Is XRP A Commodity? SEC Regulatory Uncertainty And Its Impact On XRP

Table of Contents

The SEC's Case Against Ripple and its Implications for XRP's Classification

The SEC's lawsuit against Ripple Labs, filed in December 2020, lies at the heart of the debate surrounding XRP's classification. The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. Their central argument hinges on the Howey Test, a legal framework used to determine whether an investment constitutes a security.

The SEC argues that XRP sales involved an investment of money in a common enterprise, with a reasonable expectation of profits derived from the efforts of others (Ripple). They point to Ripple's active involvement in marketing and promoting XRP, as well as its control over a significant portion of the XRP supply, as evidence supporting their claim.

- Key Allegations in the SEC's Complaint:

- Ripple engaged in an unregistered offering of securities.

- Ripple's sales of XRP were not exempt from registration requirements.

- Ripple misled investors about the nature of XRP.

- Ripple profited significantly from the sale of XRP.

The outcome of this legal battle will set a crucial precedent for the crypto industry, potentially affecting the classification of other cryptocurrencies and influencing future regulatory frameworks. The SEC lawsuit, along with the ongoing debate on XRP classification, has created significant uncertainty for investors and businesses alike.

Arguments for XRP as a Commodity

Conversely, proponents of XRP's commodity classification highlight its decentralized nature and its functional utility within the RippleNet payment network. They argue that XRP, unlike many other cryptocurrencies, lacks the characteristics typically associated with securities.

- Key Arguments for XRP as a Commodity:

- Decentralization: XRP operates on a decentralized ledger, reducing the influence of any single entity.

- Utility: XRP functions as a bridge currency facilitating faster and cheaper cross-border transactions within RippleNet. This provides real-world utility, unlike some cryptocurrencies that solely exist as speculative investments.

- Market Forces: XRP's price is primarily determined by market supply and demand, rather than being controlled by a central issuer.

- Absence of Investment Contracts: There's no explicit promise of profits derived from Ripple's efforts to purchasers of XRP.

These arguments suggest that XRP exhibits characteristics more closely aligned with traditional commodities, traded based on market forces rather than investment contracts promising future returns based on the efforts of others.

The Ongoing Regulatory Uncertainty and its Impact on XRP's Market

The ongoing legal battle has significantly impacted XRP's market. The uncertainty surrounding its classification has led to considerable price volatility and affected investor confidence. Many exchanges delisted XRP during the height of the lawsuit, limiting trading opportunities for investors.

- Consequences of Regulatory Uncertainty:

- Price Volatility: XRP's price has experienced significant swings due to the uncertainty surrounding its legal status.

- Exchange Listings: Many exchanges delisted XRP, reducing trading liquidity.

- Investor Confidence: The uncertainty has eroded investor confidence in XRP.

- Innovation: Regulatory uncertainty hinders the development and adoption of XRP-related technologies.

The long-term consequences of the SEC's decision could be far-reaching, potentially influencing how regulators approach other cryptocurrencies and shaping the future of the digital asset landscape.

International Regulatory Perspectives on XRP

Regulatory approaches to XRP vary across jurisdictions. While the SEC's stance is highly influential, other regulatory bodies around the world have adopted different approaches. This creates a complex international regulatory environment that may impact XRP's future development and adoption. Understanding these international differences is crucial for a comprehensive understanding of the XRP commodity debate.

- Examples of differing regulatory stances: Some jurisdictions might consider XRP a utility token, others a security, and some might have no specific regulations yet.

The lack of global regulatory harmonization creates challenges for XRP's widespread adoption and presents significant hurdles for businesses operating in multiple jurisdictions.

Conclusion: The Future of XRP and its Commodity Status

The question of "Is XRP a commodity?" remains unanswered, pending the final resolution of the SEC's lawsuit against Ripple. The arguments presented for and against XRP's commodity classification highlight the complexities involved in classifying cryptocurrencies within existing legal frameworks. The SEC's decision will have a profound impact on the cryptocurrency market and XRP investors alike.

The potential outcomes range from XRP being classified as a commodity, potentially boosting its value and adoption, to being deemed a security, which could severely restrict its trading and usage. A balanced perspective acknowledges the inherent risks and uncertainties associated with investing in XRP given the ongoing legal battle.

Stay informed about the evolving legal landscape surrounding XRP and its classification as a commodity or security. Understanding the risks associated with investing in XRP is crucial for navigating this uncertain regulatory environment. The ongoing debate surrounding XRP's commodity status is a pivotal moment for the entire cryptocurrency industry, and continued monitoring of the situation is essential.

Featured Posts

-

Mental Health Awareness Understanding The Silence And Finding Support Featuring Dr Shradha Malik

May 02, 2025

Mental Health Awareness Understanding The Silence And Finding Support Featuring Dr Shradha Malik

May 02, 2025 -

Rubio Urges De Escalation As India Reiterates Call For Justice

May 02, 2025

Rubio Urges De Escalation As India Reiterates Call For Justice

May 02, 2025 -

Mwqe Bkra Ykshf Akthr 30 Laeb Wmdrb Mkrwhyn Fy Tarykh Krt Alqdm

May 02, 2025

Mwqe Bkra Ykshf Akthr 30 Laeb Wmdrb Mkrwhyn Fy Tarykh Krt Alqdm

May 02, 2025 -

Ahead Computings 21 5 Million Seed Funding Round

May 02, 2025

Ahead Computings 21 5 Million Seed Funding Round

May 02, 2025 -

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

May 02, 2025

Jw 24 Thdhyr Sryh Lslah Bshan Mghamrath Alkhtyrt

May 02, 2025

Latest Posts

-

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

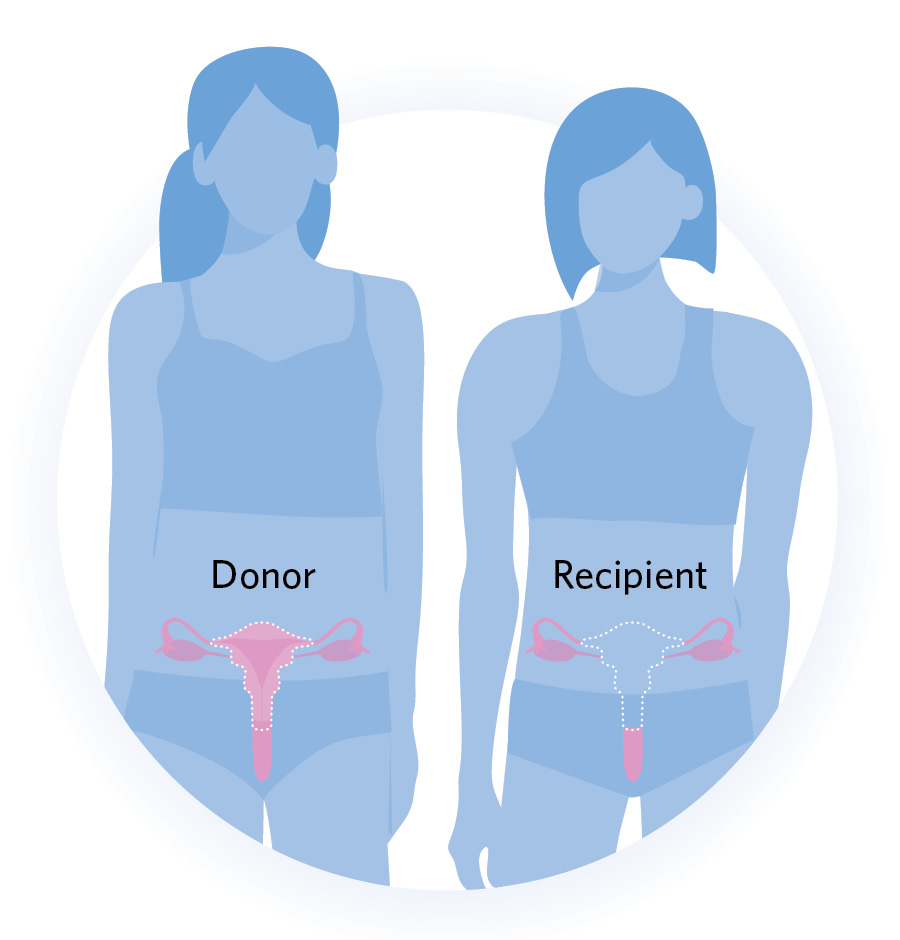

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025 -

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025 -

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025