Land Your Dream Private Credit Job: 5 Key Do's And Don'ts

Table of Contents

Do: Tailor Your Resume and Cover Letter for Private Credit Roles

Your resume and cover letter are your first impression. A generic application won't cut it in the competitive private credit job market. To stand out, you need to tailor your materials to each specific role, highlighting the skills and experience most relevant to the position. This shows the hiring manager you understand their needs and are genuinely interested in their firm.

- Quantify Your Achievements: Instead of simply stating your responsibilities, quantify your accomplishments using metrics. For example, instead of "Managed a portfolio of loans," write "Managed a $50 million portfolio of loans, resulting in a 15% increase in portfolio returns over three years." This demonstrates your impact and adds weight to your application.

- Highlight Key Skills: Private credit roles require a specific skillset. Be sure to highlight relevant keywords from the job description, such as:

- Financial modeling

- Credit analysis and underwriting

- Due diligence

- Portfolio management

- Legal documentation review (for roles involving legal aspects)

- Experience with different financing structures (e.g., unitranche, mezzanine financing, senior secured debt)

- Showcase Private Credit Expertise: Demonstrate your understanding of various private credit strategies, including direct lending, mezzanine financing, distressed debt investing, and other alternative lending strategies. Mention specific examples from your experience.

- Customize for Each Application: Don't use a generic template. Carefully review each job description and tailor your resume and cover letter to match the specific requirements and keywords. This shows initiative and attention to detail.

Do: Network Strategically Within the Private Credit Industry

Networking is crucial in landing a private credit job. Building relationships within the industry can open doors to opportunities you might not otherwise find.

- Attend Industry Events: Conferences, seminars, and workshops are excellent opportunities to meet professionals and learn about new job openings.

- Leverage LinkedIn: Actively engage on LinkedIn. Connect with professionals in private credit, join relevant groups, and participate in industry discussions. A strong and up-to-date LinkedIn profile is essential for showcasing your expertise and experience.

- Informational Interviews: Reach out to people working in your target roles for informational interviews. This allows you to learn more about their work and build valuable connections.

- Join Professional Organizations: Membership in relevant professional organizations, like those focused on finance or alternative lending, provides networking opportunities and access to industry insights.

- Tap Your Existing Network: Don't underestimate the power of your existing network. Let your contacts know you're looking for a private credit job; you never know who might have a valuable connection.

Do: Master the Art of the Private Credit Interview

The interview stage is your chance to shine. Thorough preparation is key to success.

- Technical Proficiency: Prepare for technical questions on financial modeling, valuation, credit analysis, and due diligence. Be ready to discuss specific examples from your experience.

- Behavioral Questions: Practice answering behavioral questions like, "Tell me about a time you failed," or "Describe a challenging situation you overcame." These assess your problem-solving skills and personality fit.

- Company Research: Thoroughly research the firm and the interviewer. Understand their investment strategy, portfolio companies, and culture. Demonstrate your knowledge during the interview.

- Insightful Questions: Prepare insightful questions to ask the interviewer. This shows your genuine interest and engagement. Focus on questions that demonstrate your understanding of the firm's strategy and the role's responsibilities.

- Market Awareness: Showcase your understanding of current market trends and events impacting the private credit industry. Demonstrate you are up-to-date on relevant news and legislation.

Don't: Neglect Your Online Presence

Your online presence is a reflection of your professional brand. Ensure it represents you positively.

- LinkedIn Profile: Maintain a professional and up-to-date LinkedIn profile, highlighting your relevant skills and experience in private credit, private debt, or alternative lending.

- Social Media Awareness: Be mindful of your social media presence. Keep it professional and avoid anything that could negatively impact your reputation.

- Consistent Branding: Ensure your online presence is consistent and reflects a professional image.

- Active Participation: Use LinkedIn to showcase your expertise by sharing relevant articles, participating in discussions, and commenting on industry news.

Don't: Underestimate the Importance of Due Diligence

Due diligence isn't just for the firms you're evaluating; it's also crucial for you as a job seeker.

- Company Research: Thoroughly research the firms you're applying to. Understand their investment strategies, portfolio companies, culture, and recent transactions. Look for information on their website, press releases, and news articles.

- Industry Knowledge: Demonstrate your understanding of the different types of private credit strategies (e.g., senior secured debt, subordinated debt, mezzanine financing, distressed debt).

- Interviewer Research: Research the individuals interviewing you to understand their background and experience. This allows you to tailor your answers and ask more relevant questions.

Conclusion

Landing your dream private credit job is attainable with the right preparation and strategy. By following these do's and don'ts, you'll significantly increase your chances of success. Remember to tailor your application materials, network effectively, master the interview process, maintain a strong online presence, and conduct thorough due diligence on potential employers. Start implementing these tips today and begin your journey toward securing your ideal private credit job, or a similar role in private debt or alternative lending.

Featured Posts

-

Troubled Nhs Trust Boss Cooperates With Nottingham Attacks Investigation

May 10, 2025

Troubled Nhs Trust Boss Cooperates With Nottingham Attacks Investigation

May 10, 2025 -

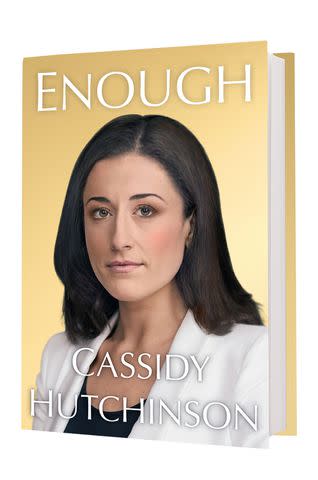

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Events This Fall

May 10, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Events This Fall

May 10, 2025 -

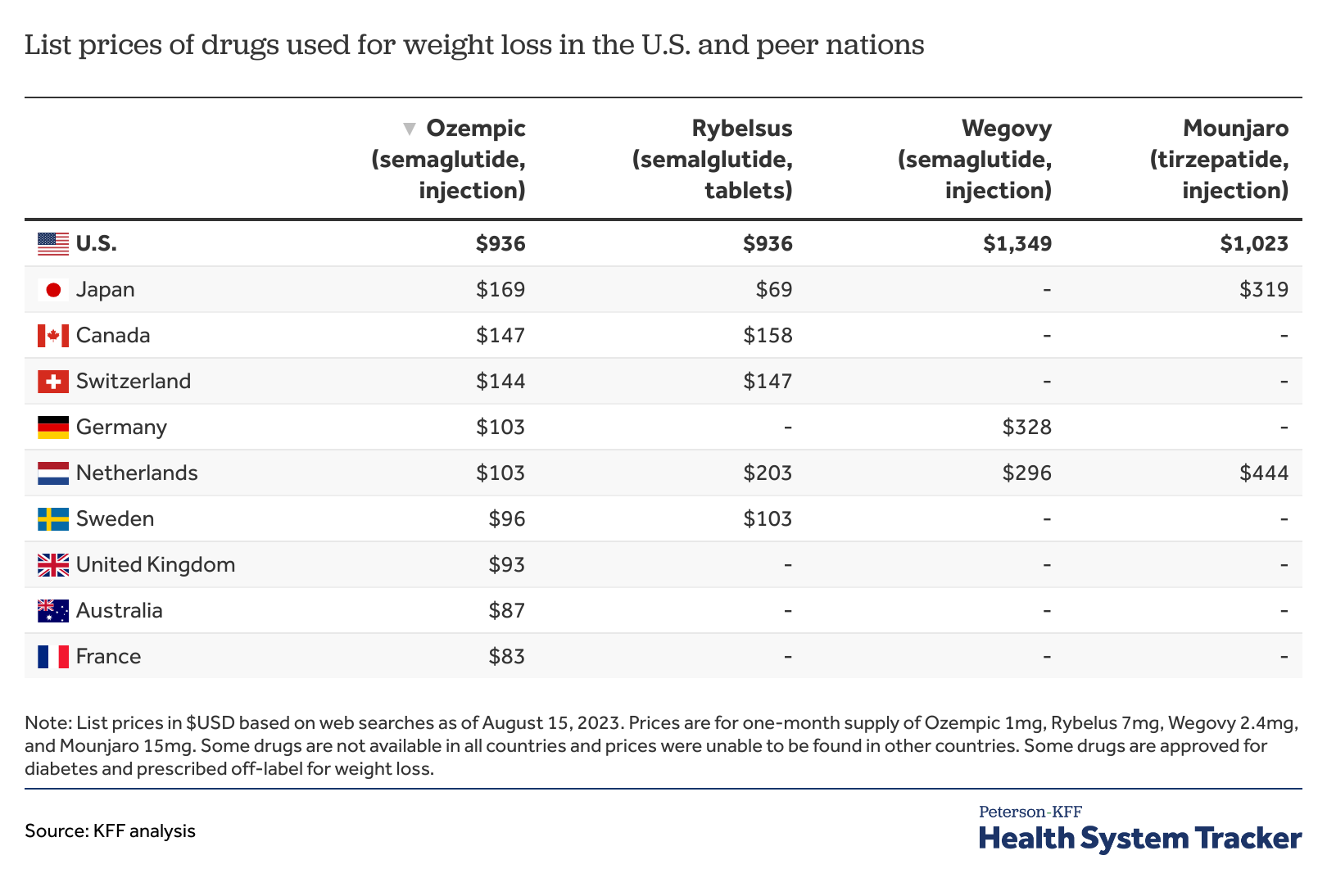

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs

May 10, 2025

Weight Watchers Files For Bankruptcy Impact Of Weight Loss Drugs

May 10, 2025 -

Ice Detention Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025

Ice Detention Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025 -

Pakistan Stock Market Crisis Operation Sindoor Triggers Kse 100 Plunge

May 10, 2025

Pakistan Stock Market Crisis Operation Sindoor Triggers Kse 100 Plunge

May 10, 2025