Lack Of Funds: Overcoming Financial Barriers

Table of Contents

Identifying the Root Causes of Your Lack of Funds

Understanding why you're facing a lack of funds is the first step towards solving the problem. This involves a thorough examination of your spending habits, income streams, and existing debt.

Analyzing Your Spending Habits

Tracking your expenses is crucial for identifying areas where you can cut back. Many budgeting apps can simplify this process.

- Track expenses: Use budgeting apps like Mint, YNAB (You Need A Budget), or Personal Capital to monitor your spending.

- Identify areas for reduction: Analyze your spending patterns to pinpoint unnecessary expenses. Differentiate between needs (essential expenses like rent and food) and wants (non-essential expenses like entertainment and dining out).

- Create a realistic budget: Develop a budget that aligns with your income and expenses. Be realistic about your spending habits and stick to your plan.

Creating a realistic and detailed budget is the cornerstone of effective financial management. It allows you to visualize your cash flow and make informed decisions about your spending.

Evaluating Your Income Streams

Exploring ways to increase your income is another vital step in addressing a lack of funds.

- Explore additional income opportunities: Consider part-time jobs, freelancing, gig work (like driving for a ride-sharing service or delivering food), or selling unused items online.

- Negotiate a raise or seek a higher-paying job: Research industry salary standards and prepare to negotiate a raise with your current employer. If necessary, actively search for higher-paying employment opportunities.

- Diversify income sources: Relying on a single income source can be risky. Diversifying your income streams creates financial stability and resilience.

Uncovering Hidden Debt

Hidden debt can significantly contribute to a lack of funds. It's essential to identify and address all outstanding debts.

- List all debts: Create a comprehensive list of all your debts, including credit cards, loans, and any other outstanding balances.

- Calculate total debt and interest: Determine the total amount of debt you owe and the associated interest rates. High interest rates can quickly exacerbate financial problems.

- Explore debt consolidation or debt management options: Consider debt consolidation loans to simplify repayments or explore debt management plans if you're struggling to manage your debt. Understanding interest rates and fees is vital for making informed decisions.

Strategies for Addressing Lack of Funds

Once you've identified the root causes, you can implement strategies to address your lack of funds.

Budgeting and Saving Techniques

Effective budgeting and saving are crucial for overcoming financial difficulties.

- The 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Create an emergency fund: Aim to save 3-6 months' worth of living expenses in an emergency fund to cover unexpected costs.

- Automate savings: Set up automatic transfers from your checking account to your savings account to make saving effortless. Consider high-yield savings accounts to maximize your returns.

Consistent saving habits, even small amounts, can make a significant difference over time.

Seeking Financial Assistance

Don't hesitate to seek help if you're struggling. Various resources can provide financial assistance.

- Government assistance programs: Research government assistance programs like food stamps, housing assistance, or unemployment benefits.

- Charitable organizations: Many charitable organizations offer financial assistance to individuals and families in need.

- Non-profit resources: Non-profit organizations often provide financial counseling and support services.

Remember to check eligibility requirements and application processes for each program.

Improving Financial Literacy

Improving your financial literacy empowers you to make informed decisions and manage your finances effectively.

- Take online courses: Numerous online platforms offer free or affordable courses on personal finance.

- Read financial books: Explore reputable books and articles on budgeting, saving, investing, and debt management.

- Attend workshops: Participate in financial literacy workshops offered by community organizations or financial institutions.

Long-Term Financial Planning to Prevent Future Lack of Funds

Proactive financial planning is essential to prevent future financial hardship.

Investing for the Future

Investing your money wisely can help you build wealth and secure your financial future.

- Types of investments: Explore different investment options like stocks, bonds, mutual funds, and ETFs (exchange-traded funds).

- Diversification: Don't put all your eggs in one basket. Diversify your investments to reduce risk.

- Risk tolerance: Understand your risk tolerance before investing. Start with low-risk investments and gradually increase your risk exposure as you gain experience.

Start small and learn as you go. Many online resources offer beginner-friendly guides to investing.

Building Credit

A good credit score opens doors to better financial opportunities.

- Importance of good credit score: A good credit score is essential for securing loans, mortgages, and credit cards at favorable interest rates.

- Paying bills on time: Make all your payments on time to maintain a good credit history.

- Responsible credit card use: Use credit cards responsibly and avoid accumulating high balances.

Monitor your credit report regularly and take steps to correct any errors.

Developing a Financial Mindset

Adopting a positive and proactive financial mindset is crucial for long-term success.

- Setting realistic financial goals: Set achievable short-term and long-term financial goals.

- Prioritizing needs over wants: Learn to distinguish between needs and wants and prioritize accordingly.

- Patience and discipline: Building financial security requires patience, discipline, and consistent effort.

Conclusion: Overcoming Financial Barriers and Addressing Lack of Funds

Overcoming a lack of funds requires a multi-faceted approach. Identifying the root causes, implementing effective budgeting techniques, seeking assistance when needed, and proactively planning for the future are all critical steps. By improving your financial literacy, you empower yourself to make informed decisions and take control of your financial well-being. Don't let lack of funds control your life. Start implementing these strategies today and take control of your financial future! Address your financial challenges proactively and build a strong foundation for lasting financial stability.

Featured Posts

-

Macrons Call To Eu Buy European Not American

May 21, 2025

Macrons Call To Eu Buy European Not American

May 21, 2025 -

Open Ai Facing Ftc Investigation Concerns And Potential Outcomes

May 21, 2025

Open Ai Facing Ftc Investigation Concerns And Potential Outcomes

May 21, 2025 -

A New Addition To The Pig Family Its A Girl

May 21, 2025

A New Addition To The Pig Family Its A Girl

May 21, 2025 -

Penn Relays Allentown Boys Make History With First Sub 43 4x100m Relay

May 21, 2025

Penn Relays Allentown Boys Make History With First Sub 43 4x100m Relay

May 21, 2025 -

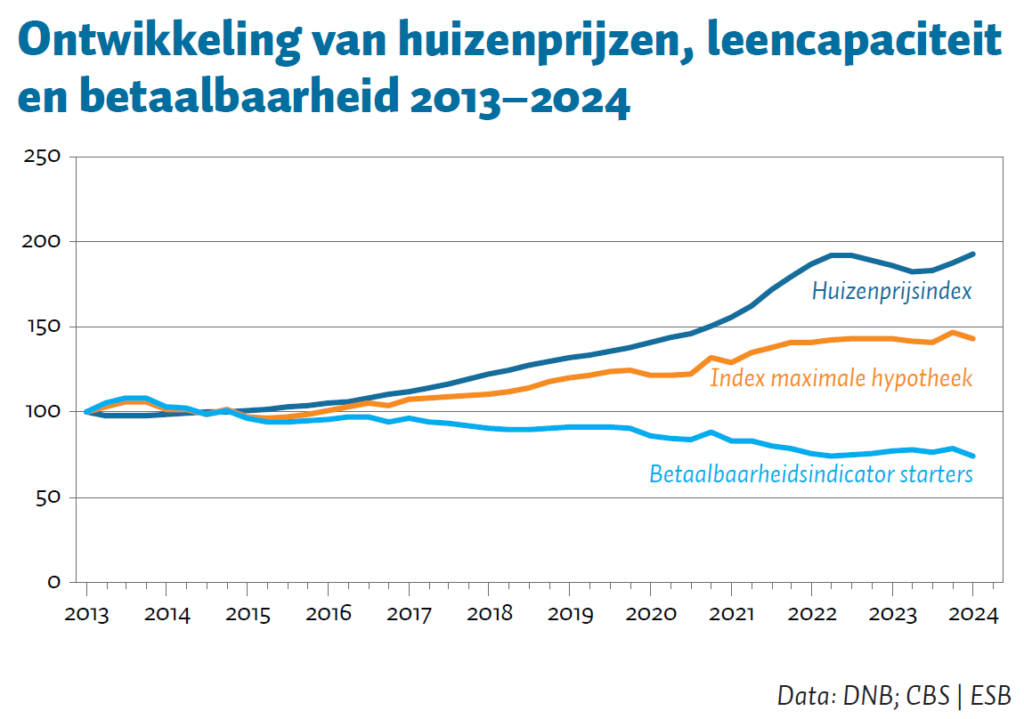

Abn Amro En Geen Stijl Oneens Over Betaalbaarheid Woningen

May 21, 2025

Abn Amro En Geen Stijl Oneens Over Betaalbaarheid Woningen

May 21, 2025

Latest Posts

-

Llm Powering Siri Apples Plan For A Smarter Assistant

May 21, 2025

Llm Powering Siri Apples Plan For A Smarter Assistant

May 21, 2025 -

Revolutionizing Software Development Chat Gpts Integrated Ai Coding Agent

May 21, 2025

Revolutionizing Software Development Chat Gpts Integrated Ai Coding Agent

May 21, 2025 -

Analyzing Apples Llm Strategy For Siris Enhancement

May 21, 2025

Analyzing Apples Llm Strategy For Siris Enhancement

May 21, 2025 -

The Forever Mouse Logitechs Opportunity For A Revolutionary Design

May 21, 2025

The Forever Mouse Logitechs Opportunity For A Revolutionary Design

May 21, 2025 -

Chat Gpts New Ai Coding Agent A Developers Game Changer

May 21, 2025

Chat Gpts New Ai Coding Agent A Developers Game Changer

May 21, 2025