Is Uber Recession-Proof? Analyst Insights And Stock Outlook

Table of Contents

Uber's Business Model and Resilience During Economic Slowdowns

Uber's unique business model offers a degree of resilience during economic downturns, but it's not without its challenges. Let's examine the key aspects.

The Two-Sided Marketplace Advantage

Uber's platform connects riders and drivers (or customers and delivery drivers), creating a powerful network effect. This inherent structure can be surprisingly resilient during recessions.

- Increased demand for affordable transportation during recession: When personal finances tighten, people may choose ride-sharing as a cost-effective alternative to car ownership, especially for essential trips.

- Potential for increased driver participation due to job losses in other sectors: Economic downturns often lead to job losses, which can drive individuals to seek supplemental income through platforms like Uber. This increases driver supply, potentially offsetting some demand reduction.

- Decreased ridership during a recession is a possibility, but the extent depends on the severity and duration of the downturn. However, the affordability of ride-sharing compared to personal vehicle ownership and maintenance could still create some demand, even in a challenging economic climate.

Diversification Across Services

Uber's diversification beyond ride-sharing is a significant factor in its potential recession resistance. Uber Eats, for example, has proven to be relatively resilient during previous economic slowdowns.

- Resilience of food delivery even during recessions: People still need to eat, and food delivery often remains a convenient option, even during tougher economic times.

- Growth opportunities in new markets: Uber continues to expand its services into new geographic areas and demographics, diversifying its revenue streams and reducing reliance on any single market.

- Potential for cross-selling and upselling opportunities across platforms: A user ordering food through Uber Eats might be more likely to use Uber for transportation, creating synergistic revenue streams. Data from recent quarters shows a strong performance from Uber Eats, compensating for potential dips in ride-sharing revenue.

Analyst Sentiment and Stock Performance

Understanding analyst sentiment and historical stock performance offers valuable insights into Uber's potential behavior during a recession.

Current Analyst Ratings and Price Targets

As of [Insert Date], analyst ratings for Uber stock vary. [Cite specific sources like Bloomberg, Yahoo Finance, etc., and include a table summarizing buy, hold, and sell ratings from several reputable firms]. The range of price targets reflects differing opinions on Uber's future trajectory and its ability to navigate economic headwinds.

Historical Stock Performance During Past Recessions

Analyzing Uber's (and similar companies') performance during previous recessions can provide valuable context. [Insert charts and graphs depicting historical stock performance during past downturns. Compare this to the performance of the broader market. Highlight key factors impacting the stock during those periods, such as overall economic conditions, technological disruptions, or competitive pressures].

Key Risks and Challenges for Uber During a Recession

Despite its strengths, Uber faces several significant challenges during economic downturns.

Fuel Prices and Inflation

Rising fuel costs directly impact driver earnings and profitability, potentially leading to reduced driver supply and increased fares. Inflation can also decrease consumer spending, reducing demand for ride-sharing and delivery services.

- Increased operational costs for Uber: Higher fuel prices translate to higher operational expenses, squeezing profit margins.

- Potential for price increases reducing demand: Passing increased costs onto consumers through higher fares or delivery fees can reduce demand, especially during a recession.

- Strategies to mitigate these risks: Uber might employ dynamic pricing strategies to adjust fares based on demand and supply, and explore partnerships to secure more favorable fuel prices.

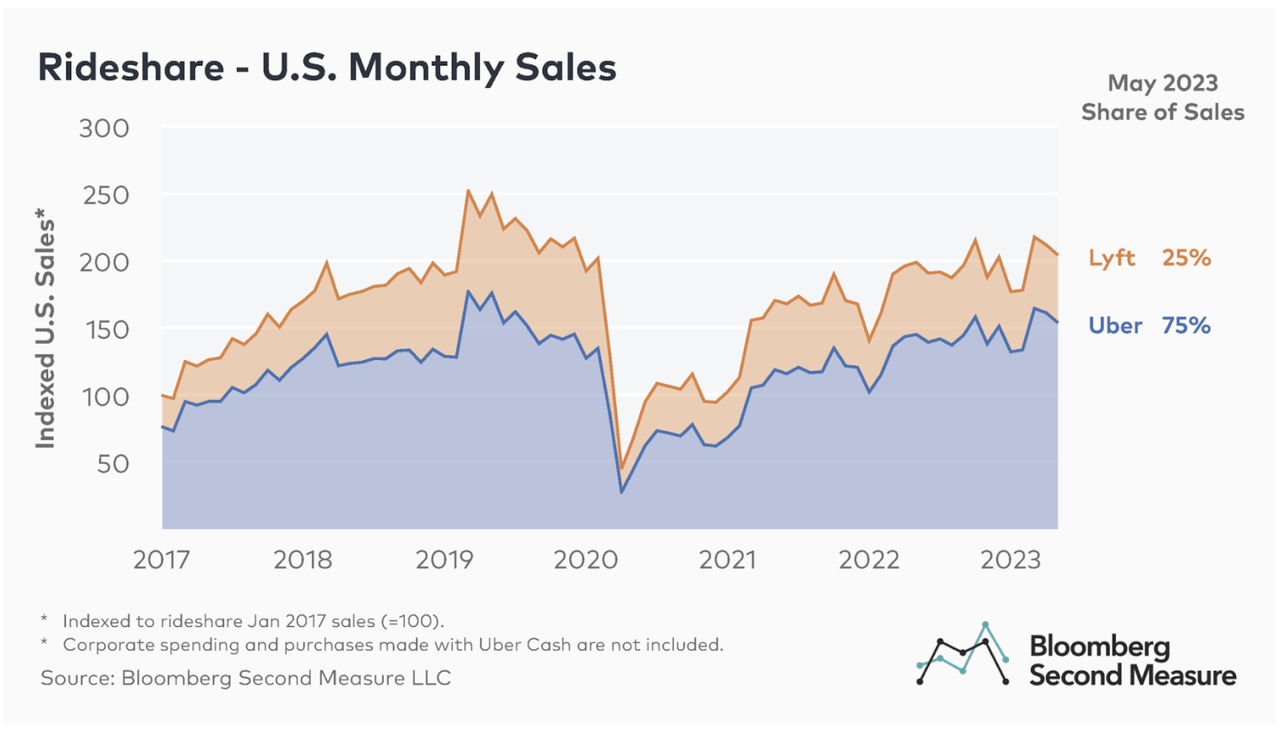

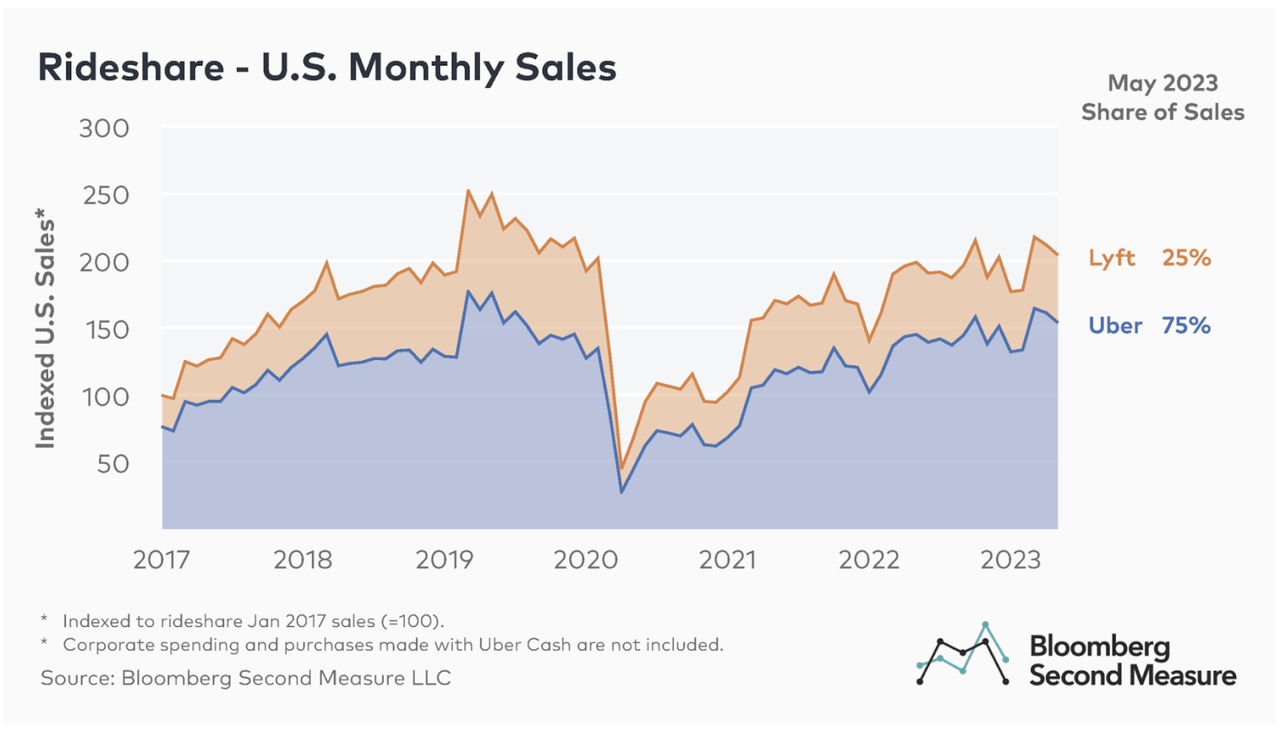

Competition and Market Saturation

The ride-sharing and food delivery markets are fiercely competitive, with major players like Lyft, DoorDash, and others vying for market share. Increased competition can intensify price wars and reduce profit margins.

- Key competitors (Lyft, DoorDash, etc.): These companies present ongoing competitive pressures, especially during times of economic uncertainty.

- Impact of increased competition on pricing and market share: Competition can lead to price wars, reducing Uber's profitability and potentially impacting market share.

- Strategies to maintain a competitive edge: Uber might focus on innovation, strategic partnerships, and superior customer service to differentiate itself and maintain its competitive edge.

Regulatory Hurdles and Legal Challenges

Ongoing regulatory scrutiny and potential legal battles can significantly impact Uber's financial performance and investor confidence.

- Examples of regulatory changes impacting the company: Ongoing debates around worker classification, data privacy, and safety regulations can create uncertainty.

- Potential for legal costs and fines: Legal challenges can lead to significant financial burdens, impacting profitability.

- Strategies to manage these challenges: Uber proactively engages with regulators and implements measures to comply with evolving regulations.

Conclusion

Uber's diversified business model and its ability to adapt to changing market conditions offer some level of resilience against economic downturns. However, several significant risks, including rising fuel costs, intense competition, and regulatory uncertainties, need careful consideration. Analyst sentiment is mixed, with price targets varying widely. While the "Uber recession-proof" debate is ongoing, analyzing historical performance and understanding these potential risks are crucial for investors.

Call to Action: While Uber displays certain characteristics that suggest some degree of recession-resistance, thorough due diligence is essential before making any investment decisions concerning Uber stock. Continue researching the company's financial performance and consider diverse investment strategies to navigate economic uncertainties effectively. Further analyze the implications of the Uber recession-proof debate to inform your investment decisions.

Featured Posts

-

Kanye Wests Super Bowl Ban Taylor Swift Feud Explained

May 18, 2025

Kanye Wests Super Bowl Ban Taylor Swift Feud Explained

May 18, 2025 -

Mlb Dfs May 8th Expert Picks Sleepers And Players To Fade

May 18, 2025

Mlb Dfs May 8th Expert Picks Sleepers And Players To Fade

May 18, 2025 -

Amanda Bynes Announces New Showbiz Venture Her First In 15 Years

May 18, 2025

Amanda Bynes Announces New Showbiz Venture Her First In 15 Years

May 18, 2025 -

Damiano David Un Artista Solista L Annuncio Ufficiale

May 18, 2025

Damiano David Un Artista Solista L Annuncio Ufficiale

May 18, 2025 -

Is The Osama Bin Laden Manhunt Documentary Available On Netflix

May 18, 2025

Is The Osama Bin Laden Manhunt Documentary Available On Netflix

May 18, 2025

Latest Posts

-

April 30 2025 Daily Lotto Winning Numbers Announced

May 18, 2025

April 30 2025 Daily Lotto Winning Numbers Announced

May 18, 2025 -

Winning Daily Lotto Numbers Friday April 25 2025

May 18, 2025

Winning Daily Lotto Numbers Friday April 25 2025

May 18, 2025 -

25 April 2025 Daily Lotto Winning Numbers

May 18, 2025

25 April 2025 Daily Lotto Winning Numbers

May 18, 2025 -

Check The Daily Lotto Results For Wednesday 30th April 2025

May 18, 2025

Check The Daily Lotto Results For Wednesday 30th April 2025

May 18, 2025 -

Daily Lotto Results Friday 25 04 2025

May 18, 2025

Daily Lotto Results Friday 25 04 2025

May 18, 2025