Jim Cramer's Foot Locker (FL) Pick: A Genuine Winner?

Table of Contents

Foot Locker's Recent Performance and Financial Health

Analyzing Foot Locker's recent performance requires a close look at its quarterly earnings reports and revenue trends. Key financial metrics like earnings per share (EPS), revenue growth, and debt levels provide crucial insights into the company's financial health and stability. Understanding these metrics is essential to evaluating the validity of Jim Cramer's Foot Locker prediction.

-

Comparison to Competitors: Foot Locker faces stiff competition from industry giants like Nike and Adidas. Comparing FL's performance against these competitors reveals its relative strength and market position within the athletic footwear and apparel sector. Analyzing market share and growth rates offers a comparative perspective.

-

Impact of External Factors: Supply chain disruptions and persistent inflation significantly impact FL's profitability. These macroeconomic factors influence production costs, pricing strategies, and overall financial outcomes. Analyzing the company's ability to mitigate these challenges is crucial.

-

Inventory Management: Foot Locker's inventory management practices directly affect its sales and profitability. Efficient inventory management minimizes storage costs and ensures the availability of in-demand products. Inefficient management, on the other hand, can lead to losses due to obsolete stock or lost sales due to stockouts.

Cramer's Rationale Behind His Foot Locker Recommendation

To understand the potential of Foot Locker stock, we must examine the reasoning behind Jim Cramer's recommendation. What specific factors influenced his positive outlook on FL? Understanding his perspective helps assess the validity of his prediction.

-

Growth Catalysts: Did Cramer cite specific catalysts for future growth, such as new product lines, innovative marketing campaigns, or strategic partnerships? Identifying these potential growth drivers is crucial for evaluating the long-term prospects of FL.

-

Long-Term Potential: What were Cramer's expectations regarding FL's long-term potential? Did he project significant growth in revenue, market share, or profitability? His assessment of the company's future trajectory is a key element of his recommendation.

-

Risk Assessment: Importantly, did Cramer acknowledge any risks associated with investing in FL? A balanced assessment should include both the potential upside and downside of the investment. Identifying potential risks is crucial for making informed investment decisions.

Market Analysis and Future Outlook for Foot Locker

Analyzing current market trends in the athletic footwear and apparel industry is essential for evaluating Foot Locker's future outlook. Considering expert opinions and analyst ratings for FL stock further enriches the analysis.

-

Valuation Metrics: Examining FL's current price-to-earnings ratio (P/E) provides insight into its valuation relative to its earnings. Comparing this to industry averages helps determine if FL is overvalued or undervalued.

-

Earnings Growth Projections: Analyzing projected earnings growth rates for FL provides insight into the potential for future returns. Growth projections should be considered in conjunction with other market factors.

-

Upcoming Catalysts: Are there any upcoming catalysts that could significantly impact FL's stock price? New store openings, innovative product launches, or strategic partnerships could all influence the stock price. These catalysts must be carefully considered.

Risks and Potential Downside of Investing in Foot Locker

While Jim Cramer's Foot Locker (FL) pick might seem promising, potential risks and downsides must be considered before investing. A comprehensive risk assessment is crucial for making informed investment decisions.

-

E-commerce Competition: The rise of e-commerce poses a significant challenge to Foot Locker's brick-and-mortar stores. The company's ability to adapt to the changing retail landscape is a critical factor.

-

Changing Consumer Preferences: Fashion trends and consumer preferences are fickle. Foot Locker's vulnerability to shifts in these preferences is a key risk factor. Analyzing current trends and predicting future changes is crucial.

-

Debt Levels: High debt levels can increase financial risk and limit the company's ability to respond to unexpected challenges. Assessing FL's debt burden and its impact on financial flexibility is essential.

Conclusion

This article analyzed Jim Cramer's recommendation on Foot Locker (FL) stock, considering its recent performance, financial health, market outlook, and potential risks. While Cramer's bullish stance presents a compelling argument, investors should conduct thorough due diligence before making any investment decisions. Weighing the potential rewards against the associated risks is crucial for informed investment choices.

Call to Action: Before making any investment decisions based on Jim Cramer’s Foot Locker (FL) pick or any other stock recommendation, remember to conduct your own thorough research and consider consulting a qualified financial advisor. Do your homework and make an informed decision about whether Foot Locker is a genuine winner for your portfolio. Investing in Foot Locker stock, or any stock for that matter, requires careful consideration of all relevant factors and a thorough understanding of your own risk tolerance.

Featured Posts

-

Private Equity Firm Acquires Boston Celtics In Record 6 1 Billion Deal

May 16, 2025

Private Equity Firm Acquires Boston Celtics In Record 6 1 Billion Deal

May 16, 2025 -

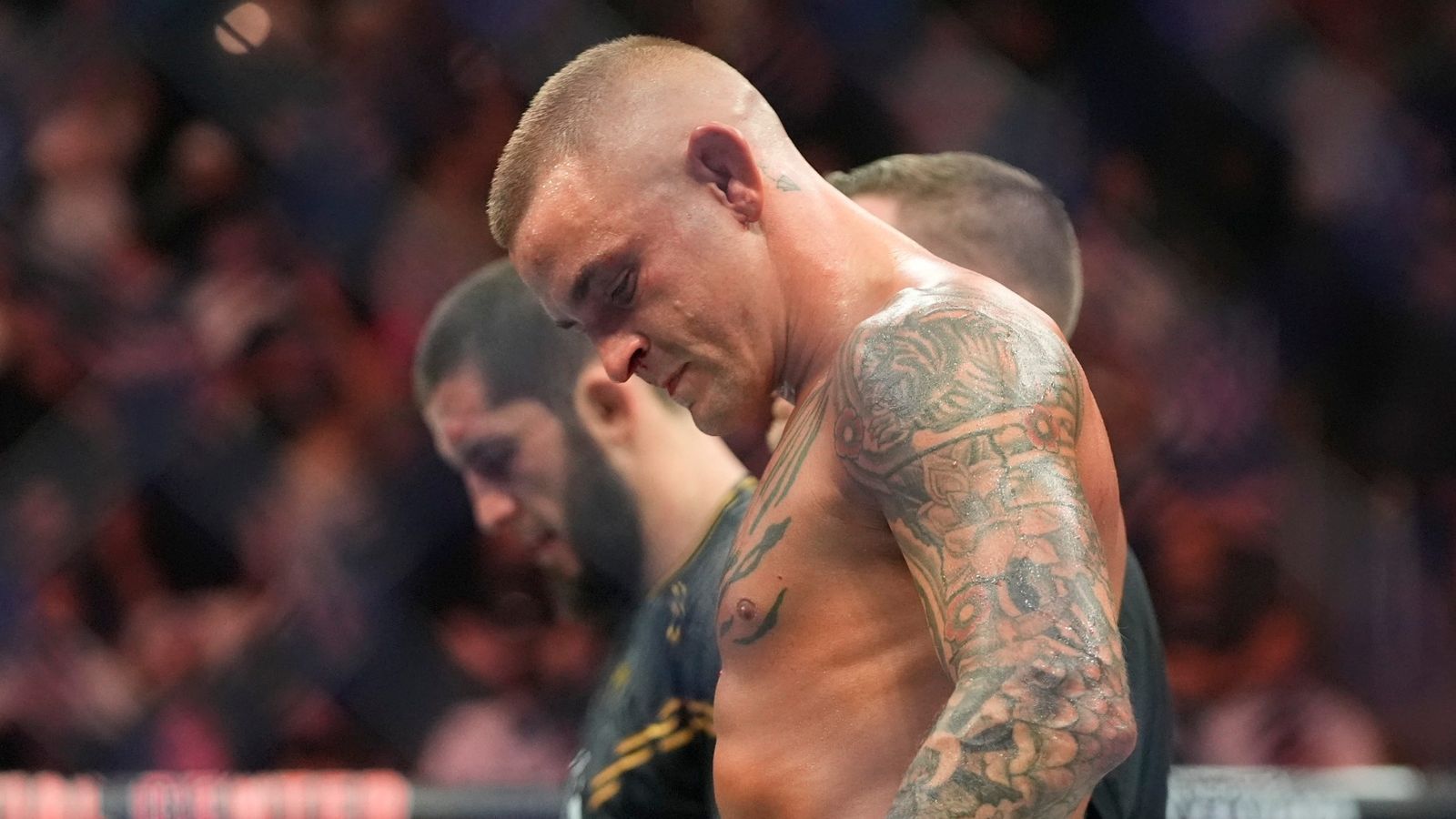

Is Dustin Poiriers Retirement A Done Deal Paddy Pimbletts Perspective

May 16, 2025

Is Dustin Poiriers Retirement A Done Deal Paddy Pimbletts Perspective

May 16, 2025 -

Luis Arraez And Jason Heyward Power Padres Sweep Pursuit

May 16, 2025

Luis Arraez And Jason Heyward Power Padres Sweep Pursuit

May 16, 2025 -

Kid Cudis Personal Items Fetch Record Prices At Auction

May 16, 2025

Kid Cudis Personal Items Fetch Record Prices At Auction

May 16, 2025 -

From Forgotten Signing To La Diamond A Dodgers Story

May 16, 2025

From Forgotten Signing To La Diamond A Dodgers Story

May 16, 2025