Land Your Dream Private Credit Job: 5 Do's And Don'ts

Table of Contents

5 Do's to Land Your Dream Private Credit Job

Do 1: Network Strategically within the Private Credit Industry

Building a strong network is crucial for securing a private credit job. Private credit networking is less about collecting business cards and more about cultivating genuine relationships.

- Attend industry events: Conferences, networking events, and even smaller industry gatherings are prime opportunities to meet professionals and learn about open private credit roles.

- Leverage LinkedIn effectively: Optimize your LinkedIn profile to highlight your skills and experience relevant to private credit. Actively connect with professionals in the field and engage in relevant industry discussions.

- Informational interviews: Reaching out to professionals for informational interviews allows you to gain insights into the industry, learn about specific firms, and potentially uncover hidden job opportunities. This is a powerful tool in your private credit job search.

- Genuine connections: Remember, networking is about building relationships, not just collecting contacts. Focus on making genuine connections and fostering long-term relationships within the private credit community.

Do 2: Tailor Your Resume and Cover Letter to Each Private Credit Role

A generic resume and cover letter won't cut it in the competitive private credit market. Your private credit resume needs to be meticulously tailored to each specific job description.

- Showcase relevant skills: Highlight skills and experience relevant to private credit, such as financial modeling, credit analysis, underwriting, and portfolio management.

- Use keywords: Incorporate keywords directly from the job description to improve your chances of getting noticed by applicant tracking systems (ATS).

- Quantify achievements: Instead of simply stating your responsibilities, quantify your accomplishments whenever possible using metrics and numbers.

- Emphasize your understanding: Clearly demonstrate your understanding of private credit markets, investment strategies, and relevant regulations.

Do 3: Master the Art of the Private Credit Interview

The private credit interview process is rigorous. Thorough preparation is key to success.

- Behavioral questions (STAR method): Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result) to showcase your skills and experience effectively.

- Technical proficiency: Demonstrate a strong understanding of financial statements, credit analysis techniques, valuation methods, and private credit investment strategies.

- Case studies: Practice case studies related to private credit investments to showcase your analytical and problem-solving skills.

- Research the firm: Research the firm and the interviewer beforehand to demonstrate your genuine interest and ask insightful questions.

Do 4: Highlight Your Knowledge of Private Credit Investment Strategies

Demonstrate a comprehensive understanding of various private credit investment strategies.

- Showcase expertise: Highlight your expertise in different private credit strategies such as direct lending, mezzanine financing, distressed debt, and other relevant approaches.

- Credit risk assessment: Demonstrate a strong understanding of credit risk assessment, due diligence processes, and portfolio management techniques.

- Relevant certifications: Mention any relevant certifications or qualifications, such as CFA, CAIA, or other relevant designations, to bolster your credibility. Highlight your experience with private credit strategies in your resume and interview.

Do 5: Follow Up After Every Private Credit Interview

Following up after each interview is a crucial step often overlooked.

- Thank-you note: Send a thank-you note reiterating your interest and highlighting key discussion points.

- Maintain communication: Maintain professional communication throughout the process.

- Follow-up (appropriately): Follow up after a reasonable timeframe (e.g., a week) if you haven't heard back. This shows continued interest in the private credit job.

5 Don'ts When Seeking a Private Credit Job

Don't 1: Neglect Research on Private Credit Firms

Thorough research is paramount. Avoid generic applications.

- Understand the firm: Understand each firm's investment strategy, culture, recent transactions, and team dynamics before applying.

- Targeted applications: Tailor your resume and cover letter to reflect your understanding of each specific firm and the role you're applying for.

Don't 2: Underestimate the Importance of Financial Modeling Skills

Proficiency in financial modeling is essential in private credit.

- Crucial skill: Emphasize your proficiency in building and interpreting financial models, as this is a cornerstone of private credit analysis.

- Demonstrate expertise: Highlight specific examples where your financial modeling skills contributed to successful outcomes in your previous roles. Show you understand financial modeling for private credit.

Don't 3: Overlook the Importance of Networking

Networking is not optional; it's a critical element of your job search.

- Missed opportunities: Neglecting networking significantly limits your access to information about open positions and potential connections.

- Relationship building: Reiterate the value of building relationships within the private credit industry to access hidden job markets and gain valuable insights.

Don't 4: Fail to Prepare for Behavioral Interview Questions

Behavioral questions assess your soft skills.

- STAR method: Practice answering behavioral questions using the STAR method to present compelling examples of your skills and experiences in a structured manner.

- Soft skills: Demonstrate your soft skills, including teamwork, communication, problem-solving, and adaptability. These are as crucial as your technical skills in a private credit interview preparation.

Don't 5: Send Generic Cover Letters and Resumes

Generic applications show a lack of interest and effort.

- Tailored applications: Always tailor your cover letter and resume to each specific role and firm. Show that you've thoroughly researched the opportunity.

- Genuine interest: Demonstrate your genuine interest in the specific opportunity and the firm's mission. A private credit cover letter should show you understand the nuances of the role.

Conclusion: Securing Your Place in Private Credit

Landing your dream private credit job requires a strategic approach combining thorough preparation, effective networking, and a deep understanding of the industry. By following the "do's" and avoiding the "don'ts" outlined above, you significantly increase your chances of success. Remember to tailor your applications, master the art of the interview, and network strategically to stand out from the competition. Start implementing these strategies today and take a step closer to securing your dream private credit career! For further resources on private credit job search strategies, check out [link to relevant resource].

Featured Posts

-

The Mystery Of Dasanis Uk Unavailability Explained

May 15, 2025

The Mystery Of Dasanis Uk Unavailability Explained

May 15, 2025 -

In Depth La Lakers Analysis On Vavel United States

May 15, 2025

In Depth La Lakers Analysis On Vavel United States

May 15, 2025 -

Black Decker Steam Iron Review Finding The Perfect Model For You

May 15, 2025

Black Decker Steam Iron Review Finding The Perfect Model For You

May 15, 2025 -

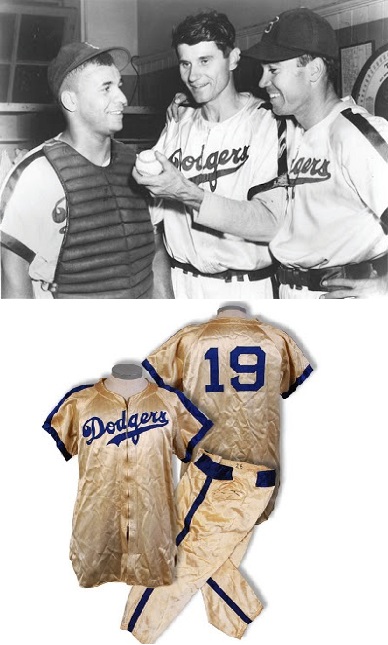

Forgotten Dodgers Signing A Long Awaited La Debut

May 15, 2025

Forgotten Dodgers Signing A Long Awaited La Debut

May 15, 2025 -

Emergency Situation Resolved Individual In Custody At Gsw

May 15, 2025

Emergency Situation Resolved Individual In Custody At Gsw

May 15, 2025