Japan's Steep Yield Curve: A Growing Concern For Investors And The Economy

Table of Contents

Understanding Japan's Yield Curve

Defining the Yield Curve

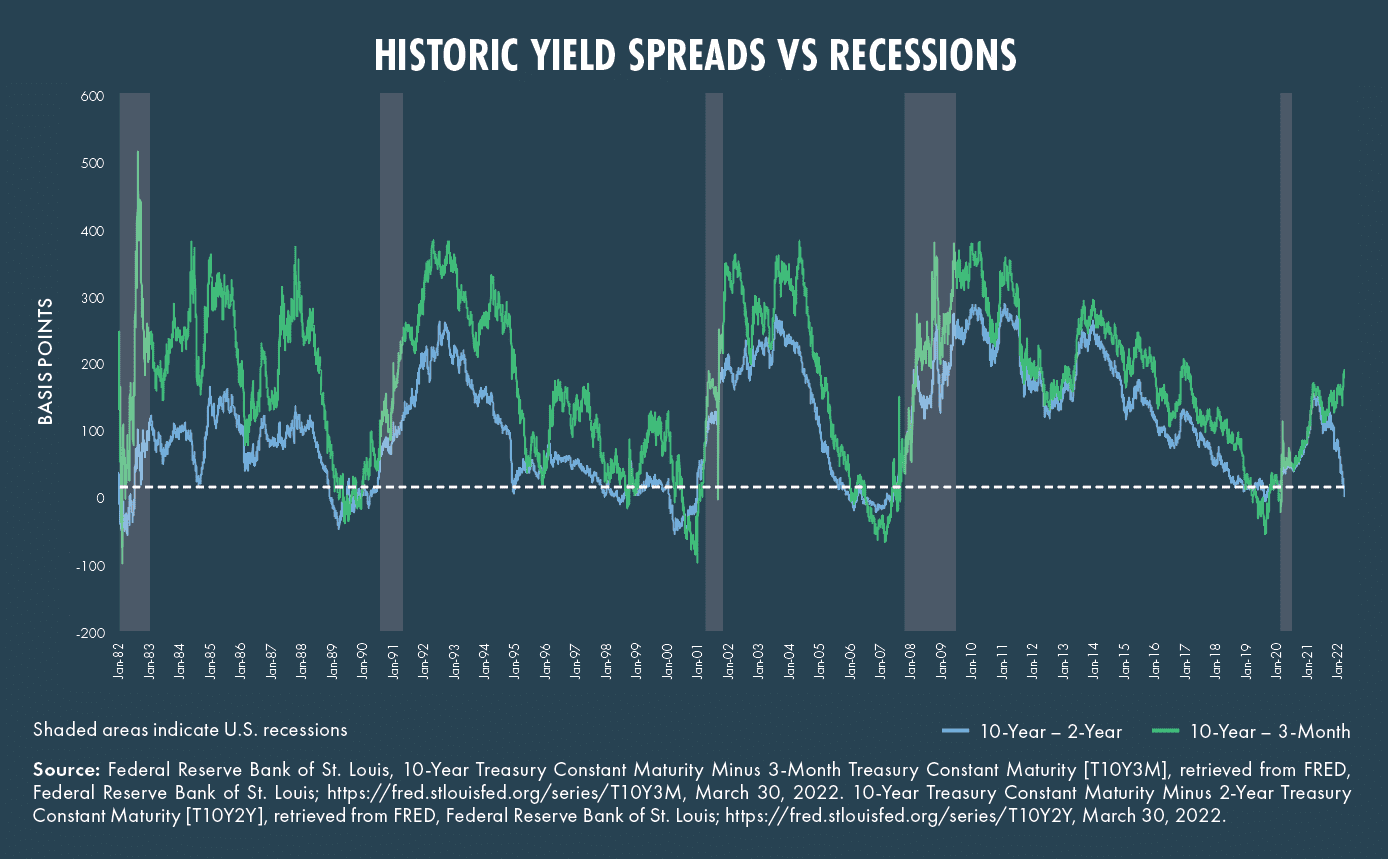

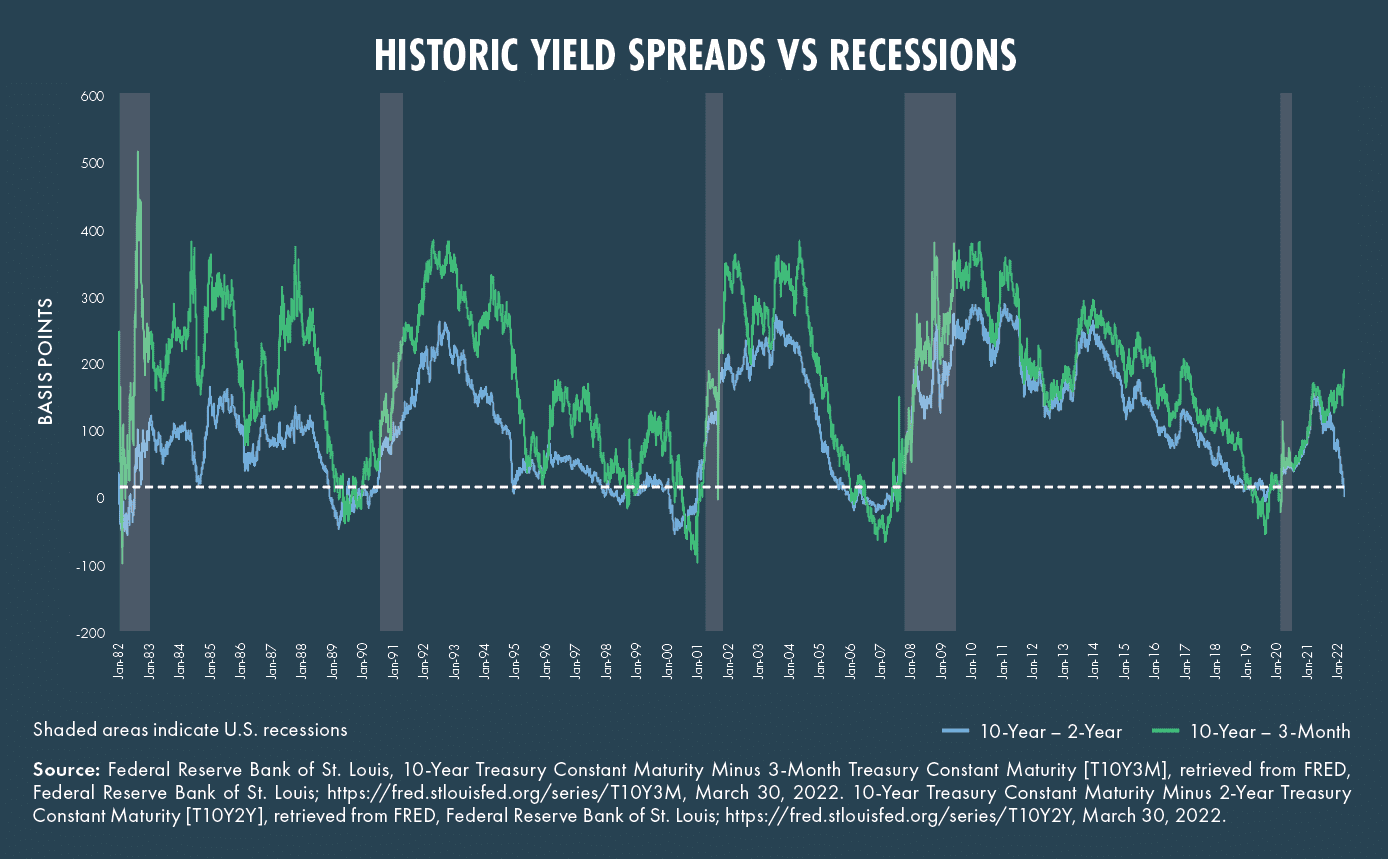

A yield curve illustrates the relationship between the interest rates (yields) and the time to maturity of debt securities with the same credit quality. It's a graphical representation of these yields plotted against their maturities. Different shapes reveal market sentiment and expectations about future interest rates. A normal yield curve slopes upward, indicating that long-term bonds offer higher yields than short-term bonds, reflecting higher perceived risk for longer-term investments. An inverted yield curve, where short-term yields exceed long-term yields, often signals an impending economic slowdown or recession. A flat yield curve shows minimal difference between short-term and long-term yields.

Japanese Government Bonds (JGBs) are the benchmark debt securities issued by the Japanese government. They form the backbone of Japan's yield curve and are crucial for understanding the dynamics of the Japanese financial market. The JGB market is one of the largest and most liquid government bond markets globally. Changes in JGB yields directly impact the broader Japanese economy and financial system.

- Definition of yield curve and its significance: The yield curve is a crucial indicator of economic health and future interest rate expectations.

- Explanation of normal, inverted, and flat yield curve shapes: Each shape carries a different economic interpretation, reflecting investor confidence and expectations.

- Description of Japanese Government Bonds (JGBs) and their role in the Japanese yield curve: JGBs are the primary driver of the Japanese yield curve.

- Visual aid: [Insert chart showing the recent evolution of Japan's yield curve here. Source should be cited.]

Causes of the Steepening Yield Curve

The Bank of Japan's Monetary Policy

The Bank of Japan's (BOJ) Yield Curve Control (YCC) policy has played a significant role in shaping the Japanese yield curve. YCC aims to manage long-term interest rates by setting a target for the 10-year JGB yield. However, the recent steepening of the curve suggests challenges to the effectiveness of this policy. The BOJ's attempts to maintain low interest rates in the face of rising global inflation and increasing market pressure have contributed to the widening gap between short-term and long-term yields.

- Detailed explanation of the BOJ's Yield Curve Control (YCC) policy: Focus on its mechanics and intended effects.

- Analysis of the BOJ's recent adjustments to YCC: Highlight any changes and their impact on the yield curve.

- Discussion of the challenges the BOJ faces in maintaining its monetary policy goals: Analyze the conflicting pressures the BOJ is under.

- Mention potential market speculation and its role in yield curve movements: Speculation can amplify yield curve shifts.

Inflationary Pressures

Rising inflation is a key factor driving the steepening of Japan's yield curve. Increased inflation expectations lead investors to demand higher yields on long-term JGBs to compensate for the erosion of purchasing power. Global inflationary pressures, driven by factors such as supply chain disruptions and increased energy prices, have further exacerbated this effect in Japan. The current inflation rates in Japan, while relatively moderate compared to some other developed economies, are still putting upward pressure on long-term interest rates.

- Explanation of the relationship between inflation and long-term interest rates: Higher inflation generally leads to higher long-term interest rates.

- Discussion of current inflation levels in Japan: Cite relevant data and sources.

- Analysis of the impact of global inflation on Japan's yield curve: Explain the transmission mechanism of global inflation to Japan's bond market.

- Mention of potential future inflation scenarios and their implications: Discuss the uncertainties around future inflation and its possible effects on the yield curve.

Implications for Investors and the Economy

Impact on Investors

The steepening yield curve in Japan presents both risks and opportunities for investors. The increased yield spread between short and long-term JGBs introduces greater volatility and uncertainty. Investing in JGBs with longer maturities carries increased interest rate risk. On the other hand, the widening spread also opens up opportunities for sophisticated investors to employ hedging strategies and potentially profit from yield curve arbitrage.

- Risks associated with investing in JGBs in a steep yield curve environment: Highlight the potential for capital losses.

- Potential opportunities for investors (e.g., hedging strategies): Explain how investors can potentially benefit.

- Discussion of alternative investment options in Japan: Consider other asset classes and their relative risks and rewards.

- Importance of diversification in the context of Japan's yield curve: Emphasize risk management through portfolio diversification.

Economic Consequences

A steep yield curve can have significant consequences for the Japanese economy. Increased borrowing costs for businesses and consumers could dampen economic growth and investment. A sharp increase in long-term interest rates could strain the financial health of highly indebted companies and potentially destabilize the financial system. Government intervention may be required to manage the yield curve and mitigate these risks.

- Impact on borrowing costs for businesses and consumers: Explain the transmission mechanism.

- Potential effects on economic growth and investment: Discuss the potential for a slowdown.

- Implications for the overall stability of the Japanese financial system: Analyze potential systemic risks.

- Discussion of potential government interventions to manage the yield curve: Consider the possible policy responses.

Conclusion

Japan's steep yield curve is a complex issue stemming from a combination of the BOJ's monetary policy challenges and rising inflationary pressures. This steepening curve presents significant risks and uncertainties for investors and the broader Japanese economy. The potential for increased borrowing costs, dampened economic growth, and financial instability necessitates close monitoring. Understanding the dynamics of Japan's yield curve is crucial for making informed investment decisions and assessing the future trajectory of the Japanese economy. Investors and economists need to carefully monitor Japan's yield curve and its implications. Stay informed about developments concerning Japan's steep yield curve to mitigate risks and capitalize on potential opportunities.

Featured Posts

-

Alianza Lima Vs Talleres Goles Resumen Y Resultado Final 2 0

May 17, 2025

Alianza Lima Vs Talleres Goles Resumen Y Resultado Final 2 0

May 17, 2025 -

Knicks Overtime Heartbreak Averted Or Just Delayed

May 17, 2025

Knicks Overtime Heartbreak Averted Or Just Delayed

May 17, 2025 -

Boston Celtics Ownership Change 6 1 Billion Sale Sparks Debate Among Fans

May 17, 2025

Boston Celtics Ownership Change 6 1 Billion Sale Sparks Debate Among Fans

May 17, 2025 -

Rune Pobeduje Alkarasa U Finalu Barselone Uprkos Povredi

May 17, 2025

Rune Pobeduje Alkarasa U Finalu Barselone Uprkos Povredi

May 17, 2025 -

Auckland Southern Motorway E Scooter Incident Dashcam Captures Reckless Act

May 17, 2025

Auckland Southern Motorway E Scooter Incident Dashcam Captures Reckless Act

May 17, 2025