inherently uncertain. However, analyzing the perspectives of leading analysts can offer valuable insights into potential future price movements.

Bullish Predictions

Several prominent analysts maintain a bullish outlook on Bitcoin's price, predicting continued growth based on various factors.

- Many experts point to the increasing institutional adoption and the limited supply of Bitcoin as key drivers for future price appreciation.

- Some analysts cite the growing use of Bitcoin as a hedge against inflation in uncertain macroeconomic environments as a bullish indicator.

- [Link to a reputable source supporting a bullish prediction]

Bearish Predictions

Conversely, some experts hold a bearish view, highlighting potential risks that could trigger a price correction or prolonged downturn.

- Concerns remain about regulatory uncertainty and potential government crackdowns on cryptocurrency trading.

- The volatility inherent in the cryptocurrency market remains a significant risk factor, making substantial price drops possible.

- [Link to a reputable source supporting a bearish prediction]

Factors that Could Impact Long-Term Sustainability

Several factors could significantly influence the long-term sustainability of any Bitcoin price rebound.

Regulatory Uncertainty

The evolving regulatory landscape poses a significant challenge to Bitcoin's long-term growth.

- Differing regulatory approaches across various jurisdictions create uncertainty and could hinder widespread adoption.

- Stricter regulations could stifle innovation and limit the growth of the cryptocurrency market.

- Conversely, clear and consistent regulatory frameworks could foster greater investor confidence and market stability.

Market Sentiment and Investor Confidence

Market sentiment and investor confidence heavily influence Bitcoin's price volatility.

- Periods of fear, uncertainty, and doubt (FUD), often fueled by negative news or social media narratives, can trigger sharp price drops.

- Conversely, positive news and growing investor confidence can drive substantial price increases.

- The influence of social media and mainstream news coverage on market sentiment cannot be ignored.

Conclusion

The question of whether this Bitcoin price rebound is sustainable remains complex. While technical analysis suggests potential for continued growth, fundamental factors and expert opinions paint a mixed picture. The impact of regulatory uncertainty and shifting market sentiment underscores the inherent volatility of the cryptocurrency market. It's crucial to weigh both bullish and bearish perspectives before making any investment decisions. Conduct thorough research, stay updated on market developments, and make informed decisions based on your own risk tolerance. The ongoing debate about the long-term prospects of the Bitcoin price rebound necessitates continuous analysis and careful consideration of all available information.

Featured Posts

-

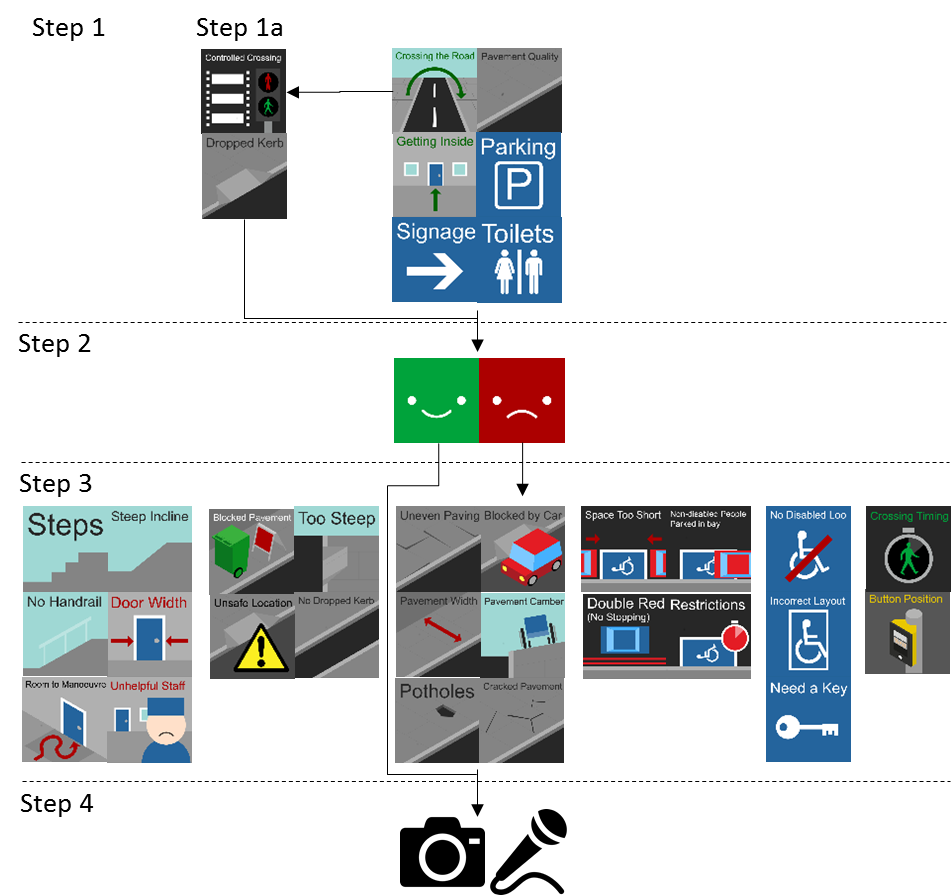

Improving Wheelchair Accessibility On The Elizabeth Line

May 09, 2025

Improving Wheelchair Accessibility On The Elizabeth Line

May 09, 2025 -

Analiza E Formacionit Te Gjysmefinaleve Te Liges Se Kampioneve Fuqia E Psg Se

May 09, 2025

Analiza E Formacionit Te Gjysmefinaleve Te Liges Se Kampioneve Fuqia E Psg Se

May 09, 2025 -

Is Figmas Ai The Future Of Design Comparing It To Adobe Word Press And Canva

May 09, 2025

Is Figmas Ai The Future Of Design Comparing It To Adobe Word Press And Canva

May 09, 2025 -

The Latest On Doohan At Williams Addressing Colapinto Driver Rumors

May 09, 2025

The Latest On Doohan At Williams Addressing Colapinto Driver Rumors

May 09, 2025 -

Na Dobar Fudbaler Na Site Vreminja Zoshto Bekam E Bez Konkurentsi A

May 09, 2025

Na Dobar Fudbaler Na Site Vreminja Zoshto Bekam E Bez Konkurentsi A

May 09, 2025

Latest Posts

-

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025 -

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025

Open Ai 2024 New Tools For Streamlined Voice Assistant Development

May 10, 2025