Land Your Dream Private Credit Job: 5 Crucial Tips

Table of Contents

1. Craft a Compelling Resume and Cover Letter Tailored to Private Credit

Your resume and cover letter are your first impression, and in the private credit sector, that impression needs to be impeccable. They need to clearly demonstrate your understanding of the industry and showcase your relevant skills and experience.

H3: Highlight Relevant Skills and Experience:

- Financial Modeling: Showcase your proficiency in building complex financial models, including discounted cash flow (DCF) analysis, leveraged buyout (LBO) models, and other valuation techniques.

- Credit Analysis: Detail your experience in assessing credit risk, analyzing financial statements, and evaluating collateral. Mention specific methodologies used, like Altman Z-score or credit scoring models.

- Due Diligence: Describe your involvement in conducting due diligence on potential investments, including financial, legal, and operational aspects.

- Portfolio Management: If applicable, highlight experience in managing a portfolio of private credit investments, including monitoring performance, managing risk, and making investment decisions.

- Private Debt Instruments: Specify your experience with different types of private debt, such as direct lending, mezzanine financing, distressed debt, or asset-based lending. Quantify your achievements whenever possible. For example: "Increased portfolio returns by 15% through proactive risk management and strategic investment decisions." or "Successfully negotiated terms on a $50M loan, resulting in a lower interest rate and improved terms for the borrower."

H3: Showcase Your Understanding of Private Credit Markets:

Demonstrate a strong grasp of current market trends, regulatory changes (e.g., the LIBOR transition), and various investment strategies within the private credit landscape. Mention specific private credit funds or strategies you are particularly interested in. Understanding key financial ratios and credit metrics (e.g., leverage ratios, debt service coverage ratio, interest coverage ratio) is crucial.

H3: Tailor to Each Application:

Generic applications rarely succeed. Carefully review each job description and tailor your resume and cover letter to emphasize the skills and experiences most relevant to the specific role and company. Research the firm's investment strategy and highlight how your skills align with their needs.

2. Network Strategically Within the Private Credit Industry

Networking is paramount in securing a private credit role. Building relationships with professionals in the field can open doors to unadvertised opportunities.

H3: Attend Industry Events:

Attend conferences, workshops, and networking events specifically focused on private credit. Make an effort to engage in conversations, exchange business cards, and follow up with new contacts. Examples include industry association meetings and specialized private credit conferences.

H3: Leverage LinkedIn:

Develop a professional and comprehensive LinkedIn profile highlighting your experience and skills. Actively engage with industry professionals by commenting on relevant posts, participating in discussions, and joining groups focused on private credit.

H3: Informational Interviews:

Reach out to individuals working in private credit for informational interviews. These conversations offer valuable insights into the industry, specific roles, and companies, while also building relationships that could lead to job opportunities.

3. Ace the Private Credit Interview

Interview preparation is critical. Practice your responses to technical and behavioral questions, and conduct thorough research on the firm and interviewers.

H3: Technical Skills Preparation:

Prepare for in-depth technical questions on financial modeling, credit analysis, valuation techniques, and industry-specific knowledge. Practice case studies and use online resources to brush up on your technical skills.

H3: Behavioral Questions Practice:

Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result) to demonstrate your problem-solving, teamwork, and communication skills. Common questions include: "Tell me about a time you failed," "Describe a challenging project and how you overcame it," and "How do you handle conflict?"

H3: Research the Firm and Interviewers:

Demonstrate genuine interest by thoroughly researching the firm's investment strategy, recent deals, and the interviewers' backgrounds and experience.

4. Negotiate Your Private Credit Job Offer Effectively

Once you receive a job offer, be prepared to negotiate effectively to secure the best possible compensation package.

H3: Know Your Worth:

Research salary ranges for similar roles using online resources and industry salary surveys to understand your market value.

H3: Consider the Total Compensation Package:

Don't focus solely on base salary. Consider the total compensation package, including benefits (health insurance, retirement plan), bonuses, and other perks.

H3: Practice Your Negotiation Skills:

Prepare for potential counter-offers by practicing your negotiation strategy. Know your bottom line and be prepared to justify your salary expectations.

5. Follow Up After the Interview

Following up after the interview demonstrates your continued interest and professionalism.

H3: Send a Thank-You Note:

Send a personalized thank-you note to each interviewer expressing your gratitude and reiterating your interest in the position.

H3: Maintain Contact:

Follow up with recruiters or hiring managers after a reasonable timeframe (e.g., a week) to express your continued interest and inquire about the next steps in the hiring process.

H3: Be Persistent (But Professional):

Maintain a positive and professional attitude throughout the job search process. Persistence pays off, but always maintain professional decorum in your communications.

Conclusion:

Securing a dream job in private credit requires a strategic and multifaceted approach. By implementing these five crucial tips – crafting a compelling resume and cover letter, networking strategically, acing the interview, negotiating effectively, and following up diligently – you significantly increase your chances of landing your dream private credit job. Remember, the private credit job market is highly competitive, but with thorough preparation and a proactive approach, you can secure your ideal private credit role and achieve your career aspirations in this exciting and rewarding field. Start implementing these strategies today to find your perfect private credit position!

Featured Posts

-

Okreme Sidinnya Trampa Ta Zelenskogo Poyasnennya Podiyi

Apr 30, 2025

Okreme Sidinnya Trampa Ta Zelenskogo Poyasnennya Podiyi

Apr 30, 2025 -

Mother Confesses To Drowning Five Children

Apr 30, 2025

Mother Confesses To Drowning Five Children

Apr 30, 2025 -

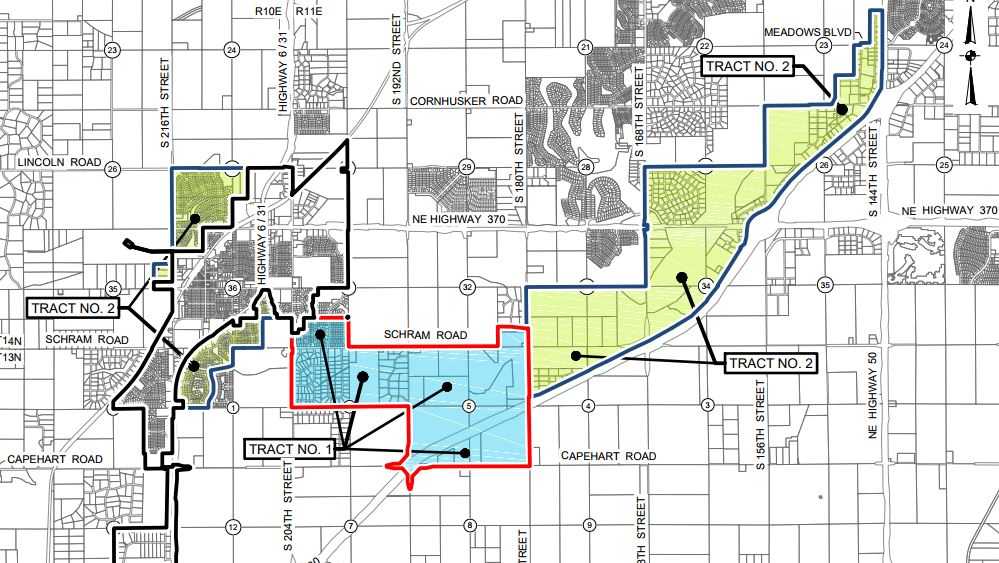

Nebraska Senators Express Concerns Over Proposed Gretna Development

Apr 30, 2025

Nebraska Senators Express Concerns Over Proposed Gretna Development

Apr 30, 2025 -

Lich Thi Dau Gio Thi Dau Vong Chung Ket Thaco Cup 2025

Apr 30, 2025

Lich Thi Dau Gio Thi Dau Vong Chung Ket Thaco Cup 2025

Apr 30, 2025 -

Fondi 8xmille Slittamento Apertura Processo Fratello Becciu Ultime Notizie

Apr 30, 2025

Fondi 8xmille Slittamento Apertura Processo Fratello Becciu Ultime Notizie

Apr 30, 2025