KSE 100 Index Freefall: Operation Sindoor And Market Volatility

Table of Contents

Operation Sindoor: The Trigger for Market Volatility?

Understanding Operation Sindoor:

Operation Sindoor, a government initiative [ insert brief, factual description of Operation Sindoor and its stated goals here ], has been met with considerable controversy. Its perceived negative impact on various sectors of the Pakistani economy has significantly contributed to the uncertainty fueling the KSE 100 Index's volatility.

- Specifics of Operation Sindoor: [ Insert detailed bullet points outlining the specifics of the operation, including its implementation, target areas, and potential economic consequences. ]

- Uncertainty and Investor Confidence: The lack of transparency surrounding Operation Sindoor and its potential long-term effects has created significant uncertainty in the market. This uncertainty erodes investor confidence, leading to a reluctance to invest and prompting existing investors to sell their holdings.

The Psychological Impact on Investors:

The negative news surrounding Operation Sindoor triggered a wave of panic selling, exacerbating the KSE 100 Index's decline. This demonstrates the powerful influence of investor psychology on market behavior.

- Herd Behavior: Fear and uncertainty led to herd behavior, where investors, fearing further losses, followed the actions of others and sold their assets en masse, further accelerating the market downturn.

- Investor Sentiment and Confidence: The overall investor sentiment regarding the Pakistani economy has taken a significant hit. The negative perception of Operation Sindoor has dampened confidence, leading many to seek safer investments outside the PSX.

Analyzing the KSE 100 Index Freefall:

Magnitude and Speed of the Decline:

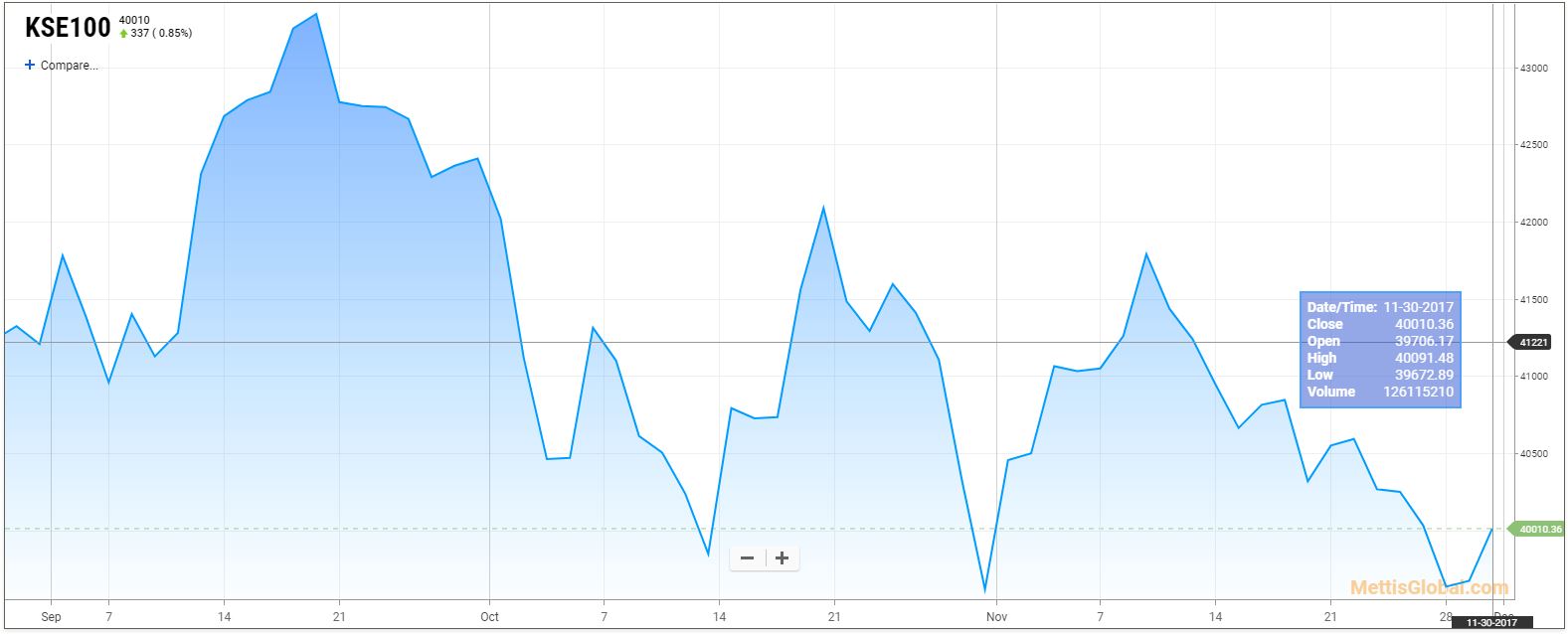

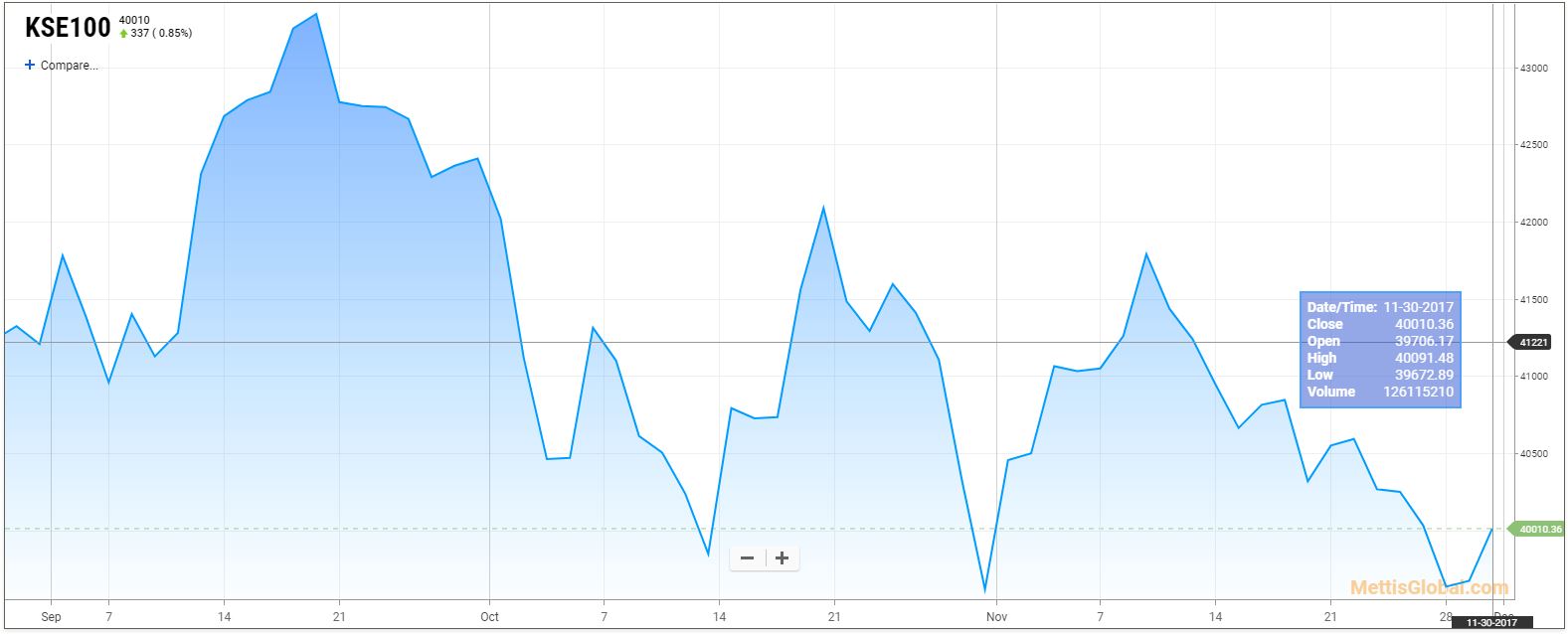

The KSE 100 Index experienced a dramatic [ insert percentage ] decline within [ insert timeframe ]. This represents [ insert comparison to previous market downturns, e.g., "one of the sharpest declines in recent history," or a comparison to a specific previous crash ].

- Visual Representation: [ Insert charts and graphs (if available) visually depicting the KSE 100 Index's decline. Clearly label axes and provide a concise caption. ]

- Comparison to Previous Downturns: [ Provide a detailed comparison with other notable declines in the KSE 100 Index, citing specific dates and percentage drops. This provides context and allows readers to gauge the severity of the current situation. ]

Impact on Different Sectors:

The KSE 100 Index freefall disproportionately affected certain sectors. [ Insert specific sectors and percentage declines. ] For example, the [ mention specific sector ] sector experienced a sharper decline due to [ explain the reasons for the sector-specific impact – e.g., direct regulatory impact, reduced consumer confidence, etc. ].

- Sector-Specific Reactions: [ Detail how different sectors reacted to the overall market volatility. Consider factors like industry-specific regulations, consumer spending patterns, and international market trends. ]

- Implications for Specific Companies: [ Discuss the impact on specific companies listed on the KSE 100, providing examples of companies that were heavily affected and explaining why. ]

Navigating Market Volatility: Strategies for Investors:

Risk Management Techniques:

During times of high market volatility, employing robust risk management strategies is crucial.

- Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate) and sectors reduces the impact of any single investment's poor performance.

- Stop-Loss Orders: Stop-loss orders automatically sell your assets when they reach a predetermined price, limiting potential losses.

- Long-Term Investment Strategy: Maintaining a long-term investment perspective is key. Avoid impulsive decisions based on short-term market fluctuations.

Opportunities Amidst the Volatility:

While the current market conditions are challenging, opportunities may arise for discerning investors.

- Undervalued Stocks: The sharp decline may have created opportunities to acquire undervalued stocks in fundamentally sound companies. Thorough research is critical.

- Informed Decision-Making: Avoid panic-driven decisions. Careful analysis and a long-term perspective can help investors identify opportunities and mitigate risks.

Conclusion:

The KSE 100 Index freefall, significantly impacted by the uncertainty surrounding Operation Sindoor, underscores the importance of understanding the interplay between political events and market fluctuations. The speed and magnitude of the decline highlighted the vulnerability of the Pakistani stock market to sudden shifts in investor sentiment and economic uncertainty. Effective risk management techniques and a long-term investment strategy are crucial for navigating such turbulent periods.

Call to Action: Understanding the KSE 100 Index's volatility and its correlation with events like Operation Sindoor is crucial for informed investing in the Pakistani market. Stay informed about the latest developments on the PSX, conduct thorough research before making any investment decisions, and develop a robust investment strategy that accounts for potential market fluctuations and geopolitical risks. Further research into the long-term effects of Operation Sindoor and its continued impact on the KSE 100 Index is essential for all investors.

Featured Posts

-

R5

May 09, 2025

R5

May 09, 2025 -

Elizabeth Hurley Showcasing Her Cleavage Through The Years

May 09, 2025

Elizabeth Hurley Showcasing Her Cleavage Through The Years

May 09, 2025 -

Aoc Criticizes Pro Trump Fox News Commentary

May 09, 2025

Aoc Criticizes Pro Trump Fox News Commentary

May 09, 2025 -

How Harry Styles Reacted To That Awful Snl Impression Of Him

May 09, 2025

How Harry Styles Reacted To That Awful Snl Impression Of Him

May 09, 2025 -

Bitcoin Madenciligi Gelecegi Ve Sonu

May 09, 2025

Bitcoin Madenciligi Gelecegi Ve Sonu

May 09, 2025

Latest Posts

-

Resultat National 2 Dijon S Incline Face A Concarneau 0 1

May 09, 2025

Resultat National 2 Dijon S Incline Face A Concarneau 0 1

May 09, 2025 -

Dijon Concarneau 0 1 Resume Du Match De National 2 28e Journee

May 09, 2025

Dijon Concarneau 0 1 Resume Du Match De National 2 28e Journee

May 09, 2025 -

Accident Mortel A Dijon Chute D Un Jeune Ouvrier D Un Immeuble

May 09, 2025

Accident Mortel A Dijon Chute D Un Jeune Ouvrier D Un Immeuble

May 09, 2025 -

Dijon Un Ouvrier Meurt Apres Une Chute Du Quatrieme Etage

May 09, 2025

Dijon Un Ouvrier Meurt Apres Une Chute Du Quatrieme Etage

May 09, 2025 -

New Uk Visa Policy Restrictions On Applications From Select Countries

May 09, 2025

New Uk Visa Policy Restrictions On Applications From Select Countries

May 09, 2025