Land Your Dream Private Credit Role: 5 Do's And Don'ts To Follow

Table of Contents

5 Do's to Land Your Dream Private Credit Role

Do 1: Master Financial Modeling & Valuation Techniques

Proficiency in financial modeling is paramount for any private credit role. This involves more than just basic spreadsheet skills. You need to demonstrate expertise in building and interpreting complex models.

- Develop proficiency in Excel: This includes mastering advanced functions like VBA (Visual Basic for Applications) to automate tasks and build more efficient models.

- Gain experience building complex financial models: Practice building models for leveraged buyouts (LBOs) and debt financings. This is crucial for understanding the financial implications of debt structures and evaluating the creditworthiness of borrowers.

- Understand different valuation methodologies: Become proficient in discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. These are essential tools for assessing the value of assets and determining appropriate lending terms.

- Practice building models for various credit instruments: Familiarize yourself with modeling term loans, revolving credit facilities (revolvers), mezzanine debt, and other debt financing structures. Each has unique characteristics that impact your modeling approach.

- Keyword optimization: Financial modeling, LBO modeling, DCF analysis, valuation techniques, Excel skills, VBA, Leveraged Finance Modeling.

Do 2: Network Strategically within the Private Credit Industry

Networking is not just about collecting business cards; it's about building genuine relationships. The private credit industry is relationship-driven, and your network can be your greatest asset.

- Attend industry conferences and events: These provide excellent opportunities to meet professionals, learn about new trends, and expand your network. Look for private credit focused events and conferences.

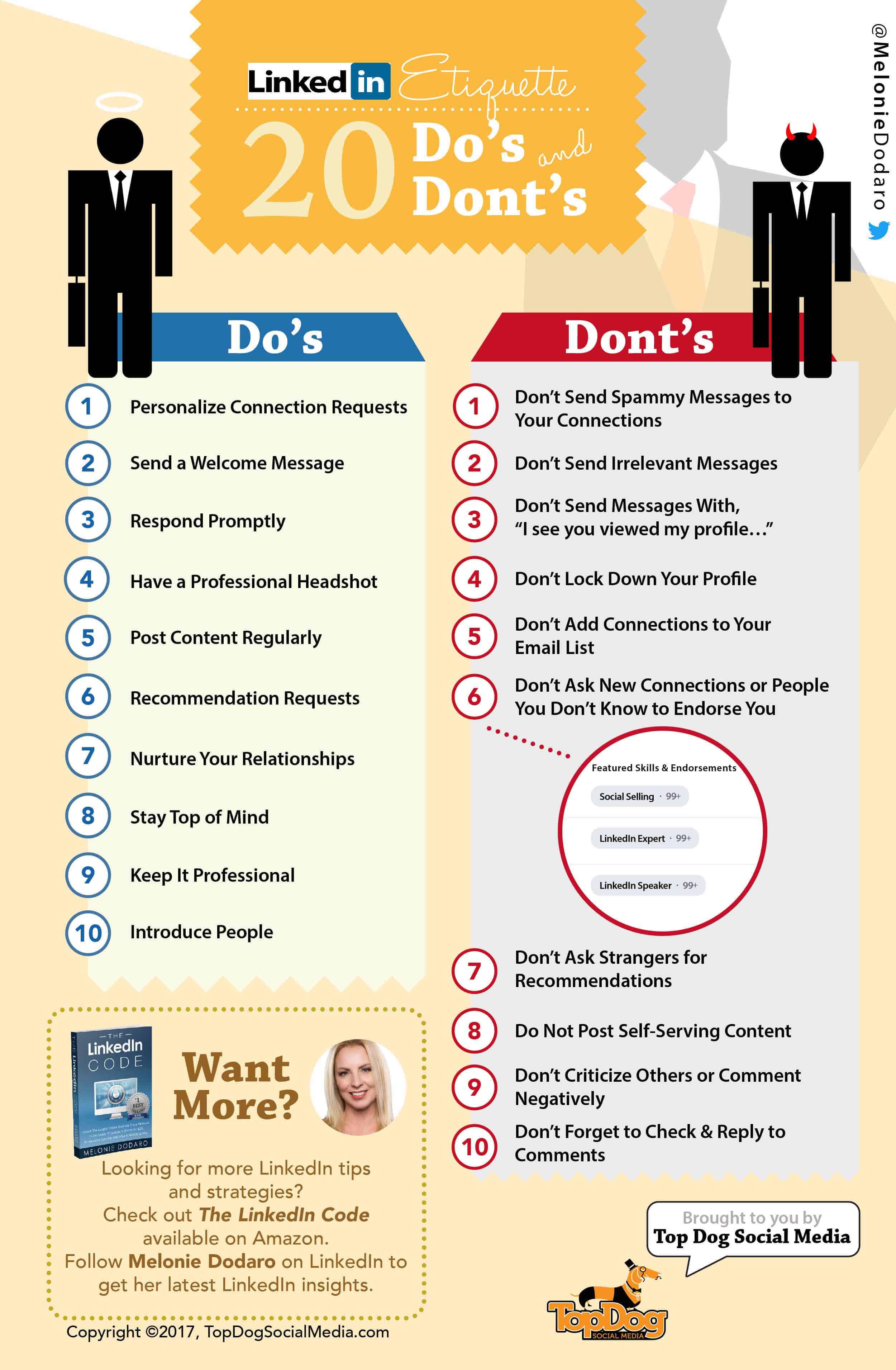

- Leverage LinkedIn: Use LinkedIn to connect with people working in private credit. Research firms you're interested in and reach out to individuals working in roles you aspire to.

- Informational interviews are invaluable: These allow you to learn about different career paths, gain insights into specific firms, and build relationships with potential mentors or future employers.

- Target firms and individuals: Don't just send generic connection requests. Research firms and individuals whose work aligns with your career goals and tailor your outreach accordingly.

- Keyword optimization: Networking, Private Credit Networking, Industry Events, Informational Interviews, LinkedIn for Finance, Private Equity Networking, Credit Fund Networking.

Do 3: Showcase Your Credit Analysis Skills

Private credit professionals need strong analytical skills to assess credit risk. You need to be able to critically evaluate financial statements, identify key risks, and make informed lending decisions.

- Highlight experience in credit underwriting, due diligence, and risk assessment: Quantify your accomplishments and demonstrate your ability to manage risk effectively.

- Demonstrate a strong understanding of credit metrics: Familiarize yourself with key metrics such as leverage ratios, interest coverage, debt-to-equity ratio, and other relevant financial indicators.

- Develop case studies showcasing your analytical abilities: Prepare case studies highlighting your analytical skills in credit situations, focusing on your problem-solving abilities.

- Emphasize your ability to identify and mitigate credit risks: This is crucial in private credit, where the stakes are high.

- Keyword optimization: Credit Analysis, Credit Underwriting, Due Diligence, Risk Assessment, Credit Metrics, Financial Statement Analysis, Debt Analysis.

Do 4: Tailor Your Resume and Cover Letter

Your resume and cover letter are your first impression. They need to be compelling, well-written, and specifically tailored to each job application.

- Customize your resume and cover letter: Don't use a generic template. Carefully review the job description and tailor your application to match the specific requirements and keywords.

- Quantify your accomplishments: Use data and metrics to demonstrate the impact you've made in previous roles. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15% resulting in X cost savings."

- Highlight relevant skills and experience: Focus on skills and experience directly relevant to the job description.

- Use keywords from the job description: Incorporate keywords from the job description into your resume and cover letter to improve your chances of getting noticed by Applicant Tracking Systems (ATS).

- Keyword optimization: Resume writing, Cover letter writing, Tailored resume, Job Application, Keyword optimization, ATS optimization.

Do 5: Prepare for Behavioral and Technical Interviews

Private credit interviews are rigorous and test both your technical skills and your personality. Thorough preparation is essential.

- Practice answering common behavioral interview questions (STAR method): The STAR method (Situation, Task, Action, Result) is a useful framework for structuring your answers.

- Prepare for technical questions related to financial modeling, valuation, and credit analysis: Be ready to discuss your experience with LBO modeling, DCF analysis, credit metrics, and other relevant topics.

- Research the firm and the interviewers beforehand: Demonstrate your genuine interest by researching the firm's investment strategy, recent transactions, and the interviewers' backgrounds.

- Ask insightful questions during the interview: Asking thoughtful questions shows your engagement and helps you learn more about the role and the firm.

- Keyword optimization: Interview preparation, Behavioral Interview, Technical Interview, Finance Interview Questions, STAR Method.

5 Don'ts to Avoid When Pursuing a Private Credit Role

Don't 1: Neglect Soft Skills

Technical skills are crucial, but soft skills are equally important in private credit. Strong communication, teamwork, and work ethic are essential for success.

- Communication is key: Practice clear and concise communication, both written and verbal.

- Teamwork is essential: Highlight your collaborative skills and ability to work effectively in a team environment.

- Strong work ethic is a must: Private credit demands long hours and dedication. Demonstrate your commitment to hard work and perseverance.

- Keyword optimization: Communication skills, Teamwork, Work ethic, Collaboration.

Don't 2: Lack Industry Knowledge

Stay informed about the latest market trends and economic factors impacting the private credit industry. Demonstrate your understanding of the market landscape and its dynamics.

- Stay updated on market trends: Read industry publications, follow relevant news sources, and attend industry events.

- Familiarize yourself with leading private credit firms: Research different firms and their investment strategies. Understand their focus areas, investment philosophies, and recent transactions.

- Keyword optimization: Private Credit Industry, Market Trends, Economic Factors, Industry Knowledge, Financial News.

Don't 3: Submit Generic Applications

Each application should be tailored to the specific job and company. A generic application will likely be overlooked.

- Avoid using the same resume and cover letter: Customize your application materials for every job you apply for.

- Tailor your application materials: Highlight the skills and experiences most relevant to each specific job description.

- Keyword optimization: Generic Application, Targeted Application, Customized Application.

Don't 4: Underestimate the Importance of Networking

Networking is not a one-time event; it's an ongoing process. Actively build relationships with professionals in the industry.

- Don't just rely on online applications: Attend industry events, reach out to people on LinkedIn, and leverage your existing network.

- Build relationships: Networking is about building genuine relationships, not just collecting contacts.

- Keyword optimization: Networking, Relationship Building, Industry Connections.

Don't 5: Ignore Feedback

Seek feedback on your resume, cover letter, and interview performance. Use this feedback to improve your application and interviewing skills.

- Seek feedback from mentors, career counselors, or trusted colleagues: Be open to constructive criticism.

- Use feedback to improve: Identify areas for improvement and work on strengthening your weaknesses.

- Keyword optimization: Feedback, Self-Improvement, Interview Skills.

Conclusion

Securing your dream private credit role requires dedication, preparation, and a strategic approach. By following these five "do's" and avoiding the five "don'ts," you'll significantly enhance your chances of success. Remember to master financial modeling, network effectively, showcase your credit analysis skills, tailor your application materials, and prepare thoroughly for interviews. Don't underestimate the power of networking and continuous self-improvement. By implementing these strategies, you'll be well on your way to landing your dream job in private credit! Start building your career in private credit today!

Featured Posts

-

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Para Todos Los Signos

May 24, 2025

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Para Todos Los Signos

May 24, 2025 -

The Philips Future Health Index 2025 Preparing For An Ai Driven Healthcare System

May 24, 2025

The Philips Future Health Index 2025 Preparing For An Ai Driven Healthcare System

May 24, 2025 -

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025

French Stock Market Cac 40 Week Ending March 7 2025 Analysis

May 24, 2025 -

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sales

May 24, 2025

Wwe Wrestle Mania 41 Memorial Day Weekend Ticket And Golden Belt Sales

May 24, 2025 -

Italys New Citizenship Law Claiming Citizenship Through Great Grandparents

May 24, 2025

Italys New Citizenship Law Claiming Citizenship Through Great Grandparents

May 24, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time A 1965 Inspired Triumph

May 24, 2025

Review Jonathan Groffs Just In Time A 1965 Inspired Triumph

May 24, 2025 -

Just In Time Musical Review Groffs Captivating Bobby Darin Portrayal

May 24, 2025

Just In Time Musical Review Groffs Captivating Bobby Darin Portrayal

May 24, 2025 -

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025 -

Jonathan Groff Discusses His Past And Asexuality

May 24, 2025

Jonathan Groff Discusses His Past And Asexuality

May 24, 2025 -

How Jonathan Groff Brought Bobby Darin To Life In Just In Time

May 24, 2025

How Jonathan Groff Brought Bobby Darin To Life In Just In Time

May 24, 2025