Is XRP's 400% 3-Month Rally A Buying Opportunity? Analysis And Predictions.

Table of Contents

XRP's Recent Price Surge: A Deep Dive into the 400% Rally

Analyzing the Factors Behind the Rally:

XRP's dramatic price increase isn't solely attributable to one factor. Instead, a confluence of events has contributed to this impressive rally. Let's break down the key drivers:

- Increased Trading Volume and Market Capitalization: The significant increase in trading volume reflects heightened investor interest and market participation in XRP. This, coupled with a substantial rise in market capitalization, signals a potential shift in market sentiment.

- Positive Developments in the Ongoing SEC Lawsuit: Positive developments, such as favorable court rulings or statements from involved parties, can significantly impact investor confidence and drive up XRP's price. Any sign of progress in resolving the SEC lawsuit favorably for Ripple is likely to be a major catalyst.

- Growing Adoption of XRP in the Payment Sector: Increased adoption by payment providers and financial institutions boosts XRP's utility and network effect, potentially leading to increased demand and price appreciation. This increased utility makes XRP more attractive to investors.

- Influence of Broader Cryptocurrency Market Trends: The overall cryptocurrency market environment plays a crucial role. Positive movements in Bitcoin's price, for example, can create a ripple effect across the entire market, impacting XRP's price as well.

[Insert Chart/Graph illustrating XRP's price movement over the past three months here]

Evaluating the Sustainability of the Rally:

Predicting the long-term sustainability of this rally requires a nuanced approach. While the 400% increase is remarkable, it's crucial to examine several factors:

- Short-Term vs. Long-Term Price Predictions: Short-term predictions are highly speculative, influenced by market volatility and news events. Long-term predictions, however, should consider the underlying technology, adoption rates, and regulatory landscape.

- Potential Resistance and Support Levels: Technical analysis can help identify key resistance levels (price points where upward momentum might stall) and support levels (price points where downward pressure might ease). These levels can offer insights into potential price targets and risk management strategies.

- On-Chain Metrics: Examining on-chain data, such as transaction volume and whale activity (large XRP holders' actions), provides insights into market sentiment and potential future price movements. Increased transaction volume, for example, can indicate growing adoption and network activity.

The SEC Lawsuit and its Impact on XRP's Future

Current Status of the SEC vs. Ripple Case:

The ongoing SEC lawsuit against Ripple Labs is a major factor influencing XRP's price. The outcome of the case could significantly impact XRP's future:

- Key Arguments and Recent Developments: A summary of the arguments presented by both sides, along with any recent court decisions or settlements, should be included here. Mention key legal precedents cited by both sides.

- Potential Outcomes and Their Impact on XRP's Price: A positive outcome for Ripple could lead to a significant price surge, while an unfavorable outcome could trigger a sharp decline. This analysis must consider both possibilities and their potential impact.

- Expert Opinions and Legal Analysis: Incorporating expert opinions from legal professionals and market analysts provides valuable context and insights into the potential legal ramifications.

The Ripple Effect on Investor Sentiment and Market Confidence:

The lawsuit's progression directly impacts investor confidence and market stability for XRP:

- Impact on Investor Confidence: Negative news related to the lawsuit can trigger sell-offs, while positive news can lead to price rallies. Investor sentiment is highly volatile in response to legal updates.

- Impact of Regulatory Uncertainty: Regulatory uncertainty surrounding XRP's status as a security creates volatility. Clarity on this issue could bring stability, but until then, the market will remain susceptible to price fluctuations.

- Influence of Positive/Negative News: Any news related to the case, be it positive or negative, immediately impacts investor sentiment and the price. Monitoring news sources is crucial for understanding market fluctuations.

Technical Analysis: Chart Patterns and Predictions

Identifying Key Technical Indicators:

Technical analysis provides a framework for predicting future price movements:

- Key Technical Indicators: Analyzing indicators like moving averages (MA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help determine potential price trends and identify buy/sell signals.

- Chart Patterns: Identifying patterns such as head and shoulders, double tops/bottoms, and triangles can provide additional insights into potential price movements. Visual representations are crucial for explaining these patterns.

- [Insert relevant charts and graphs illustrating the technical analysis here]

Setting Realistic Price Targets and Stop-Loss Levels:

Based on technical analysis, it's possible to set potential price targets:

- Potential Price Targets: These targets should be based on identified support and resistance levels, along with other technical indicators. It's essential to state clearly that these are projections, not guarantees.

- Importance of Stop-Loss Orders: Setting stop-loss orders is crucial for risk management. This helps limit potential losses if the price moves against the expected direction. Explain how to set realistic stop-loss levels.

Adoption and Utility: XRP's Role in the Payment Ecosystem

Analyzing XRP's Use Cases and Partnerships:

XRP's potential lies in its utility within the financial sector:

- Cross-Border Payments: Explain XRP's efficiency and speed in facilitating international transactions compared to traditional methods. Highlight the cost advantages.

- Other Applications: Explore other applications where XRP's technology is being used, such as remittance services and decentralized finance (DeFi).

- Partnerships and Collaborations: Discuss any strategic partnerships that are enhancing XRP's adoption and utility within the payment ecosystem.

Assessing the Potential for Future Growth and Demand:

The long-term potential of XRP depends on several factors:

- Long-Term Prospects: Evaluate the factors that could drive long-term growth and demand for XRP, including its potential to become a widely adopted cross-border payment solution.

- Adoption Rate: Discuss the factors that could influence the adoption rate of XRP, such as the regulatory landscape, user-friendliness, and partnerships with major financial institutions.

Conclusion: Is XRP a Buy or Sell? Final Verdict and Actionable Insights

This analysis reveals a complex picture. While XRP's 400% rally is impressive, the ongoing SEC lawsuit introduces significant uncertainty. The potential for wider adoption within the payment ecosystem suggests a long-term upside, but the risks associated with the legal battle are substantial. Therefore, a cautious approach is recommended.

Our final verdict is that XRP presents a high-risk, high-reward investment opportunity. Investors should carefully assess their risk tolerance before investing. Consider diversifying your portfolio to mitigate risks. Implement stop-loss orders to protect your investment. Continuously monitor news and legal updates related to the SEC lawsuit.

Actionable Advice:

- Conduct thorough due diligence and research before making any investment decisions.

- Consider your risk tolerance and diversify your portfolio accordingly.

- Use stop-loss orders to manage risk and limit potential losses.

- Stay informed about the SEC lawsuit and other market developments impacting XRP.

Remember, this analysis is for informational purposes only and is not financial advice. Do your own research and assess your risk tolerance before investing in XRP.

Featured Posts

-

Xrp Gains Momentum Ripple Legal Battle Update And Us Etf Implications

May 02, 2025

Xrp Gains Momentum Ripple Legal Battle Update And Us Etf Implications

May 02, 2025 -

Is Xrp A Commodity The Ripple Case And Implications Of Sec Settlement

May 02, 2025

Is Xrp A Commodity The Ripple Case And Implications Of Sec Settlement

May 02, 2025 -

Building Voice Assistants Made Easy Open Ais Latest Advancements

May 02, 2025

Building Voice Assistants Made Easy Open Ais Latest Advancements

May 02, 2025 -

Technical Failure Strands Passengers On Kogi Train Route

May 02, 2025

Technical Failure Strands Passengers On Kogi Train Route

May 02, 2025 -

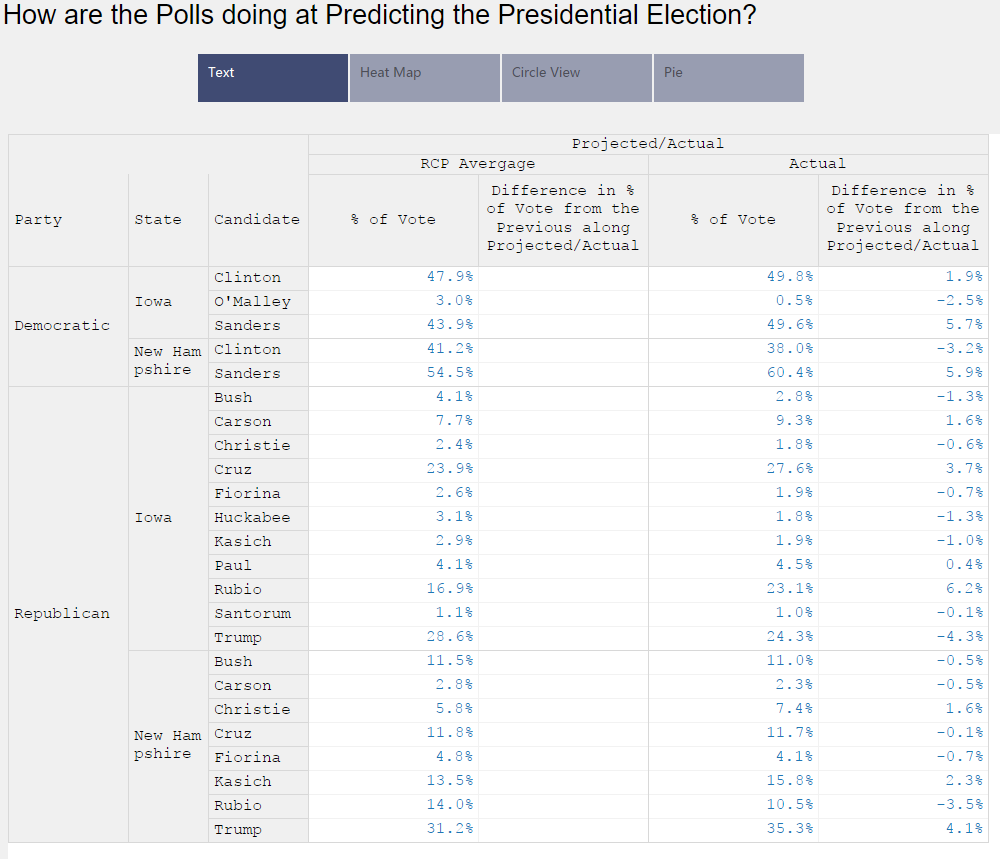

Improving Election Accuracy With A Robust Poll Data System

May 02, 2025

Improving Election Accuracy With A Robust Poll Data System

May 02, 2025

Latest Posts

-

Deconstructing The Arguments Around Trumps Transgender Military Ban

May 10, 2025

Deconstructing The Arguments Around Trumps Transgender Military Ban

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban An Opinion

May 10, 2025

The Impact Of Trumps Transgender Military Ban An Opinion

May 10, 2025 -

Trumps Transgender Military Policy A Comprehensive Analysis

May 10, 2025

Trumps Transgender Military Policy A Comprehensive Analysis

May 10, 2025 -

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025 -

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025