Landmark Saudi Regulatory Reform: Transforming The Kingdom's ABS Market

Table of Contents

Easing Regulatory Hurdles for ABS Issuance

The new regulations significantly streamline the process of issuing Asset-Backed Securities in Saudi Arabia, making it more attractive for businesses and financial institutions.

Streamlined Approval Processes

The reformed regulatory environment aims to reduce bureaucratic bottlenecks and encourage more issuers to enter the market. This is achieved through:

- Reduced application processing time: Faster approvals allow issuers to access capital more quickly, accelerating business growth and investment projects.

- Clearer guidelines: Simplified and transparent guidelines reduce ambiguity and uncertainty, making it easier for companies to navigate the regulatory landscape.

- Improved transparency: Increased transparency in the approval process fosters trust and confidence among both issuers and investors.

- Online application portals: The introduction of digital platforms streamlines the application process, making it more efficient and convenient.

Enhanced Legal Framework

A modernized legal framework provides greater clarity and certainty, addressing concerns around risk and mitigating potential disputes. Key improvements include:

- Strengthened investor protection mechanisms: Robust mechanisms safeguard investor interests, building confidence in the Saudi ABS market.

- Clearer definitions of ABS structures: Precise definitions reduce ambiguity and enhance the predictability of transactions.

- Improved contract enforceability: Stronger contract enforcement ensures that agreements are upheld, minimizing disputes and protecting investors.

Fostering Innovation in Islamic Finance through ABS

Saudi Arabia's commitment to Islamic finance is a key driver of the ABS market reform.

Development of Shari'a-compliant ABS Structures

The reform actively supports the growth of the Islamic finance sector by facilitating the creation and issuance of Shari'a-compliant ABS. This includes:

- Support for Sukuk issuance: The regulations specifically support the issuance of Sukuk, an important instrument in Islamic finance.

- Development of innovative Shari'a-compliant structuring techniques: The Kingdom is actively fostering innovation in structuring Shari'a-compliant ABS products.

- Engagement with Islamic scholars: Collaboration with leading Islamic scholars ensures that all ABS structures adhere to Shari'a principles.

Attracting Foreign Investment in Islamic ABS

The streamlined regulations are attracting significant foreign investment in the Kingdom's Islamic finance sector. Initiatives include:

- Marketing campaigns targeting international investors: Saudi Arabia is actively promoting its ABS market to international investors.

- Collaborations with international financial institutions: Partnerships with global financial institutions are helping to build trust and attract foreign capital.

- Promotion of Saudi Arabia as a hub for Islamic finance: The Kingdom is positioning itself as a leading center for Islamic finance globally.

Expanding the Range of Eligible Underlying Assets

The reform significantly expands the types of assets that can be securitized through ABS.

Diversification beyond traditional assets

The range of eligible underlying assets has been broadened to include:

- Increased securitization opportunities for banks and other financial institutions: This provides banks with new avenues for managing risk and freeing up capital.

- Diversification of investment opportunities for investors: Investors now have access to a wider range of asset classes, reducing risk and increasing potential returns.

Development of new asset classes

The reform is fostering the development of new asset classes, driving innovation and growth in the Saudi economy. Examples include:

- Securitization of renewable energy projects: This helps to attract investment in sustainable energy initiatives.

- Securitization of infrastructure projects: This facilitates the development of crucial infrastructure projects across the Kingdom.

- Securitization of other high-growth sectors: This encourages investment in diverse and promising sectors of the Saudi economy.

Strengthening Investor Protection and Market Transparency

The reformed regulatory framework prioritizes investor protection and market transparency.

Enhanced Disclosure Requirements

Improved disclosure requirements aim to provide investors with complete and accurate information. Key improvements include:

- Standardized disclosure templates: This ensures consistency and clarity in the information provided to investors.

- Improved data quality: Higher data quality enhances the reliability of information used for investment decisions.

- Enhanced reporting frequency: More frequent reporting allows investors to monitor their investments more closely.

Robust Investor Protection Mechanisms

The regulatory framework incorporates robust mechanisms to safeguard investor interests and build confidence:

- Clear guidelines on investor rights: Investors have clear understanding of their rights and protections.

- Independent trustee oversight: Independent oversight ensures that investor interests are protected throughout the process.

- Strengthened dispute resolution mechanisms: Efficient dispute resolution mechanisms reduce uncertainty and promote fair outcomes.

Conclusion

The landmark regulatory reform in Saudi Arabia's ABS market is a significant step towards achieving Vision 2030's financial sector goals. By streamlining processes, fostering Islamic finance innovation, expanding eligible assets, and strengthening investor protection, the Kingdom is creating a thriving and dynamic ABS market. This isn't just about capital formation; it's about building a robust, transparent, and internationally competitive financial ecosystem. To learn more about opportunities within the evolving Saudi ABS market and how these changes can benefit your investment strategy, contact us today. Explore the transformative potential of the Saudi ABS market and its role in shaping the Kingdom's financial future.

Featured Posts

-

Kshmyrywn Ka Msylh Jnwby Ayshyae Ke Amn Ke Lye Ayk Sngyn Chylnj

May 02, 2025

Kshmyrywn Ka Msylh Jnwby Ayshyae Ke Amn Ke Lye Ayk Sngyn Chylnj

May 02, 2025 -

Bbc Two Hd Programme Guide When Is Newsround On

May 02, 2025

Bbc Two Hd Programme Guide When Is Newsround On

May 02, 2025 -

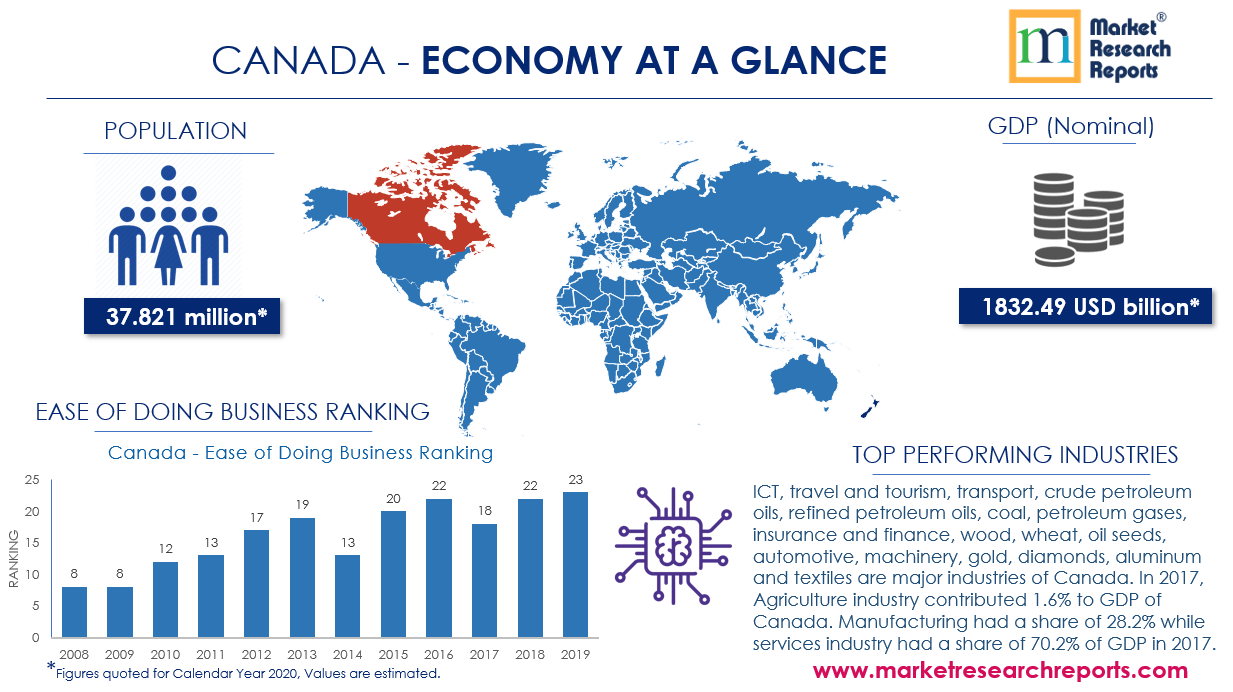

Canadas Economy David Dodge Predicts Ultra Low Growth In 2024

May 02, 2025

Canadas Economy David Dodge Predicts Ultra Low Growth In 2024

May 02, 2025 -

Kshmyr Ky Jng Pakstany Fwj Ka Mstqbl Ka Mnswbh

May 02, 2025

Kshmyr Ky Jng Pakstany Fwj Ka Mstqbl Ka Mnswbh

May 02, 2025 -

Investigation Launched Into Rupert Lowe Following Bullying Complaints

May 02, 2025

Investigation Launched Into Rupert Lowe Following Bullying Complaints

May 02, 2025

Latest Posts

-

Dijon Concertation Et Validation Du Projet De 3e Ligne De Tram

May 10, 2025

Dijon Concertation Et Validation Du Projet De 3e Ligne De Tram

May 10, 2025 -

Dijon Revele Le Role Crucial De Melanie Eiffel Dans L Edification De La Tour Eiffel

May 10, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans L Edification De La Tour Eiffel

May 10, 2025 -

Le Projet De 3e Ligne De Tram A Dijon Concertation Adoptee

May 10, 2025

Le Projet De 3e Ligne De Tram A Dijon Concertation Adoptee

May 10, 2025 -

Dijon La Contribution Essentielle De Melanie Eiffel A La Construction De La Tour Eiffel

May 10, 2025

Dijon La Contribution Essentielle De Melanie Eiffel A La Construction De La Tour Eiffel

May 10, 2025 -

La Cite De La Gastronomie Pourquoi Dijon Garde Ses Distances Avec Les Difficultes D Epicure

May 10, 2025

La Cite De La Gastronomie Pourquoi Dijon Garde Ses Distances Avec Les Difficultes D Epicure

May 10, 2025