Is This New SPAC Stock The Next MicroStrategy? Investor Analysis

Table of Contents

The SPAC's Business Model and Investment Strategy

Understanding the SPAC's Target Market

This new SPAC, [Insert SPAC Name and Ticker], aims to disrupt the [Insert Target Industry] sector. This rapidly growing market is projected to reach [Insert Market Size Data and Projections], driven by [mention key market drivers]. The SPAC's focus on [Specific Niche within the Industry] positions it to capitalize on significant growth opportunities within this expanding market. Understanding the target market's size, growth potential, and competitive landscape is crucial for evaluating the SPAC's potential for success. A thorough understanding of market dynamics, including competitive forces and technological advancements, is vital in assessing long-term viability.

Investment Thesis and Strategy Comparison to MicroStrategy

[Insert SPAC Name and Ticker]'s investment strategy focuses on acquiring a company within the [Target Industry] that aligns with its stated goals of [mention specific goals]. This contrasts with MicroStrategy's singular focus on Bitcoin. While MicroStrategy bet heavily on a single, volatile asset, this SPAC aims for a more diversified approach within a specific industry. The SPAC's management team, led by [mention key figures and their experience], possesses extensive experience in [mention relevant fields]. Their track record suggests a capability to identify and execute successful acquisitions. However, the success of this strategy hinges on their ability to identify a target company with substantial growth potential and execute a smooth merger.

- Detailed comparison: The SPAC targets a tangible industry with established growth drivers, unlike MicroStrategy's bet on a digital asset.

- Risk tolerance: The SPAC's strategy presents lower volatility compared to MicroStrategy's Bitcoin-centric approach, although market risks still exist.

- Management expertise: The SPAC's management team possesses a proven track record within the target sector.

- Synergies and opportunities: The SPAC intends to leverage synergies between acquired companies and its existing network.

Financial Performance and Valuation

Analyzing Key Financial Metrics

[Insert SPAC Name and Ticker]'s projected financials reveal [mention key projections, e.g., revenue growth, profitability]. Comparing these projections to MicroStrategy's financials at a similar stage reveals [mention comparative data]. Key financial ratios such as the P/E ratio and debt-to-equity ratio are crucial in understanding the SPAC's valuation and risk profile. A thorough comparison with industry benchmarks provides a clearer picture of its financial health and potential.

Assessing Potential Returns and Risks

Potential returns for investors hinge on several factors, including the successful acquisition of a target company, the subsequent performance of that company, and overall market conditions. A sensitivity analysis reveals that under various scenarios, the potential returns range from [mention return range]. However, risks associated with SPAC investments include dilution, market volatility, and the possibility of the SPAC failing to find a suitable target. The SPAC's projected timeline and milestones provide a framework for assessing the probability of success.

- Key financial ratios: A direct comparison of key financial metrics with MicroStrategy's historical data provides valuable context.

- Sensitivity analysis: Exploring various market conditions illustrates the potential range of outcomes.

- Risks: Dilution, market volatility, and unsuccessful acquisitions present significant risks to investors.

- Valuation: A thorough valuation, compared to industry benchmarks and MicroStrategy's market cap at a similar stage, provides a relative assessment.

Market Sentiment and Investor Confidence

Analyzing News and Analyst Reports

Current market sentiment towards [Insert SPAC Name and Ticker] is [mention prevailing sentiment, positive, negative or neutral]. Recent news articles and analyst reports suggest [summarize key insights from news and reports]. Social media sentiment reflects [mention social media sentiment]. Analyzing this data provides a valuable indication of investor confidence and expectations.

Assessing Investor Confidence and Future Outlook

Investor confidence in the SPAC is [mention current level of confidence]. The long-term prospects for the SPAC depend on [mention key factors]. Comparing the SPAC's performance and trajectory to other successful SPACs in similar industries provides additional context. Potential regulatory hurdles or risks could significantly impact the SPAC's future performance.

- News summary: A concise summary of recent news and press releases.

- Social media sentiment: Analyzing social media sentiment reveals public perception.

- Analyst ratings: Summarize key analyst ratings and price targets.

- Successful SPAC comparisons: Comparing the SPAC to its successful peers.

- Regulatory risks: Highlighting potential regulatory obstacles.

Comparison with MicroStrategy's Journey

MicroStrategy's Success Factors

MicroStrategy's success with its Bitcoin investment strategy stems from several factors: [mention key factors, e.g., early adoption, long-term vision, management's conviction]. Understanding these elements is crucial for comparing its path with the SPAC's trajectory.

Identifying Parallels and Divergences

While MicroStrategy took a high-risk, high-reward approach with Bitcoin, [Insert SPAC Name and Ticker] adopts a more traditional acquisition strategy. Both strategies aim for significant returns, but their risk profiles and approaches differ significantly. The market conditions surrounding each investment were also vastly different.

- MicroStrategy's business model: Detailing the evolution of MicroStrategy's business and its strategic shifts.

- MicroStrategy's Bitcoin investment: Analyzing the rationale behind MicroStrategy's Bitcoin investment.

- Key decisions: Identifying strategic decisions and their impact on MicroStrategy's success.

- Market comparison: Comparing the market environment surrounding both MicroStrategy's and the SPAC's investments.

Conclusion

This analysis reveals both similarities and differences between [Insert SPAC Name and Ticker] and MicroStrategy. While MicroStrategy's success was built on a high-risk, concentrated bet on Bitcoin, this SPAC employs a more traditional acquisition strategy within a specific industry. The potential for significant returns exists, but so do considerable risks. A comprehensive understanding of the SPAC's business model, financial projections, market sentiment, and a comparison to MicroStrategy's journey are crucial for making an informed investment decision.

Investment Recommendation: While this SPAC presents a potentially interesting investment opportunity within the [Target Industry], its success hinges on numerous factors, making it a higher-risk venture compared to a more established company. Given the inherent risks associated with SPACs, a cautious approach is warranted.

Call to Action: Learn more about this exciting new SPAC stock and conduct your own thorough due diligence before investing. Mirroring the due diligence performed before investing in MicroStrategy, thoroughly research the SPAC’s target market, management team, and financial projections to make an informed investment decision. While this SPAC could potentially follow a similar growth trajectory as MicroStrategy, it’s crucial to remember that the two ventures differ significantly in their approach and risk profile. Whether this SPAC becomes the "next MicroStrategy" remains to be seen.

Featured Posts

-

9 Maya Makron I Tusk Podpishut Vazhnoe Oboronnoe Soglashenie

May 09, 2025

9 Maya Makron I Tusk Podpishut Vazhnoe Oboronnoe Soglashenie

May 09, 2025 -

Uncovering Morgans Weakness A New Theory On Davids High Potential

May 09, 2025

Uncovering Morgans Weakness A New Theory On Davids High Potential

May 09, 2025 -

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025

Mdkhnw Krt Alqdm Asmae Lamet Athrt Altdkhyn Ela Msyrtha

May 09, 2025 -

Skuadra E Psg Se 11 Lojtaret Kyc

May 09, 2025

Skuadra E Psg Se 11 Lojtaret Kyc

May 09, 2025 -

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025

Latest Posts

-

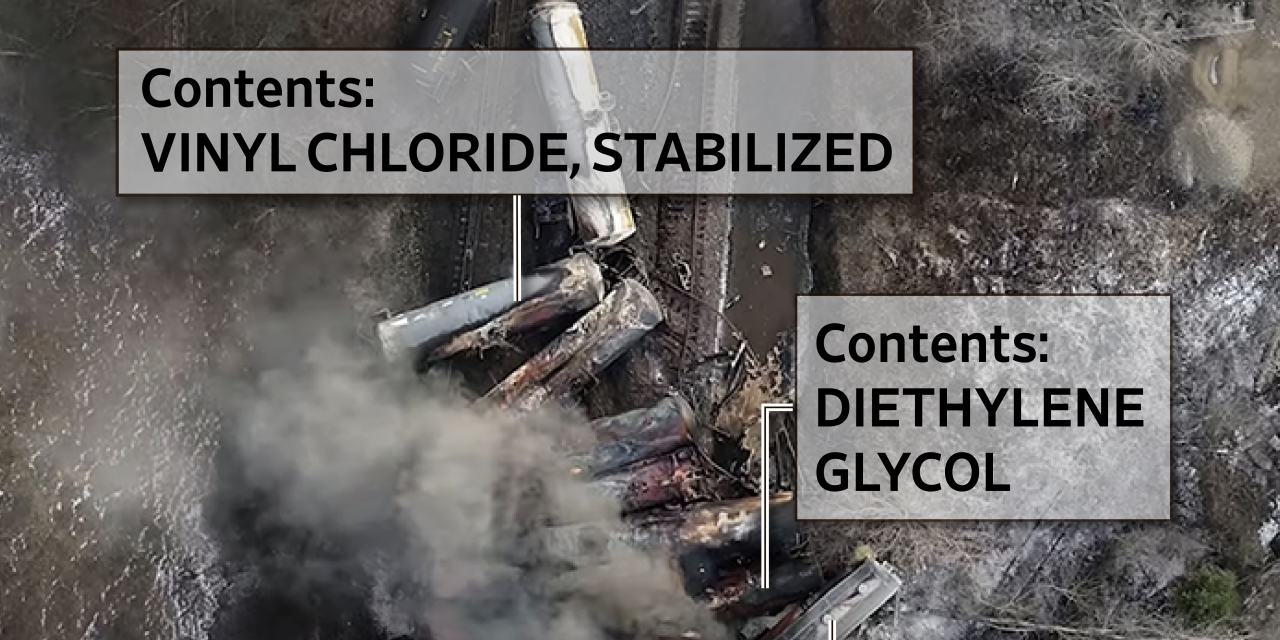

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025

Ohio Train Derailment Persistence Of Toxic Chemicals In Buildings

May 10, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025

Cybercriminals Office365 Scheme Nets Millions Federal Indictment

May 10, 2025 -

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025

Office365 Executive Inboxes Targeted Millions Stolen Fbi Reports

May 10, 2025