Lagarde's Strategy: Elevating The Euro's Global Standing Via EUR/USD

Table of Contents

Interest Rate Hikes and their Impact on EUR/USD

The ECB's aggressive interest rate hikes are a cornerstone of Lagarde's strategy to strengthen the Euro. These hikes are primarily designed to combat stubbornly high inflation within the Eurozone.

Combating Inflation:

Higher interest rates make the Euro more attractive to foreign investors seeking higher returns. This increased demand for the Euro, in turn, strengthens the EUR/USD exchange rate. The ECB's actions are a direct response to inflation pressures exceeding their target.

- Analysis: A strong correlation exists between interest rate adjustments and EUR/USD fluctuations. Historically, rate hikes have generally led to a stronger Euro against the dollar, although the relationship is not always linear.

- Downsides: Aggressive rate hikes, while effective in curbing inflation, can also slow economic growth, potentially triggering a recession. This is a crucial balancing act for the ECB.

- Comparison: The ECB's approach to rate hikes has been compared and contrasted with that of other major central banks, particularly the Federal Reserve (Fed) in the United States. The divergence in monetary policy strategies between these two influential institutions significantly impacts the EUR/USD exchange rate.

Market Reaction and Volatility:

The market's reaction to the ECB's monetary policy changes has been significant, leading to periods of considerable volatility in the EUR/USD pair.

- Speculation and Sentiment: Market speculation and investor sentiment play a crucial role in driving EUR/USD price action. Positive economic news and expectations of continued rate hikes often boost the Euro, while negative news or concerns about the Eurozone economy can lead to a decline.

- Geopolitical Events: Geopolitical events, such as the war in Ukraine and the ongoing energy crisis, have also significantly impacted the EUR/USD exchange rate, often overriding the impact of monetary policy decisions in the short term.

- Price Movements: Charts and graphs illustrating the correlation between ECB interest rate decisions and subsequent EUR/USD price movements provide a visual representation of this dynamic relationship.

Quantitative Tightening and its Influence on the Euro

In addition to interest rate hikes, the ECB has employed quantitative tightening (QT) measures to further influence the Euro's value.

Reducing the ECB's Balance Sheet:

QT involves the reduction of the ECB's balance sheet through the unwinding of its asset purchase programs. This reduces the amount of liquidity in the Eurozone. By reducing liquidity, the ECB aims to control inflation and further support the Euro.

- Consequences of QT: QT's potential consequences on Eurozone growth and stability are a subject of ongoing debate. While it helps control inflation, it can also slow economic expansion.

- Comparison with Other Central Banks: The ECB's QT strategy is being compared and contrasted with those of other central banks globally, providing insights into best practices and potential pitfalls.

- Long-Term Implications: The long-term implications of QT on the EUR/USD exchange rate remain uncertain, dependent on various economic factors and global market conditions.

Geopolitical Factors and their Effect on EUR/USD

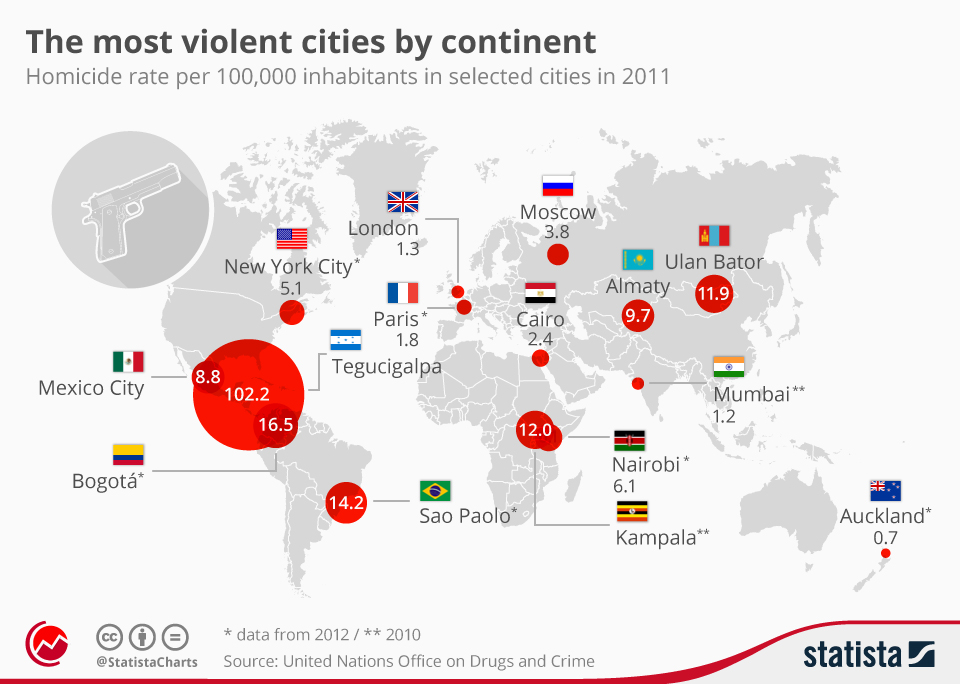

Geopolitical factors play a significant role in influencing the EUR/USD exchange rate, often overshadowing the impact of monetary policy in the short term.

Energy Crisis and its Influence:

The ongoing energy crisis in Europe, exacerbated by the war in Ukraine, poses a significant challenge to the Eurozone economy and the EUR/USD exchange rate.

- Energy Dependence: Europe's dependence on Russian energy imports has made its economy vulnerable to geopolitical shocks.

- Diversification Strategies: Eurozone countries are actively pursuing diversification strategies to reduce their reliance on Russian energy and mitigate future risks.

- Euro's Resilience: The Euro's ability to withstand energy market fluctuations and regain strength depends heavily on the success of these diversification efforts and overall economic recovery.

The War in Ukraine and its Economic Repercussions:

The war in Ukraine has had profound economic repercussions for the Eurozone, significantly affecting the EUR/USD exchange rate.

- Supply Chain Disruptions: The war has disrupted supply chains, leading to increased inflation and slower economic growth.

- Sanctions on Russia: Sanctions imposed on Russia have had ripple effects across the global economy, including the Eurozone.

- EU Support for Ukraine: The EU's substantial financial and humanitarian aid to Ukraine has further strained the Eurozone's budget and economy.

Conclusion

Christine Lagarde's strategy for strengthening the Euro's global standing, as reflected in the EUR/USD exchange rate, is a complex interplay of interest rate adjustments, quantitative tightening, and navigating volatile geopolitical landscapes. Understanding these dynamics is crucial for investors and businesses operating within the Eurozone and globally. By closely monitoring the ECB's actions and their impact on the EUR/USD pair, you can better anticipate market trends and make informed decisions. Stay informed on Lagarde's Euro strategy and its continuing impact on the EUR/USD to optimize your financial planning. Continuously analyze Lagarde's Euro strategy and its effects on the EUR/USD for successful navigation of the forex market.

Featured Posts

-

Stream The 2025 American Music Awards Online A Free Viewers Guide

May 28, 2025

Stream The 2025 American Music Awards Online A Free Viewers Guide

May 28, 2025 -

Hailee Steinfelds Gma Outfit A Closer Look

May 28, 2025

Hailee Steinfelds Gma Outfit A Closer Look

May 28, 2025 -

Todays Mlb Game Brewers Vs Diamondbacks Predictions Betting Odds And Analysis

May 28, 2025

Todays Mlb Game Brewers Vs Diamondbacks Predictions Betting Odds And Analysis

May 28, 2025 -

Marlin Fishing The Growing Popularity Of Torpedo Bats

May 28, 2025

Marlin Fishing The Growing Popularity Of Torpedo Bats

May 28, 2025 -

Wolverines Most Violent X Men 97 Moment A Look Back After One Year

May 28, 2025

Wolverines Most Violent X Men 97 Moment A Look Back After One Year

May 28, 2025

Latest Posts

-

Far Left Groups Exploit Muslim Mans Killing To Condemn Islamophobia In France

May 31, 2025

Far Left Groups Exploit Muslim Mans Killing To Condemn Islamophobia In France

May 31, 2025 -

Bodenseekreis Die Erste Pflegekonferenz Ein Ueberblick

May 31, 2025

Bodenseekreis Die Erste Pflegekonferenz Ein Ueberblick

May 31, 2025 -

Sanofis Commitment To Respiratory Health Asthma And Copd Pipeline Advancements

May 31, 2025

Sanofis Commitment To Respiratory Health Asthma And Copd Pipeline Advancements

May 31, 2025 -

Erste Pflegekonferenz Bodenseekreis Wichtige Informationen Fuer Teilnehmer

May 31, 2025

Erste Pflegekonferenz Bodenseekreis Wichtige Informationen Fuer Teilnehmer

May 31, 2025 -

Erste Pflegekonferenz Im Bodenseekreis Programm Und Anmeldung

May 31, 2025

Erste Pflegekonferenz Im Bodenseekreis Programm Und Anmeldung

May 31, 2025