Land Your Dream Private Credit Job: 5 Do's And Don'ts To Follow

Table of Contents

H2: 3 Do's to Land Your Dream Private Credit Job

H3: Do 1: Network Strategically within the Private Credit Industry

Networking is paramount in the private credit world. Building strong connections can open doors to unadvertised opportunities and provide valuable insights. Here's how to approach it:

- Attend Industry Conferences and Events: Participate in events like the SuperReturn International Private Equity Conference, the Private Debt Investor Forum, or smaller, niche conferences focused on specific areas of private credit, such as real estate debt or infrastructure finance. Actively engage with speakers and attendees, exchanging business cards and following up afterward.

- Leverage LinkedIn Effectively: Optimize your LinkedIn profile with relevant keywords like "private credit analyst," "private credit associate," "direct lending," "mezzanine financing," and "private equity." Engage with content related to private credit, join relevant groups (e.g., groups focused on private debt or specific asset classes), and connect with professionals in the field. Search for "LinkedIn private credit jobs" to find relevant opportunities.

- Informational Interviews: Reach out to professionals working in private credit firms for informational interviews. These conversations offer invaluable insights into the industry, specific firms, and potential career paths. Prepare thoughtful questions and demonstrate genuine interest.

- Join Relevant Professional Organizations: Membership in organizations like the CFA Institute, the American Private Equity & Venture Capital Council (formerly NVCA), or industry-specific associations can provide networking opportunities, access to resources, and enhance your credibility.

H3: Do 2: Tailor Your Resume and Cover Letter to Specific Private Credit Roles

Generic applications rarely succeed in a competitive market like private credit. Each application should be meticulously crafted to highlight your unique skills and experience relevant to the specific role and firm.

- Highlight Relevant Skills and Experience: Carefully analyze the job description and identify keywords and skills mentioned. Tailor your resume and cover letter to emphasize those specific skills and experiences.

- Use Keywords from Job Descriptions: Conduct thorough keyword research using tools like Google Keyword Planner or SEMrush to identify relevant terms used in private credit job postings. Incorporate these keywords naturally throughout your resume and cover letter.

- Quantify Your Achievements: Use metrics to demonstrate your impact in previous roles. For example, instead of saying "Improved efficiency," say "Improved operational efficiency by 15%, resulting in $X cost savings." Quantifiable results showcase your abilities clearly.

- Showcase Understanding of Private Credit Investment Strategies: Demonstrate your understanding of various private credit investment strategies, including direct lending, mezzanine financing, and other relevant strategies. Mention specific examples from your experience or research.

H3: Do 3: Ace the Private Credit Job Interview

The interview stage is critical. Preparation and professionalism are essential for making a strong impression.

- Prepare Answers to Common Interview Questions: Practice answering common behavioral questions (e.g., "Tell me about a time you failed"), technical questions related to financial modeling, valuation, and private credit instruments, and questions about your career goals.

- Practice Your Responses and Showcase Your Enthusiasm: Rehearse your answers to ensure smooth delivery. Maintain a positive and enthusiastic demeanor, demonstrating genuine interest in the role and the firm.

- Research the Firm Thoroughly: Conduct thorough due diligence on the firm you are interviewing with. Understand their investment strategy, portfolio companies, and recent news. Demonstrate your knowledge during the interview.

- Ask Insightful Questions: Prepare insightful questions to ask the interviewer. This demonstrates your engagement and allows you to gather more information about the role and the firm. Avoid generic questions and focus on specific aspects of the firm or the role.

H2: 2 Don'ts to Avoid When Seeking a Private Credit Job

H3: Don't 1: Neglect Your Online Presence

Your online presence can significantly impact your job search. A strong and professional online profile is crucial.

- Ensure Your LinkedIn Profile is Up-to-Date and Professional: Your LinkedIn profile is your digital resume. Keep it current, professional, and optimized for private credit-related keywords.

- Monitor Your Online Reputation and Clean Up Any Negative Content: Review your online presence and remove any content that could negatively affect your candidacy. Maintain a consistent and professional online persona.

- Consider Creating a Professional Website Showcasing Your Portfolio: If you have relevant work samples or portfolio pieces (e.g., financial models, presentations), creating a professional website can showcase your skills and experience effectively.

H3: Don't 2: Apply Generically to Private Credit Jobs

Mass applications without personalization rarely yield positive results. Focus your efforts on targeted applications.

- Avoid Mass Applications Without Tailoring Your Resume and Cover Letter: Each application should be tailored to the specific requirements of the job description. Generic applications demonstrate a lack of effort and interest.

- Focus on a Few Target Firms Rather Than Many Irrelevant Ones: Identify a few firms that align with your career goals and expertise. Invest time in researching these firms and crafting highly targeted applications.

- Demonstrate a Clear Understanding of the Specific Role You Are Applying For: Show that you've thoroughly researched the role and understand its responsibilities and requirements. Highlight how your skills and experience align perfectly with the position.

3. Conclusion

Securing your dream private credit job requires a strategic and well-planned approach. By following these do's and don'ts—networking effectively, tailoring your applications, acing the interview, and maintaining a strong online presence—you significantly increase your chances of landing your ideal private credit job. Don't wait—start refining your resume, updating your LinkedIn profile, and researching firms that offer a lucrative private credit career. Take the next step towards your next private credit career today!

Featured Posts

-

Teslas Q1 Profit Plunge A Deeper Look At The Causes

Apr 24, 2025

Teslas Q1 Profit Plunge A Deeper Look At The Causes

Apr 24, 2025 -

Bold And The Beautiful April 9 Recap Icu Drama Blame And A Desperate Plea For Secrecy

Apr 24, 2025

Bold And The Beautiful April 9 Recap Icu Drama Blame And A Desperate Plea For Secrecy

Apr 24, 2025 -

Us Stock Market Slump Emerging Markets Show Resilience

Apr 24, 2025

Us Stock Market Slump Emerging Markets Show Resilience

Apr 24, 2025 -

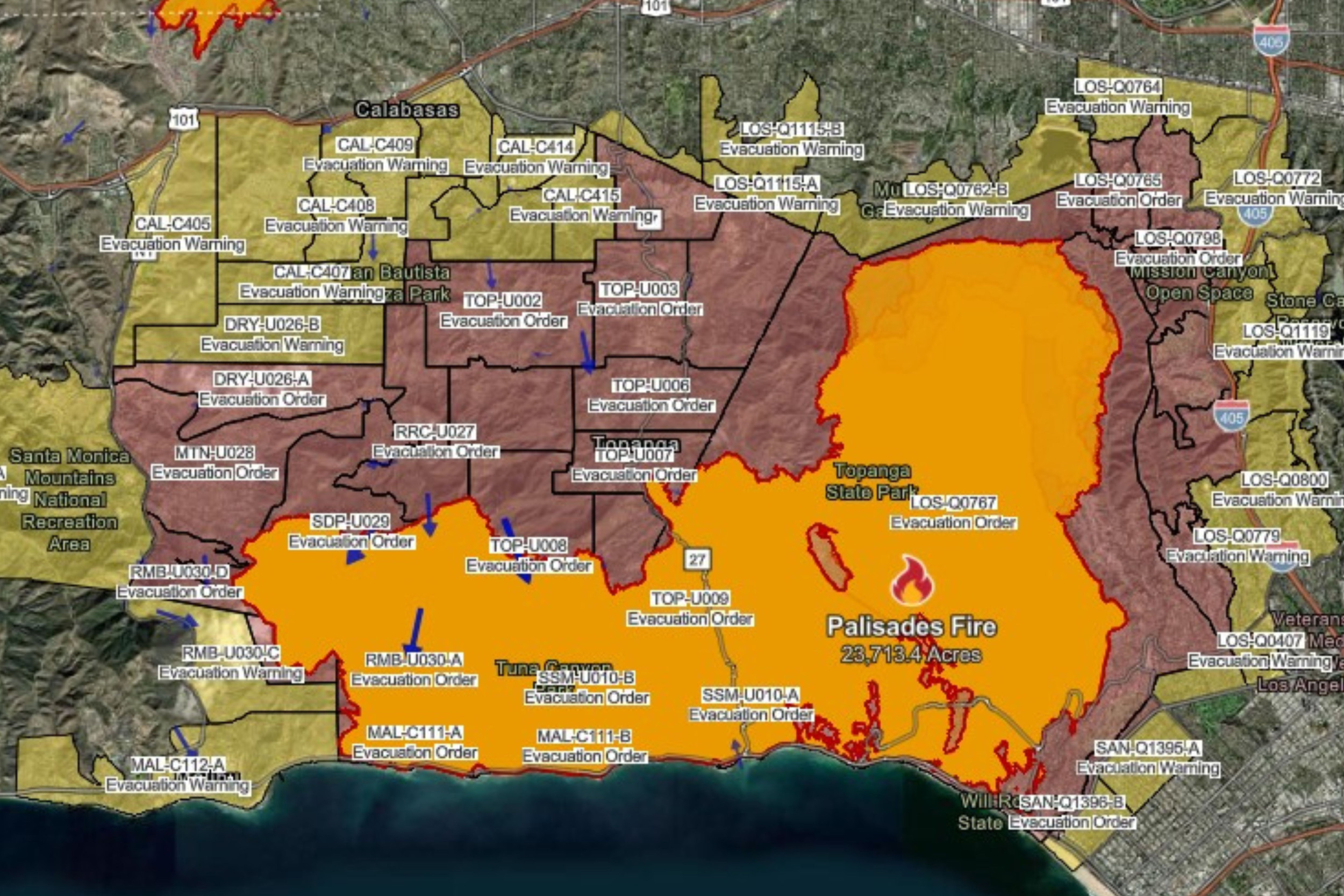

Los Angeles Palisades Fires A List Of Celebrities Who Lost Properties

Apr 24, 2025

Los Angeles Palisades Fires A List Of Celebrities Who Lost Properties

Apr 24, 2025 -

Faa Investigates Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Investigates Collision Risks At Las Vegas Airport

Apr 24, 2025